Where Crypto lending comes from?

Before talking about Crypto Lending (lending of cryptocurrency), let’s just take a step back and look at the cryptocurrency market. Since 2020 and the pandemic, the crypto market has increased exponentially month after month, bringing in millions of investors and billions of dollars in Crypto market capitalization.

As a crypto investor, you might have cumulated a good amount of crypto assets, but a problem arises when you need physical money.

Many of us investors are strongly believing in the future of cryptocurrencies and are thus aiming to hold their positions to earn thanks to our expected long-term price increase. Just take a look at the Bitcoin price chart below, would you really be willing not to stay in the game by selling your crypto?

Fortunately holding your crypto while spending physical currencies (e.g. USD, EUR, CAD) is now possible thanks to crypto lending!

Crypto holders use crypto lending to borrow physical money while investors lend their digital assets in return of an interest. And that the cool this about crypto lending! It’s basically a simple and straightforward way to generate passive income from lending your crypto.

Btw, some people will also call this bitcoin lending. But this term basically applies only when you lend Bitcoins. But don’t worry! Lending is available for dozens of cryptos, coins, stablecoins. So if you have ETH, ADA, BNB, XPR, LTC, …. laying around, it works as well too!

Stick around until the end of this investment course to learn about these key topics and to start generating returns with your crypto:

- What is it and how it works?

- How can I invest and make profits with it?

- How to maximize returns and choose the best investment platforms (I’ll show you a selection at the end, don’t miss it!)

So keep focused and let’s dig in! Get ready to be the next lending master!

By the way, look at these numbers. These are the earning per year (APY) that you can make on crypto lending, if you select the best crypto lending platforms to maximize returns!

6 to 17% APY

What is crypto lending?

One of the current emerging trends in finance and blockchain, crypto lending is a form of Decentralized Finance (DeFi) where investors lend cryptocurrencies to borrowers in exchange for interest payments (crypto dividends). Crypto lending platforms usually accept cryptos and stablecoins.

Crypto lending for investors

To make it clearer let’s take an example: You are the happy owner of 10 bitcoins and you would like to generate a steady passive income with your bitcoins. By depositing these 10 bitcoins on the wallet of a crypto lending platforms, you will receive weekly (or monthly) interests from it. For bitcoin lending these interest rates usually are from 3% to 7% while they can be a lot higher (up to 17%) for example on more stable assets such as stablecoins (e.g. USD Coin, True USD, Binance USD).

And what is even more interesting with these investment type compared to others such as peer-to-peer lending, ii’s that with crypto-backed lending, borrowers have to stake their own cryptocurrency as security and guarantees of loan repayment. So in case the borrower decides not to repay the loan, the investors can just sell the cryptocurrency assets to cover the loss.

Naturally, sometimes borrowers don’t repay their loans. But since investment platforms require borrowers to stake 25 to 50% of the loan in crypto, platforms are generally able to recover most of the losses and avoid investors losing money.

Crypto lending to borrow

So we talked about all this as an investment, but let’s not forget the borrowing side of it!

If you are reading thins article, you are most likely believing in the future of crypto. Thus holding your crypto for the long term is crucial.

Cryptocurrency lending allows you to borrow physical money (e.g. USD, EUR, CAD) when you need it in order to avoid having to sell your crypto in case of an emergency.

Check out these 2 crypto lending platforms

How crypto lending works?

Who is involved?

Lenders and borrowers in cryptocurrency lending are connected through a third party, in this case, an online crypto lending platform, which acts as a trusted intermediary.

So, for this type of lending to take place, there have to be three parties involved: lenders, borrowers and lending platforms:

- The lenders or investors who want to lend crypto. This could be someone holding cryptocurrencies waiting for the value to soar (HODL-ers), or just a crypto aficionado looking to grow his assets’ output.

- The crypto lending platform takes care of the transaction involving lending and borrowing. When it comes to these platforms, we have decentralized platforms, autonomous platforms, and centralized platforms with a group of individuals or companies operating behind the curtains.

- The borrowers looking to obtain funds for whatever purposes. This could be an individual or a business looking for fundings and should use crypto or fiat assets as collateral in order to get funding.

Detailed steps of the process

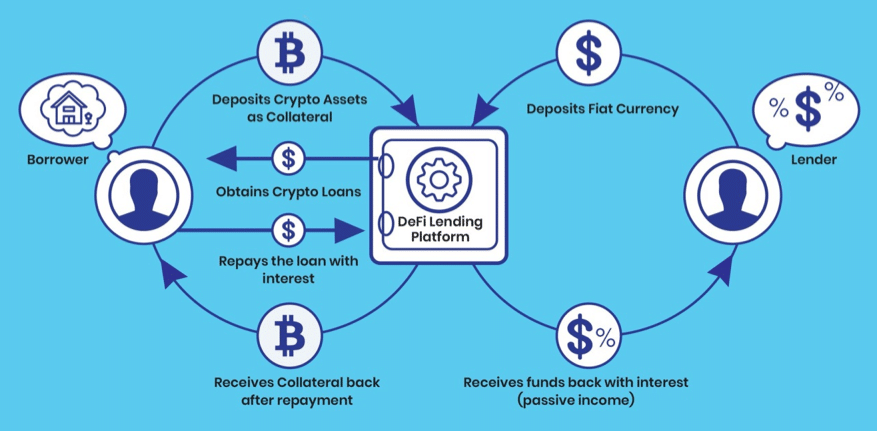

Let’s take a look at the image below that explains the process. You can find the explanation just under it.

Figure: How Cryptocurrency Lending Works (source: Medium)

Step 1: The borrower going on a platform requests a crypto loan (backing it up with his crypto)

Step 2: Once the platform accepted the loan request, the borrower stakes his crypto collateral. The borrower won’t be able to get back the staked amount until he funds back all his loan.

Step 3: Investors (lenders) fund the loan automatically via the platform. Usually, this process is invisible for investors for whom the balance of crypto on their accounts will be unchanged.

Step 4: Regularly interests are paid to investors (usually on a weekly or monthly basis, and rarely at the end of the lending period).

Step 5: Once the borrower paid back the loan, he received back his crypto collateral.

While cryptocurrency lending is different from platform to platform, the general concept is the same for all platforms.

In some cases, cryptocurrency lending also makes use of smart contracts, making the whole process of lending and borrowing safer in that the contract itself enforces the terms.

A smart contract is simply a self-executing contract with terms between the parties being written into lines of code. The code and terms of the contract contained exists across a distributed, decentralized blockchain network.

Smart contract definition

Case Studies of Crypto lending investments

There are 2 main types of lending platforms: automated and manual.

- Automated ones generate you dividends as soon as you have deposited assets in your crypto wallet

- Manual ones usually require you to manually stake (= block for a certain amount of time) a certain amount of your assets to generate dividends

Let’s have a look at both type with concrete examples!

Automated crypto lending: Celsius.Network

If you decide to invest with a crypto lending platform like Cesius.Network, then the lending process will be fully automated.

Basically, you just need to transfer your coins to the wallet that they provide and you will automatically earn dividends on your cryptocurrencies based on the coin you deposited. Each cryptocurrency has a different yield with stablecoins having yields usually from 10% to 18% per year and crypto coins from 3 to 8% per year.

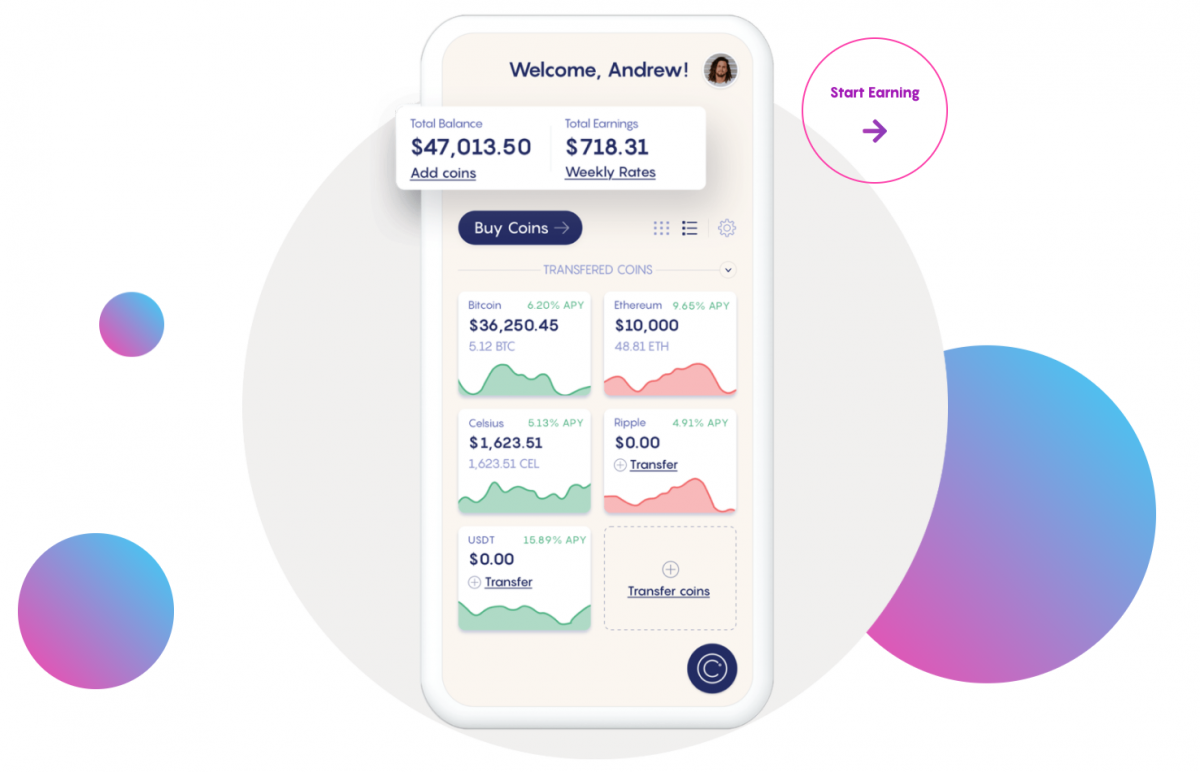

In the image below of the Celsius.Network you’ll see that next to the name of each deposited crypto you can see a green number indicating the automatic yearly yield (e.g. for Bitcoin: 6.20% APY)

Figure: Celsius.Network Crypto lending App

If you would like to try using this crypto lending platform you can use the button below to earn a $50 bonus when opening your account and holding $400 for 30 days in the wallet.

If you are on a desktop computer, you can use the promo code 115185f01c

Manual crypto lending: CoinLoan

I found it would be also interesting to give you another example but will a platform that allows you to manually lend your crypto to the loans you want. With this second example, I believe it will be easier to understand the fundamental process of crypto lending.

The case study below is about the crypto lending platform CoinLoan.

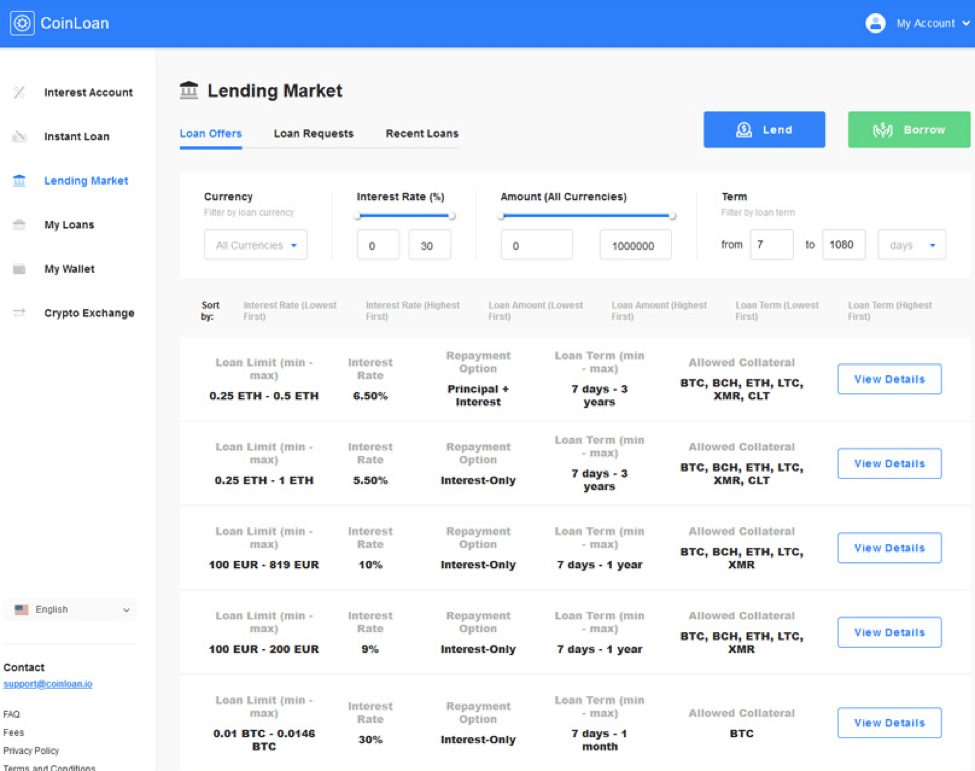

Figure: Cryptocurrency Lending Case Study – CoinLoan

From the above figure, borrowers can set their loan requirements (e.g. amount, interest rate, duration, collateral coin) and then post them to the platform’s marketplace, and if an investor is interested in the loan terms can accept them straightaway.

As an investor, you can click ‘Loan Requests’ at the right to see a variety of loan options available for you to invest. This is the marketplace section, though different platforms have a different format, it is basically where loan requirements from borrowers are displayed live.

After a borrower has posted his or her requirements, you can back it directly if you like the look of the financing request.

Remember that crypto lending is just like p2p lending, and once you have backed a loan, the repayment procedure will be similar.

You will receive monthly repayments depending on whether you choose Principle + Interest or Interest-Only.

Once again, this will vary from one platform to another, but the general core concept is the same.

Market size, growth, and forecast

Market size

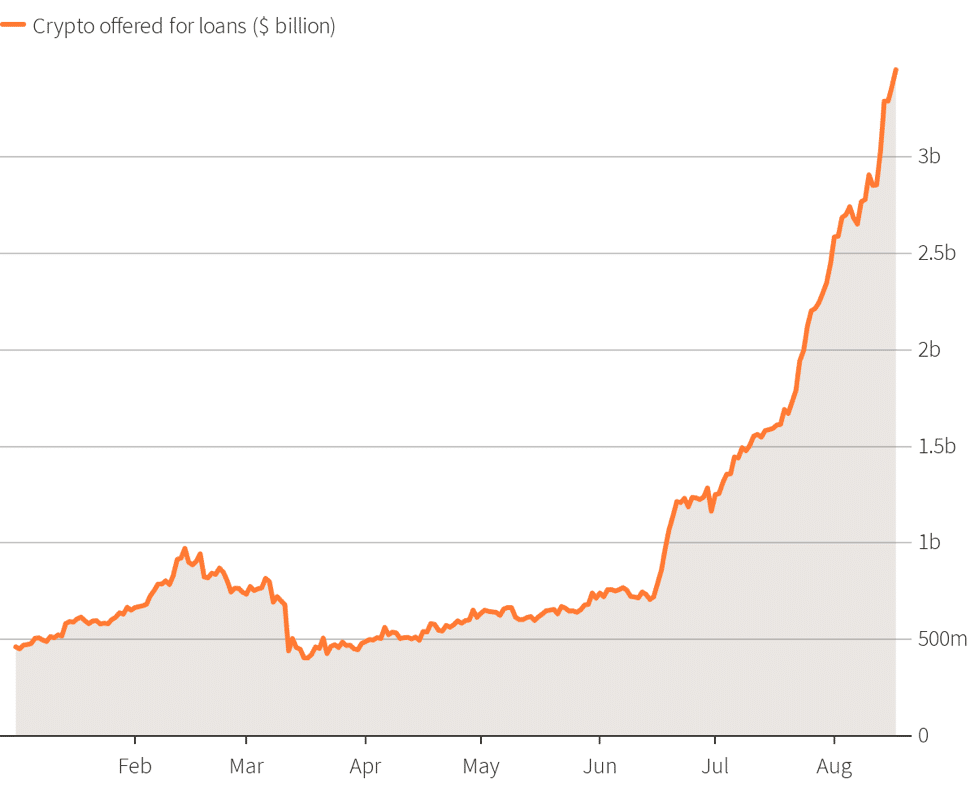

According to a recent report by Global Market Insights, the crypto lending market is expected to explode post-pandemic, with the industry less fazed by the ongoing global economic disruption. More and more crypto holders are now realizing that their holdings could be a brilliant source of collateral.

Most of these holders now want to access fiat currency while still holding onto their virtual assets, and thus can easily collateralize fiat loans using their crypto supply.

Crypto miners experiencing operational expenses can obtain loans to fund their ongoing expenditure without having to get rid of their crypto stash.

Today (in 2021), the total market value of funds locked in DeFi lending is over $50 billion.

Figure: Crypto-Lending loans volumes in 2020 (Source: Reuters)

Market growth and forecasts

The market is projected to experience an accelerated growth between now (2021) and 2027, reaching $20.31 billion at CAGR 16.7% according to CISION PR Newswire. The growth is partly due to the surging internet penetration as well as the rising digitization across financial institutions around the world.

One of the leading drivers of the adoption of crypto lending is the increasing demand among traditional financial institutions to curb their operation coast through restructured operations across all interactions between borrowers and lenders.

Crypto lending platforms are expected to mitigate operational, business, and regulatory risks, which will further accelerate the growth of the industry.

How to increase your returns?

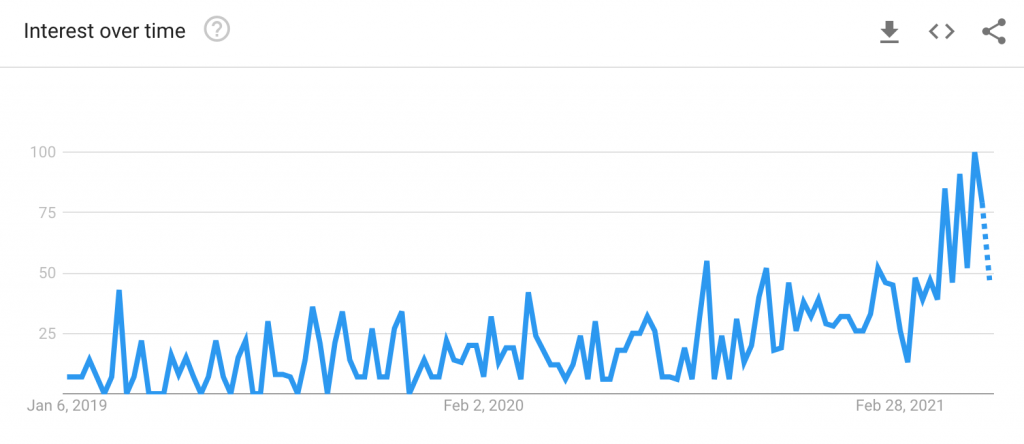

Now let’s take a look at this information. You will soon understand why. Below you can see the growing amount of people searching for the keywords Crypto Lending worldwise on Google since the beginning of 2019. The scale is a percentage of the maximum amount of search (100%) in this case happening in May 2021. As you can see the number of searches grew x5 to x10 over the last two years.

Now, let’s take the same timescale for the chart of the CEL token, which is a token of the lending platform Celisus.Network that you receive when lending there. The value of the token is increasing at a similar pace.

What I want to show you is that several crypto lending platforms such as Celsius.Network allows you to choose if you would like to be rewarded for lending your crypto in usually either the same cryptocurrency or in their our crypto (for example CEL tokens in this case).

And since now the investors’ base is exponentially increasing, and that a majority of lenders select to earn interests in special tokens (for e.g. at Celsius, 65% of investors choose that option), then the value of the token should (and not will) increase exponentially as the demand.

So you might be able to benefit from crypto lending not only from the dividends but also from the value increase of the cryptocurrencies.

Pros and Cons

Pros

Compared to other types of lending, crypto lending has lots of advantages for both borrowers and investors.

- Crypto lending is easily accessible to everyone since you don’t need to open a bank account, know about your credit score, or consider your income.

- On automated lending platforms earning lending dividends is fully automated and don’t require any effort

- Crypto lending is safer than other lending investments such as p2p lending, since the loans are backed by crypto assets, which are extremely liquid.

- For borrowers, cryptocurrency borrowing rates are pretty low (in the single digit) compared to other credit card or unsecured loans rates.

- For borrowers there is no credit check.

- The funding of a loan is fast (usually it takes few hours to a day to receive your borrowed amout).

Cons

There are a few drawbacks of using crypto lending as an investment option.

- Crypto assets can be super volatile (but to avoid this issue you can lend stablecoins)

- Platform security is an increasing concern for crypto lending, especially with the rising cases of crypto theft.

- Borrowers are limited on the borrowing amount (dictated by the % of crypto they need to stake).

- Some platforms require that you stake your crypto for a certain time (e.g. 30 days, 90 days) in order to receive interest. So make sure to select a platform that doesn’t require that such as Celsius.

- In order to participate in cryptocurrency lending activities, you will have to add your crypto on an online digital wallet, which is less secure than storing your crypto on a physical wallet (e.g. Ledger).

Crypto lending rates

The return on your investment will depend on the platform you use. Each crypto lending platform has its own ROI and risks, thus consider trying out multiple platforms to diversify your investments as well as spread your risks.

These are a typical range of yearly yield that you can expect with crypto lending:

- stablecoins: 10% to 18%

- crypto coins: 3% to 8%

Each investment platform has different rates per coin, so you will want to choose your platform based on the coins you are holding to optimize returns.

How to Invest in Crypto Lending

Choosing the Right Platform

Before we go any further, it is important to inform you that crypto-lending platforms are categorized as centralized or decentralized. Whichever category you chose will be influenced by its pros and cons.

Centralized platforms usually allow lenders and borrowers to agree on the essential details of the terms of the loan, but the transfer of loans, as well as its management, is done by the platform.

Decentralized on the other hand eliminates the use of a third party in the handling of the loan.

Investing in Crypto Lending

It’s pretty simple and straightforward, first of all, you need to select between an automated and a manual lending platform. I personally advise you an automated one so you make sure that your assets are constantly growing and not laying down forgotten without generating profit.

Then in a second time, you have to select the investment platform you want to use. And for this, make sure to get relevant informations such as:

- is the platform safe and legit?

- is the crypto I want to lend available on this platform? (not all cryptos are always available on each platform)

- what are the yearly returns on the crypto I want to lend?

And remember one last thing! Due to their volatility, cryptocurrency collateral may change in value at any time, which can lead to loss of investment on the lender side.

Crypto lending platforms

If you want to have a more detailed view when choosing your investment platform, have a look at our article: Best Crypto Lending platforms.

The list below comprises leading platforms that offer cryptocurrency lending services. If you are thinking of trying out this type of lending, these platforms may provide you with the best starting options.

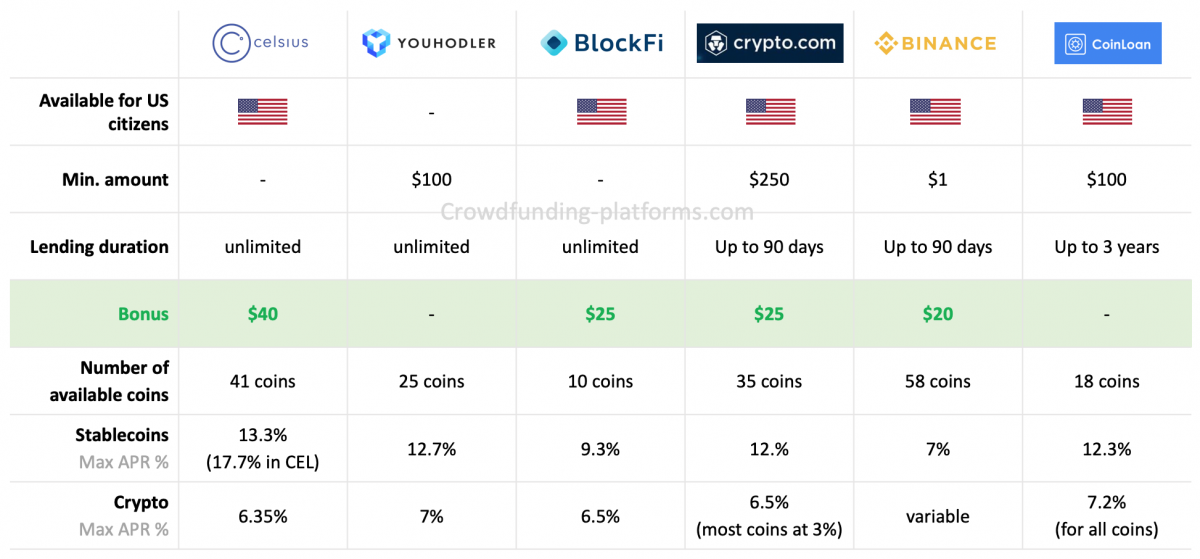

Before going into detail on the different platforms, check out the table below comparing them. It will give you a great idea of what to choose.

Best Crypto lending platforms

Now that you looked at the comparison, you can read through the list of crypto lending platforms with some additional details and bonuses.

|

|

|

|