Before talking about the best crypto lending platforms, if you haven’t done it yet, we advise you to read our course: Crypto Lending – What is it and how to invest?

In this article we will talk into details about the ranking of the best crypto lending platforms below.

What is Crypto lending?

Crypto lending is a pretty new segment of the lending investment industry that is rapidly growing in the past years.

The goal of this type of investment is to allow individuals with cryptocurrency assets to generate some dividends (ranging from 4% to 17% yearly ROI) by lending their cryptocurrencies. Lending is usually available via Crypto Lending Platforms for both crypto (e.g. Bitcoin lending) and stable coins (e.g. Tether lending).

What is a Crypto Lending Platform

What is it used for?

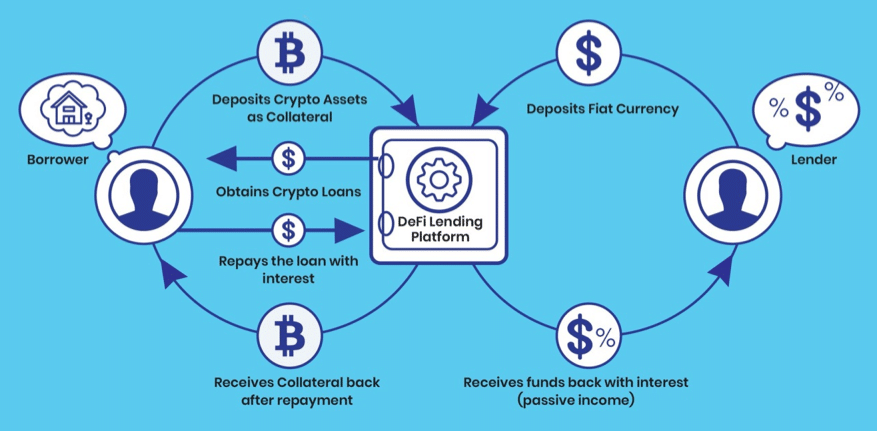

A Crypto Lending platform is an online platform that allows you to lend your crypto in exchange of interests. These platforms are used by two different parties:

- borrowers that need physical money (e.g. USD, EUR) that will take a loan via these platforms in exchange of interests

- lenders (also called investors) that have some crypto laying around and would like to generate passive income from it

How Crypto Lending platforms work?

When investing via a crypto lending platform, these are the key steps of the process:

- a borrower requests a loan to the platform (specific duration, amount)

- the lending platforms evaluates the loan (in terms of security)

- once approved, the borrower stakes a certain amount of his crypto as collateral for the loan (usually the platforms request that 50% of the total loan amount is available as crypto collateral)

- the assets of lenders deposited on the wallets of these lending platforms are used to fulfill the loan

- investors receive interest usually weekly or monthly based on their amount of assets

- once the borrower pays back his loan, he can unblock his crypto collateral

Check out these 2 crypto lending platforms

How to compare platforms?

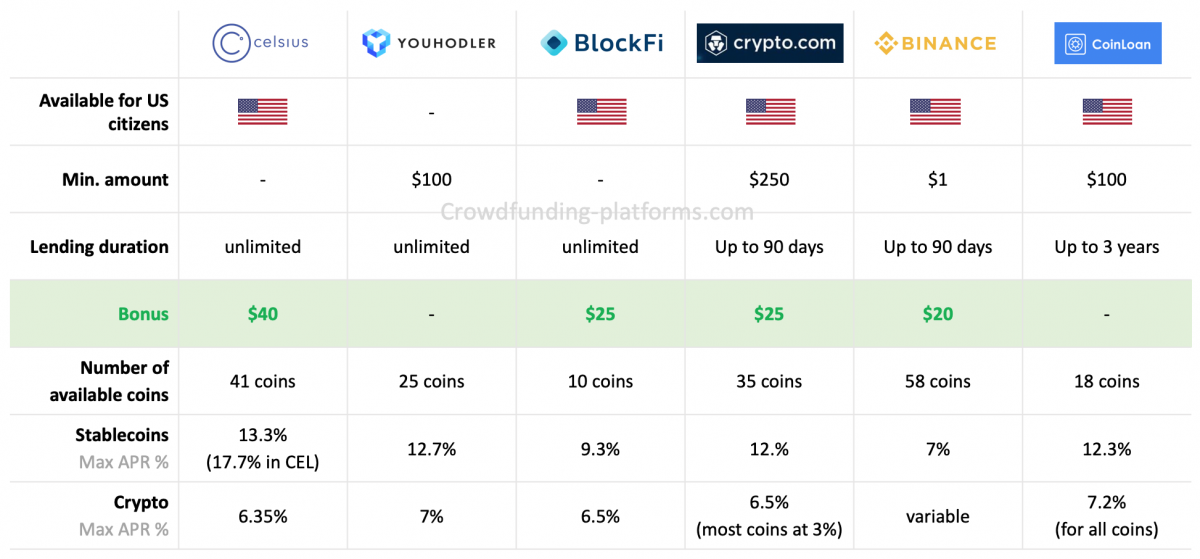

The table below lists the main platforms that should consider and further deep-dive in before investing. When choosing a platform to lend cryptocurrencies, you need to analyze several factors such as:

- interest rate (depending on the coin you want to lend)

- lending duration (is it fix on not)

- deposit limit (is there a minimum amount)

- collateral (how much crypto collateral borrowers need to have compared to the amount of money they are borrowing)

- fees

- platform risks and track record

What we note in this summary is that every crypto lending platform has its own specialty:

- Some platforms don’t require any minimum amount (e.g. Celsius Network, BlockFi)

- Some platforms focus on providing high returns on cryptos, others focus on stable coins returns

- Depending on the crypto assets you own, you might want to select a different platform (e.g. Binance for Bitcoins)

Crypto lending platforms comparison

The outcome of the comparison is:

- Most of the platforms are available for US citizens (except YouHodler)

- Several platforms offer no minimum investment amount (e.g. Celsius, BlockFi)

- Ideally select a platform with unlimited lending duration (e.g.Celsius, YouHodler, BlockFi)

- Most of the platforms offer signup bonus (the biggest being Celsius with $50)

- Platform offer to lending 30 coins on average (Binance and Celsius offering the mos)

- Yields/rates: will be discussed in the next section

As a conclusion, most of the positive characteristics usually are identified on Celsius.Network, YouHodler and BlockFi.

Crypto lending rates

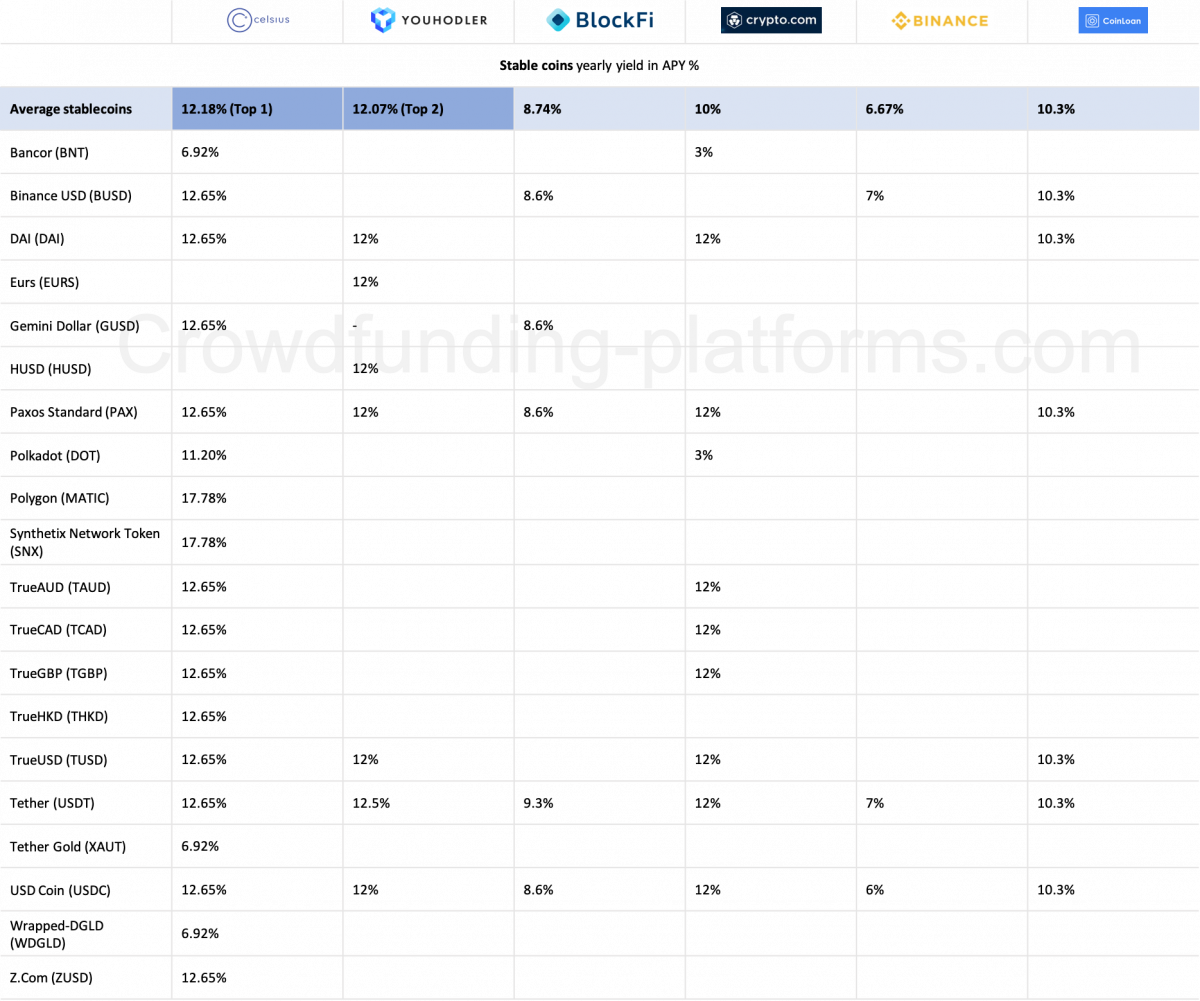

Let’s now look more into details about the yield of each investment platform. Like we said before, choosing the right platform depends on the coins you are planning to lend. Let’s take a look at Stablecoins and coins returns. You can use the following tables listing the rates of the available coins in order to select the best platform based on your portfolio.

Stablecoins lending rates

The figure below describes the rates and the available stablecoins for each platform. The best returns on stablecoins lending are made with:

- Celsius.Network with a 12.18% APY

- YouHodler with a 12.07% APY

Crypto lending rates

The figure below describes the rates and the available coins for each platform. The best returns on coins lending are made with:

- YouHodler with a 4.62%% APY

- Celsius.Network with a 4.53% APY

Best crypto lending platforms

Based on the analysis above we believe the top 4 crypto lending platforms in terms of characteristics and returns are:

You can find a detailed description of these 4 platforms and other extra platforms. The green subscription buttons below give both of us a sign-up bonus. If you liked our article, don’t hesitate to use them, it will be highly appreciated!!!

|

|

|

|

If you are still unclear on what is crypto lending and still need time and information to decide which one is the best platform for you, don’t hesitate to read our article about crypto lending.