|

|

The P2P lending market is unstable at this moment with the crash of Envetio and Kuetzal. Some people are raising concerns about Wisefund. Thus I advise you not to invest in this platform in the medium term until the market becomes more stable. You can invest in more trustable platforms such as Mintos.

Investors [11.2019] |

Investments [11.2019] |

Founded |

Country |

| Wisefund is a crowdlending platform focusing in the fields of business crowdfunding. This platform is a pretty new entrant on the market as it was founded in March 2019. The platform rapidly started to be trendy, and in the first 9 months of its launch, the platform raised more than 3 millions of investments and attracted more than 1700 investors.

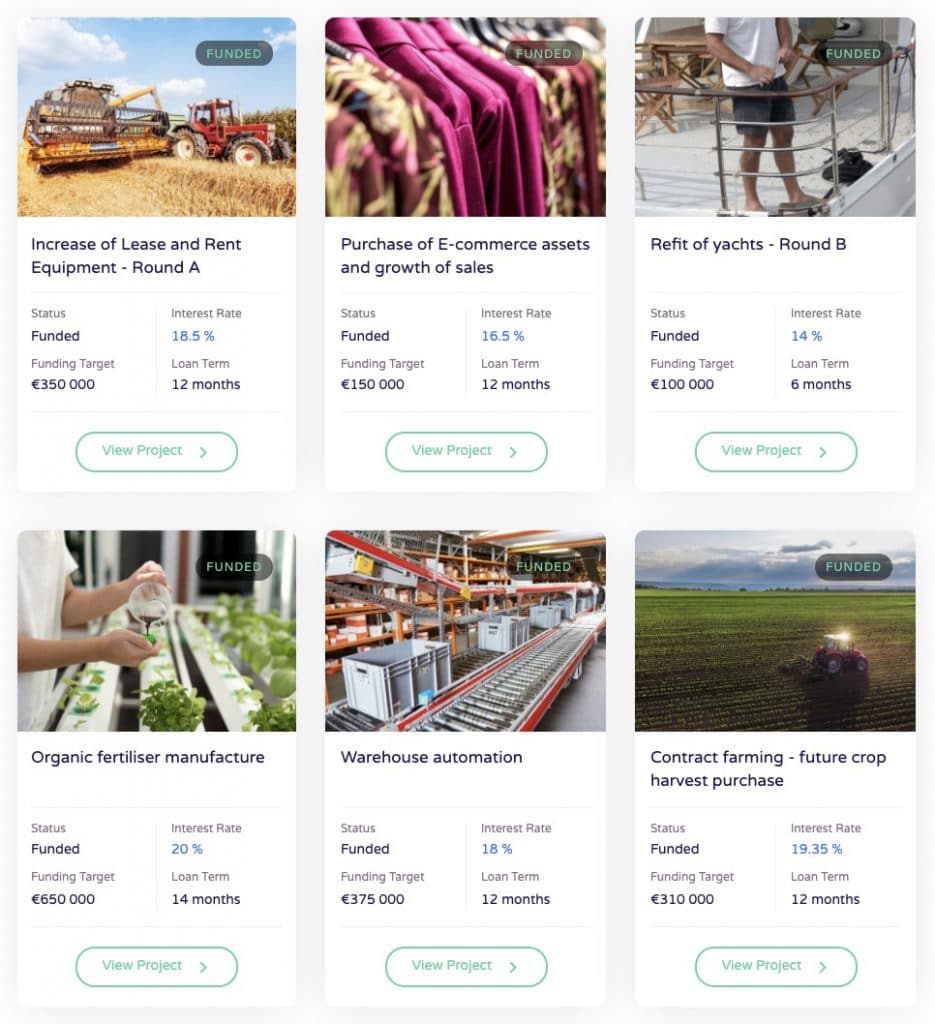

On November 2019 the platform has excited his two first investments allowing her to start building its track record. Available projects have a minimum size of € 50’000 and can be described in the categories below:

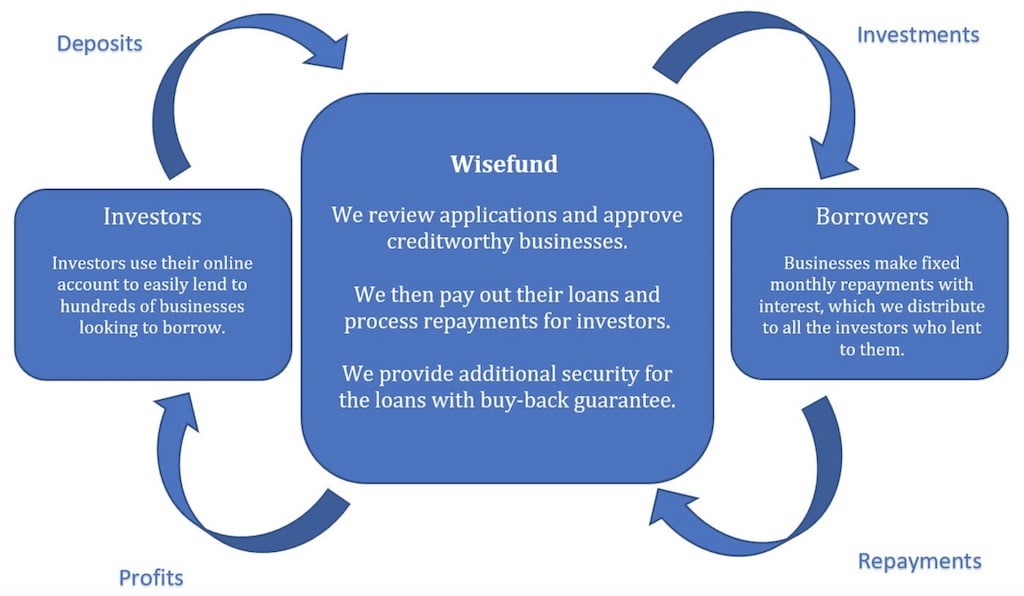

Sadly, the details of previous investments are only available to their investors. Location-wise, the platform offer projects located in Germany, Latvia, Estonia and Poland Projects usually return monthly interests (the last calendar day of the month) and the invested amount (principal amount) is returned to the investor at the end of the investment which is often of a 4-14 month term. The €10 minimum investment amount is a great advantage of this platform compared to his competitor Crowdestor. How it works:

Performances: The ROI of Wisefund investments is in the highest range of the market, averaging at 18.06% ROI (on 11.2019) and with projects ranging from 14% to 20% return on investments (directly related to risks). Safety: Wisefund offers two interesting features to investors:

|

Advice

| Wisefund has really high returns on investments averaging at 18.06% over their available projects and the platform offers interesting alternative projects.

The platform is an interesting new-comer to watch and to start inserting gradually and carefully in your portfolio as it has still a small track record but provides great returns. |

Pros & Cons

| Pros | Cons |

| + Highest-interest rates of the market (~18%) + Small minimum investment amount (€10) + Short-Medium term investments (4-14 months) + Early exit (variable fee) + Diversified types of investments + Monthly interest payment + BuyBack guarantee (100% principal) |

– Small track record (founded 2019) – BuyBack is optional (variable fee) – BuyBack guarantee doesn’t repay interests – No Auto-invest available – No secondary market for early withdrawal |

Wisefund investment details

| Investment currencies | EUR | |

| Return on investment (ROI) | 18% | |

| Minimum investment | 10 EUR | |

| Investment period | 4 – 14 months | |

| Default rate | 0% | |

| Investment fees | 0% | |

| BuyBack guarantee | Yes, option (60 days) | |

| Auto-invest | No | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 4.4/5 | [11.2019] |

Investment types

Investment example

|

Investment result forecast

| Below you will find the resulting forecast when investing using Wisefund compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using Wisefund for 15 years you might end up with €11’974 (€9’577 more than with the stock market). |

Wisefund competitors

Useful links

|

||

| Wisefund Risk Analysis |