About it

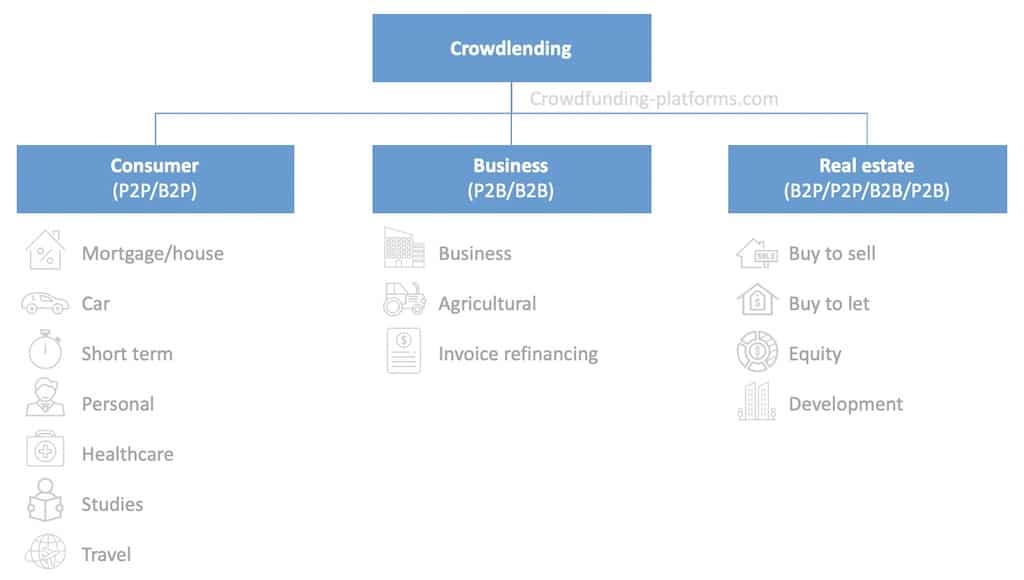

Business crowdfunding (also called crowdfunding for business) is one of the 3 main categories of crowdfunding investments, the others being real estate crowdfunding and personal crowdfunding (see figure below).

In this article, we will talk in particular about lending-based crowdfunding for business, which is commonly called business crowdlending.

In this type of investment, a large number of individuals come together to lend money to a business in the form of a loan in exchange of interests and dividends. The investors don’t own assets in the company they are investing in contrary of Equity-based Crowdfunding (also called Crowdinvesting).

Figure: Crowdlending investment categories

In order to invest in business crowdfunding, investors must use investment platforms called Crowdlending platforms.

These platforms work with businesses that need money for their projects (borrowers) and individuals or companies that are willing to invest their money (investors). Their objective is to facilitate the process of linking those two parties together. Businesses will thus receive a loan from a large number of investors. On the other side, investors spread their funds into small sums thought multiple investments in businesses in order to mitigate risks.

The advantage of crowdlending, compared to equity-based crowdfunding, is that since investors invest in a loan, the interest rate is usually fixed, while it is a lot more difficult to predict returns from purchase and sales of shares of a company, where the value may depend on tons of factors.

In peer to peer business lending, loans usually range from as little of €10’000 to more than €1 million and the entry ticket for investors starts from just €1 to €100 depending on the rules of the investment platform (€50 being a market average).

Why borrowers use it instead of banks?

If it is hard to get a personal loan from a financial institution, it is even harder to get business loans. But thanks to business crowdlending, the gap has been filled.

Typically, to get a loan for a business through p2p business lending, businesses need to be at least six months old. On the other hand, banks require a business to be two years or more to be able to get a loan. Business crowdlending usually offers bigger loans than banks. The loans can reach up to €1 million.

How it works

It actually works in a pretty simple way. Business owners apply for a loan on crowdlending platforms. Once they applied, they go through the risk assessment process of the peer to peer lending platforms where their information are analyzed such as business plan, financials, team structures, etc… in order to establish their eligibility for a loan and then attach a loan grade on the business, which will help investors or lenders to assess how much risk might be for them the investment in the target business.

The next step, for the business crowdlending platforms, is to establish a contract with the borrower, including the terms and the interest rate. With most business crowdlending platforms, borrowers have the chance to make a case for themselves; they can offer an introduction and explain why they need the loan. A convincing, creative listing might have more luck scooping a lender’s attention and trust.

Once the contract is signed, the business loan is displayed on the p2p lending platform marketplace. Lenders can then select an investment loan, read its information including the return on investment (ROI) and select the amount they are willing to invest in it.

After the funding phase has been completed, the investors’ money is brought together into a single loan and the total amount is deposited into the business’ bank account.

Types of investments

Using peer to peer business lending investment sites can be a great way to fund businesses. However, there are other investment options to consider.

There are two types of investments in business crowdlending. They include business loans and real estate loans also called property crowdfunding.

- Business loans: This type of business crowdlending investment allows investors to lend their money to companies and business projects. The companies may be startups or well-established businesses that are cash strapped. In this investment category, the loans are usually given ranging from €10’000 to €1 million, which can be distributed amongst a number of investors.

- Real estate loans: As the name suggests, this type of peer to peer business lending deals with property development projects. This category is further divided into three forms of investments that are, new real estate development loans including loans to construct new buildings that will be sold off in future; buy-to-resell loan, which involves loans to buy an apartment, renovate it, and then sell it and earn on the plus-value. The last division of real estate loans is a buy-to-rent loan, which involves buying a property and renovating it, and then rent it to tenants and earn monthly rental incomes.

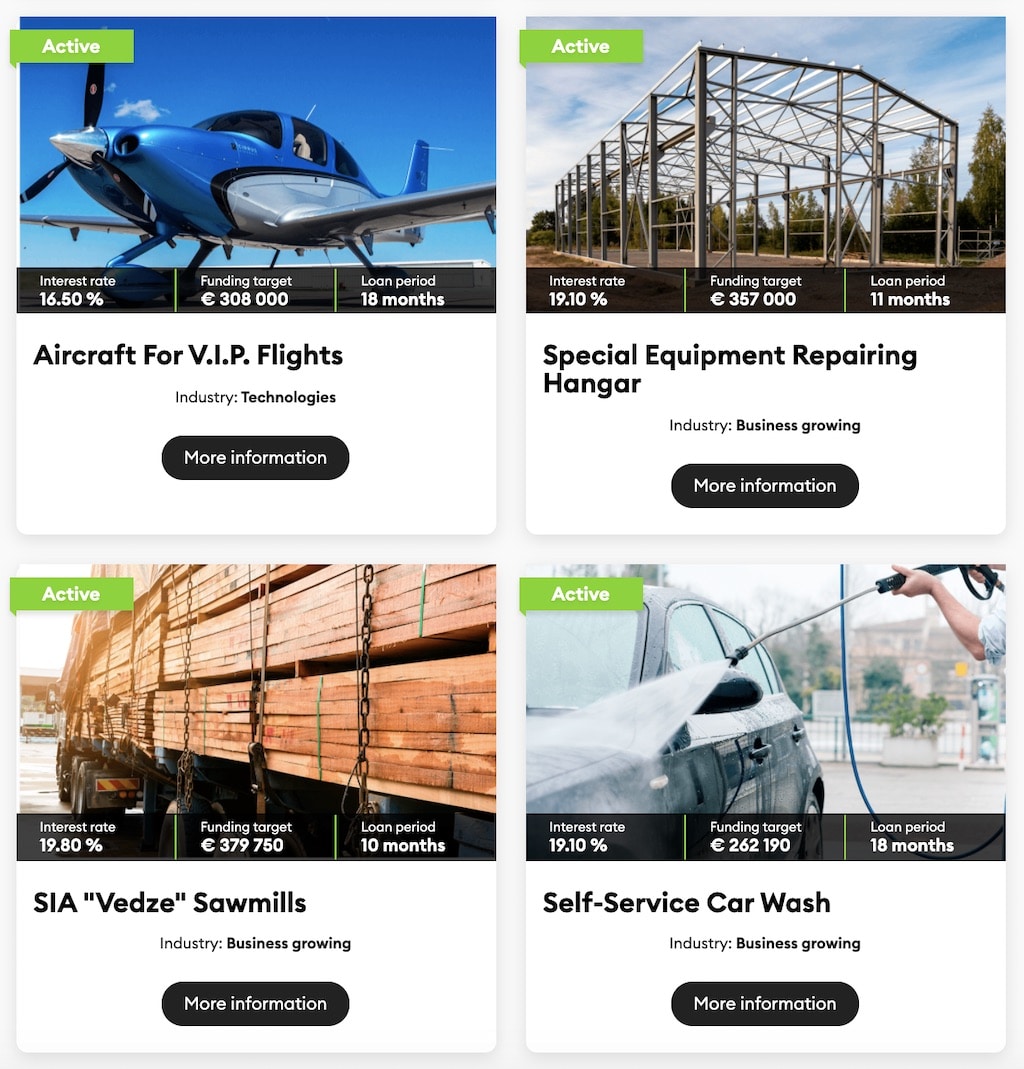

In the image below you can find some ideas of business investments of business crowdlending.

Figure: Example of Business crowdfunding investments from Monethera

European Market

In Europe, crowdlending comprises a variety of different types of alternative financing which by the look of the data, consumer lending is the largest with market size of 42%. The highest funding volumes come from the United Kingdom, which is the pioneer of crowdlending, followed by France, Germany, and the Netherlands.

Business crowdlending has been on the rise in recent years especially in Europe. But the largest peer to peer lending markets are in Asia, then the United States and Europe.

2016 marked a significant period for Europe’s P2P lending as an alternative finance market, which demonstrated clear signs of prolonged strong growth and increased maturation in the industry as a whole.

In 2015, the European alternative finance market including P2P lending grew by 92% to €5.4 billion, according to a study conducted by the Cambridge Center for Alternative Finance at the University of Cambridge Judge Business School, in collaboration with KPMG and supported by the CME Group Foundation.

The United Kingdom dominates the European market when it comes to the alternative finance industry, with 81% of the market share. However, the signs show that the rest of the continent is quickly catching up.

P2P lending is also 5 times greater in popularity in Western Europe than in Eastern Europe. While the interest rates have been increasing steadily in East Europe, it has nearly remained the same in Western Europe. The East European market increased by 153% from 2015 to 2017, confirming the rapidly growing volumes. The main reason for the bigger popularity of crowdlending in Western Europe is the region’s fast-paced development.

In 2018, the UK market alone extended to lend up to 6 billion pounds of P2P loans, with the big four platforms having stakes in up to 5 billion pounds of liability and indicating a 20% upsurge in the year 2017.

Benefits for investors

Business crowdlending provides massive advantages to investors:

- Higher returns: peer to peer lending generally offer higher returns to investors (yearly ROI from 8% to 20%) as compared to other types of investments such as the US stock market (6% yearly ROI aver last 30 years)

- Accessibility: p2p lending is available to investors with small to now investment experience. Investment platforms are built in a way to make all processes super easy and guided.

- Spreading risk: Business crowdlending offers many options as far as the types of risk investors want to take on, and provide a way to distribute the amount investors are intending on lending over a number of small loans with varying risk levels (investment starting for as small as €1 to €10)

- Interactions between investors: Depending on the investment platforms used for P2P lending, the parties involved can feel some sense of community. Site’s forums tend to be pretty active with users who are willing to exchange information about borrowing and lending experiences.

- Streamlined processes that make the whole concept convenient. The application process is quite easy for both lenders and borrowers.

- Interesting investment opportunities allow accessing deals such as startups, company growth, restaurant financing, green companies funding, etc…

Benefits for borrowers

- Easy application as P2P platforms offers direct interaction between the lenders and borrowers. Borrowers sign up and explain the purpose of their loans in as many details as possible to provide a clear picture to lenders. P2P lending sites usually do all the necessary checks quickly and make loan requests available for lenders in a short time. Borrowers simply have to produce their personal information; the loan amount; the credit score; the purpose of the loan; and the income range. If it’s a business loan for a startup, they may be asked to provide details of the business financials, balance sheets, tax returns, and income statements.

- Get funded instantly. The speed of funding depends on many factors but is still quicker than banks. Since loans are split into small investment amounts among a wide range of lenders willing to invest, the loans are usually funded rapidly. Good crowdlending platforms usually can raise money up to €1 million in 2-3 weeks.

- The loans are sometimes unsecured, meaning that borrowers don’t always necessarily have to attach an asset to the requested funds which can in contrary have a negative impact for investors (when investing, if possible it is always advised to invest in asset-backed loans).

- Peer to peer lending for business offers a great alternative for sourcing funds.

Risks

While P2P lending has been nothing but a revolutionary, everything has risks particularly if it involves finances. Here are some of the risks associated with business crowdlending.

Borrower defaults

There is a risk that some borrowers may fail to repay the loans. This could be due to unforeseen events such as business bad performances, ill-health, or even something more sinister like a deliberate attempt to defraud.

P2P platform goes bust

This, while rare, is the most grievous risks associated with crowdlending. The platform through which you lend your money can go out of business.

In this case, good platforms have an Audital/Financial expert pre-assigned, that will take the lead in case of platform bankruptcy. His goal will be to gather an much money as possible and to redistribute it to investors and suppliers of the platform.

Investors’ money may not be loaned straight away

Once investors deposit their money in a P2P platform and make it available to be loaned, interest are usually only earned when the total amount of the invested loan is funded. This process takes a maximum of 1-2 weeks, which corresponds to the time that money might not generate interests. Some crowdlending platforms, to avoid this inconvenience, offer interests calculated starting from the day the investors locks his money in an investment opportunity.

Best Business Crowdfunding platforms

Several crowdfunding platforms are available for business crowdfunding investors. Without appropriate information, one can easily get lost in a sea of options. When choosing a platform, you need to look at its credibility, site functionality, customer service quality, and documentation. You may want to pick a platform that acts as a broker-dealer rather than a listing service, and platform with prior experience of handling crowdfunding investments for business.

Before choosing a platform, make sure the site has solid venture capital backing. In most cases, your investment could be locked up in the platform for a substantial amount of time. You should make sure that the platform you choose is credible and will remain in operations for a long time. Also, look at the way the platform conducts its due diligence and ask all the relevant questions. Find out the kind of documentation that the platform collects before closing potential deals and whether they as companies to provide indemnities of liability to investors when something goes wrong. As for customer service, verify the existence and quality of customer care provided by the platform.

Given the large number of platforms available, you probably want to settle with a verified and reviewed one. If you want to invest in businesses via business P2P lending platforms, the following investment platforms may be your best choice:

Takeaways

Crowdfunding or peer-to-peer lending is a rising trend in the business industry. It allows investors to diversify their investment portfolio by investing in projects they would otherwise not afford. Buyers also gain access to more capital that they would not otherwise access, and in a shorter time frame. When utilized correctly, this form of financing can benefit both those who are looking to fund a project and those seeking to get funding. When searching for viable investment platforms, it is crucial to conduct thorough research and due diligence. This will help in choosing a reputable and easy-to-work-with platform.

Don’t forget to like our Facebook page !!!