|

|

|

Investors [06.2020] |

Investments [06.2020] |

Founded |

Country |

| PeerBerry is a crowdlending platform allowing to invest in consumer loans originated by credible non-banking lenders from across Europe. At start the platform was launched on 1st of November 2017 with loans originated by Aventus Group, an international lending company of +500 employees founded in 2009. Aventus Group first started providing loans to Minos, but since their market was expanding, they decided to launch PeerBerry.

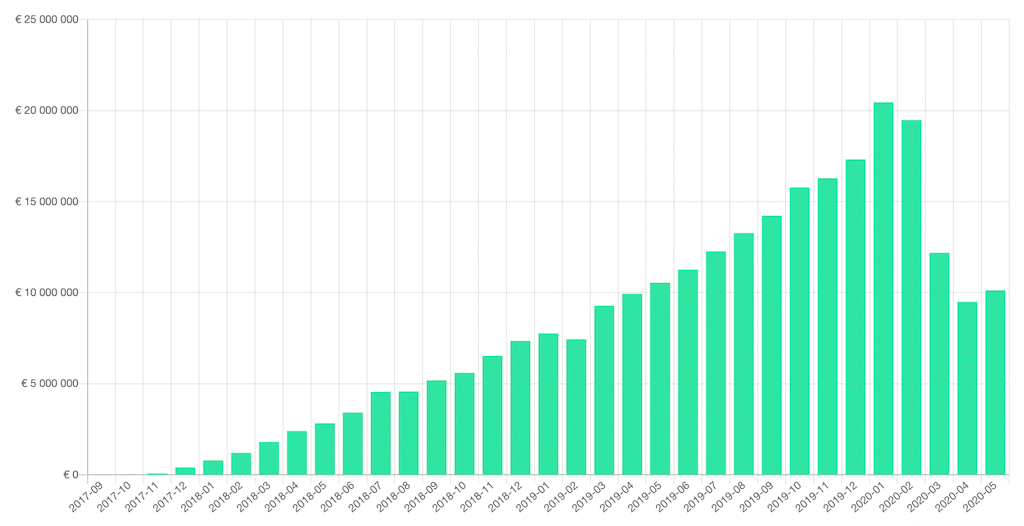

The platform has been growing really fast. Investors had invested 4.5M EUR of loans in July 2018 and in July 2019 they reached 12.3M EUR. The investments’ term starts from 10 days to 1 year and the minimum investment amount is of €10. Deposits on the investment account can be done in any currency but they will be automatically converted by PeerBerry to EUR at the daily rate. There are no fees for any investor-related activities such as registration, service, deposit, withdrawal, Statistics: PeerBerry is evolving at a steady state as you can see in the figure below. While there has been a drop in investments during the months of COVID-19, the platform started to increase again in May 2020.

Figure: Loans funded monthly by PeerBerry How it works: Performances: The platform offers an average of 12% ROI (market average) with investments usually ranging from 11% to 13%. This p2p lending platform offers an additional return for bigger and loyal investors. If the investor is a member of PeerBerry for more than 90 days, then it can get a bonus depending on his category:

Safety:

|

Investment details

| Investment currencies | EUR |

|

| Return on investment (ROI) | 12% | |

| Minimum investment | € 10 |

|

| Investment period | 10 days – 1 year | |

| Default rate | 0% |

|

| Investment fees | 0% |

|

| BuyBack guarantee | Yes, 60 days | |

| Auto-invest | Yes | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 4.8/5 | [06.2020] |

Investment types

Real Estate |

Investment example

|

Investment result forecast

| Below you will find the resulting forecast when investing using PeerBerry compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using PeerBerry for 15 years you might end up with €5’474 (€3’077 more than with the stock market). Chart by Visualizer |

PeerBerry bonus and cashback

| You can register to PeerBerry by clicking the button below. It will be highly appreciated. Thanks!

+0.5% ROI from € 10’000 invested |

Similar platforms

|

|||

| View the list of all the platforms | |||

Useful links

|

|

|

| How to configure PeerBerry Auto-Invest | PeerBerry Risk Analysis |