|

|

|

Investors [01.2020] |

Investments [01.2020] |

Founded |

Country |

Swaper details

| Investment currencies | EUR, GBP | |

| Accepted investors | EU, Swiss | |

| Return on investment (ROI) – average | 12% | |

| Minimum investment amount | € 10 | |

| Investment period | 1-36 months | |

| Default rate | 0% | |

| Investment fees | 0% | |

| BuyBack guarantee | Yes (30 days) | |

| Auto-invest | Yes | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 5.9/10 | (09.08.19) |

About Swaper

| Swaper is a peer to peer lending platform offering pre-funded unsecured consumer loans investments mostly in Central and Eastern Europe. You can invest in p2p loans in countries such as Denmark, Spain and Poland with returns on investment of 12%. All the investments offered on this crowdfunding platform come with a Buyback Guarantee.

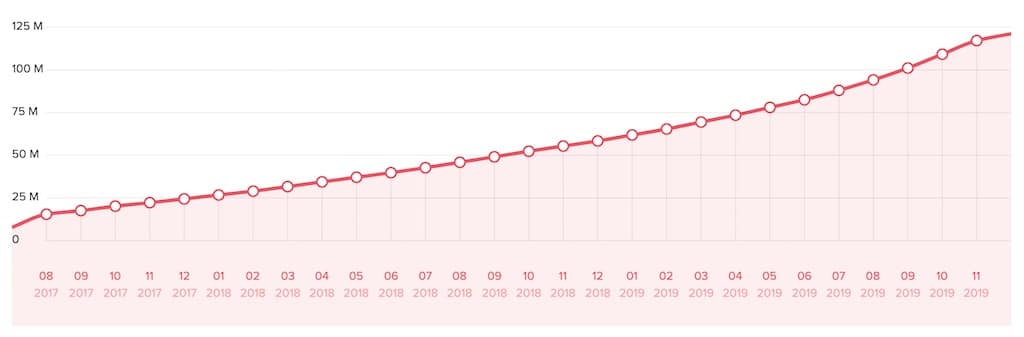

The customer loans provided on this p2p marketplace are unsecured, which means that they are not backed by an asset, like you could find for example in real estate crowdfunding. Swaper is a platform ideal for new crowdfunding investors: Swaper is really simple to use, you just need to set up the auto-invest functionality and the platform will take care of investing your money. The return rate of investments is around 12% but the short loans’ term (30 days average) will increase the returns above 12%. The downside of this platform is that we have small visibility about the loans invested in. In the figure below you can see the total amount of investments done via Swaper on the past years. In just 3 years following its launch, more than 100M investments were done via Swaper, which shows its success.

Figure: Swaper’s total cumulative investments (source: Swaper) How it works: Here is how Swaper works:

Performances: All loans available for investment on this p2p lending platforms have the same return on investment rate of 12%. And in addition, if you invest more than € 5’000 for at least three months you will earn an additional bonus of +2% ROI Safety: When borrowers are late for more than 30 days Swaper’s Buyback guarantee kicks-in and Swaper will buy back the loan from the investor and compensate him for the missing interests. |

Investment types

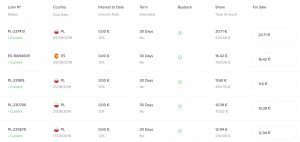

Investment example

|

Investment result forecast

|

Below you will find the resulting forecast when investing using Swaper compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years). By investing €1’000 using Swaper for 15 years you might end up with €5’474 (€3’077 more than with the stock market). Chart by Visualizer |

Swaper bonus and cashback

| You can register to Swaper by clicking the button below. You’ll be able to benefit from their loyalty program:

LOYALTY BONUS: Invest more than € 5’000 for at least 3 months and earn +2% for new investments |

Swaper competitors

|

|||

| View the list of all the platforms | |||