Peer to peer platforms have provided the best alternative option to traditional banks and other lending institutions, to those looking for investing or borrowing personal loans, real estate loans, or business loans. While it is still a new form of alternative finance, still not many people understand how P2P lending really works.

In this article, we are going to cover the advantages of crowdlending for both investors and borrowers.

Advantages for Investors

One of the reasons why crowdlending is so popular to investors is because of its immense advantages they offer.

Here are some of the benefits of P2P lending to investors.

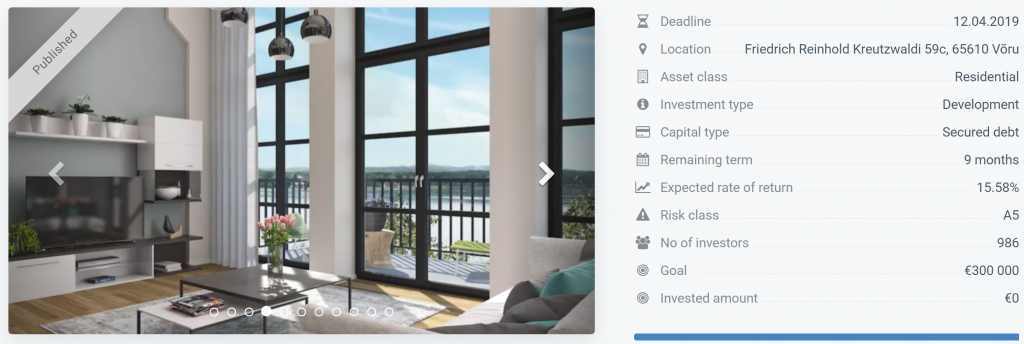

High rates

Saving your money in a savings account will yield no more than 1% annually. And if you want to earn a little more, you should brace yourself let your deposit stay for some months or even years in an instrument. But with crowdlending, it is possible for you to earn high single-digit returns for your cash (4-8% yearly ROI). If you are risk-tolerant, you can even earn low double digits by lending to borrowers who have less than decent credit ratings (10-18% yearly ROI).

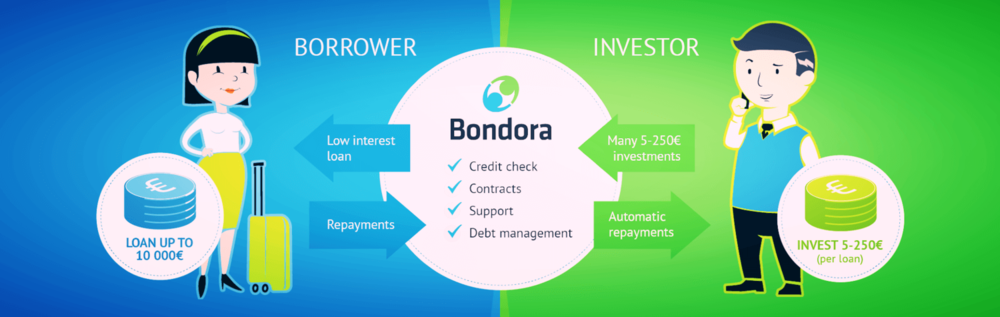

Everything is done online

Everything happens online. There is no need for a large number of papers or meetings with borrowers face to face. Investing and also receiving your repayments is done online. You just have to sign up on a P2P site of your liking, transfer the fund to your account, choose your investments, and sit back and wait for your monthly payments.

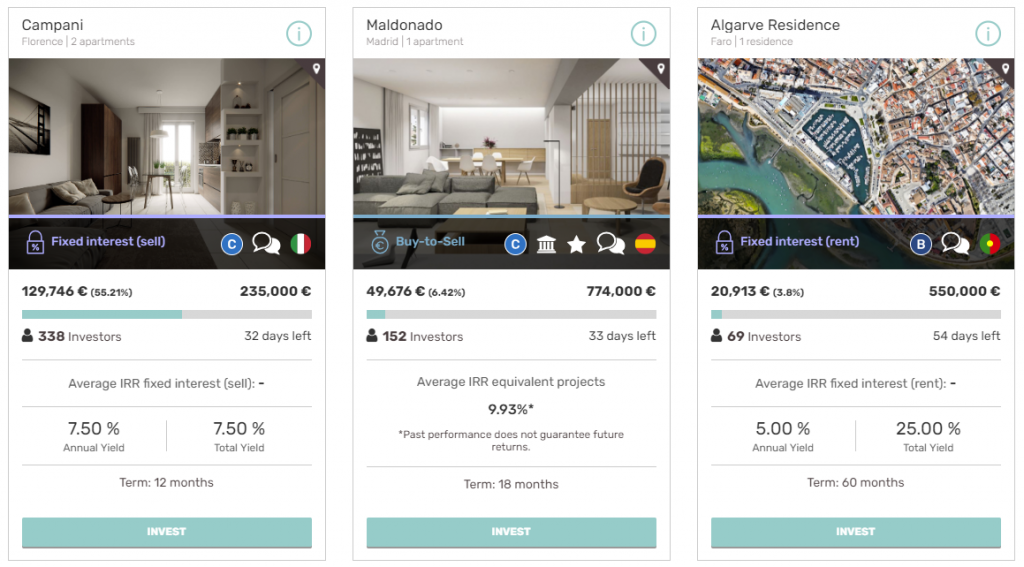

Diversification

Risk diversification is important to any investor. When you put your money in p2p lending, the platform will offer you “notes’ that are actually small amounts of a whole loan. This helps you spread your loans across a number of investors, thus reducing the risk as even if one borrower defaults, the rest will repay.

Passive income

Investing with p2p platforms means you get regular income monthly (usually in the shape of a monthly dividend). The payment includes both interest and the principal, meaning that the small notes are self-liquidating.

Advantages for Borrowers

Peer-to-peer lending offers a number of benefits to borrowers too, including competitive rates, flexible terms, and convenience. Here are some of the advantages.

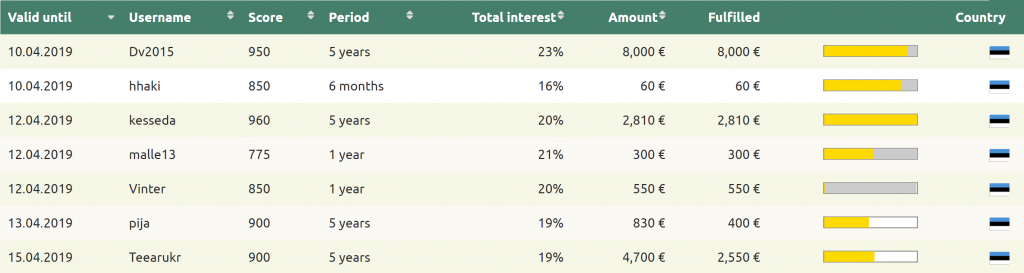

It is fast and convenient

Since crowdlending platforms operate typically online, it means that the whole process, from application to receiving the loan is quick. This can be very handy if you want to secure the loans quickly. Some platforms have a waiting list of investors to lend their money to borrowers, which when combined with the automated matching process; the turnaround time on receiving the loan can be very quick.

Lower rates

Borrowers can access loans with lower interest rates than they could get from banks and building societies.

As lenders offer the fund directly through the online platform to borrowers, there are no typical overheads synonymous with banks and other financial institutions.

A great alternative to banks

If looking for an alternative option to banks or other traditional lending institutions, crowdlending provides a perfect alternative that is worth a try.

No physical meeting with the lenders

Even though p2p loans are provided by individual investors rather than banks, the platform facilitates the whole process by acting as a middleman between the borrower and the lender (investor). This means that you don’t have to meet anyone physically.

The entire setup offers the best for both parties – the lower rates are available for borrowers while risk diversification for lenders.

P2P loans are unsecured

This means that borrowers don’t always have to attach an asset to the deal in order to receive the fund. Moreover, P2P loans are more flexible than bank loans.