What is a stock?

A stock (also known as equity) is a security that represents the ownership of a fraction of a corporation. This entitles the owner of the stock to a proportion of the corporation’s assets and profits equal to how much stock they own. Units of stock are called “shares.”

Investopedia (source)

So basically a stock is a piece of a company and when you buy a stock on stock exchanges you buy a piece of a company.

Corporations issue stock to raise funds to operate their businesses. These stocks can be bought and sold mainly on stock exchanges (or can be sold in special cases during private sales. You will hear a lot about stocks and it is important for you to understand what exactly they are as it is the main type of item traded while investing in the stock market.

Also normally when you own a piece of a company you are entitled to share the company profits, have voting rights on important decisions, etc…

In the stock market it is also like this but into a certain extent:

- You can earn benefits on the company profits in form of dividends: Dividends are the distribution of the surplus of profits left after the rest of profits have been reinvested in the company growth. So depending on the company, the management will decide to reinvest all or a part of the profits. Typical dividends compared to your stock value can go from 0% to 6% per year. And technology companies have typically small or no dividends since they prefer to reinvest all the profits on developing the company (via R&D, sales, product development, etc…)

- You can earn benefits in case the stock value goes up and will lose money in case the value goes down. Remember that in some rare cases a company can also go bankrupt and you would then lose the total sum of your investments in that company. At least there is one good news, you cannot loose more money that the one you invested when buying stocks.

- For some specific topic, you might have voting rights but the majority of the decision will be taken by the company’s management

Let’s take a simple example using the company Apple that can be traded on stock exchanges and let’s imagine that apple has a total of 1,000 stocks

If you were to buy 10 stocks of Apple you would end up owning 1% of the company Apple (1,000 stocks / 10 purchases stocks).

Unfortunately Apple is composed of a lot more shares (around 17 billion in 2021), so when investing in it you will own just a super small percentage of the company!

Example of benefits holding stocks

Let’s imagine you invested in Apple stock in April 2020 and held then during 1 year until April 2021 (see the figure below for the value chart).

Let’s assume that you bought 100 shares in April 2020 at the value of $72. Your total money invested when purchasing Apple stocks was:

Investment amount = 100 shares x $72 = $7,200Let’s assume that you sold back the shares in April 2021 at the new market value of $134.

Benefit on value increase = ($134 - $72) x 100 shares = $6,200In addition we also know that Apple stocks generate a dividend of 0.85% per year. For simplicity let’s assume that you got paid dividends in April 2021 so when the stocks had a value of $134.

Benefit on dividends = 0.85% ($134 x 100 shares) = $113.9So you total benefit when investing an initial value of $7,200 has been of:

Benefit = value + dividend = $6,200 + $113.9 = $6,313.9This return accounts for a yearly return on investment of 87.7% which is amazing and not common.

Yearly return = 100% x ($6,313.9/$7,200) = 87.7%The different types of stocks

Let’s talk about the different types of shares traded int he stock market. There are 2 main types of stocks that you need to know about:

- common shares

- preference shares

We will talk about it more in detail later but basically preferred shares guarantee dividend payments at a fixed rate, while common shares have no such guarantee. In exchange, preferred shareholders give up the voting rights that benefit common shareholders.

Common shares

Common stock/share (also called ordinary stock/share) represents shares of ownership in a corporation and the type of stock in which most people invest. When people talk about stocks they are usually referring to common stock. In fact, the great majority of stock is issued is in this form.

Investopedia (source)

So common shares are the most common types of shares. This type of shares have the following characteristics:

- they provide voting rights

- they trade on stock exchanges

- shareholders are entitled to receive dividends (if existing dividends)

Concerning dividends it is important to note that common shares will receive dividends after preferred shares (discussed more into details below).

Common shares have 2 main different types of classes:

- A-class common shares: these are the usual common shares traded on the stock market

- B-Class common shares: these are common shares that are for example issues to employees of the company, and sometimes also traded on the stock market

The two classes differ from each-other on the following possible differences:

- Voting rights: A-class share tend to have more voting rights per share than B-class

- Dividend payoff rules

- Trading price: can be different for the two classes due to differences in voting rights and dividend payoff rules

Example of 2-classes stock

To understand all this with a concrete example, let’s look at the company Berkshire Hathaway run by the famous Warren Buffett. It’s company has A-class (BRK.A) and B-class (BRK.B) stocks.

Now there are several differences in these shares as stated in the table below:

| Info | A-class (BRK-A) | B-class (BRK-B) |

|---|---|---|

| Ticker | BRK-A | BRK-B |

| Stock value (as of May 2021) | $ 415,500 | $ 275 |

| Voting rights | 1 per share | 1/15,000 per share |

| Conversion | A-class can be converted to B-class shares | B-class CAN’T be converted to A-class shares |

| Dividend | No dividend | No dividend |

So as you can see the main difference between the two share classes is the voting rights which translates itself to a higher stock value for the A-class that has 15,000 times more voting rights than the B-class.

In this case, the CEO of Berkshire Hathaway, Warren Buffett, decided to let the A-class stock value grow without never splitting it to keep a low prices in order to give access to these expensive shares only to people that really care about the company and are more professionsal and serious investors that have the money to do so.

On the other side he created the B-class shares that have a way smaller value and that can be easily purchased by small investors but that have small voting rights.

To conclude, A-class shares have usually higher voting rights and higher prices. Invest in them mainly if you care about having voting rights, otherwise it won’t make you any different.

Preference shares

Preference shares, more commonly referred to as preferred stock, are shares of a company’s stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

Investopedia (source)

Companies will issue preference shares for the following main reasons:

- Companies can collect more funding with preferred shares because investors like fixed dividends and stronger bankruptcy protections (better than common shares)

- Companies can keep the debt-to-equity ratio lower by issuing preference shares than issuing bonds

- Companies give less control to outsiders than common stocks that have voting rights.

The first difference between common shares and preference shares are the payment rules of dividends. Preference shares will be paid dividends before common shares. Let’s take a look at the difference steps of dividends payments for you to understand better priorities:

- First paid are creditors that lended money to companies. They are not entitled to dividends but to loan repayment and interests.

- Secondly are paid preference shares who usually are promised fixed dividend which is a percentage of the total value of a stock (e.g. 3% of the stock value per year).

- Finally, if the is still some money left from profits, common shares are paid their dividend. (that is usually not a fix and promized dividend, but more an expected one based on past years)

The second difference between those two types of shares are voting rights. Common shares usually have voting rights while preference shares don’t.

The third difference is that preference shares are redeemable (also called “callable”) by the company while common shares usually not. This means the company can buy back the shares at a later date. These shares usually have to follow these redeeming rules:

- redeemable at a fixed time or at a particular event

- redeemable at the company’s or shareholder’s option

Now that you understood the difference between these shares, let me just give you one last information about preference shares. There are actually four types of preference shares:

- Callable Preferred Shares

- Convertible Preferred Shares

- Cumulative Preferred Shares

- Participatory Preferred Shares

Callable Preferred Shares

Callable shares can be bought back by the issuing company at a fixed price in the future.

Let’s imagine the company defines in the contract with the investor that she has the right to purchase back the shares at a $100 value. Then the company may choose to buy out shareholders at this price if the market value of preferred shares looks like it might exceed this level.

Convertible Preferred Shares

Convertible shares can be exchanged for common shares at a fixed rate. This can be great for investors if the market value of common shares increases.

Let’s imagine that you own 10 shares of convertible preferred stock at $100 per share, and one share of preferred stock can be converted to 2 shares of common stock. You’ll be able to make a profit on the initial $1,000 investment if the 10 preferred shares are converted to 20 common shares when the value of common shares rises above $50 ($1,000/20 = $50).

Common share connot be exchange back for preferred shares.

Cumulative Preferred Shares

Cumulative shares require that any unpaid dividends must be paid to preferred shareholders before any dividends can be paid to common shareholders.

Let’s imagine that a company guarantees dividends of $10 per preference share but cannot afford to pay dividends for 2 consecutive years, it must pay a $30 cumulative dividend in the third year before any other dividends can be paid to common shares.

Participatory Preferred Shares

Participatory shares guarantee additional dividends (on top of the fixed dividend of preference shares) in the event that the issuing company meets certain financial goals.

Example of Preferred Share

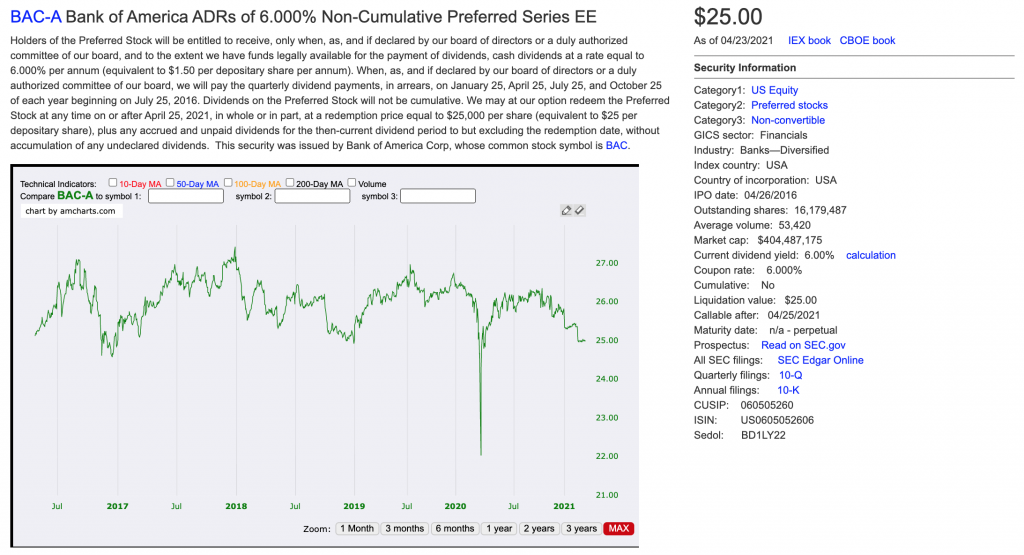

Let’s now illustrate preferred shares with an example. The figure below represents a preferred share of Bank of America.

In the stock information (right column in the image) you find the details that we talked just before:

- the dividend yield (they call it “coupon rate”): 6,00%

- cumulative: this stock is not cumulative (as a reminder it means that if one year the dividends are not paid, they won’t be paid together with next year’s dividend, but will be lost)

- callable date: 04/05/2021 (this means that Bank of America) can purchase back the stocks after this date and at the liquidation value of $25,00

- liquidation value: $25 (so even if the stock value is higher than $25, the company can call back the stocks at the liquidation value after the callable date)

- non-convertible: this means these preferred shares can be converted to common shares

Later on, in this training, we will talk more in practical detail about how to invest in preferred stock. You will find the information in the section about online stock market trading.

Stocks categorization

Stocks categorization by market cap

Another important categorization of stocks is the one by the size of its issuing company. And when we say “by size” it means more precisely by Market Capitalization of the company.

Market Capitalization

As a reminder, Market capitalization, commonly referred to as “market cap,” is calculated by multiplying the total number of a company’s outstanding shares by the current market price of one share. As an example, a company with 10 million shares selling for $100 each would have a market cap of $1 billion.

There are 4 categories of companies sizes:

- mega-cap companies: $200+ billions market cap (e.g. Amazon, Apple, Facebook)

- large-cap companies: $10-$200 billions market cap (e.g. Johnson & Johnson)

- mid-cap companies: $2 to $10 billions market cap (e.g. Viasat Inc)

- small-cap companies: $300 millions to $2 billions (e.g. Palantir Technologies)

Here is a table summarizing the 4 types:

| Mega cap | Large cap | Mid cap | Small cap | |

|---|---|---|---|---|

| Market cap | $200B+ | $10B – $200B | $2B – $10B | $300M – $2B |

| Example | Apple | J&J | Viasat | Palantir |

| Dividend | Large | Medium | Small | Usually not |

| Price increase | Small | Small | Medium | Large |

So if you are looking more for risky investments with higher returns and more volatile prices you should opt for small and mid-cap stocks. And if you prefer a stable income with limited volatility you should invest in large to mega-cap companies.

Stocks categorization by return

Here are the 3 categories of stocks by return:

- Growth stocks

- Value stocks

- Income stocks

Growth stocks

A growth stock is a share in a company that is anticipated to grow at a rate significantly above the average growth for the market (such as Facebook or Telsa).

When investing in growth stock you should expect capital gain (increase of the stocks’ value).

The characteristics of grow stocks:

- They look expensive with a high P/E ratio (we will talk about this ratio in the section about How to evaluate stocks)

- They usually don’t pay dividends (since the company reinvests earnings to accelerate growth for e.g. in R&D, product development)

- Many small-cap stocks are considered growth stocks. However, some larger companies may also be growth companies (e.g. Amazon)

Value stocks

A value stock is a share of a company that appears to trade at a lower price relative to its financial characteristics, such as dividends, earnings, or sales (such as IBM or Intel).

The characteristics of value stocks:

- Low P/E ratio

- Low P/B ratio (we will talk about this ratio in the section about How to evaluate stocks)

- High-dividend yields

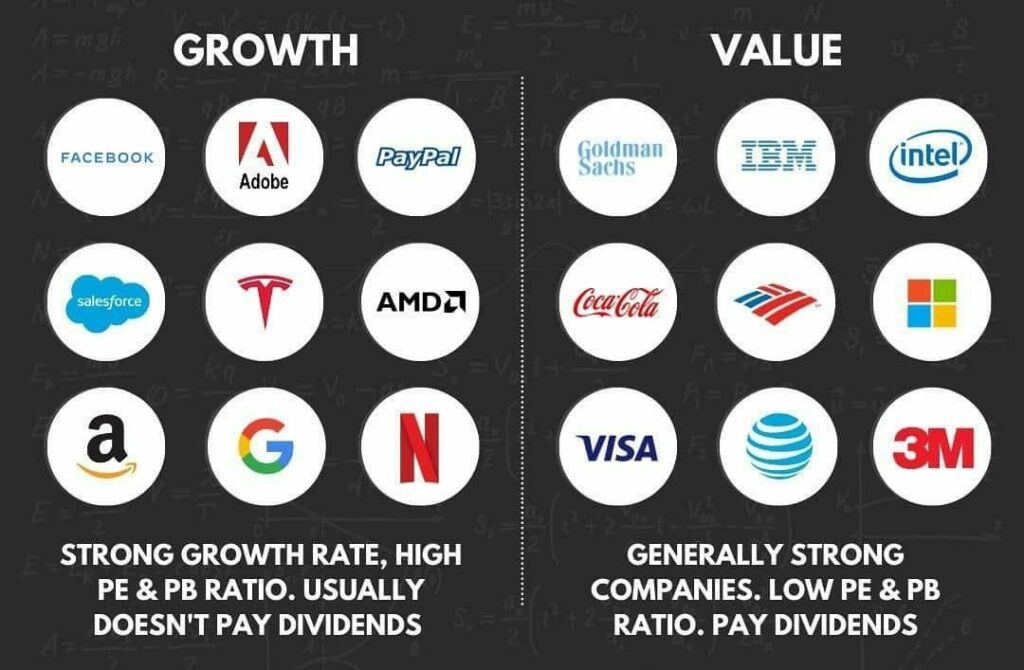

The figure below give you some extra examples of growth and value stocks.

Income stocks

An income stock is a share of a company that generate regular dividends (such as AT&T that pays an annual dividend of around 6% and Walmart with 2-3%).

The characteristics of income stocks:

- Low volatility

- Regular dividends with a steady yield increase to follow the inflation

- Smaller capital growth

← Previous |

Back to start |

Next → |