Many people don’t think about investing their money because nobody ever explained to them why they should do it and when. It is actually normal since investing is not something taught in school or university.

There are actually two main reason why you should invest your money: inflation and compound interests.

What is inflation?

Inflation is a general rise in the price level in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money.

Wikipedia’s definition (source)

Basically to make it short, normally every year the value of the money you have is reduced by few percentage. So imagine you are buying a coffee this year for $2, then next year you might need 2% more cash to buy it due to inflation. So next year the same coffee will cost you $2 + 2% = $2.04

And to counterbalance this inflation that makes reduce the value of your money, it is important to invest it to generate returns.

Here is a table summarising the inflation rates of 2020:

Country | 2020 |

|---|---|

United States (USD) | 1.25% |

United Kingdom (£) | 1.50% |

Australia (AUD) | 0.75% |

Canada (CAD) | 0.62% |

European Union (€) | 0.38% |

So if you had USD during 2020, they lost 1.25% of value during the year.

What are compound interests?

Compound interest (or compounding interest) is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods.

Investopedia (source)

To make it short, compound interest and like “interests of interests”. Let’s look at an example.

Let’s say that you decide to invest $10’000 at a 5% return rate:

- At end of year 1 your interests will be: 5% of $10’000 = $500

- At end of year 2 your interest will be: 5% of $10’500 = $525

- …

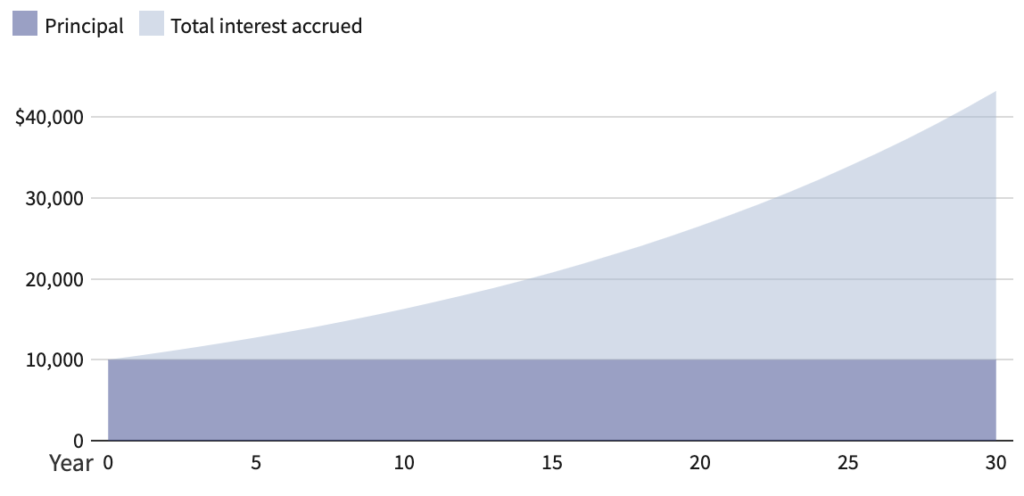

Let’s look at the chart below to see how an investment of $10’000 would return at a 5% rate over 30 years. Over 30 years, your initial invested amount of $10’000 has been transformed to $43’219.

The illustrate you even better why you should start investing early, here are two more examples:

Example 1: Invest $10’000 (5% ROI) at 20 yo and cash out at 65 yo

Your initial invested amount of $10’000 would be worth $89’850 at 65 yo.

Example 2: From 20 yo, start with $10’000 invested and add every month $500 (5% ROI) and cash out at 65 yo

Your principal amount during 45 years will be of $280’000, but your total amount (including interests) at 65 yo will be of $1’073’808 !!!!

Here is a nice Interest Calculator tool that you can do to do your own calculations and projections: Interest Calculator

← Previous |

Back to start |

Next → |