|

|

|

Investors |

Investments |

Founded |

Country |

About Crowdesate

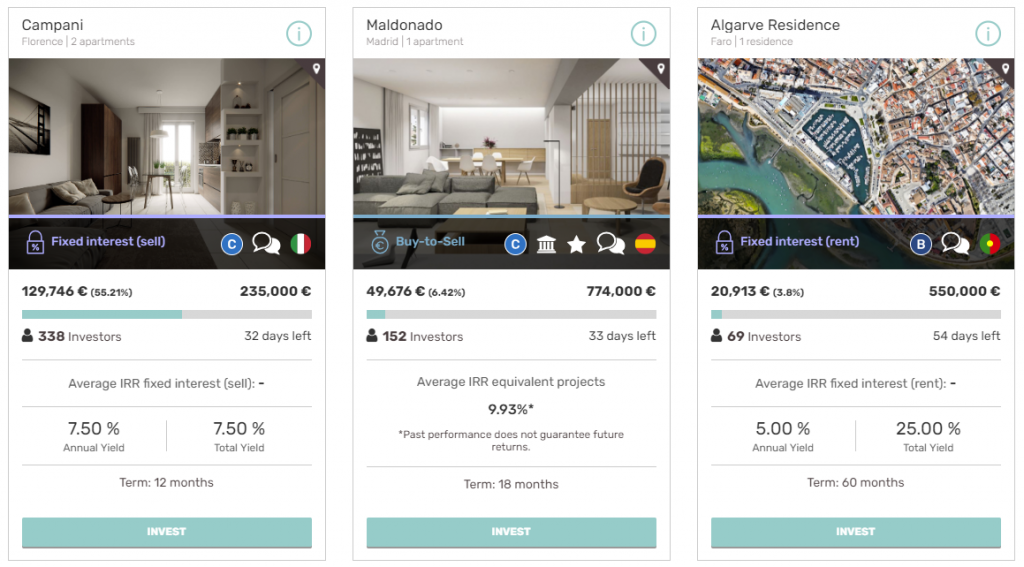

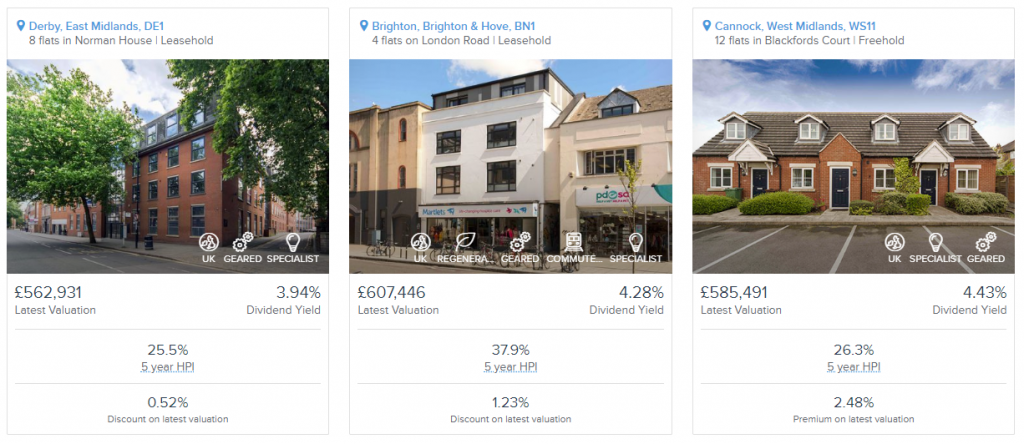

IntroductionCrowdestate is the leading real estate crowdlending platform in Europe. The platform allows investing mainly in real estate loans split into 2 categories:

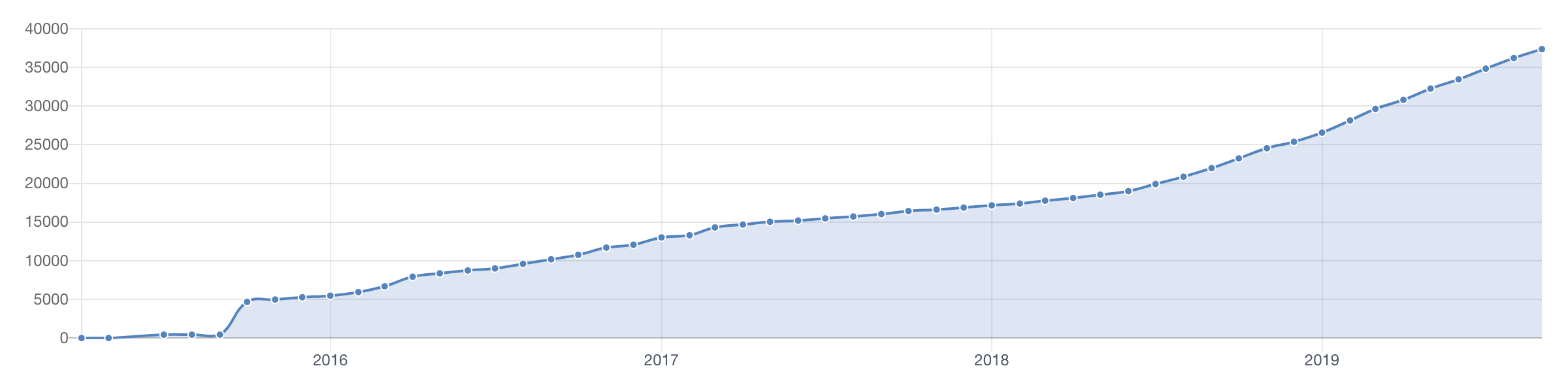

They also have few opportunities in business investments that they call “Corporate Finance” (e.g. financing a sea-food shop, a construction company equipment, a wood factory). Investments are available across three countries: Estonia, Latvia, Finland and Italy. The minimum amount is of € 100 for any single investment and investments can be made with € 100 intervals (e.g. 100, 200, 300, etc…). The average investment size is of € 300-350 in 2019 (see image below). It as reduced considerably over the years.

The platformCrowdestate is growing steadily since 2015. The progression of the number of registered users is displayed in the image below, which can prove its popularity.

The platform is based in Estonia and the company has opened offices in Estonia, Latvia, Italy, Georgia and Romania over the years 2014 to 2019. How it works

PerformanceThis p2p lending platform provides loans generating an average of 16% ROI and proposes investments with a term from 4 months to 36 months. RisksThe platform is not supervised by the Financial Supervisory Authority since they weren’t required to do so by the authorities. The different types of investments and their related risks that you will find on the platform:

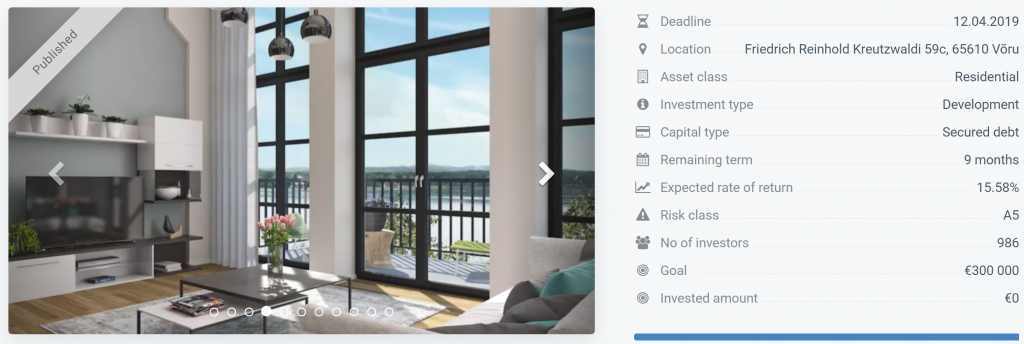

A great point is that a lot of information are provided for each investment to understand it and evaluate risks such as:

For each investment, you will even have the possibility to write your questions to the borrower and read other investors questions in a public discussion feed. |

Advice

| Crowdestate is a great platform for investors that want to diversify their portfolio with real estate since returns are high and documentation on investments is transparent. The platform exposes a pretty complete analysis of each project and investors are even able to contact the project leaders to ask questions. |

Pros & Cons

| Pros | Cons |

| + High-interest rates (~16%) + 5+ years of platform track record + Detailed/transparent investment infos + Available risk and SWOT analysis + Amortized repayment + Auto-invest available + Secondary market available (for early exit) |

– No BuyBack guarantee (guarantee money back) – Large minimum investment amount (€100) – Interesting projects get funded rapidly (2-3 days) – Few investment countries (4) |

Investment details

| Investment currencies | EUR | |

| Return on investment (ROI) | 16% | |

| Minimum investment amount | € 100 | |

| Investment period | 4 – 36 months | |

| Default rate | 0% | |

| Investment fees | 0% | |

| BuyBack guarantee | No | |

| Auto-invest | Yes | |

| Secondary market | Yes | |

| Trustpilot Score (Safety) | 7.1/10 |

Investment types

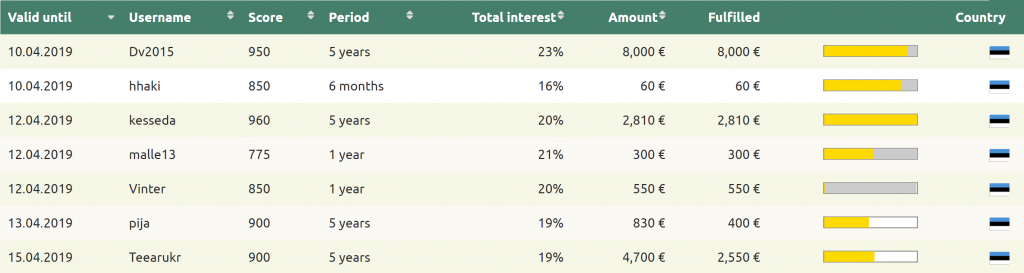

Investment example

|

Investment result forecast

| Below you will find the resulting forecast when investing using Crowdestate compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using Crowdestate for 15 years you might end up with €9’266 (€6’869 more than with the stock market). |

Welcome bonus – affiliate/referral link

| You can register to Crowdestate by clicking the button below. It will be highly appreciated. Thanks! |

Similar platforms

| View the list of all the platforms | |||||