Mintos to Provide Debit Cards and IBAN Accounts to Investors

P2P lending marketplace Mintos has raised 5 million EUR in a Series A. The money is earmarked to provide new features for investors.

Mintos will be magnifying its role in the financial services sector by adding personal IBAN accounts and debit cards to its established global lending marketplace in the near future. The IBAN personal accounts will give investors the ability to make and receive payments from around the world, including receiving a salary directly to their Mintos account. Meanwhile, the Mintos card will allow investors to make transactions around the world or online and withdraw money at ATMs.

This will be made possible by the e-money licence Mintos is applying to receive. As an Electronic Money Institution, Mintos will protect money held by investors under the European PSD2 legislation.

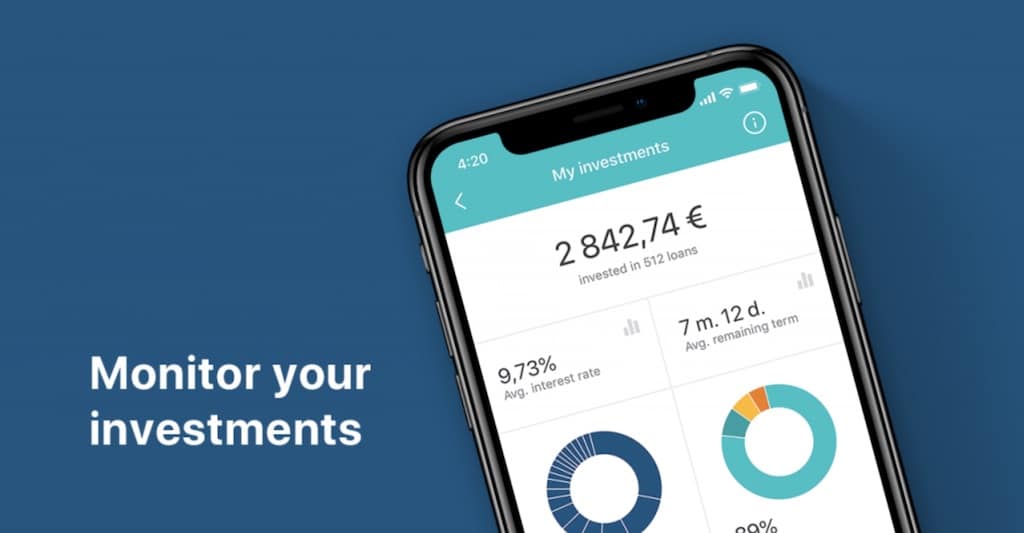

Martins Sulte, Mintos CEO and co-founder: “Providing customers with a personal IBAN account and debit card will mark a major leap in our services and significantly improve the user experience. Soon, everybody with their own IBAN accounts will be able to give the account details to their friends, companies or customers to get paid, to pay using a debit card, and to continue using Mintos for investing in loans around the globe and earning great returns. Our upcoming mobile app will make it even more convenient.”

The fintech startup has a fast-growing customer base of 87 000 investors from 71 different countries, with plans to open doors to more users in additional locations. With 100 000 registered investors forecasted by the end of the year and 300 000 by the end of 2019, Mintos will be focusing efforts on investor acquisition and expanding to additional global markets. To accomplish this, Mintos plans to significantly invest in doubling the size of its team.

The 5 million EUR series A funding comes from existing investors Grumpy Investments (previously, Skillion Ventures), Riga based venture capital firm that is focused on investing in technology companies.

Clearly Mintos attempts to position itself away from a pure investment offer to a broader financial service.

Mintos raises eur 5 million to provide users with personal iban accounts and debit cards

Mintos, the award-winning global marketplace for loans, has raised EUR 5 million Series A round to provide their users with personal IBAN accounts and debit cards. This marks the largest VC investment into a Latvian company this year.

Mintos will be magnifying its role in the financial services sector by adding personal IBAN accounts and debit cards to its established global lending marketplace in the near future. The IBAN personal accounts will give investors the ability to make and receive payments from around the world, including receiving a salary directly to their Mintos account. Meanwhile, the Mintos card will allow investors to make transactions around the world or online and withdraw money at ATMs.

This will be made possible by the e-money licence Mintos is applying to receive. As an Electronic Money Institution, Mintos will protect money held by investors under the European PSD2 legislation.

Martins Sulte, Mintos CEO and co-founder: “Providing customers with a personal IBAN account and debit card will mark a major leap in our services and significantly improve the user experience. Soon, everybody with their own IBAN accounts will be able to give the account details to their friends, companies or customers to get paid, to pay using a debit card, and to continue using Mintos for investing in loans around the globe and earning great returns. Our upcoming mobile app will make it even more convenient.”

The fintech startup has a fast-growing customer base of 87 000 investors from 71 different countries, with plans to open doors to more users in additional locations. With 100 000 registered investors forecasted by the end of the year and 300 000 by the end of 2019, Mintos will be focusing efforts on investor acquisition and expanding to additional global markets. To accomplish this, Mintos plans to significantly invest in doubling the size of its team.

Martins Sulte, Mintos CEO and co-founder: “We have been profitable since January 2017, but we see a huge opportunity to expand on a much larger scale and speed. Additional funding will help us to even faster execute on building great products and new services to our clients globally, invest in hiring the best team and expand geographically, to Latin America, Africa, and Southeast Asia.”

The company has already facilitated more than EUR 1 billion in investments in loans through its marketplace, putting it as the largest marketplace of its kind globally. Investors in total have earned EUR 26.7 million in interest through loans to individuals and businesses and have attained an average net return of nearly 12%.

Mintos has a team of 60 employees at its headquarters in Riga, Latvia, with representative offices in Warsaw, Poland and Mexico City, Mexico.

The EUR 5 million series A funding comes from existing investors Grumpy Investments (previously, Skillion Ventures), Riga based venture capital firm that is focused on investing in technology companies.

https://labsoflatvia.com/en/inspirational-stories/mintos-raises-eur-5-million-to-provide-users-with-personal-iban-accounts-and-debit-cards

Mintos to Provide Debit Cards and IBAN Accounts to Investors