|

|

|

Grupeer Review

Grupper is currently not accepting new investments. We advise you to explore the platforms Mintos.

Investors [01.2020] |

Investments [01.2020] |

Founded |

Country |

About Grupeer

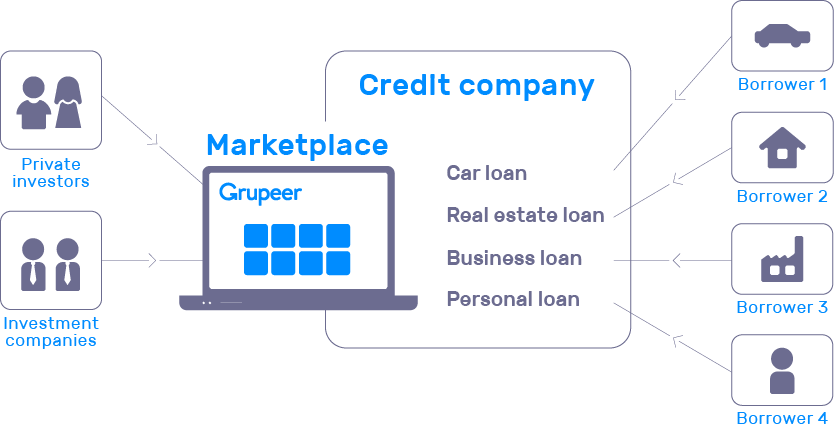

| Grupeer is a p2p lending platform where you can invest in business and real estate loans across worldwide countries (e.g. Finland, Denmark, Spain, Russia, Philippines). You will lend money to borrowers in exchange for monthly interests.

All investments come with BuyBack guarantee, which means that if a borrower doesn’t pay you back your investment, this feature will kick-in to give you back your investment. In this platform case, it happens after 60 days. When selecting an investment, information are provided such as the borrowing company information, investment description, ROI, repayment plan). Mostly projects provide you monthly interests and you receive back your invested amount (principal amount) at the end of the investment term. Performances: Grupeer offers returns of 13.5% average (which is more than the 12% p2p lending market average) with loans ranging typically from 10% to 15% ROI. How it works? Here is how Grupeer works:

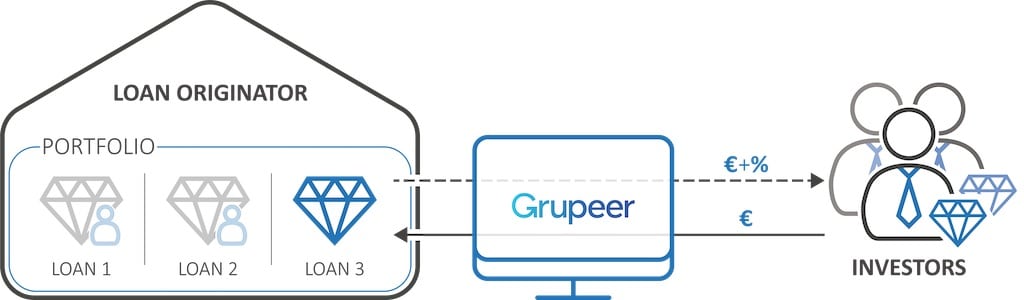

The figure below represents the structure between the three parties of the Grupeer business model: the loan originators (that generate new investment loans), the Grupeer platform that displays the new loan offers, the investors that lend money in return of interests.

Safety: Here is how it works if an investment defaults:

|

Grupeer details

| Investment currencies | EUR |

|

| Return on investment (ROI) | 13.5% | |

| Minimum investment | € 10 |

|

| Investment period | 1 – 21 months | |

| Default rate | 0% |

|

| Investment fees | 0% |

|

| BuyBack guarantee | Yes (60 days) | |

| Auto-invest | Yes | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 3.9/5 | [01.2020] |

| Company profitability | No | [-46K in 2018] |

| Accepted investors | EU, Most of World | Not US |

Pros & Cons

| Pros | Cons |

| + High-interest rates (~13.5%) + Buyback guarantee on all loans + Periodical cash-back investments (1%) + Detailed investment information + Multiple loan originators (>20) + Multiple investment countries (>10) + Auto-invest available |

– Medium-sized platform (lower track record) – Periodical low loan volumes – No secondary market for early withdrawal – Small investment statistics |

Investment types

Investment example

|

Investment result forecast

| Below you will find the resulting forecast when investing using Grupeer compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using Grupeer for 15 years you might end up with €6’682 (€4’285 more than with the stock market). |

Grupeer bonus (affiliate/referral)

| No bonus available for the moment. |

Grupeer competitors

|

How works Grupeer

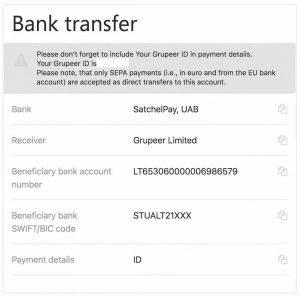

Step 1: Deposit money

Transfer money from your bank account to your Grupeer account. You will have to indicate your Grupeer account ID in your transfer comment (the comment system is supported by all banks.). You must send your deposit from a EURO account. It usually takes 3-4 business days to receive your money. It is advised to first send a small deposit (e.g. €10) to make sure your transfer information is correct, and then to execute the “real” deposit.

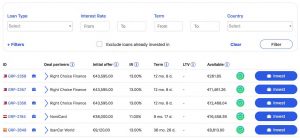

Step 2: Choose the project to invest

Grupeer provides a nice search tool to find your ideal investment. Filter by investment type (mortgage, business or development loan), interest rate (usually 12 to 14%), investment term (usually 6 to 12 months), country, loans originator and LTV (loan ratio of total value).

You can also click on the loan ID to view a lot of additional information about what you are investing in.

Step 3: Select the investment amount

Once you have located the loan you want to invest it, decide how much you want to invest. You need to select at minimum €10. It is advised to do smaller investments and diversify them across multiple projects, loan originators and countries. You have the possibility to do that with this platform.

Step 4: Invest

Once you have confirmed your investments, you can view the list of all your investments with the main information such as the amount invested, the loan type, the ROI, the loan term and the contract you did wit the borrower.

Step 5: Earn interests

You will receive monthly incomes from your investments. So you can expect to start receiving interests after 30 days after your first investment. Some of the investment also give you back a proportion of your invested money monthly, but most of them give it back to you at the end of the term.

Step 6: Track investment

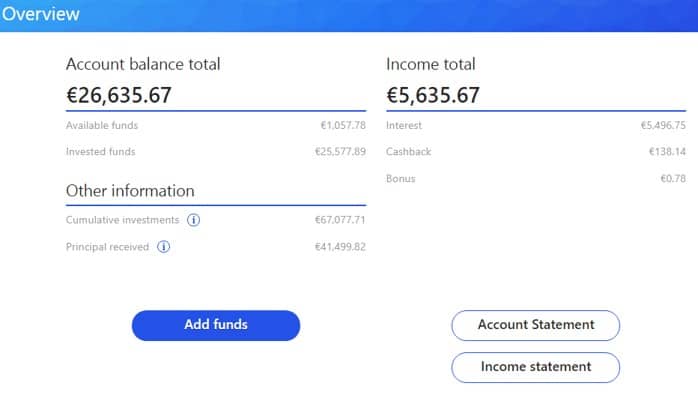

You can easily follow the results and numbers of your investment activities thanks to the dashboard. It provides simple but useful information such as the money you earned (“Income”), the money you invested (“Invested funds”) and the available money to invest (“Available funds”).

Welcome bonus – affiliate/referral link

| No bonus available for the moment. |

Useful links

|

||

| How to configure Grupeer Auto-Invest |