Investors [05.2021] | Investments [01.2022] | Founded | Country |

9000+ | €10+ M | 2018 |  Estonia |

About Reinvest24

Reinvest24 is an Estonian real estate investment platform, that was launched in 2018. The Reinvest24 team consists of experts in finance, real estate, marketing and IT with many years of experience working with more than 10 million euros in investment. The platform’s mission is to lower entry gaps, when it comes to investing in real estate, create a secured environment for investors, minimising risks as much as possible and still providing the possibility to earn decent returns. Thanks to this Reinvest24 review we will go through all the aspects of the platform.

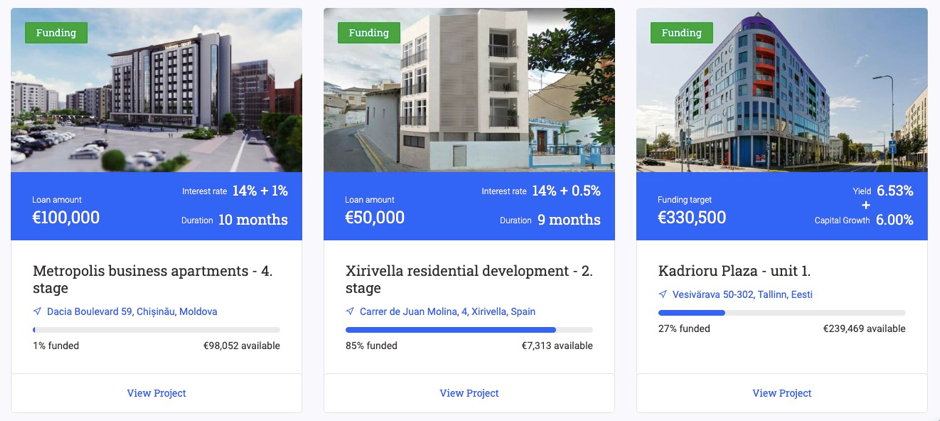

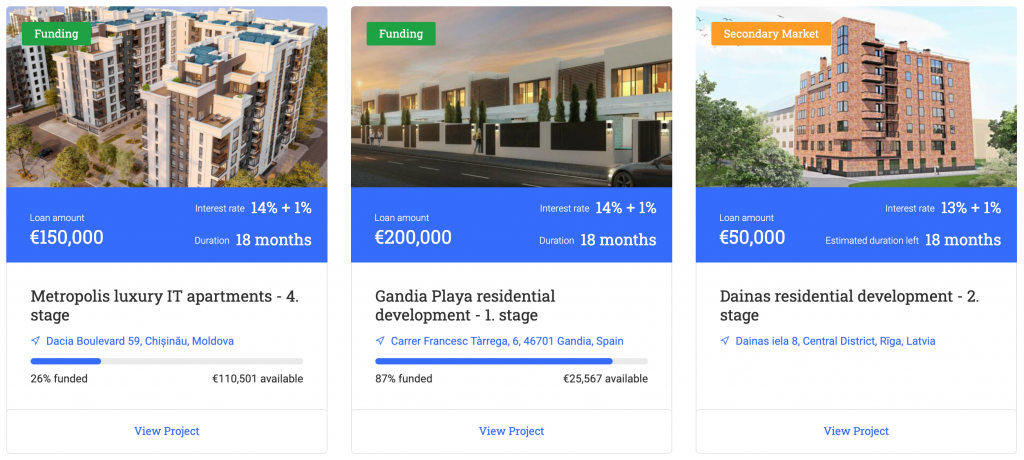

The platform is unique, as it provides an opportunity to invest in 3 different real estate loan types and diversify the portfolio among 4 European countries – Estonia, Latvia, Moldova and Spain. Also, we have received the information that soon they will expand to German market as well.

Reinvest24 is best known European platform for providing rental projects – loans that has equity characteristics. Equity-based crowdfunding gives investors the same benefits and security as ownership of an apartment, proportional to their investment contribution. The concept is very similar to REIT (Real Estate Investment Trust). Rental projects provide 2 flows of passive income – rental income and capital growth. Rental income means that You will be able to receive monthly dividends from the properties that are rented out. You don’t have to worry about managing the commercial real estate, as Reinvest24 does it for You. And investors receive first profits once the property has a tenant.

The second income stream is a so-called capital growth (when the price of real estate property appreciates). Investors will receive this income once the property is sold or when they sell their shares of the real estate, they have invested in on the secondary market.

Last year the platform started to expand massively, adding new countries and new investment types – real estate backed loans and development projects.

In terms of real estate backed loans – they give the financing to the 3rd party developers, in their case – KIRSAN Swiss – an experienced international developer, which is known for implementing numerous successful projects in Spain, Latvia, Switzerland, Germany, Romania and Moldova.

As per development projects, it is a loan, where the financing is used to purchase aproperty in order to renovate and sell it. In this case, the renovation works, as well asproperty’s management is fully conducted by the Reinvest24 team.

All the projects are in EUR currency and Reinvest24 platform accepts investors, who is older than 18 years old from most of the countries. Even investors from United-States (USA), if they use European Payment system provided or has a European bank account.

Reinvest24 is an Estonian real estate investment platform, that was launched in 2018. The Reinvest24 team consists of experts in finance, real estate, marketing and IT with many years of experience working with more than 10 million euros in investment. Platform’s mission is to lower entry gaps, when it comes to investing in real estate, create a secured environment for investors, minimising risks as much as possible and still providing the possibility to earn decent returns.

The platform is unique, as it provides an opportunity to invest in 3 different real estate loan types and diversify the portfolio among 4 European countries – Estonia, Latvia, Moldova and Spain. Also, we have received the information that soon they will expand to German market as well.

Reinvest24 is best known European platform for providing rental projects – loans that has equity characteristics. Equity-based crowdfunding gives investors the same benefits and security as ownership of an apartment, proportional to their investment contribution. The concept is very similar to REIT (Real Estate Investment Trust). Rental projects provide 2 flows of passive income – rental income and capital growth. Rental income means that You will be able to receive monthly dividends from the properties that are rented out. You don’t have to worry about managing the commercial real estate, as Reinvest24 does it for You. And investors receive first profits once the property has a tenant.

The second income stream is a so-called capital growth (when the price of real estate property appreciates). Investors will receive this income once the property is sold or when they sell their shares of the real estate, they have invested in on the secondary market.

Last year the platform started to expand massively, adding new countries and new investment types – real estate backed loans and development projects.

In terms of real estate backed loans – they give the financing to the 3rd party developers, in their case – KIRSAN Swiss – an experienced international developer, which is known for implementing numerous successful projects in Spain, Latvia, Switzerland, Germany, Romania and Moldova.

As per development projects, it is a loan, where the financing is used to purchase aproperty in order to renovate and sell it. In this case, the renovation works, as well asproperty’s management is fully conducted by the Reinvest24 team.

All the projects are in EUR currency and Reinvest24 platform accepts investors, who is older than 18 years old from most of the countries. Even investors from United-States (USA), if they use European Payment system provided or has a European bank account.

How works Reinvest24?

The next important information part of this Reinvest24 review is how it works to invest with it.

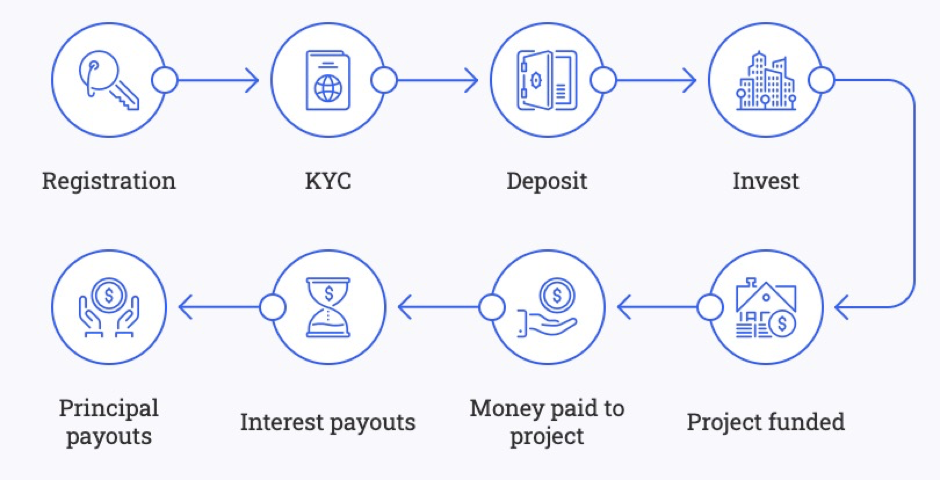

- After a simple registration investor will need to identify yourself (KYC). To start investing you need to make a deposit.

- The deposited money is being held in a separate bank account until the project is funded and once the project is fully funded, the funds are being released to the project.

- After that, the final agreements are being signed and security collaterals are being installed.

- As the time passes – investors receive payouts according to the project schedule.

- Once the project deadline is reached, the project will pay back the principal amount with the outstanding interests to investor’s account on Reinvest24.

Reinvest24 chooses a standout property, but only after screening the market, making thorough financial calculations, conducting research on the market and its future potential, visiting the property itself and closing the greatest deal to ensure investors make an outstanding profit. Reinvest24 has always been very conservative platform that stands for quality over quantity. As a result, even in times of COVID-19 they managed to show excellent performance, successfully exiting several projects and to date the default rate is still 0%.

Reinvest24 interests rate

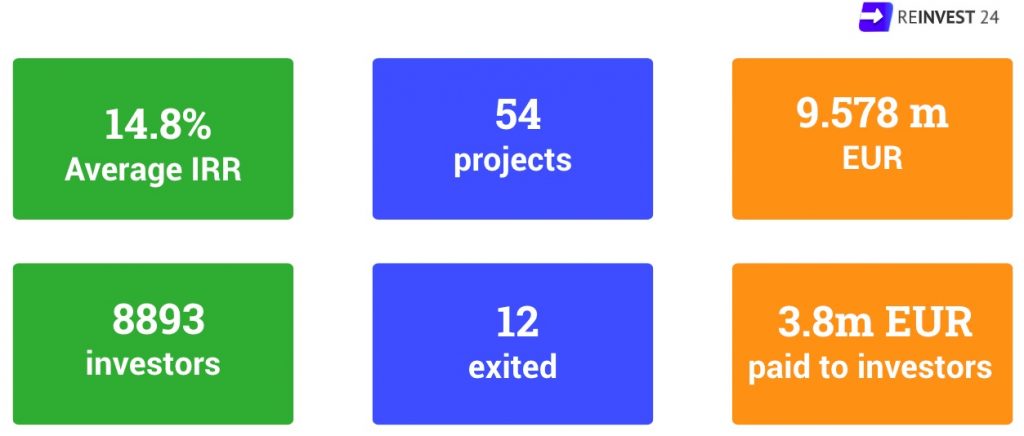

So far, Reinvest24 has published 54 projects and successfully exited from 12 of them. The best performing project generated 24.3% in return.

This month is very meaningful for Reinvest24, as they are planning to exit 3 more projects, overall repaying back to investors 1.1m EUR. To be honest, it is extremely great performance, as currently, many European crowdfunding platforms are facing project defaults or late payments.

As per the average interest rate, it is 14.8% per annum and this is one of the highest-yielding platforms on the market. The length of projects varies from 6 to 36 months.

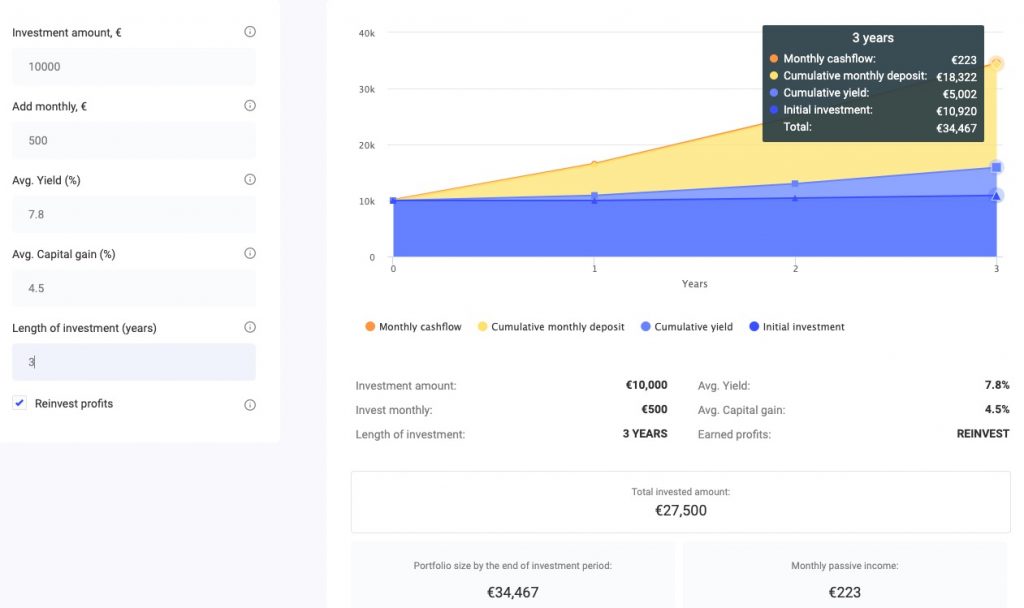

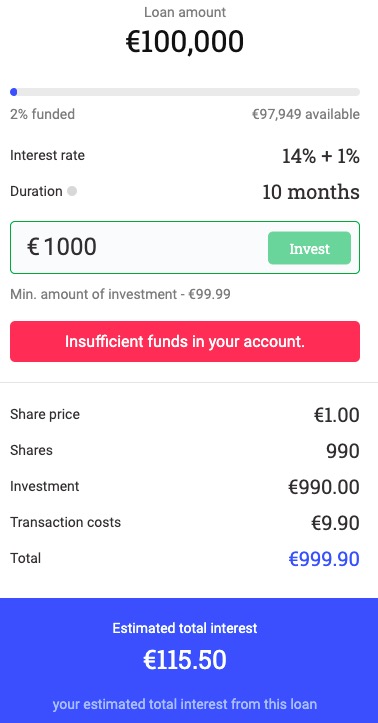

Investment result forecast

To calculate potential returns from the investments Reinvest24 has developed two tools – one is their investment calculator that plays around any strategy You want to achieve. It shows also the difference in returns if you choose to reinvest Your monthly payouts though the secondary market, starting from 1 EUR.

And the second is the calculator showing the returns for particular project, excluding all the costs. It is available in the description of each project and shows the estimations of Your returns, taking into account the details of the particular property.

Is Reinvest24 safe?

As part of this Reinvest24 review, let know know about safety, which is a main concern of many investors.

Apart from providing one of the highest yields on the market for real estate investing, Reinvest24 loans are greatly secured, as all comes with mortgage. Normally it is a 1st rank mortgage and LTV is equal or even lower than 50%.

As an additional level of security, for their rental and development projects, that are fully managed by Reinvest24, they are creating SPVs (Special Purpose Vehicle) companies for each project. It means that if something bad happens to one property or the platform itself, the risk is not transformed to any other project.

When it comes to transparency, this platform is one of the best in class. In the description of the projects, investors can find the necessary documentation as well as verify the information provided in the registries. In their blog section, they share very comprehensive updates on the progress of the projects. Here You can see the pictures, check at what construction stage the project is, as well as watch video overviews. Besides, Tanel, the CEO of the platform often visits the projects himself and records comprehensive video overviews, that are available in their Youtube channel.

As per financial reports, they are available online in the Estonian registry, as well as can be seen if you ask platform’s support to share it with You. The latest available are for financial years of 2018 and 2019. The platform is profitable, as, according to the 2019 years financial statements, the profit was 2 000 EUR. If the investor wants to exit project before its maturity day, the secondary market tool can be used. Besides, taking into account that minimum investment on the secondary market is 1 EUR, you can reinvest your monthly payouts, thus, increasing the return on investment even more. So far, it is one of the best secondary market tools, available in the industry.

Start to earn interests with Reinvest24

To benefit from lending interests you need first of all to create a Reinvest24 account. Good news! With Reinvest24 you can earn a bonus when creating the account via our partner link.

| Start lending with Reinvest24 to earn yearly interests of 14+%

|

Review of Reinvest24 Pros & Cons

Pros | Cons |

+ Impressive track record of exited projects + All projects secured with collateral and average LTV is 50% + High-yielding platform 14.9% p.a. + 0% projects in default + Profitable platform + Diversification (different countries and loan types) + Invest from € 1 in the secondary market + Very attentive and fast customer support + High rating on Trustpilot | – No Buyback Guarantee – Investment fee 1% – Withdrawal fee 2 EUR – No auto-invest – Small amount of available investments |

Reinvest24 investments details

Investment currencies | EUR | |

Return on investment (ROI) | 14.8% | |

Minimum investment | € 100 (primary market) € 1 (secondary market) | |

Investment period | 6 months – 36 months | |

Default rate | 0% | |

Investment fees | 1% | |

BuyBack guarantee | No (But all projects are secured with collateral. Normally it is a 1st rank mortgage and in the average LTV is 50%) | |

Auto-invest | No | |

Secondary market | Yes | |

Trustpilot Score (Safety) | 9.4/10 | [01.2022] |

Investment types

Investment example

Investment result forecast

Below you will find the resulting forecast when investing using Reinvest24 compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using Reinvest24 for 15 years you might end up with €4’785 (€2’388 more than with the stock market).

Reinvest24 bonus and cashback

| Register on Reinvest24 by clicking the button below |

Reinvest24 competitors

View the list of all the platforms