Good! So now you got all the basics about stocks, but there are actually many more sort of investments that you can invest in on the stock market.

Here is the full list that we will then discuss into details:

- stocks

- index funds

- mutual funds

- ETFs

- REITs

- bonds

- forex

- commodities

- options

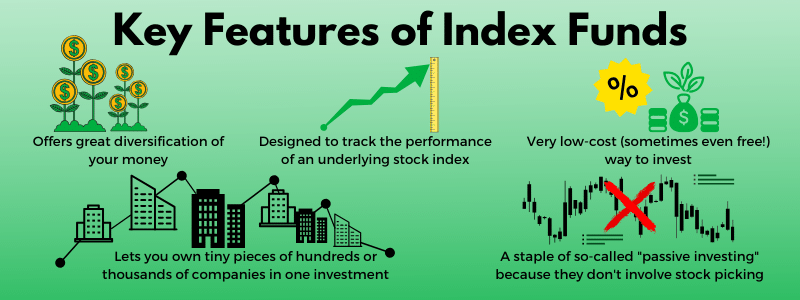

Index funds

What is an index fund?

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500).

Investopedia

These funds, usually fully automated by computers, try to replicate at best the index they are following (e.g. S&P 500, Dow Jones, Nasdaq, Nikkei, SMI). They usually contain the globality of the companies of an index or at least a large segment of it via the purchase of stocks or bonds from these companies.

Due to their diversification, they are often good options for lower-risk/long-term investments (in opposition to picking individual stocks), and are thus a good option if you want to save on the long term for your retirement via a passive investment strategy.

Advantage and disadvantages of index funds

The advantages of index funds are:

- broad market exposure (e.g. 500 companies for the S&P 500)

- low operating expenses (average of 0.2-0.5% of fees on the invested amount per year, with some cheap funds down to 0.02%)

- strong long-term returns (as we have seen at the beginning of this training, returns of the US stock market since 1970 have been of around 8% per year)

- passive investment (doesn’t require time)

The disadvantages of index funds are:

- vulnerable to market swings and crashes (e.g. in 2008 several US index funds crashed of 30-40%)

- non-flexibles (investors can’t choose the companies invested in)

- no-human element (as these funds are usually automated with computers that manage transactions)

- limited gain (compared to stock picking where you could make x10 your investment over some years, but with related risks)

Examples of index fund

Here are some examples of index funds:

| Name | Content |

|---|---|

| Nasdaq Composite | 3,000 stocks from Nasdaq |

| Dow Jones Industrial Average (DJIA) | 30 large-cap companies from the Dow Jones |

| MSCI EAFE | 874 companies, from 21 developed countries (excl. US, Canada) |

| Wilshire 5000 | ~3,500 US market stocks |

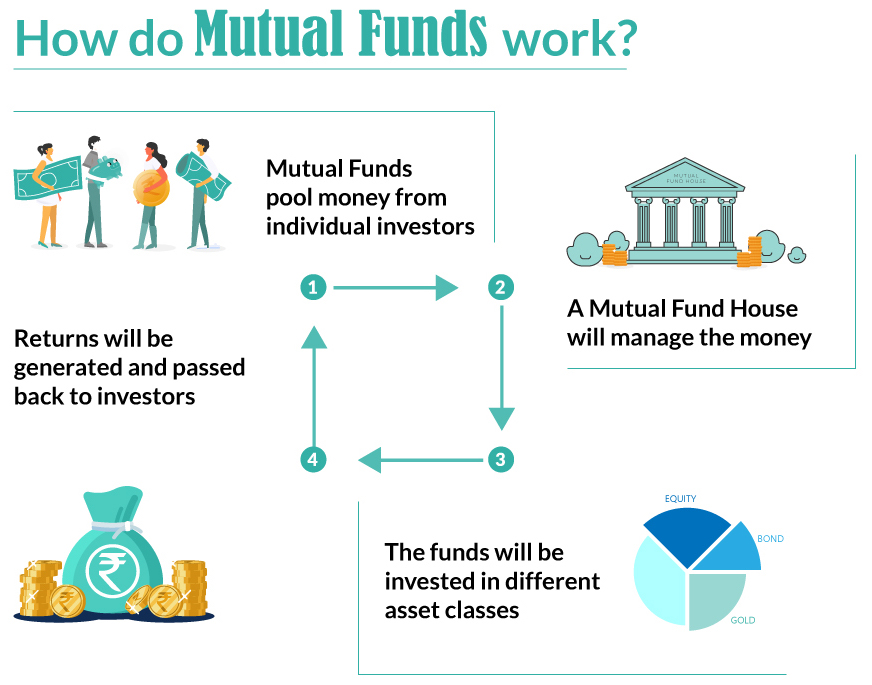

Mutual funds

What is a mutual fund

A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors.

Investopedia

The figure below describes the functioning of mutual funds:

In concrete words, when you invest in a mutual fund, you are giving your money to an investment company called typically an “asset management company”. This company collects the money of thousands of investors and puts this money together in a pool called a Mutual Fund. Now what is important to know is that compared to stocks investments, mutual funds have a minimum investment amount usually of a few thousand dollars (often $2,000-3,000).

The asset management company has its own investment team that chooses which investments to make with this pool of money (e.g. stocks, bonds, ETF, REITs, derivates, money market).

Since mutual funds have their own price per share value (like a stock has), investors will earn returns from the increase of the mutual price per share.

In exchange the company gets a fee from investor (called “Management fee”) which is a percentage of the total money invested (usually ranging from 0.5-2% yearly).

Advantages and disadvantages of mutual fund

The advantages of mutual funds are:

- Diversification with a mix of investments and assets

- Easy to buy and sell

- Reduced fees since these funds invest in bulk (e.g. on stocks) reducing fees

- Professional management since the fund is manages by a fund manager that takes care of picking out stocks and other assets for you

- Variety of choices of funds on strategy (e.g. value investing, growth, dividends) and geography (e.g. developed markets, emerging markets)

The disadvantages of mutual funds are:

- Fluctuating returns with the fund stock value variating without any insurance on results

- A large cash amount is kept uninvested by funds to accommodate people depositing and withdrawing money in the fund

- High management fees of 0.5-1.5% yearly

- Conversion of fund stake into cash possible often only at the end of the day compared to stocks that can be sold anytime

- Complexity to evaluate funds due to the large number of companies included in it

- Minimum investment amount usually required (ranging from $2,000 to $3,000)

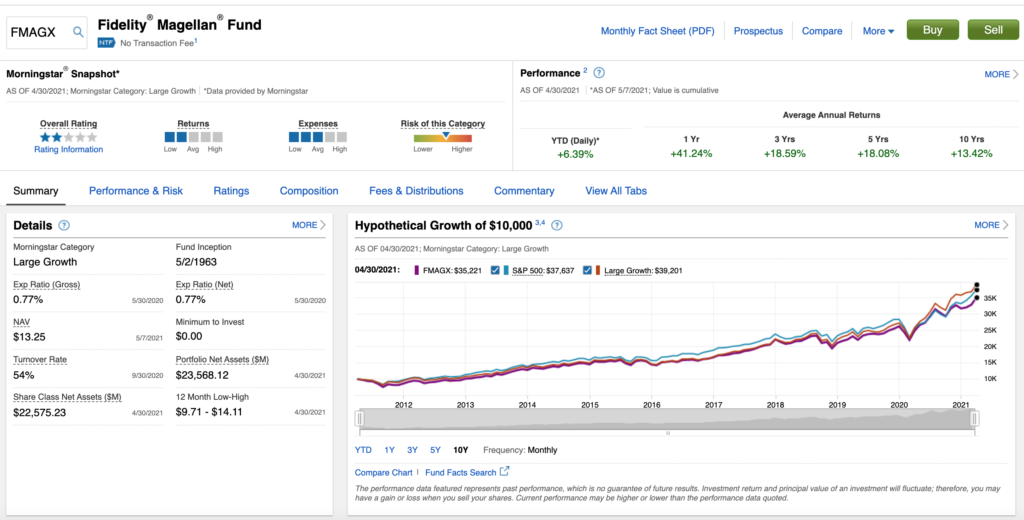

Examples of mutual funds

Let’s take a look at an example of mutual fund with a worldwide known mutual fund:

In the picture describing the fund you will find useful invformation such as:

- the expense ratio: 0.77% yearly

- the total managed assets: $23B +

- the average annual returns: 13.42% over 10 years

- the fund objective and strategy (not visible in the image): it is the strategy you are signing for when investing and trusting them. In this case the objective is “Seeks capital appreciation” and the strategy “Normally investing primarily in common stocks. Investing in either “growth” stocks or “value” stocks or both.”

- the minimum investment amount (not visible in the image): $2,500

Currently (as of 2021) there are two companies leading the mutual funds’ industry: Vanguard and Fidelity. These two companies have trillions under managed assets.

Here are some examples of mutual funds:

| Name | Content | Managed assets | Min investment |

|---|---|---|---|

| Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) | Exposure to the entire U.S. equity market: small-, mid-, and large-cap growth and value stocks (3,590 stocks, incl. Apple, Microsoft, Amazon, Alphabet, and Facebook) | $920B + | $3,000 |

| Fidelity 500 Index Fund (FXAIX) | Tracks the S&P 500 (top 10 holdings in this portfolio make up 27.86% of its portfolio, including Apple, Microsoft, Amazon, Facebook, and Alphabet among others). | $274B + | $2,500 |

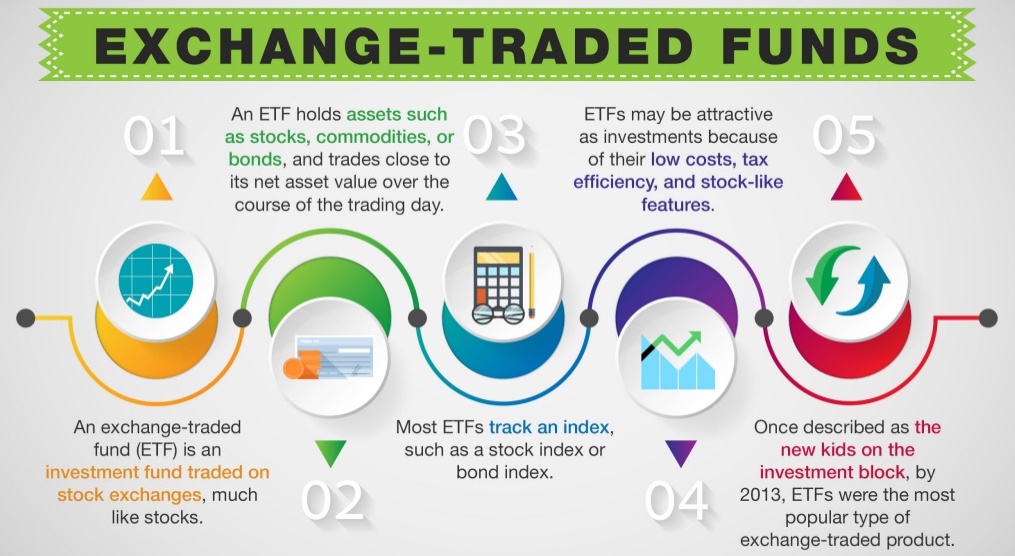

ETFs

What is an ETF?

An Exchange Traded Fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock. An ETF can be structured to track anything from the price of an individual commodity to a large and diverse collection of securities.

Investopedia

In oder words, an ETF is a basket of securities (e.g. stocks, bonds, commodities) that has an associated a price to it, allowing him to be bough or sold on the stock market. So as an investor, instead of needing to buy each security, you will buy a share of ETF, that will take care of buying and selling the shares owner by the ETF.

The trading difference with mutual funds, is that ETFs can be purchased at anytime in the day (like a stock), while mutual funds can be traded only once a day when the market is closed.

In terms of fees, ETFs tend to be more cost-effective than mutual funds with average management fees of 0.4-0.45% yearly.

The figure below gives you an illustration of how a ETF works step by step:

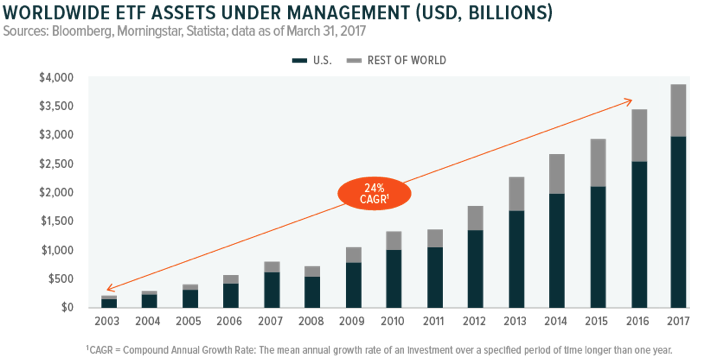

I would also like to show you how ETFs are getting popular as an investment type due to their simplicity (easy access for beginners and small-time needed by investors) and high performances (for beginners returns then to be higher than when picking stocks).

The figure below shows the amount of assets under management in ETFs worldwide with an amazingly growth of 24% per year between 2003 and 2017, way below the average market growth of around 7% yearly, which means a lot of investors are putting their money in this type of investment.

What are the different types of ETFs

The interesting thing when investing ETFs is that you can choose what is the theme of your investment (a geography, an industry, etc…).

The are 7 main categories of ETFs:

- Stock ETFs: invest in stocks of a particular index (e.g. S&P500, Nasdaq)

- Sector ETFs: invest in a particular industry (e.g. technology, hydrogen, cybersecurity, cloud computing)

- Commodity ETFs: invest in commodities (e.g. oil, gold)

- Bond ETFs: invest in government bonds, corporate bonds, state and local bonds

- Currency ETFs: invest in foreign currencies (e.g. e.g. EUR, CAD, CHF)

- International ETFs: invest in stocks from foreign countries (e.g. China, Europe, Canada, Japan)

- Inverse ETFs: invest in stocks shorting (the goal of these ETFs is to earn returns by betting on stocks price decrease)

Advantages and disadvantages of ETFs

The advantages of ETFs are:

- Diversification for reduced risk with a mix of investments and assets across various industries

- Easy to buy and sell like if you were buying a stock

- No minimum investment amount (you just need to pay the price of the share of the ETF)

- Low fees (0.05% to 0.45%) compared to mutual funds ones (0.5% to 1.5%)

- Possibility to invest in target industries (e.g. cybersecurity, cloud, semiconductors)

- Dividends are distributed by some ETFs generating investors a steady income

The disadvantages of ETFs are:

- Constituting companies can’t be chosen by investors

- Limited diversification on industry focus ETFs

- Duplicate investments in companies might occur were investing in several ETFs that home common constituting companies

Examples of ETFs

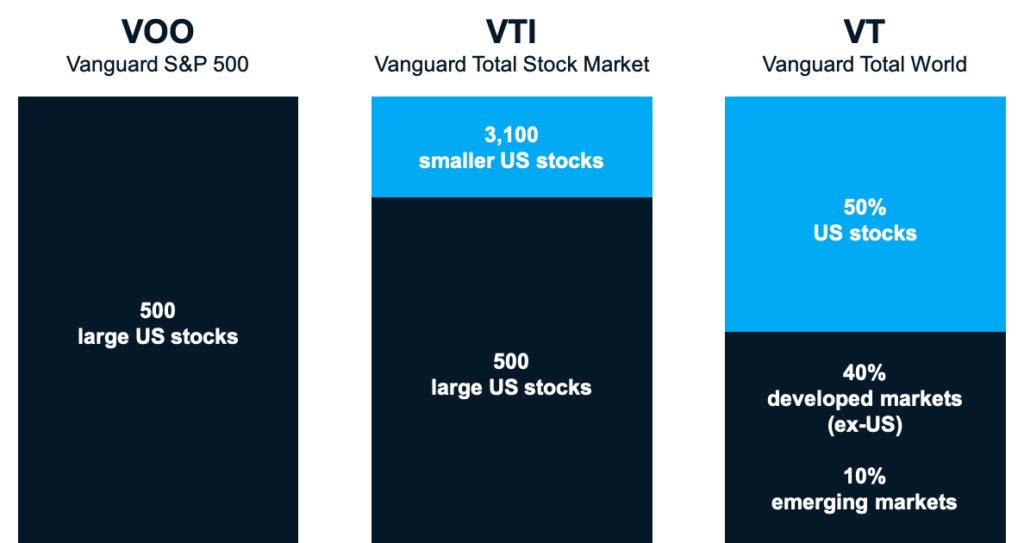

Let’s take a look at 3 example of ETFs: VOO, VTI, and VT

| Name | Content | Fees | Dividend (2020) |

|---|---|---|---|

| Vanguard S&P 500 ETF (VOO) | Tracks the S&P 500 by investing in the 500 companies of the index | 0.03% | 1.81% |

| Vanguard Total Stock Market ETF (VTI) | Track the total US stock market by investing in the 500 companies from the S&P 500 + 3000 smaller companies | 0.03% | 1.71% |

| Vanguard Total World Stock ETF (VT) | Invests internationally with around 50% US stocks, 40% Developed markets (ex-US), 10% Emerging markets | 0.08% | 1.91% |

To illustrate you better the content of these 3 ETFs look at the image below:

As you can see, VOO and VTI contain US stocks while VT aims at reflecting the overall world market (with a 50/50 mix of US and world stocks) and VOO is focused on large-cap companies (e.g. Apple, Google) while VTI reflect the overall US stock market with smaller cap companies.

All these 3 ETFs are pretty standard when creating an investment portfolio and as you can see they have the advantage of having super low fees (from 0.03% to 0.08%) and yearly dividends with a yield of 1.71% to 1.91%.

This dividend is a great advantage. Let’s say you invested $60,000 into the VT ETF. Only thanks to dividends you will earn by default $1’146 without taking into account extra income from price appreciations.

REITs

What is a REIT?

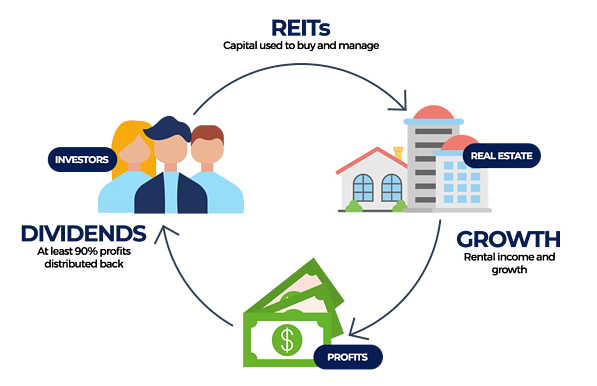

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.

Investopedia

Here is the image explaining the process of a REIT and below you can read the explanation.

So basically when you invest in a REIT, you buy shares in a company that invests in real estate to generate money from rent, interests, and mortgages. REITs invest in most real estate property types such as apartment buildings, hotels, medical facilities, office buildings, warehouses, etc… in order to generate income and growth.

The interesting characteristic of REITs is that legally they need to follow this condition: 90% of their taxable income needs to be distributed in form of dividends each year. This is great news for us, investors, to know that most of the income of REITs goes into our pocket.

Still concerning returns, REITs usually focus on generating dividends, while the price appreciation of their shares will be limited.

And if you are interested to invest in a REIT, the process will be the same than investing in a stock. Most of REITs are tradable on the stock market by purchasing their shares.

There is also an alternative solution to invest in REITs which is by investing in ETFs or mutual funds that invest in REITs. In this case you won’t have to take care of selecting which REITs are the most interesting.

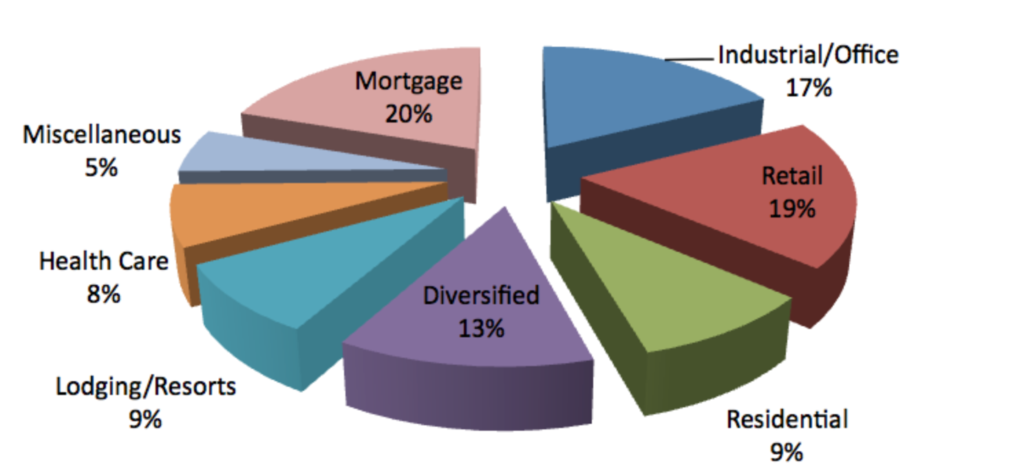

What are the different types of REITs

Here are the main types of REITs:

- Commercial/Office REITs: invest in office buildings

- Healthcare REITs: invest in healthcare facilities (e.g. hospitals, clinics, old people houses)

- Hospitality/Lodging/Resorts REITs: invest in hotels and service apartments

- Industrial REITs: invest in warehouses, logistics centers, data centers, etc…

- Residential REITs: invest in residential real estate (e.g. rental buildings)

- Retail REITs: invest in shopping malls, shops

- Mortgage REITs: invest in mortgages instead of equity (like all the other above)

The figure below give you the proportions of the different types of REITs in the United States.

Advantages and disadvantages of REITs

The advantages of REITs are:

- High-yield dividends: going up to 8% in some cases

- Stable cash flow through dividends

- Diversification: allows to invest in multiple properties thus reducing risk

- Liquidity: REITs have usually a good amount of cash flow allowing to buy and sell assets at the best moment and generate higher returns

The disadvantages of REITs are:

- Higher taxes on dividends compared to dividends from stocks (dividends are taxed as normal income in the US)

- Dependent on interest rates (if rates increase, REITs share price decrease)

- Slow capital growth (compared for e.g. to stocks)

- Medium-high fees: management fees usually between 0.25% and 0.5%

Examples of REITs

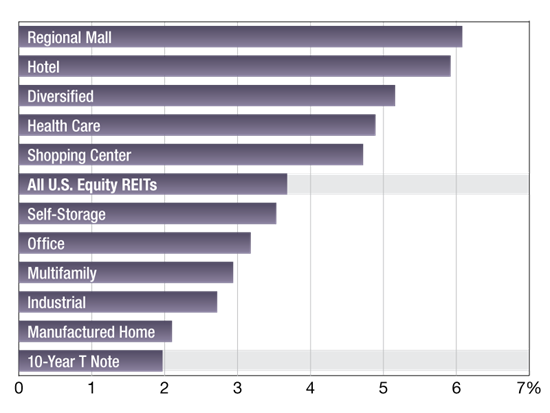

First of all I would like to share with you a chart explaining which type of REITs pay the highest dividends.

And as you can see below, the average US REIT pays around 3.7% yearly, while retail and hotels REITs have the highest yields ranging around 6%.

Let’s take a look at some example of REITs per type, this will give you a better understanding on their content and the potential dividend returns:

| Name | Type | Content | Market cp (05/2021) | Dividend (2020) |

|---|---|---|---|---|

| Boston Properties (BXP) | Office | High-end offices in the Boston, Los Angeles, New York, San Francisco, and Washington DC markets | $21.3B | 4.15% |

| Omega Healthcare Investors (OHI) | Healthcare | Skilled nursing and assisted living facilities | $8.2B | 7.69% |

| Xenia Hotels & Resorts (XHR) | Hospitality | Hotels (39 as of 2021) | $2.06B | 5.2% |

| EPR Properties (EPR) | Resorts | Amusement parks, theaters, and ski resorts. | $3.39B | NA (usually 5-7%) |

| Plymouth Industrial REIT (PLYM) | Industrial | Distribution centers, warehouses, logistics corridors | $547M | 4.51% |

| Equity Residential (EQR) | Residential | Owns 309 properties consisting of 77,889 apartment in the US | $26.92B | 3.35% |

| Agree Realty (ADC) | Retail | Acquisition & development of properties net leased to retailers in the US | $4.33B | 3.86% |

| Annaly Capital Management (NLY) | Mortgage | Borrows money, primarily via short term repurchase agreements, and reinvests the proceeds in asset-backed securities | $12.28B | 10.02% |

| Digital Realty (DLR) | Datacenter | Data centers for 2,300 firms located throughout North America, Europe, Asia, and Australia. | $41.4B | 3.12% |

| Iron Mountain (IRM) | Datacenter | Stores and protects $18 billion of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. | $11.75B | 9.2% |

Finally other items can be traded such as bonds, forex, commodities and options.

← Previous |

Back to start |

Next → |