What is Real Estate Crowdfunding?

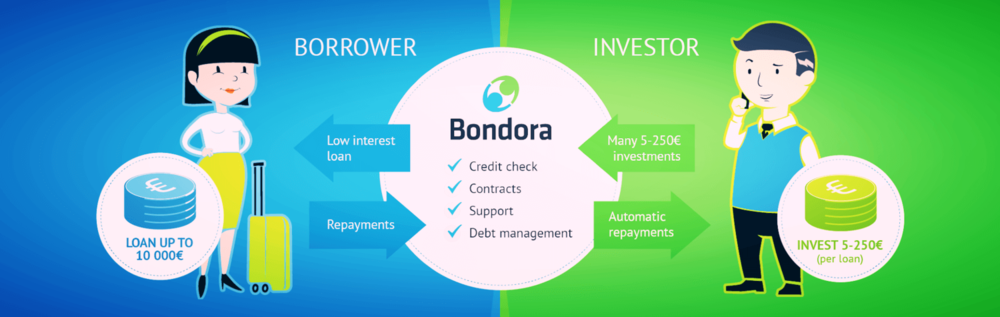

Real-estate crowdfunding (also called property crowdfunding) is a way of raising money for real estate investment by reaching out to a pool of investors to contribute a small amount of money towards a project. Simply put, it is a form of raising funds that allow small real estate investors to fund big projects.

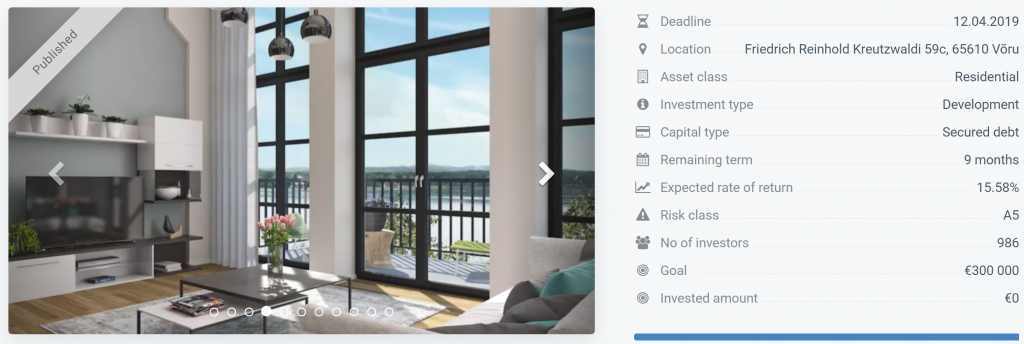

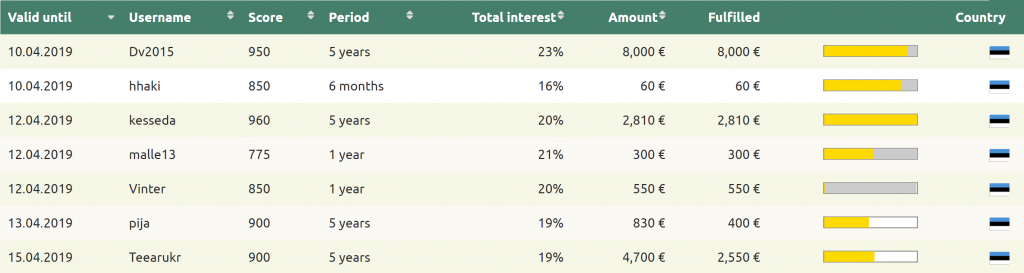

Real estate crowdfunding is also referred to us real estate peer-to-peer lending or financing of real estate projects. The process of raising money is conducted via an online crowdfunding platform (see the list). One party (the borrower) joins a platform with the aim of getting funds to start or improve a real estate project. Another party (the investor/lender) joins a platform to invest capital in exchange for high returns on the investment.

Why people use it?

A viable option for raising money amongst real estate investors is property crowdfunding, which involves raising money to buy properties for selling or renting. The approach has become a feasible alternative to traditional ways of raising funds for investments. It pools small amounts of finances from various investors (lenders) to finance a real estate asset or a portfolio of properties. As an investor, you get to invest your funds either through equity (you own a stake of the real estate asset) or debt (you lend money as a loan) in return for a proportional stake of the project returns (sales value increase or rental income).

The major attractive point of peer-to-peer lending in real estate investing is that it gives small investors the opportunity to participate in high income and highly sophisticated real estate projects. For large real estate developers, they use crowdfunding platforms as a mean of soliciting investments from accredited investors groups. On the other hand, small real estate business owners launch crowdfunding campaigns to raise money for smaller investment deals.

Whatever the purpose, peer-to-peer lending is increasingly becoming a viable option for raising money for real estate investing projects. The industry has seen an increasing number of investors allocating their portfolio into crowdfunding. A 2019 report by Transparency Market Research indicated that the number of loans issued under crowdfunding are increasing by 10% annually and transaction value by 27.4%. With such growth, the global peer-to-peer lending market is expected to grow to a market value of €900 billion by 2024. In Europe alone (excluding the UK), the crowdfunding industry has grown to €211 in equity lending, €159 in reward lending, and €53 in donation lending.

Benefits

Locking down the finances needed for real estate investments is usually a big challenge to both beginners and seasoned investors. Property crowdfunding can be an excellent alternative for raising funds. It also attracts other notable benefits for both borrowers and investors/lenders that include the following.

For Borrowers:

- Real estate crowdfunding increases the sources of funding while you grow your investor network

- Peer-to-peer lending allows real estate companies in the early stages to start operations more quickly

- Successful projects from a peer-to-peer lending platform result in positive word of mouth and eventual clients’ loyalty

- Crowdfunding involves direct marketing that helps in promoting your real estate business

- Your business can access valuable feedback from your online crowdfunding community allowing you to address possible business flaws

- You can save money and time by using a user-friendly investment platform

For investors:

- You gain access to low-levels of investments with some projects being offered for as little as €10.

- You can make short-term investments, some ranging between 2 and 48 months

- Peer-to-peer lending opportunities do not attract investment fees, which implies a higher return on your side (in Europe the average ROI is 12-14%)

- Crowdfunding has the benefit of transactions transparency as members know exactly where their funds will be invested

- Crowdfunding offers an opportunity to diversify your investment to various asset classes and countries

Types of investments

Split by Equity and Dept

If you are a real estate investor with some capital, you can grow your wealth passively through crowdfunding. You have two options: Equity and Debt investing.

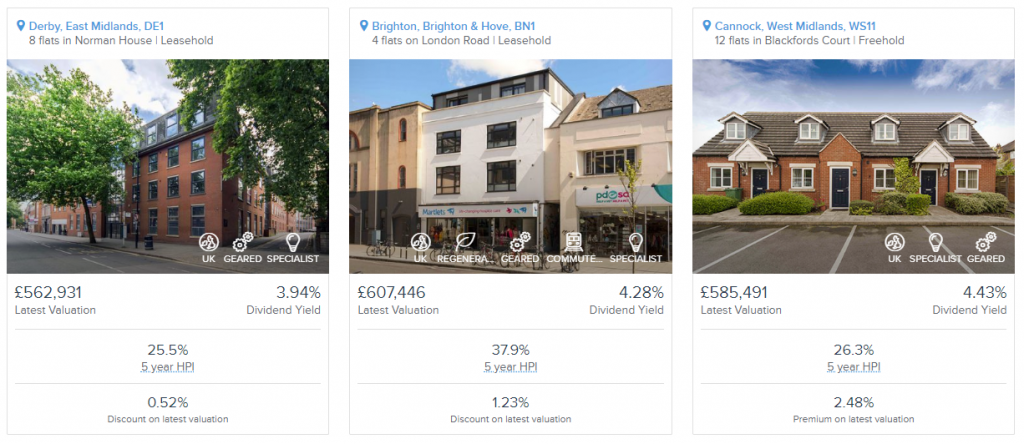

Equity (Equity-based) Crowdfunding

Equity investment provides high returns compared to debt investing. When you invest this way, you will receive returns based on the property’s rental income less crowdfunding platform fees. The pay-outs for this type are usually sent quarterly and the investors earn a share of the property’s appreciation value in case it is sold. The major risk associated with this type of investment is that investors have an equity stake in the property, which means they can lose money if the value of the asset decreases.

Debt (Lending-based) Crowdfunding

Dept investment is the most common route for investors as it is more simple to invest. In this type of investment, you lend funds to the owner of the property. In turn, you will receive a fixed interest based on the owner’s mortgage loan and the amount that you have invested. Payments for loan investment are usually given quarterly or monthly. At property pay-out (which is usually a fixed date), you will receive your invested amount (principal).

Split by investment purpose

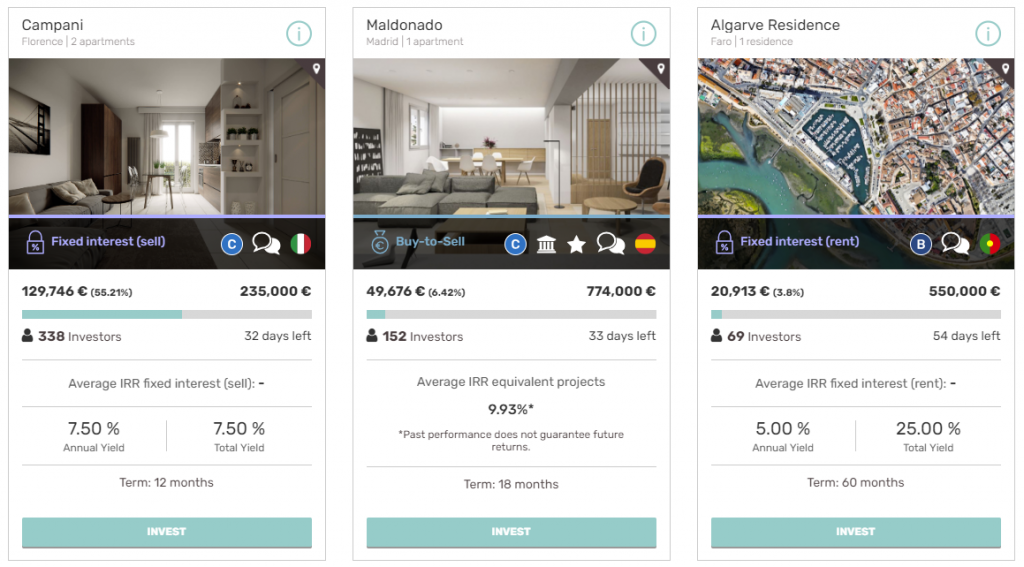

Buy-to-let

The purpose of this type of investment is to purchase a property specifically to let out, that is to rent it out. Usually, the property once bought will be renovated to increase its attractiveness towards renters and will then be rented based on its purpose: vacation rental, offices rental, primary housing, Airbnb.

Buy-to-sell

The purpose of this type of investment is to purchase a property specifically to sell it. The profits are made thanks usually to the renovation of the asset and the sales of the renovated asset at a higher price.

Development loans

The purpose of this type of investment is to finance the construction of a new building with the purpose to either sell it out or make it a rental property. It could be for example the construction of an office building with a shopping area to generate extra income.

Who should invest in it?

Crowdfunding is right for real estate investors who want a passive income from projects that they would not access or could not afford on their own. It is also a feasible option for investors who want to increase their debt exposure. Some of the people that can benefit from this form on investment include:

- Investors who are interested in investing in the real estate market but lack enough capital to outrightly purchase a property

- Investors who want to avoid the head of being a landlord or working by themselves

- Individuals who are looking for an alternative to investment in the stock market since this option allows them to own property that would be otherwise unattainable

- Individuals who are interested in investing in real estate projects outside their locality, but lack the logistics or means to do so.

While peer-to-peer lending can be a viable option for people interested in real estate investment, it is not the right option for individuals wishing to own the asset outrightly. It is also not the right options for those who want to be hands-on investors and in charge of budgeting, deadlines, choosing the finishes, and managing contractors. This form of investment is best suited to real estate investors who are interested in a more passive source of income.

Best Real Estate Crowdfunding Platforms

Several crowdfunding platforms are available for real estate investors. Without appropriate information, one can easily get lost in a sea of options. When choosing a platform, you need to look at its credibility, site functionality, customer service quality, and documentation. You may want to pick a platform that acts as a broker-dealer rather than a listing service, and platform with prior experience of handling real estate investments.

Before choosing a platform to crowd real estate, make sure the site has solid venture capital backing. In most cases, your investment could be locked up in the platform for a substantial amount of time. You should make sure that the platform you choose is credible and will remain in operations for a long time. Also, look at the way the platform conducts its due diligence and ask all the relevant questions. Find out the kind of documentation that the platform collects before closing potential deals and whether they as companies to provide indemnities of liability to investors when something goes wrong. As for customer service, verify the existence and quality of customer care provided by the platform.

Given the large number of platforms available, you probably want to settle with a verified and reviewed one. If you want to crowd real estate, the following investment platforms may be your best choice:

Top choice for Real Estate crowdfunding!! Real estate investments in Estonia, Latvia, Lithuania, Finland, Germany, Portugal, Spain +11.3% return on investment (ROI) +€205’000’000 of total investments Minimum investment of €50 Estonian crowdlending platform.

Real estate investments with yield and capital growth returns +14.5% return on investment (ROI) +€12’000’000 of total investments Minimum investment of €100 Estonian crowdlending platform.

Real estate investments in Latvia and mostly in Riga +14.75% return on investment (ROI) +23’900 investments done Minimum investment of €50 Lithuanian crowdlending platform.

The focus of this trendy platform is real estate investments. It has the benefit of investing in other countries in addition to the usual Latvia and Estonia. The platform comes with several types of real estate investments including buy-to-let, buy-to-sell, development loan, and equity. In addition, Housers allows you to diversify your investment in various counties including Italy, Portugal, and Spain. The major drawback of this platform is that the investment return rates are slightly lower compared to those of East-Europe. Nonetheless, you can expect returns of about 7 or 8% of your principal (invested) amount.

Takeaways

Crowdfunding or peer-to-peer lending is a rising trend in the real estate industry. It allows investors to diversify their investment portfolio by investing in projects they would otherwise not afford. Buyers also gain access to more capital that they would not otherwise access, and in a shorter time frame. When utilized correctly, this form of financing can benefit both those who are looking to fund a project and those seeking to get funding. When searching for viable investment platforms, it is crucial to conduct thorough research and due diligence. This will help in choosing a reputable and easy-to-work-with platform.