About it

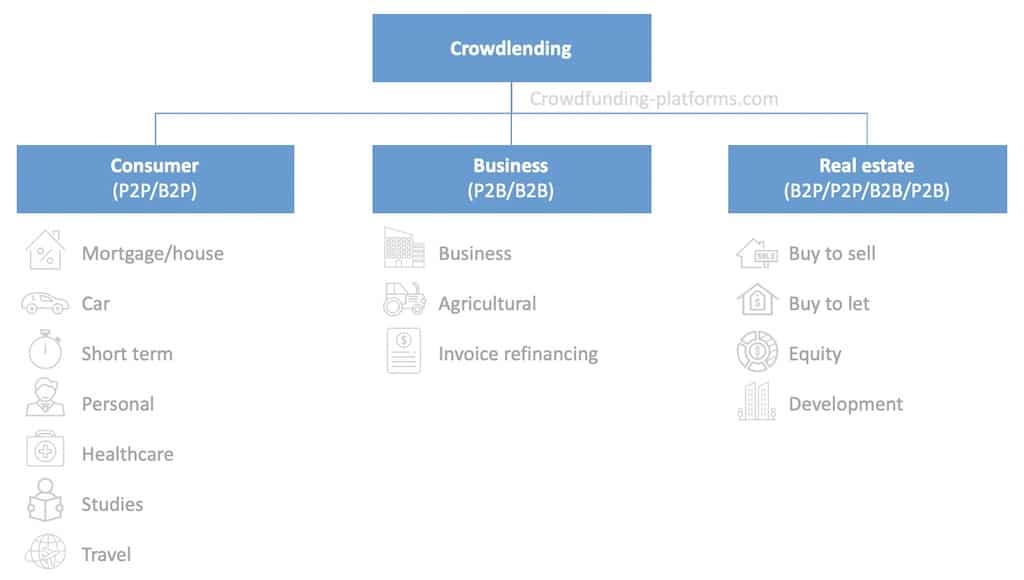

Consumer crowdfunding is one of the 3 main categories of crowdfunding investments, the others being real estate crowdfunding and business crowdfunding (see figure below).

In this article, we will talk in particular about lending-based consumer crowdfunding, which is commonly called consumer crowdlending.

In this type of investment, a large number of individuals come together to lend money to a private person in the form of a loan in exchange for interests and dividends. Individuals use these loans for example to pay a house mortgage, a car loan, a student loan, a healthcare expenditure.

Figure: Crowdlending investment categories

Crowdlending or P2P lending is the practice of lending money to consumers through online services that connect lenders with borrowers. Peer to peer lending companies typically offers their services online and attempt to operate with a much lower overhead as possible and provide their services more cheaply than banks and other traditional financial institutions. As a result, lenders can earn higher returns (12% yearly ROI in average in Europe) compared to investments and savings offered by banks and other financial institutions, while consumers can borrow money at lower interest rates, even after the platform has taken a fee of providing the connection between lenders and borrowers.

However, there is a risk of borrowers defaulting on the loans taken out from these platforms, or the platforms going bust.

Consumer crowdlending loans are typically unsecured personal loans (meaning not being backed by an asset as it’s commonly done in real estate crowdfunding) and are usually in small amounts (few hundred to few thousand euros). In some cases, secured loans can be given out against luxury assets such as jewelry, vintage cars, watches, fine art, aircraft, buildings, and other forms of business assets as collateral.

How it works

For the lender

The consumer crowdlending process starts when you sign up to a P2P lending site and deposit the amount that you wish to lend. You will be required to start making lending offers to borrowers looking for a loan. Before choosing a loan to invest in, you need to establish how long you wish to offer your money for i.e. the terms of the loan, which is usually over a fixed timeline that can be months or years. However, the longer you are willing to invest your funds the higher the potential returns.

Once your money has been deposited in the P2P consumer lending platform account, there are usually two ways to begin loaning out.

The first way is automatic via an auto-invest functionality; some P2P platforms will automatically make loaning offers on your behalf to borrowers that match the terms that you provided (such as ROI, duration, risk, country), while others will require you do it yourself manually. While the second method provides you with the most control over your funds, it can be time-consuming. Doing it automatically ensures that the whole process is faster and your money will always be invested.

Once you have been matched with a borrower’s loan or multiple borrowers’ loans, and the loan has been distributed, you will instantly begin to earn your interest. Depending on the P2P lending platform you will be provided with options to select what you want to do with your interests such as reinvesting them to earn compound interests. In this case, your earning are automatically offered to other borrowers once again, increasing your returns.

Some of the P2P consumer lending platforms have an option allowing lenders to draw a regular income from their repayments, normally on a weekly or monthly basis. Others have a choice over whether you wish to withdraw the full repayments or the interest earned only. This, depending on the investment platform, can be set automatically or manually. But automatic means more convenience.

For borrowers

For borrowers, the process of seeking peer to peer consumer lending loans starts after they have applied to a P2P platform for a loan or the loan companies issuing loans for these platforms (called loan originators). Most platforms will require users to fill out a small quote request and provide proof of identity. Then the site will carry out a soft credit check to gauge your creditworthiness.

Based on the results of the credit history, the site will quote the borrower a provisional Annual Percentage Rate (APR, which is the annual rate charged for borrowing) and a breakdown of its potential loan including details such as the amount, the duration (loan term), the monthly costs, as well as the amount payable.

Then it is up to the borrower to decide if he wants to proceed with the application of the loan or not.

After submitting the application, an underwriter will assess it and make the final decision on whether to lend the money or not. A more detailed credit check may be performed and in addition to the findings, the borrower will also be required to pass the platform’s own creditworthiness. If the loan is approved, the loan will be published for investment on the crowdlending platform’s marketplace where investors can select it and invest money in it.

The platform will serve as a middleman, therefore borrowers and investors won’t be required to deal together. Once the loan has been disbursed into the borrower’s bank account, he will start to make regular repayments through the P2P consumer lending platform, which will reflect it to the lender’s account.

Characteristics

Here are a few characteristics describing consumer crowdlending:

- Sometimes is conducted for profit

- No prior relationship needed between the lender and the borrower

- Peer to peer platforms act as an intermediary

- The lender may choose which borrowers to lend money to

- All transactions take place online

- The loans can be either secured or unsecured and are never protected by government insurance

![]()

Types of investments

There are only two types of investments available for the consumer – consumer personal loans and student/education loans.

Personal Loans

Personal loans are loans offered to borrowers for financing bills, buy a car or home improvement. They can also be used to cover debt consolidation. These loans are typically easier to obtain through the peer to peer consumer lending platform because they don’t have restrictions as those from the bank and other traditional financial institutions.

Student/Education Loans

Students or educational loans are usually lump-sum loans, which gives the consumer the discretion on how to distribute up the money for school-related expenditures. If you can’t get federal student loans, social lending platforms can offer you competitive rates than other financial institutions.

European Market

Europe is the pioneer in the consumer crowdlending sector. The first P2P lending platform was launched in the United Kingdom in 2005. Since then, Europe has then successfully maintained its position among market leaders in the industry, and currently is the third-largest market in the world after the United States and China. Recently, the European P2P lending market has been showing the signs of continued growth and strong maturation. In the year 2015, the market grew by 92% to 5.4 billion EUR and a year later by 41% to 7.7 billion EUR, according to a report by the Cambridge Center for Alternative Finance.

The United Kingdom has been traditionally dominating the P2P lending sector. In 2015, the UK market represented 81% of the overall market share with a volume of 4.4 EUR billion. Nevertheless, British peer to peer landscape is currently slowing down while the countries in continental Europe are quickly gaining ground. In 2016, the UK P2P lending platforms had only 73% or 5.6 billion EUR of the market share left.

The UK is believed to be experiencing the effects associated with the maturing stage, including consolidation of the market, growing restrictions, and a lack of high investment rates. France and Germany are currently among the dominant consumer crowdlending markets within continental Europe. But their market growth rates are massively decreasing, following the same trend as the United Kingdom.

The Future of Crowdlending

Since its inception, peer to peer lending has been a revelation and the trend looks to continue. A report by the Cambridge Center for Alternative Finance projected a 43% growth in the United Kingdom in 2016, with market size worth 1.17 billion EUR. There are few reasons why P2P consumer lending will keep growing even in the future; the banks and other financial institutions are unable to offer favorable rates to savers, and people are looking for more options to diversify their investments as well as the increasing confidence in peer to peer networks.

Benefits

For investors

Here are the benefits for investors:

- Appealing risk-reward ratio

- P2P is a great option for diversifying the investment portfolio

- Some consumer crowdlending platforms offer buyback protection for the loans in case of a loan default

- You can potentially access and withdraw your funds anytime you wish

- P2P lending can be tax-free

- The platforms offer great opportunity to make ethical investment

For borrowers

Here are the benefits for borrowers:

- Easy application process

- The funding is quick as it can take one to three weeks depending on the size of the loan

- In some cases, borrowers can get better rates than traditional banks

Risks

Unfortunately, crowdlending has a number of risks that you need to be aware of before deciding to borrow or lend your money via the platform. The risks include:

- Risk assessment and underwriting

- Defaulted loans

- The risk of the P2P platform going bust

- Yourself can also be a risk since you may be tempted

Best Consumer Crowdfunding platforms

Several crowdfunding platforms are available for business crowdfunding investors. Here is the main consumer crowdlending investment platforms.

|

|

Fast Invest is a peer to peer lending platform allowing to invest in consumer loans across European countries. All the loans have BuyBack guarantee that pays the principal investment and the interests if the borrower defaults to pay after 3 days (the industry standard is 60 days). The investment term range from 1 to 12 months. When selecting an investment, generic information are provided such as loan details (e.g. ROI, term, amount) and repayment schedule (principal and interests). More information on Fast Invest review |

PeerBerry allows investing in consumer loans at an average yearly ROI of 12%. At start the platform was launched on 1st of November 2017 with loans originated by Aventus Group, an international lending company of +500 employees founded in 2009. Aventus Group first started providing loans to Minos, but since their market was expanding, they decided to launch PeerBerry. More information on PeerBerry review |