|

|

|

Investors (09.2019) |

Investments (09.2019) |

Founded |

Country |

| NEO Finance is the crowdlending largest platform in Lithuania. This platform allows investing in consumer loans from Lithuanian borrowers with a minimum investment size starting from €10. Investment come with a BuyBack guarantee option, so people have the choice to activate it or not (in exchange, the ROI of the investment is reduced by 0.44% to 22.91% depending on the credit receiver’s creditworthiness rating and maturity of the loan). The average portfolio of investors on this platform is of €3’100.

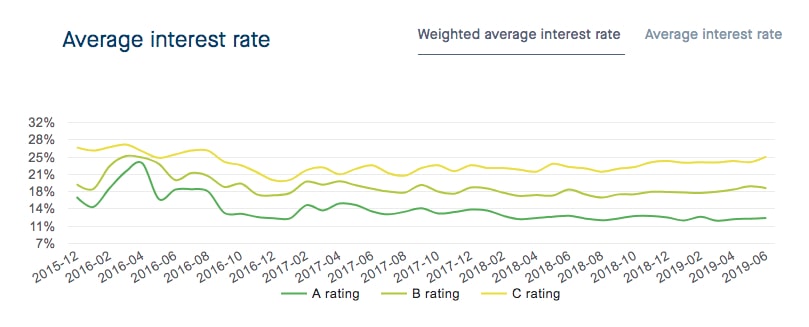

The platform offers a signup bonus of €25 when creating your account via this link. As side information, the platform has been launched leveraging a crowdfunding campaign for startups via the famous crowdfunding website Seedrs. Performances: The interest rates have an average of 12% ROI per year, like the majority of the crowdlending platforms in Europe, but you can find investments ranging from 6% to 27% with different profiles of risk. The image below displays the evolution of the average ROI per investment rating risk proposed on the platform (A: lower, B: medium, C: higher):

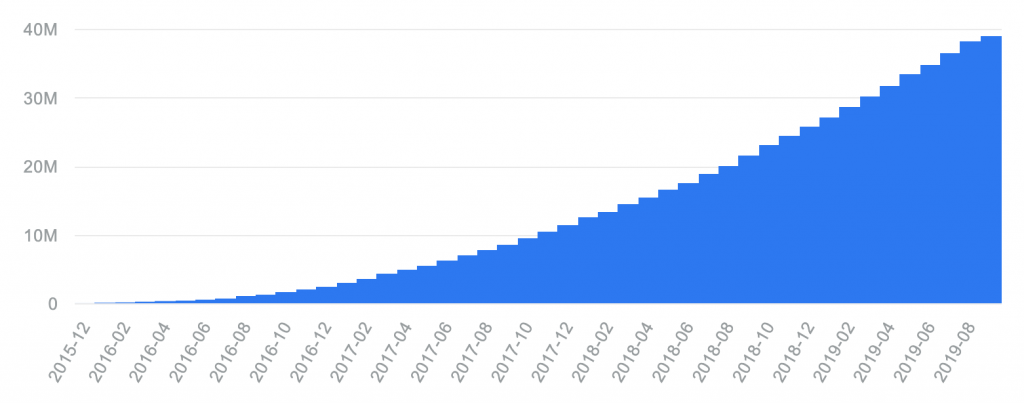

Safety: Investors seem trusting this p2p lending platform since its creation as the granted loan amount is steadily increasing (see image below).

NEO Finance is trying its best to provide safety factors to the investors:

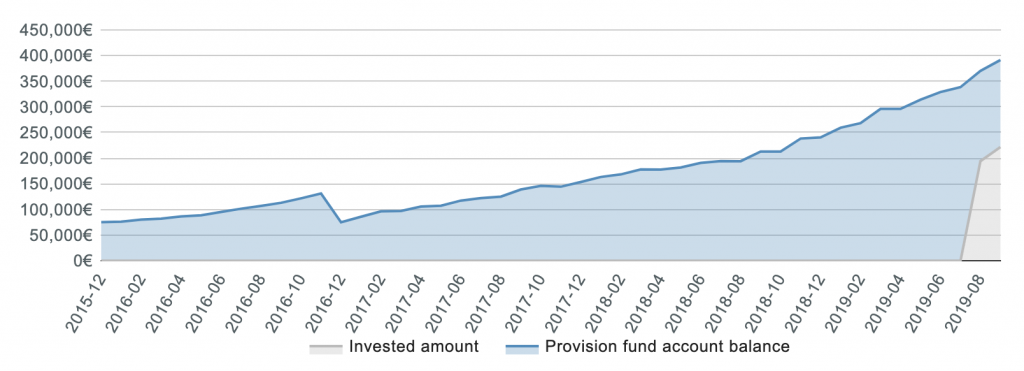

The image below displays the evolution of the provision fund size: |

Advice

| NEO Finance is a rapidly growing crowdlending platform that, compared to its competitors, provides a higher level of transparency (e.g. loans defaults statistics, financial reports).

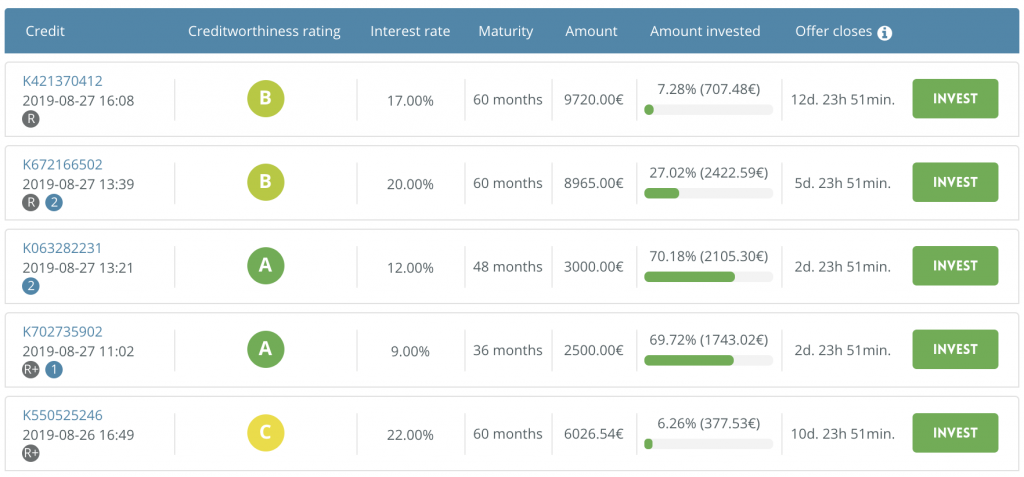

The platform also offers great flexibility in terms of investments where you can choose for e.g.:

Thanks to this flexibility you can build a portfolio ranging from 6% to extremely high 27%. |

Pros & Cons

| Pros | Cons |

| + Highest-interest rates of the market (up to 27%) + High transparency in platform statistics + Safety fund in constant increase > 300K (=1% of total loans) + Minimum investment of €10 + Detailed borrower information + Auto-invest available + Secondary market available + Bonus of € 25 after first deposit by using this link |

– BuyBack guarantee is optional and is not free – Withdrawals cost € 0.29 – No diversified investments (Consumer loans) – Investors must be European – Smaller-sized platform (lower track record) |

Investment details

| Investment currencies | EUR | |

| Return on investment (ROI) | 12% | |

| Minimum investment | € 10 | |

| Investment period | 24 – 60 months | |

| Default rate | 0% (with BuyBack) | |

| Investment fees | 0% | |

| BuyBack guarantee | Yes (optional) | |

| Auto-invest | Yes | |

| Secondary market | Yes | |

| Trustpilot Score (Safety) | 7.4/10 | (09.2019) |

Investment types

Investment example

|

Investment result forecast

| Below you will find the resulting forecast when investing using NEO Finance compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using NEO Finance for 15 years you might end up with €11’974 (€9’577 more than with the stock market). Chart by Visualizer |

NEO Finance bonus and cashback

You can register to NEO Finance by clicking the button below. It will be highly appreciated. Thanks! BONUS: € 25 bonus at signup BONUS: € 25 bonus at signup |

Similar platforms

|

|||

| View the list of all the platforms | |||

Useful links

|

||

| NEO Finance Risk Analysis |