What is Crowdlending?

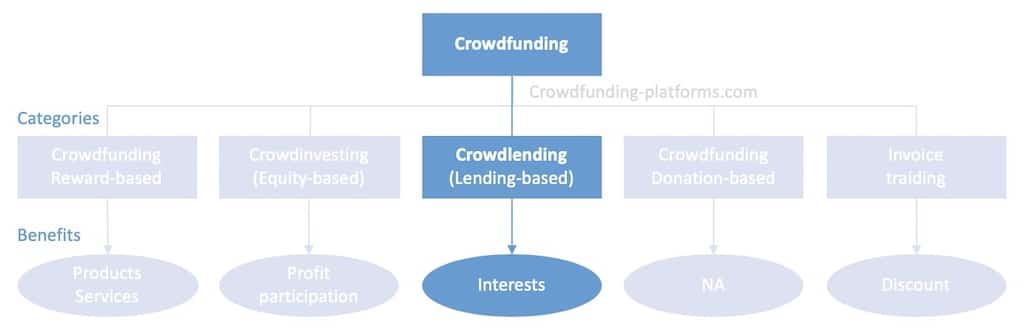

Crowdlending is one of the five categories of crowdfunding investment (see figure below). It is also called Peer-to-Peer lending (P2P lending) or Marketplace lending. It’s a crowdfunding method where investors co-finance projects by lending money (under the form of loans) to the borrowers (project owners) in return for interests (e.g. buying an apartment, financing a company). In Europe, this way of investing can generate an average return on investment of 12-14% per year.

This technique allows investors to access large investments, such as buying companies or building, that they wouldn’t be able to do on their own (source: Wikipedia).

Crowdlending investments are done via crowdlending platforms. The first-ever worldwide launched platform named Zopa was founded in UK in 2005.

Figure: Categories of crowdfunding (source: HLSU)

Explanation per crowdfunding category:

- Reward-based crowdfunding: investors receive a symbolic non-monetary reward, such as a product from the business they supported.

- Crowdinvesting (Equity crowdfunding): investors receive a stake in the financed projects’ future profits, equity in a company or in a real estate property.

- Crowdlending: investors are promised repayment with interest proportionate to the amount they lent and the associated risk.

- Donation-based crowdfunding: people donate money to a specific project without receiving anything in return.

- Invoice trading: investors purchase unsettled business invoices at a discount and receive a return consisting of the difference between what they pay for the invoices and the amounts stated on the invoices themselves.

How crowdlending works

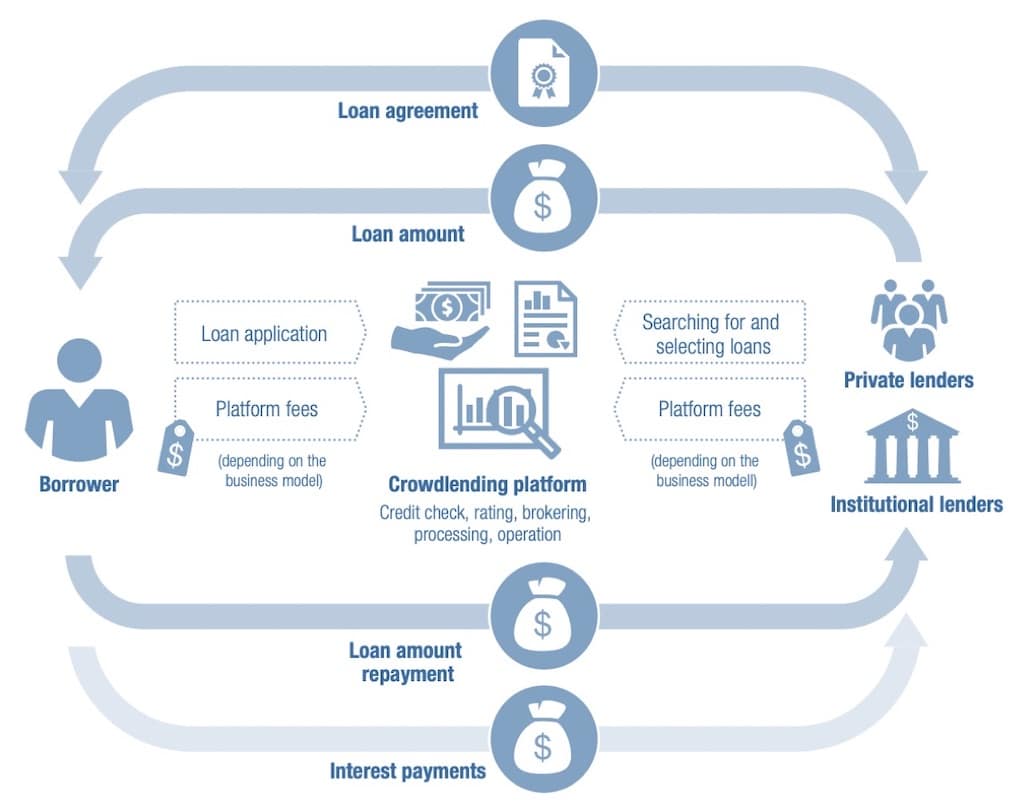

Crowdlending usually involves lenders (privates or companies) lending money to a borrower. Borrowers willing to receive fundings for their project apply for a loan at the crowdlending platform. During the process, they must provide various data needed by the platform to review their creditworthiness and borrowing capacity.

Figure: How crowdlending works (source: PWC)

Crowdlending platforms are a marketplace displaying investment opportunities. Lenders browse them to select investments based on project and borrower information. If sufficient investors are found to finance the amount requested by the borrower, a loan agreement is concluded between the lender and borrower (often credit agreements operate via the crowdlending platform).

After the contract is established, the crowdfunding platforms transfers the invested loan amount from the investor to the borrower. In return, the borrower has to repay the loan amount to the lender over a predefined period, plus interests.

The entire process is handled by the crowdlending platform, meaning that any payment delay or inability to pay on the part of the borrower is handled by the platform, without the investors themselves having to intervene, in exchange for a fee (mostly paid by the borrower).

Case studies

Real Estate investment

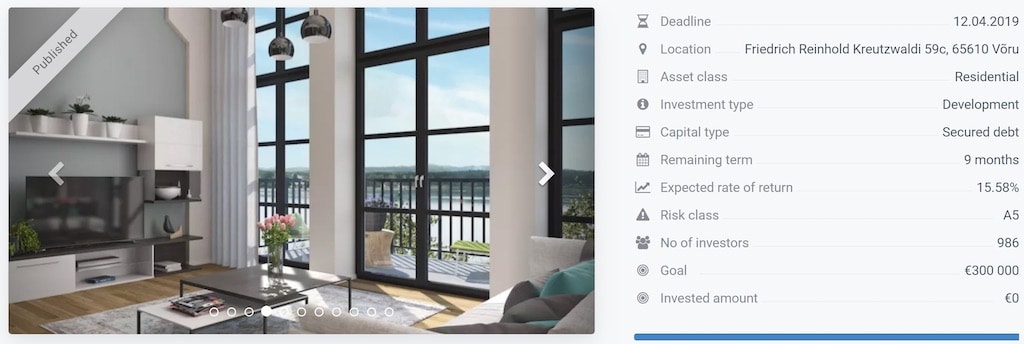

To better understand better how these investments work, here is an example of a concrete case:

Figure: Example of real estate crowdlending investment from Crowdestate

This example is a real estate crowdfunding investment (also called property crowdfunding). The owner of this project needs to get fundings to finance the construction of a new residential building (he needs a real estate development loan). From the project description, you can see that 986 investors financed this project of € 300’000. For instance, if you were part of this crowdlending project you could have invested for example € 1’000 in it.

In addition, we can also read that this investment will generate a 15.58% yearly interest rate and will run for 9 months. So in this case, you would have earned € 116.85 of interests over a 9-month period (which is 15.58% over 9 months) by investing € 1’000. At the end of this investment term of 9 months, you will receive back (unless there is a problem) all your invested money in addition to the interests.

Crypto lending investment

Crypto lending investing is usually automated. Here is the typical process.

Investors that hold crypto will transfer coins to the online wallet of a crypto lending platform. Behind the curtains, crypto lending platforms will use the deposited cryptos to lend physical money to borrowers (e.g. USD, EUR). These borrowers have on their side requested a loan on the crypto lending platform while using their cryptocurrency as collateral.

Crypto will usually automatically earn dividends based on the coin deposited. Each cryptocurrency has a different yield with stablecoins having yields usually from 10% to 18% per year and crypto coins (e.g. Bitcoin, Ethereum) from 3 to 8% per year.

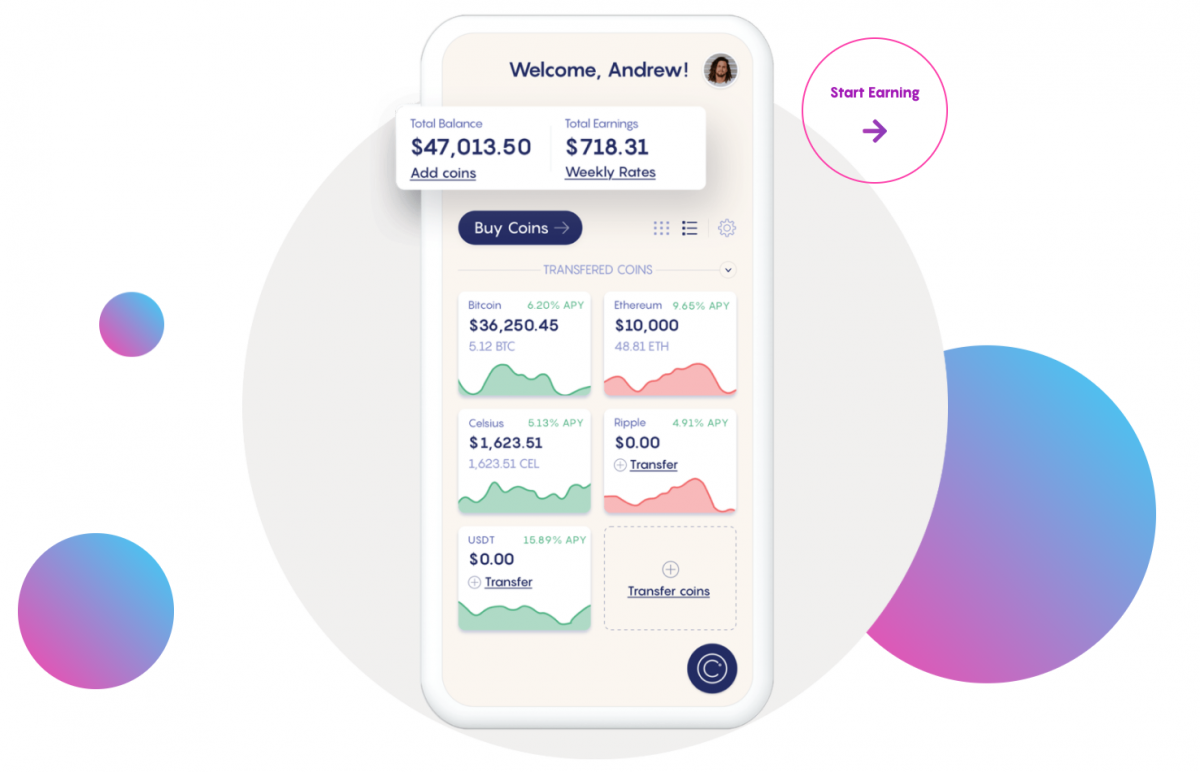

In the image below you can see an illustration of the Celsius.Network platform. You’ll see that next to the name of each deposited crypto there is a green number indicating the automatic yearly yield (e.g. for Bitcoin: 6.20% APY). At Celsius, the interests are credited every week to the crypto wallet.

Investments categories

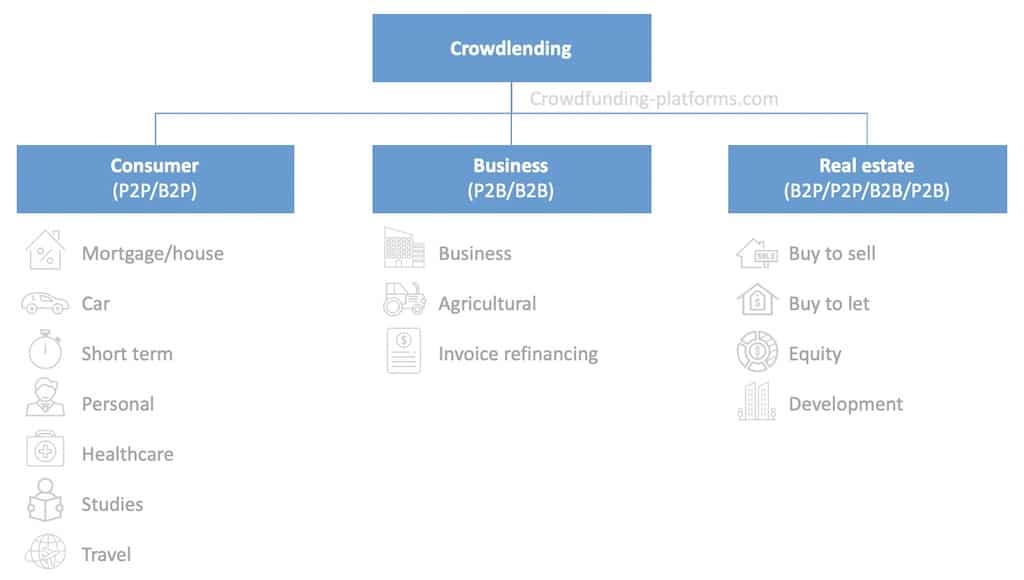

There are 3 main categories of crowdlending investment that you will be able to invest-in: consumer loans (crowdfunding for privates), business loans (crowdfunding for business) and real estate loans (property investment crowdfunding). (See figure below)

Figure: Crowdlending investment categories

Here are some examples of investments that you can find on crowdlending platforms:

Consumer loans

Consumer crowdfunding allows investing in personal loans for private people like micro-loans, car loans, short-term loans. These loans are usually used by people to buy consumer products and do small spending such as buying a car. These investments usually range from € 200 to € 20’000.

Business loans

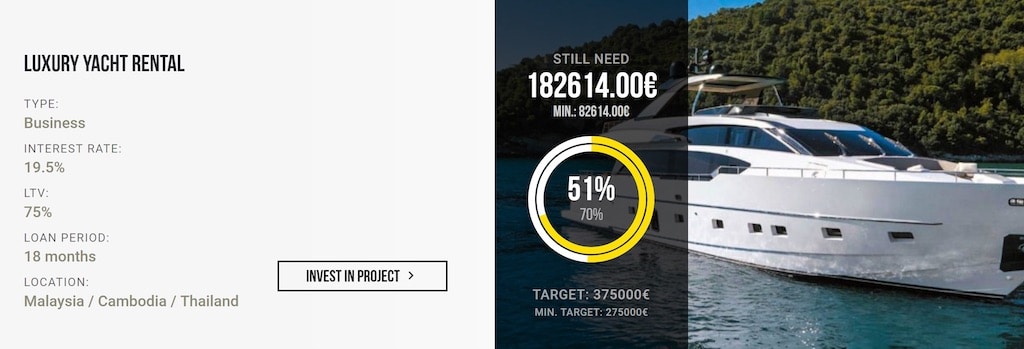

Invest in projects of businesses and companies (e.g. crypto-currency farm, restaurant, consumer goods business, startup company). These business crowdfunding investments usually range from € 50’000 to € 1 million (that can be shared between thousands of investors).

Figure: Business investment example from Crowdestor

Real estate loans

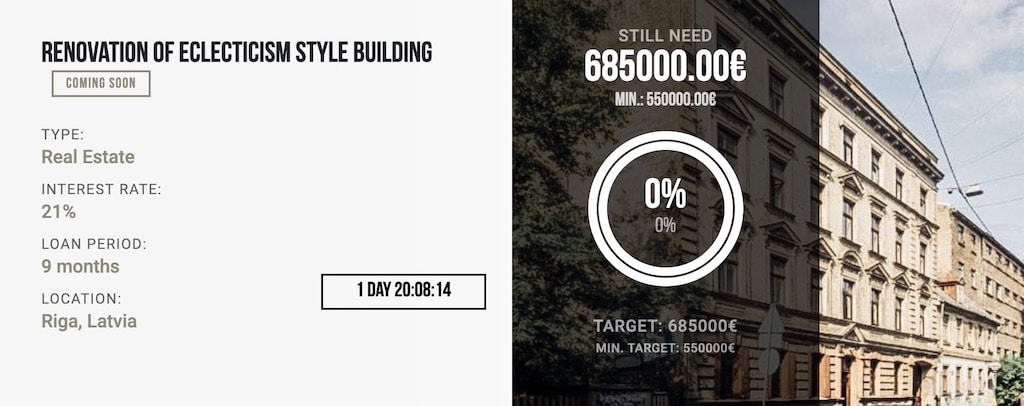

Invest in real estate crowdfunding projects. This property investment crowdfunding can be separated into 3 categories: new real estate development loans (e.g. finance a loan to build a new building that will then be sold), buy-to-resell loan (e.g. buy an apartment, renovate it, resell it and make income on the plus-value), buy-to-rent loan (e.g. buy an apartment, renovate it, rent it to make income from rents). These investments usually range from € 100’000 to € 5 million.

Figure: Real estate investment example from Crowdestor

Crypto loans

From the year 2017-2018, we have seen a new upcoming category of lending called Crypto lending. Investors receive interests by lending their cryptocurrency. Concretely investors’ crypto must be held in an online wallet, and the crypto lending platforms will take care of lending out the money automatically to borrowers in exchange for weekly/monthly returns.

Market size, growth, and forecast

Let’s now take a look at the crowdlending market. In this section we will discuss the market size, it’s characteristics, its growth over the years and the evolution forecast.

Market size

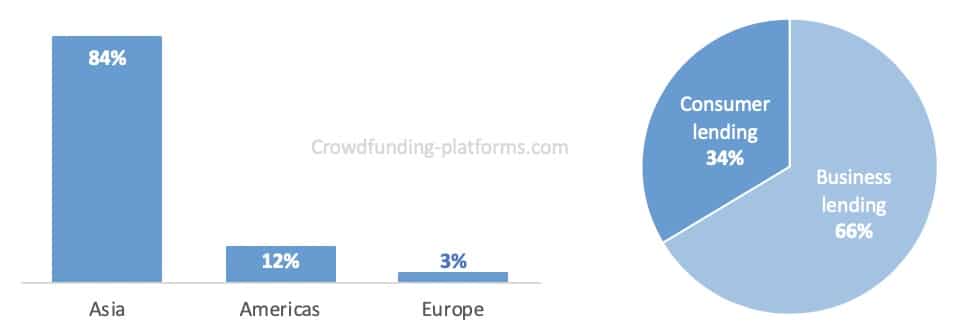

While this investment method started in the UK in 2005, it has developed all over the globe mostly on 3 main markets: Asia (84% market share with $420b transactions value in 2018), Americas (12% market share with $60b transactions value in 2018) and Europe (3% market share with $15b transactions value in 2018) the lats 1% being countries such as Africa and Australia (see figure below left side).

The market can also be split into two main categories of investments: consumer lending (34% market share) and business lending (66% market share) (see figure below right side).

Figure: Market size per region (left), Consumer vs business lending ratio in Europe (right)

Market growth and forecast

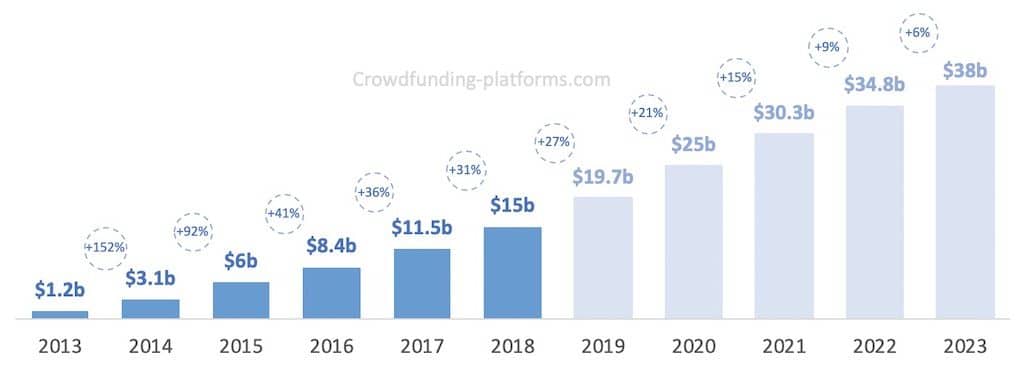

The European crowdlending market has grown from $1.2b transactions value in 2013 to $15b in 2018 representing yearly growth of +70% on average (see picture below).

The market growth is expected to slow down its growth over the next 5 years, growing from $15b transactions value in 2018 to $38b in 2023 representing a forecasted yearly growth of+16% on average (see picture below).

Figure: Crowdlending transaction value in Europe per year (sources: University of Cambridge, Statista)

Advantages

This crowdfunding investment method holds a lot of advantages such as investments possibilities, flexibility, and risks:

- Some crowdlending platforms allow you to invest starting with a small amount such as € 1 (the usual market average is € 10)

- Spread risk between multiple investments and multiple platforms (this is why it is advised to open investment accounts on at least 5-10 platforms)

- Spread the risk by investing across multiple countries (common now in Europe: Estonia, Latvia, Portugal, Spain, Italy, Finland)

- Invest with flexible/short term duration starting from 10 days to 1-2 years

- Access to big investments with small capital since many investors invest in the same project (Social lending). It is possible to invest in a project bigger than € 2-3 million even with € 10 in your pocket.

- Many crowdlending platforms also offer you a starting bonus when you register (e.g. the platform Mintos offers you a 1% cashback on your investments during the first 3 months).

Risks

Investing in crowdlending has a number of risks. These risks can be optimized by spreading risks on multiple platforms and investments. But still, these risks should be considered before investing:

- Borrower default – Happens when the borrower can pay any more interests or can’t give back the invested amount. This situation can be avoided by investing in platforms that ensure to pay you back if this happens (it’s called BuyBack guarantee. You can see it indicated with a

in the list of crowdlending platforms).

in the list of crowdlending platforms). - Loan originator bankruptcy – Happens mostly when too many of their borrower default which makes their finances negative

- Crowdlending platform bankruptcy – Can happen for many reasons (bad returns, bad risk management, too many borrowers default, small cashflow, market-wide crash …). Usually, good platforms are prepared for this event. A contract with a third party firm is put in place to manage the cashout of the loans by the investors.

Return on Investment (ROI)

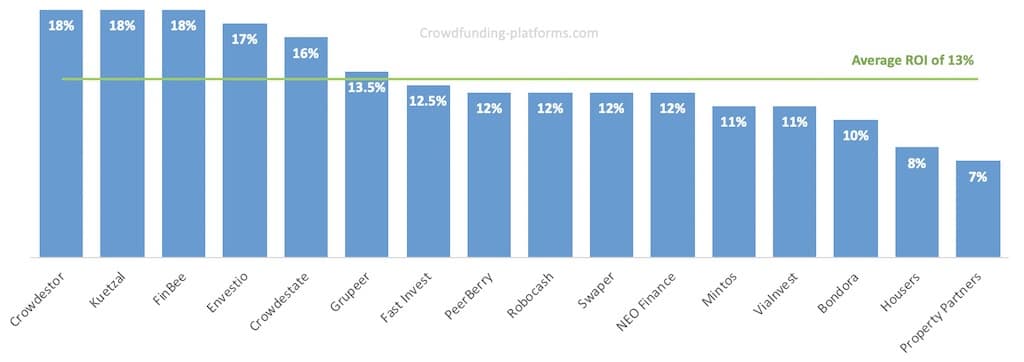

Each investment crowdfunding platform has its own ROI and risks. Therefore it is advised to invest in multiple platforms (at least 5 to 10) to diversify investments and spread risks.

Crowdfunding platforms can be split into 3-risk/return categories:

- Lower-risk platforms: 4% to 10% return per year (ROI)

- Medium-risk platforms: 10% to 14% return per year (ROI)

- Higher-risk platforms: 14% to 20% return per year (ROI)

Below you will find a chart of the expected yearly returns of the best crowdlending platforms (the return rates are based on the real current investments available in 2019 on these platforms, and are NOT based on the marketing numbers advertised on the platforms’ websites)

Figure: Expected ROI of the main crowdlending platforms in Europe

Compound interests

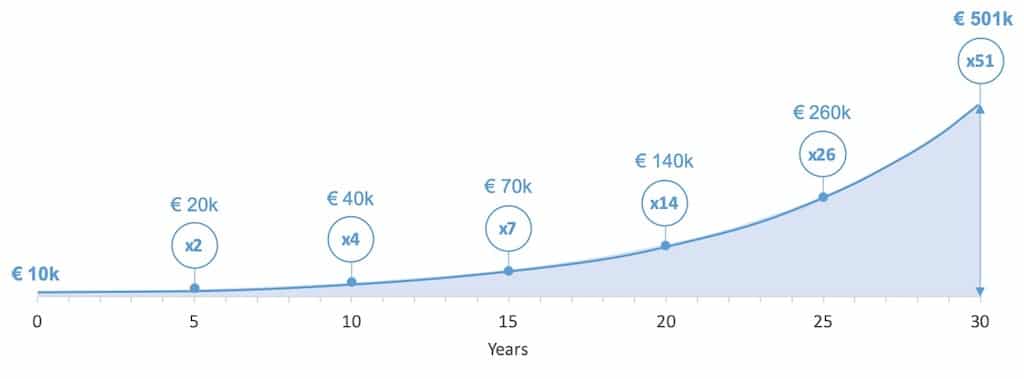

Do you know about compound interest? It is the accumulated increase of interests that you get when you reinvest all the interest generated by your previous investments.

For example, if you invest € 10’000 at a 14% yearly return, this is how will be the evolution of your assets over the years:

- at year 0: € 10’000

- 1 year after: € 11’400 (= + € 1’400)

- 2 years after: € 12’996 (= + € 1’596)

- 3 years after: € 14’815 (= + € 1’819)

- …

- 10 years after: € 37’072

- 20 years after: € 137’435

- 30 years after: € 509’501

This means that you can earn € 16’650 per year over 30 years by investing only € 10’000.

The figure below illustrates the evolution of your assets over 30 years. By investing € 10’000 at 14% you will end-up with € 510’000 after 30 years. Therefore if you are in your 20’s and 30’s, it is the perfect time to invest a small sum that will create a big capital over the years.

Figure: Yearly balance evolution investing € 10’000 at 14% during 30 years

The best crowdlending platforms

To invest, you will have to use investment platforms. There are hundreds of crowdlending platforms running in Europe. They differentiate themselves by multiple criteria such as the projects they invest in (business, real estate, …), their risk and returns, the minimum investment amount. Out of all these platforms around 20-30 are considered more “common” and are used by thousands of investors.

Figure: Main crowdlending platforms in Europe

To make you understand the most common types of investment platforms here are 3 examples of well-known European ones: Mintos, Crowdestor and Fast Invest.

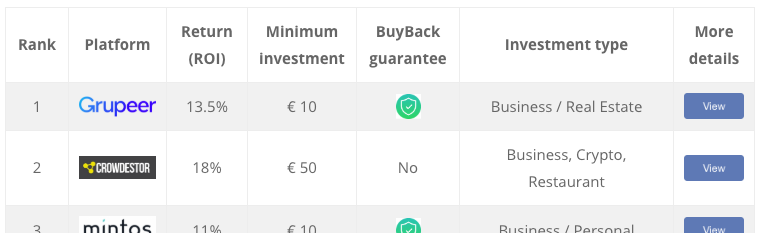

Start investing

We summarized the list of the best Crowdlending platforms to invest in. You can find information about: returns on investment (ROI), minimum investment amounts, if the platform gives you back your investment in case the borrower doesn’t (BuyBack Guarantee) and the fields of investment.