What is a stock exchange?

A stock exchange is a market that brings together buyers and sellers to facilitate investments in stocks.

Investopedia (source)

You can imagine the stock exchange as a marketplace where items such as stocks, bonds, ETFs, etc… can be sold and purchased between sellers and buyers (later we will discuss these different items).

Example: The illustrate better what is the stock market and how it works, let make an analogy.

I guess you have heard about art auctions. In art auctions there are items (in this case art pieces) that from sellers that are sold to buyers. These buyers are all sitting together in a room (which we could consider at the marketplace). During the auction of an item, buyers communicate the price they are willing to pay for the item, making the price go up until the maximum price of a buyer is reached. This process allows to define the price of the item based on the buyers’ demand.

The same process happens in the stock market with buyers and sellers defining the price of stock market items based on the offer and demand.

How stock exchanges make money

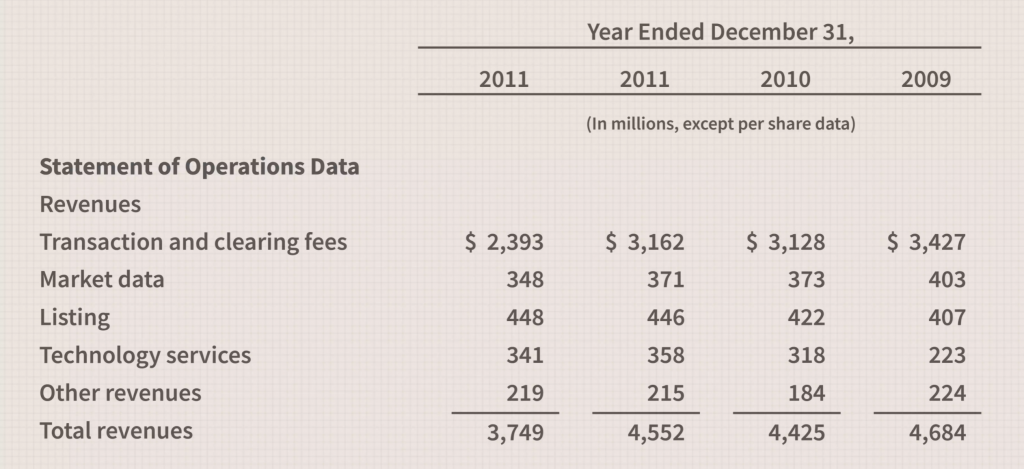

To understand better how stock exchanges work, let’s look at the four main activities that generate income to stock exchanges:

- listing fees

- transaction costs

- market data

- technology services

The imagine below show numbers related of these different income sources for the NYSE from 2009 to 2012.

Let’s dig deeper in each of these income sources.

Listing and sustaining fees

Listing fees represent around 10-12% of their income.

Companies that want their stocks to be traded in the stock market via a stock exchange need to bear two types of fees:

- listing fees: a one-time fee for the first time they join the stock exchange

- annual sustaining fees: a recurring fee usually paid annually

The table below lists the fees for the main US stock exchanges:

| Fees type | NYSE | NASDAQ |

|---|---|---|

| Listing fees | $50,000 to 75’000 Application Fee: US$5,000 New Listing: – With < 5M shares: US$50,000 – With 5 to 10M shares: US$55,000 – With 10 to 15M shares: US$60,000 – With > 15M shares: US$75,000 | $50,000 to $75,000 Application Fee: US$5,000 New Listing: – With < 15M shares: $50,000 – With > 15M shares: $75,000 |

| Annual sustaining fees | $50,000 to $60’000 – With < 50M shares: US$50,000 – With 50 to 75M shares: US$70,000 – With > 75M shares: US$60,000 | $42,000 to $75,000 – With < 10M shares: $44,000 – With 10 to 50M shares: $58,000 – With > 50M shares: $79,000 |

Transaction costs

Transaction fees are the largest source of revenues of stock exchanges, they represent around 60-65% of their income.

Every-time a listed stock is bought or sold, the stock exchange will generate a transaction cost.

These transaction fees will be paid wether it is related to a retail investor, a bang, a fund, etc…

Market data

Market data fees represent around 8-10% of their income.

Stock exchanges produce and make available a large amount of data: real-time data, historical data, summary data, and reference data.

Market players will use:

- historical data for their research

- real-time data for ongoing trading and investment activities

- summary data for reporting and auditing

- reference data for security-specific details such as corporate actions

Also to give you a simple example that might talk more to you, when you look at news TV channels or if you search a stock on Google, financial information will be provided such as the current value of the stock, the historical charts of its value change. All these pieces of information are the one provided by stock exchanges.

Technology services

Technology services fees represent around 5-7% of their income.

Stock exchanges offer extra technology and software services to large investment corporations such as investment funds and asset management companies.

Typical services will be faster market data access and faster trades execution. The ensure these services typically stock exchanges would offer to host computers and servers of these invesment first directly at the stock exchange location.

An other example are trading software such as the ones you will use from your computer of smartphone to buy stocks. They need to be integrated to the stock exchange services to pull and push data.

Main stock exchanges opening hours

It is important to note that each main geographical region has its own stock exchange with its own opening hours. The table below illustrates it.

| Name | Country | Time zone | Open | Close |

|---|---|---|---|---|

| NYSE | USA | EST (GMT -5) | 9:30am | 4pm |

| Nasdaq | USA | EST (GMT -5) | 9:30am | 4pm |

| Japan Exchange Group | Japan | JST (GMT +9) | 9am | 3pm |

| London Stock Exchange | UK | GMT | 8am | 4:30pm |

| Shanghai Stock Exchange | China | CST (GMT +8) | 9:30am | 3pm |

| Euronext | EU | CET (GMT +1) | 9am | 5:30pm |

| Toronto Stock Exchange | Canada | EST (GMT -5) | 9:30am | 4pm |

| SIX Swiss Exchange | Switzerl. | CET (GMT + 1) | 9am | 5:30pm |

So if you want to cover several market (for example the European and the US one) you will have to wake work longer hour.

← Previous |

Back to start |

Next → |