|

Investors [05.2020] |

Investments [05.2020] |

Founded |

Country |

Estonia Estonia |

| Bulkestate is a European P2P lending platform specialized in Real Estate Crowdlending. The platform operates in a model where it issues loans to borrowers (only companies, no private owners) and then offers them to investors in the marketplace. Bulkestate has a focus on funding new development or re-development projects as well as structuring group buying deals to acquire small size real estate (such as one apartment) at wholesale prices (sales price of an entire building).

When investing with this platform, as an investor you will have information on investments such as:

Investments are available in Latvia (mostly in Riga) and transactions are done in EUR. The platforms accept investors from most of countries. A great feature from Bulkestate is that for each investment, an advisor is available and can be contacted to ask any questions and bring transparency to investments.

Figure: Bulkestate Advisor per project How it works:

Performances: This p2p lending platform provides loans generating an average of 14.75% ROI and proposes investments with a term from 3 to 24 months. Multiple projects offer a bonus to investors who invest a big amount (2% for amounts larger than € 25,000, 1% for amounts larger than € 10,000). Safety: The team behind Bulkestate is mostly composed of real estate experts. They have a large experience with due diligence and approval processes. |

Pros & Cons

| Pros | Cons |

| + High-interest rates (~15%) + Possibility to talk to an advisor for each investment + Auto-invest available |

– No BuyBack guarantee (guarantee money back) – Small number of monthly return loans – Secondary market not available (for early exit) |

Bulkestate investment details

| Investment currencies | EUR | |

| Return on investment (ROI) | 14.75% | |

| Minimum investment | € 50 | |

| Investment period | 3 months – 2 years | |

| Default rate | 0% | |

| Investment fees | 0% | |

| BuyBack guarantee | No | |

| Auto-invest | Yes | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 3.4/5 | [05.2020] |

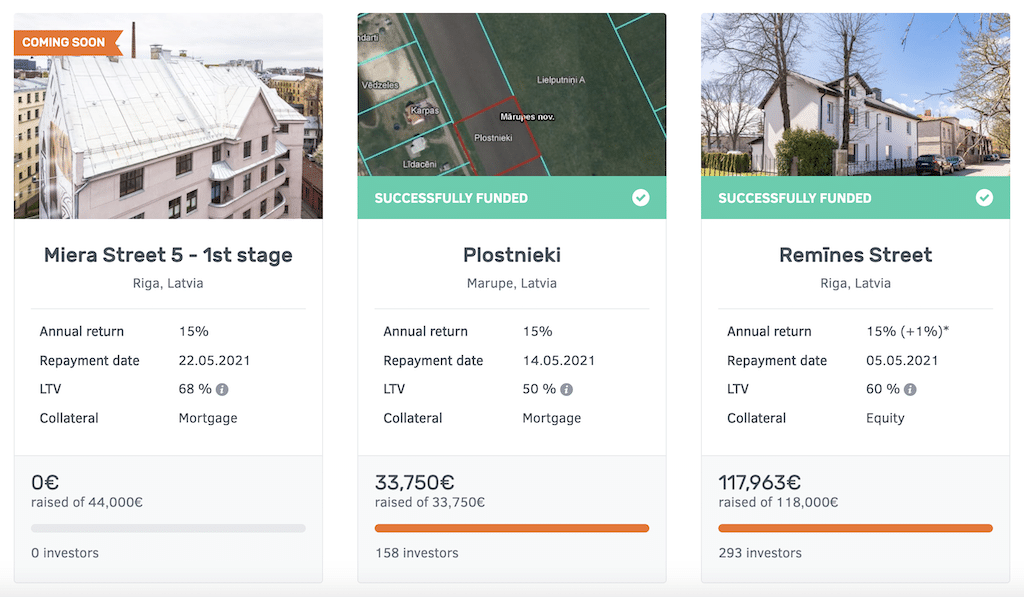

Investment types

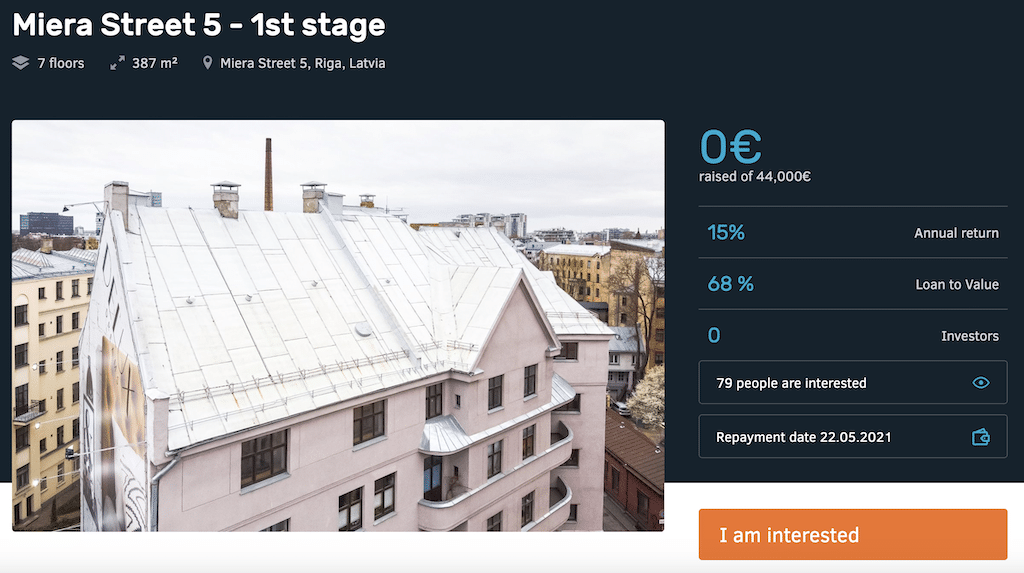

Investment example

|

Investment result forecast

|

Below you will find the resulting forecast when investing using Bulkestate compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years). By investing €1’000 using Bulkestate for 15 years you might end up with €4’785 (€2’388 more than with the stock market). |

Bulkestate bonus and cashback

| Register on Bulkestate by clicking the button below. |

Bulkestate competitors

|

|||||

| View the list of all the platforms | |||||