Hey! It’s nice to see that you’re interested to invest in crowdlending. This page will give you information on how to select the best crowdlending platforms to invest in and gives a summarized comparison of the best crowdlending platforms in Europe. By the way, if you didn’t read our article Crowdlending Guide, I would advise doing so. It gives general information on crowdlending, what is it and how to invest in it.

Ranking of the Best Crowdlending Platforms

The table below presents the best Crowdlending Platforms in Europe to use for your investments. The main characteristics of these platforms are displayed in the table below (ROI, minimum investment amount, type of investments, investment safety, etc…). If you want to have more information on each platform you can click on the “Go” button to see our detailed review.

In addition several of these platforms offer signup bonuses, to benefit from them just read there review, and there you will find links and promo codes that will allow you to benefit from them.

- P2P lending called also consumer lending

- P2B lending called also business lending

- Real Estate lending called also real estate crowdfunding

*Buyback guarantee: When a platform has this characteristics, it means that if the borrowers fails to pay you back the loan and the interests related, then the crowdlending platformss will take care of paying them back to you. It makes the lending process safer, but you still have the possibility of the platform going broke.

Best platforms’ information

Mintos

Mintos is the Best Crowdlending Platform is Europe:

- Invest is P2P loans: mortgage, car, invoice, short-term, personal, agriculture

- 7.5B+ investments done via Mintos

- 470’000+ investors

- Average return of 10% yearly return

Crowdestor

Crowdestor is the best P2B lending platform in Europe:

- Invest is P2B loans: startup, restaurant, crypto farm, energy production site, shop, video game

- 122’000+ investors

- Average return of 18% yearly return

Reinvest24

Reinvest24 is the best real estate crowdfunding platform in Europe.

- Invest is Real Estate loans: monthly yield and capital growth combined

- 10’000+ investors

- 70+ projects financed

- 14%+ of average return (APY)

EstateGuru

EstateGuru is the best real estate crowdfunding platform in Europe.

- Invest is Real Estate loans: buy to sell, buy to let, appartements, building, houses, shops

- 361M+ investments done via EstateGuru

- 84’500+ investors

- Average return of 11% yearly return

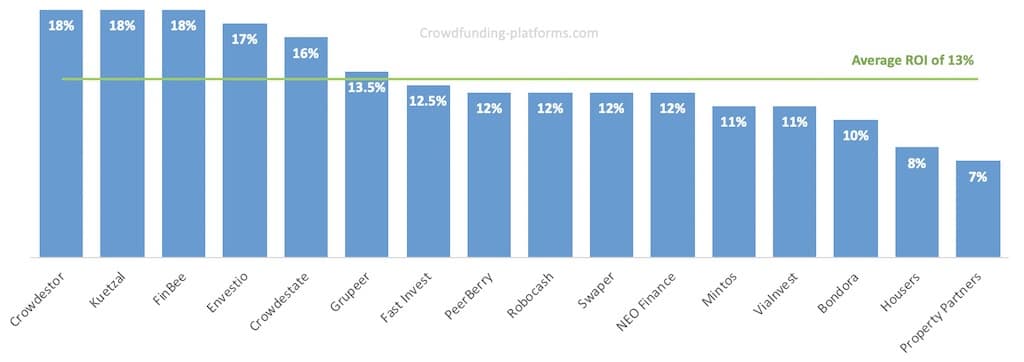

Returns of the best Crowdlending platforms

Below you will find a figure of the expected yearly returns of our top selection of Crowdlending platforms. (the return rates are based on the real current investments available on these platforms, and are NOT based on the marketing numbers advertised on the platforms’ websites)

Figure: Expected ROI of the main crowdlending platforms in Europe

More about Crowdlending platforms

What are Crowdlending platforms?

Before looking into details at the best crowdlending platforms that you can find in Europe we should discuss what are they and what you need them. By the way, bot to confuse you, these platforms are also often called p2p lending platforms, peer to peer lending platforms.

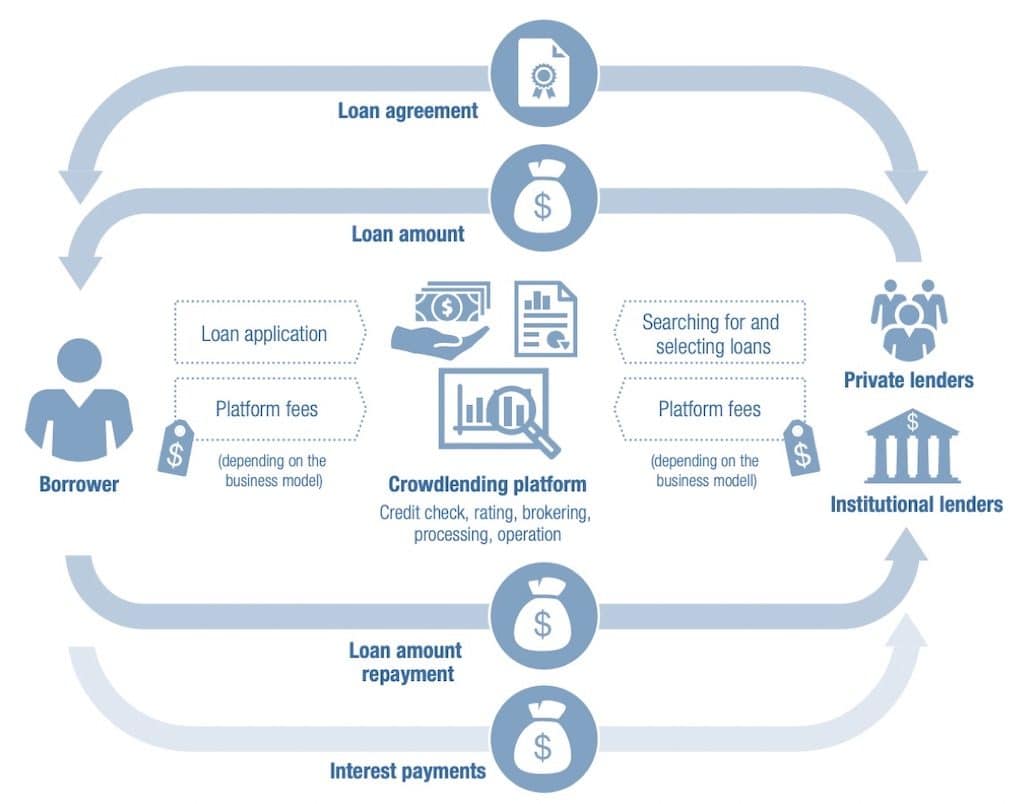

Crowdlending platforms are marketplaces where you can lend your money to borrowers. Imaging basically and Amazon of loans: borrowers that need money will post on this marketplace the amount they need and for how long, investors (lenders) on the other side will select a loan that they want to invest in and give money in exchange interests. The picture below shows you the actors of crowdlending and the flow of money.

The good news is that Crowdlending platforms became smarter and automated the lending process (the function is usually called “Auto invest”) so that as an investor you don’t need to go through every loan you want to invest in (unless you want it), but you can set some criteria you want to follow in your investments and the platforms find and invest in the best deals. Criteria are usually the investment amount, the minimum return, the risk, the duration, the country, etc…

How to choose the best crowdlending platforms?

The choice of platforms depends on two main criteria:

- the platform quantitative and qualitative characteristics which are a common factor to all investors (e.g. type of investment, platform safety, returns, track record)

- your style of investment which is a personal factor (e.g. risk, manual vs automatic investing)

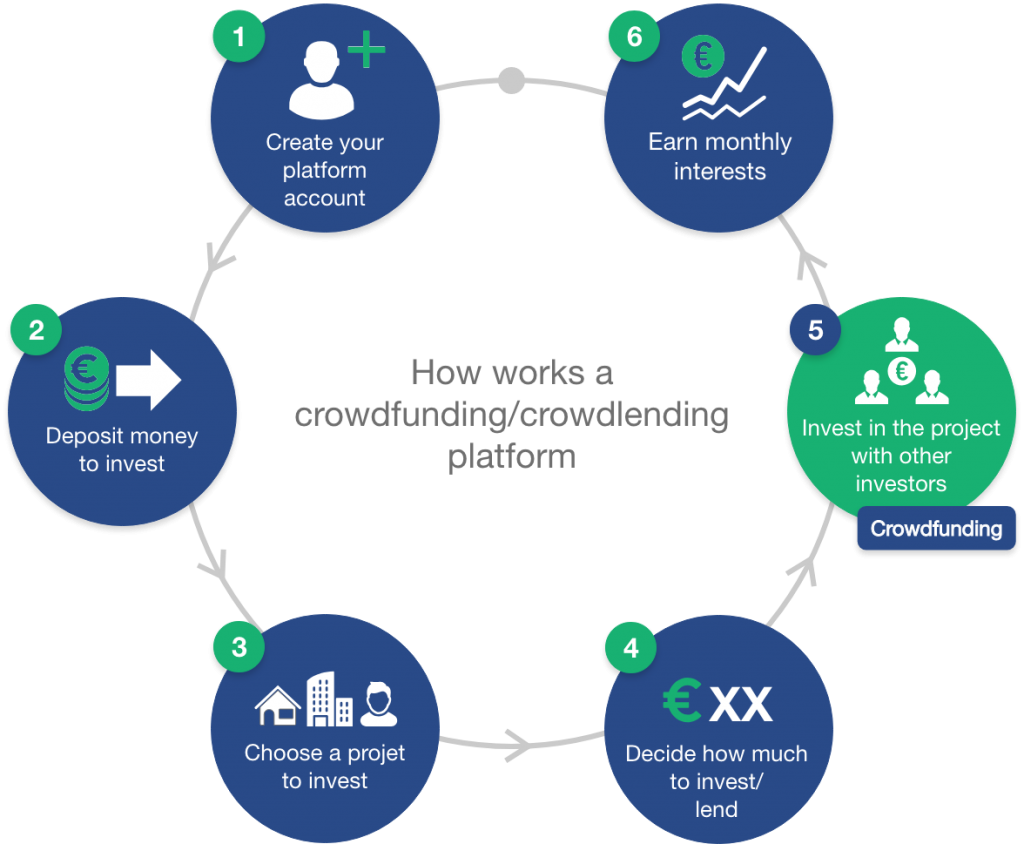

How crowdlending platforms work?

Most of the platforms follow a similar working process represented in the figure below.

Here are the details and tips about the different steps of the process:

Create your platform account (takes 5 min)

Your account will be registered directly on the external platform. During registration, you will have to provide information such as Name, Email, Phone, ID picture. In addition, in most of the platforms, it is also possible to open Business accounts if you invest through a company.

Deposit money to invest (takes 5 min)

After that, once your account is created, the next step is to send money to load your platform account. Transfers are usually done via bank transfer and in Europe and take usually 2-3 business days to go from your bank account to the platform account. Our advice is to send a small amount the first time (e.g. 10 EUR) to be sure that the transfer work and then to send the real big amount to invest.

Also, investments are mainly done in Euro, so if you are investing from a non-euro country or if you own money in a foreign currency, here is an article on currency exchange at low fees.

Choose a project to invest (time varies)

The platform will propose you a big list of investments. They will usually provide you information such as the return on investment (ROI), investment term/duration, lender information, type of investment, risk, country of investment.

Decide how much to invest/lend (takes 1 min)

Once you have chosen the investment, you just need to select how much money to invest. A good practice is to invest the smallest amount as possible on each investment (usual minimum of 10 EUR) and to diversify your money on many investments. So if you invest 1’000 EUR you will be able to invest in 100 loans of 10 EUR which will help you to spread the risk among different borrowers.

Invest in the project with other investors (takes 1 min)

Finally, validate your selected investment amount. At this point, you will be part of the investment and will have financed a big project (sometimes >2-3 M EUR) in collaboration with thousands of other investors. This is the part that is called Crowdlending (or P2P lending, Peer to Peer lending, Social lending) investment.

When you do an investment, you will usually be bound to borrowed by a contract. The investment platform is just an intermediary. Thus if the website fails and closes, legally you should be able to continue the investments and retrieve your money at the end of the contract term.

Earn monthly interests

When you invest your money in a project, the project description gives you information about interest repayments. Some loans have a very short term of a few days and others will last months. For the short term loans (few days) you will usually get your interests at the full repayment of the loan, while if the investment in on a longer-term (multiple months) you will usually get interests monthly. (Since these investments generated from 12-14% on average, you should be able to get returns on your invested money of 1% per month).