You’re starting to build up knowledge about the stock market, and you might even think “let’s try to invest”! But did you think about the stock market risks before investing your money? Remember one thing, no investment is risk-free. The risk is usually proportioned to the potential income you can make. Higher the risk, the higher the return!

This section answers the following questions:

- Which risks are you taking when investing in the stock market?

- What is the level of risk?

- How reduce your risk?

What is risk in the Stock Market?

Let’s understand first what is risk in the investments sectors.

Risk is defined in financial terms as the chance that an outcome or investment’s actual gains will differ from an expected outcome or return. Risk includes the possibility of losing some or all of an original investment.

Investopedia

So remember, when you invest in the stock market you have basically two outcomes of risks:

- you risk earning less than the forecasted return

- you risk to loose the full amount of the money invested

Let’s detail an example for each of these two outcomes.

Earn less than forecasted

I guess you remember the company Nokia and her awesome portable phone, the 3310, that allowed a full generation to play the game Snake (see illustration below).

During the years 1998 to 2000 the Nokia phone where super popular and had a clear advantage towards the competition. So many investors decided to buy Nokia shares.

Just look at the picture below showing the value of the Nokia stock. It had raised from $14.80 beginning 1998 to $63.1 mid-2000, which is an increase of value of 420% over just 2.5 years! But then it dropped, eaten by competition.

This is the first risk you might have, buying at a high price, while the stock continuously decreases, leaving you with a negative return.

Now let’s take a lot at the second case, the worse case! When you loose all your investment.

Loose the full invested amount

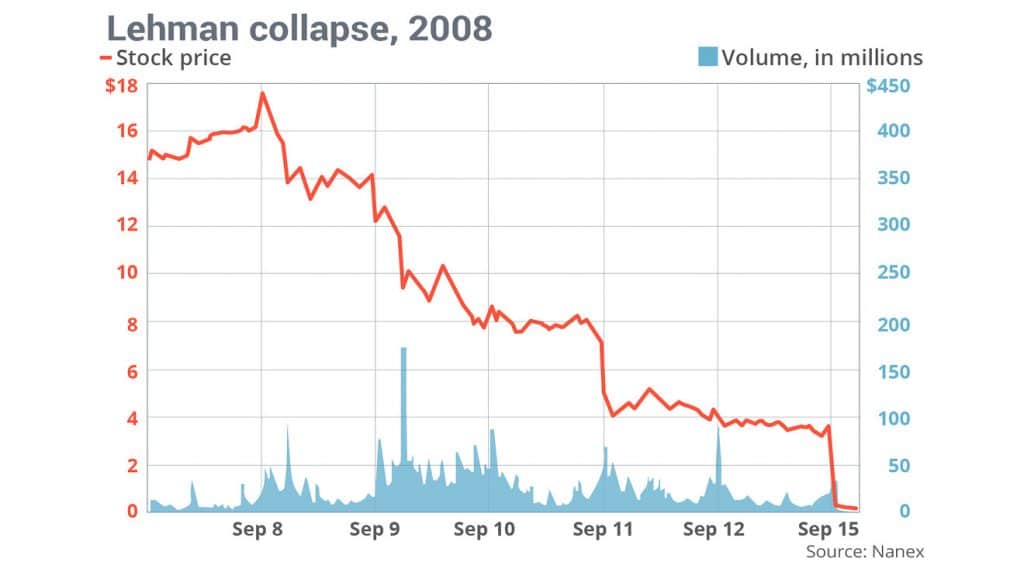

Let’s now take the example of the company Lehman Brothers. Lehman was the 5th biggest bank in the US when it went bankrupsy, 25,000 employees, and 158 years of live. But this didn’t stop her to go bust.

Look at the figure below. it gives you an illustration of how the stock decreased over the last days before it’s bankrupsy.

In this case, as a stock market investor, you risk to loose all your money. It happens pretty rarely but it happens sometimes.

If you are the owner of common stocks, your shares will become practically worthless and will stop paying dividends. Your stocks will also be unlisted from the stock exchanges and usually, a Q is added to the stock symbol to indicate that the company has filed for bankruptcy.

And in rare cases, it’s possible that the shares may regain value as the company emerges from bankruptcy.

Why risk can be good?

Remember what we said? Risk is proportional to return! So without taking any risk, the return should be quite null.

So when you are building your investment portfolio, you don’t want to reduce completely the risk, but you want to adapt it to your risk profile, basically to the risk you are willing to take (in other practical term, how much percentage you are willing to accept loosing in a short/medium term, to potentially earn higher returns later).

I’m sure you already heard of the standard marketing terms bank are using with you when trying to sell you their investment products. You will hear names such as Growth portfolio, Conservative portfolio. These are basically just words to qualify a given risk amount (and it’s related return).

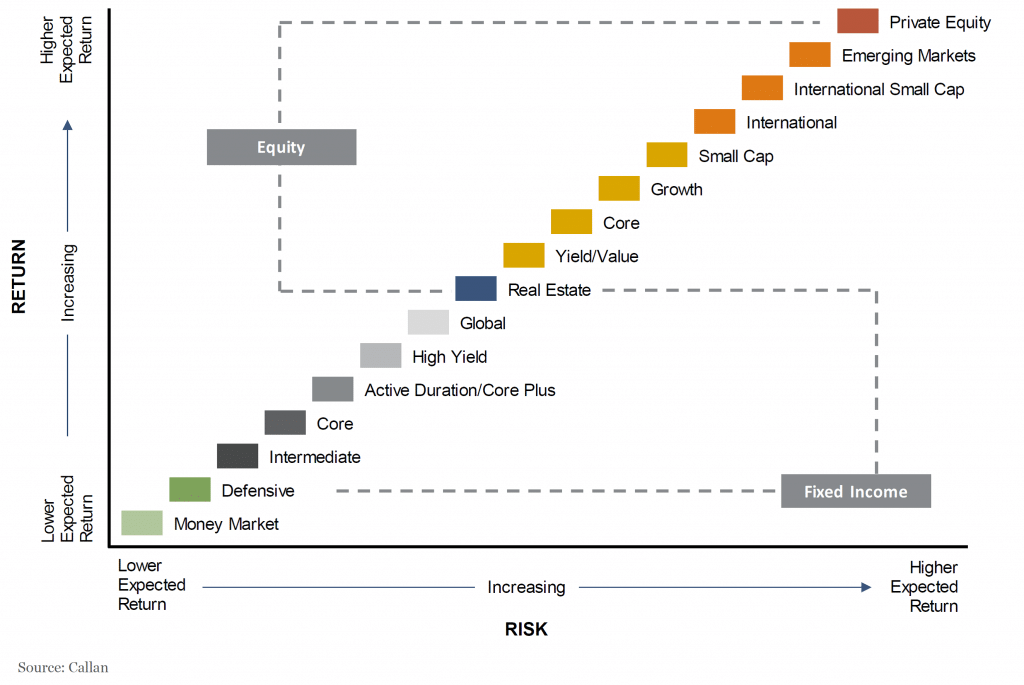

I wanted to share with you the figure below. It gives an interesting view of different types of investments and their risk vs return high level ratio.

For example, you will note that Large-cap stocks (Core), will have a lower risk and return than a Small Cap or even more than an International Small Cap.

So embrace risk, accept it, and just build a portfolio around it that fits your level of risk!

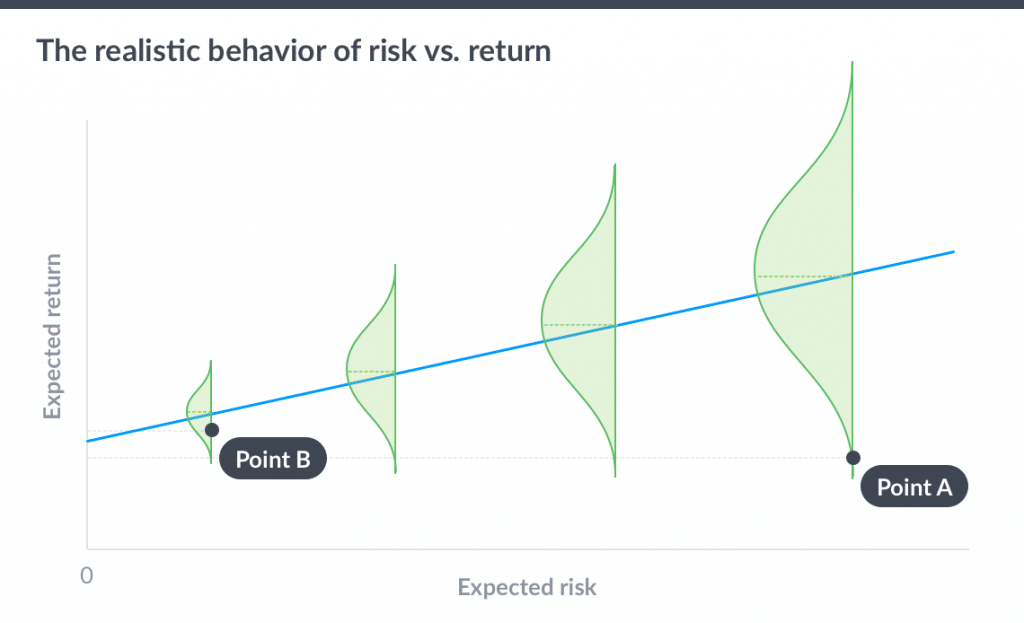

I would like to share you another image about risks and returns. This chart illustrates nicely why risk is interesting. By taking more risk you will increase the spread of your expected return. You will still risk to have a small return, but with also have the possibility to earn a lot more than if you were invested in a safer investment where you can pretty well estimate the potential income.

What are the types stock market risks?

Now that we understood the effect of risk on our stock portfolio, let’s look at the different types of stock market risks you could encounter. This will give you a view and make you understand what to pay attention at when selecting your investments.

These are the risks (sources: Marko – WhiteBoard Finance):

- Market risks: Economic developments / other events

- Liquidity risk: Can’t sell you investments

- Concentration risk: too many eggs in one basket

- Credit risk: entity can’t repay (e.g. bonds)

- Inflation risk: loss of purchasing power

- Horizon risk: your investment timeframe changes

- Foreign investment risk: you invest in another currency than your national one (and that currency looses in values)

Another way to categorise risks would be such as this (source: Medium):

- Company-Level Risk: Negative Headlines, Analyst Downgrades, Credit Risks, Strong Competitors, Bad Leadership, Legal Troubles, Accidents, Dividends Cuts, Bankruptcy, Low Liquidity

- Industry-Level Risk: Restrictive Legislation, Trade Wars, Currency Changes, Challenges in Related Industries, Rising Commodity Costs, Interest Rate Increases

- Market-Level Risk: Stock Market Crashes, Social / Geopolitical / Black Swan Events, Economic Recession, Inflation / Deflation, Interest Rates, Taxes, Removal of Fiscal Stimulus

- Investor-Level Stock Risk: Unlucky Timing, Not Being Diversified, Not Investing At All, Timing the Market, Cognitive Biases

How to optimize risk when investing?

The best way to optimise your risk is to diversify. There are many ways to diversify in the stock market such as:

- Diversification on geography: buy for examples stocks from USA, Europe, Switzerland, China, Japan

- Diversification on company size: buy small caps, middle caps, large caps companies

- Diversify in the investments currency: buy stocks in US dollars but also in Euros, Swiss Francs

- Diversify on investment types: buy stocks, bonds, gold

Another super easy way to diversify is to invest in ETFs. That’s what we discussed in the previous section and that is probably the number 1 easy way to diversify for beginner investors.

When investing in an ETF, you will invest in a large portfolio of stocks, carrying automatically also the diversification you need.

To be greatly diversified, you can invest for example in a Total World Stock ETF which will give your money a diversification among hundreds of companies, several geographies and currencies. An example of such an ETF is the Vanguard Total World Stock ETF (VT).

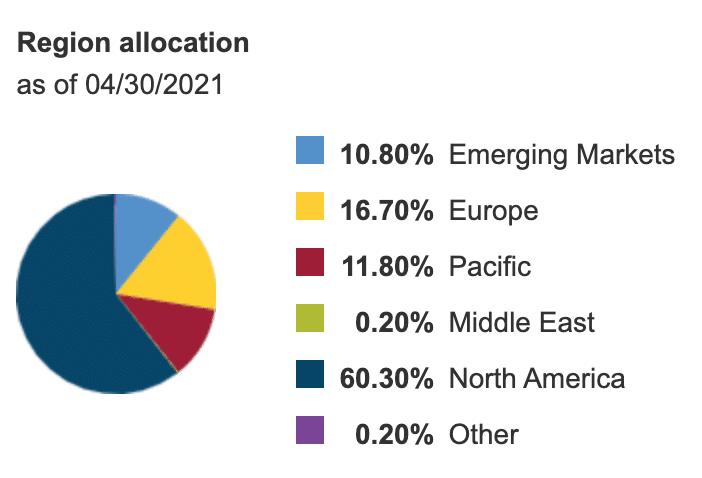

The VT ETF invests in 9,045 stocks accross the globe, spread in many geographies (see the figure below). In exchange you will just have to pay a small yearly management fee, in this case of 0.08%.

← Previous |

Back to start |