Before starting to dig deeper into the stock market, I would like to give you some information on why investing in the stock market can be a good investment. For this purpose let’s take a look both at numbers and at qualitative advantages.

Quantitative advantages: stock market returns

Let me share with you some additional numbers to show you why the stock market and especially investing in stocks can be a great and lucrative investment.

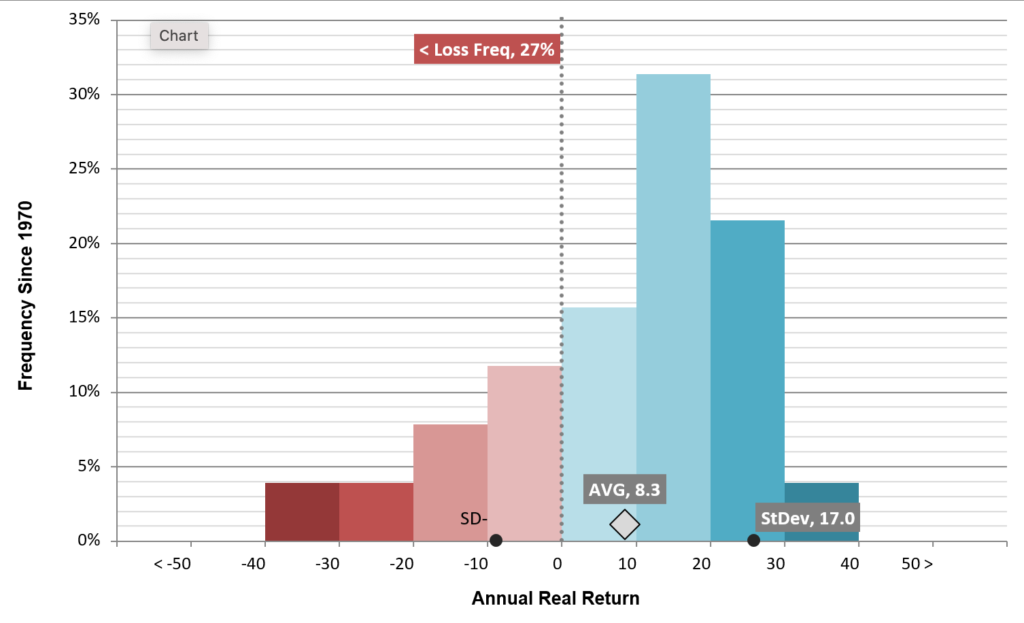

The chart below shows what have been the return on investment yearly since 1970 in the overall US stock market.

What we see from this chart are the following numbers since 1970:

- 8.3% annual average return

- 27% of the time the year generated a loss of money

- 31.5% of the time returns were between 10 and 20%

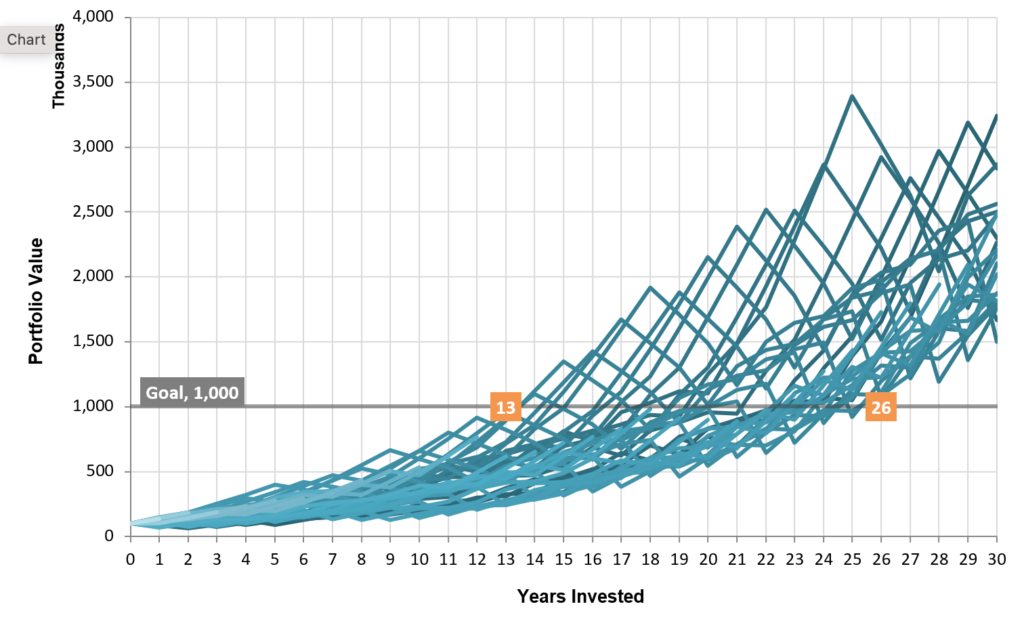

This second chart is also really interesting. It shows you the time needed at best and at worse to build a portfolio of $1 million when starting with a $100’000 portfolio and investing an additional $10’000 every year. Based on the year your started since 1970 it would take you at best 13 years and at worse 26 years,

Now these numbers are an overall average of the market, but if you are lucky or skilled enough to pick and invest in the good company you can earn a lot more. Let’s imagine you invested in Apple when it came on the market (see figure below). Let’s imagine you invested $10’000 at the IPO (Initial Public Offering) price, which is the price the day Apple entered the stock market.

- $0.13 in 1981 (the price has been reduced from $22 due to several stocks split – we will talk about this notion later)

- $134 in 2021

Your capital would have raised from $10’000 to $10’300’000 (134/0.13 = x10’300 increase in value)

Qualitative stock market advantages

Here are other advantages of investing in the stock market and in stocks:

- Depending on what you invest in and your investment strategy, investing in stocks can be a quite passive and not time-consuming investment where you only need to regularly add and invest a certain amount of money which can be transferred and invested all automatically

- It’s a good investment (for the long term 10+ years) due to his returns, beating in average other standard investments such as real estate, gold, bank deposit

- Taxes are cheaper on stock returns than on standard income from a job. Some countries such as Switzerland don’t even tax the earnings related to the increase of the value of a stock but tax only the dividends.

- You can own a business and benefit from its returns in form of dividends without having the need to manage it

Now that we are all convinced about the benefits of investing in the stock market, it is now the moment to dig deeper in it!

← Previous |

Back to start |

Next → |