About NFT Lending

NFT lending is the process of lending and/or borrowing money by using NFTs (Non-fungible token) as a collateral of the loans made. This process is managed by lending platforms, that we will discuss today in this article about the Best NFT Lending Platforms.

The NFT lending process is part of the larger topic of Crypto Lending, that uses the same principle but with “standard” cryptos as a collateral.

This is the usual process during an NFT lending situation:

- Borrowers use their NFTs as a collateral of their loan request, that will be locked (in the platform smart contract) once the loan money is issued

- Lenders, on their side, can accept to loan the money to the borrower in exchange of interests (usually paid in crypto such as ETH).

- Once the borrower repays the loan and the interests to the lender, he receives back his NFT

- If the borrower doesn’t pay back his loan, the NFT is given to the lender

The Best NFT Lending Platforms

NFTfi

NFTfi is an upcoming and trendy NFT lending platform from Sounth Africa (Cape Town).

Like the majority of the best NFT lending platforms, it allows to borrow money by using your NFT as a collateral for a loan and, if you are an investor, to lend crypto to those looking for a loan.

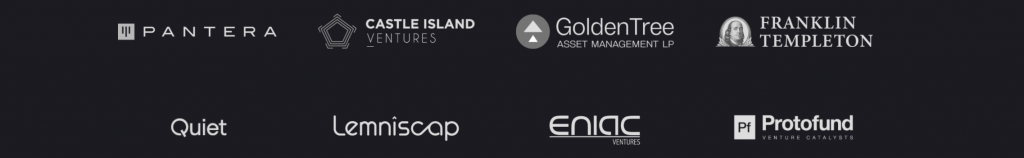

The platform is accelerating its growth thanks to approximatively $6 millions in fundings that it gathered from Venture Capital funds (VC funds). Below you can see the list of their main investors:

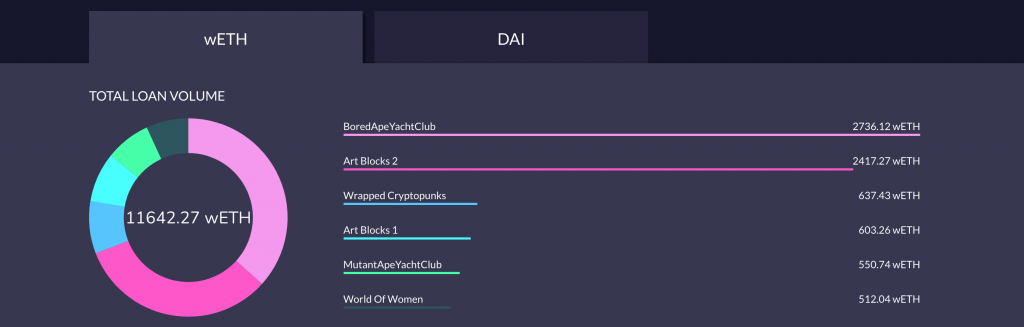

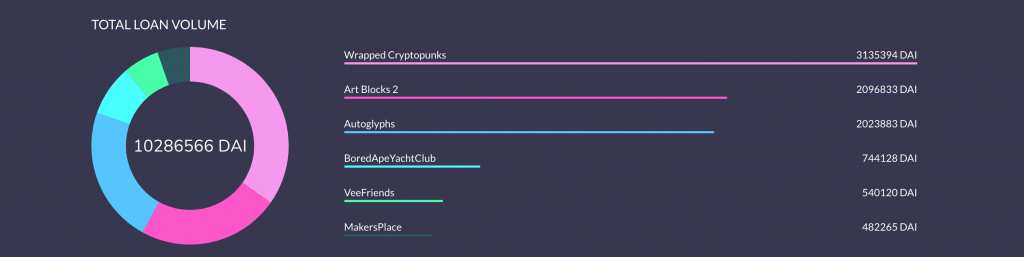

The platform allows to borrow loans into two different currencies, Wrapped Ethereum (wETH) and the DAI stablecoin.

In their of amount of managed assets, the platform have a total amount of loans assets (as of 01.2022) of:

- 11’600+ wETH

- 10M+ DAI

Which is a total of $50+ millions in loans.

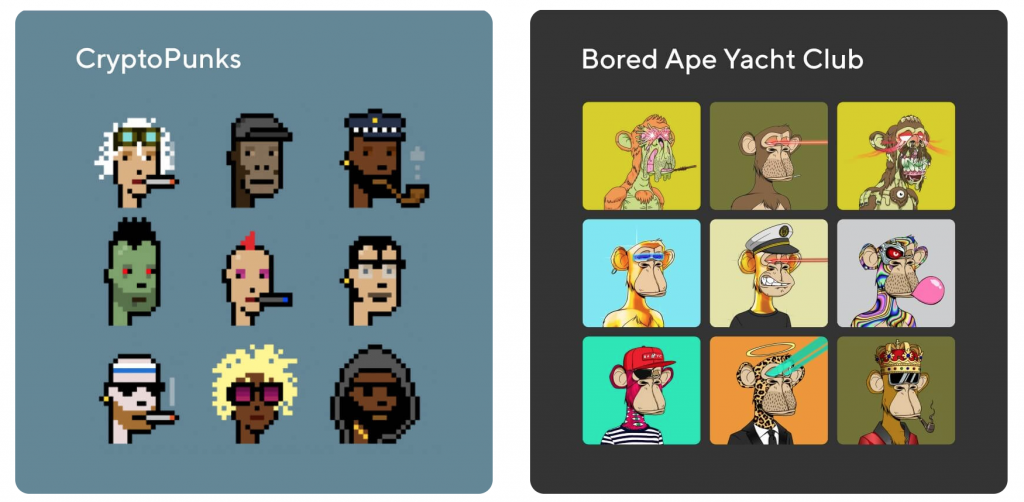

And as you could see in the two images just above, the following collections can be used to borrow crypto agains NFTs:

- Bored Ape Yacht Club

- Mutant Ape Yacht Club

- Art Blocks 1 and 2

- Wrapped Cryptopunks

- World of Women

- Autoglyphs

- Vee Friends

- Makers Place

- ….

Compared to other NFT lending platforms, NFTfi has more chance in the collections that can be used as collateral for loans.

In term of loan limitation, the platform allows returns rated of 20-80% on the lended amount with the possibility for borrowers to borrow up to 50% of their asset value (LTV).

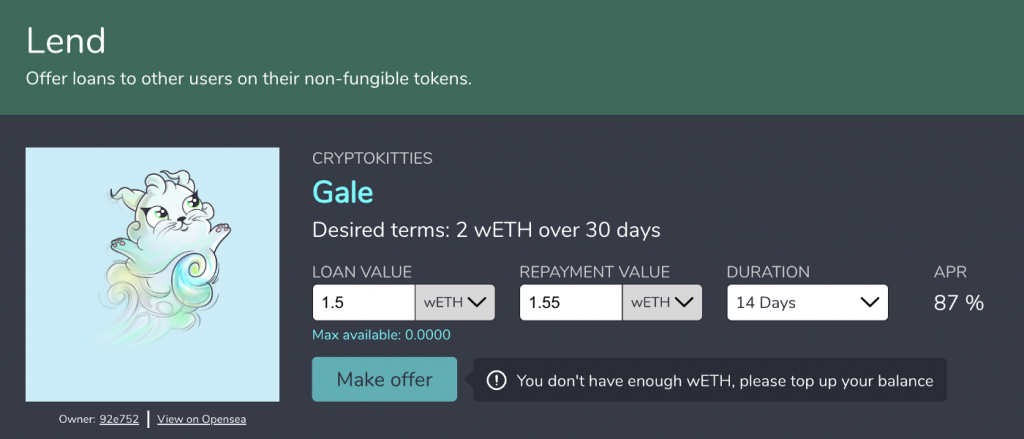

Lending with NFTfi

In order to lend on NFTfi, here is the simplified process:

- Browse your favorite NFT in the NFTfi library (where people looking for a loan listed their NFT)

- Select the NFT you want to back and make your offer in terms of loan value, repayment value, duration

- The owner of the NFT receives the loan and need to repay it

- If the borrowor defaults to pay you before the due date, you get the asset transferred to you -> this is really interesting as you could get cheaper NFTs from people that didn’t pay back the loan

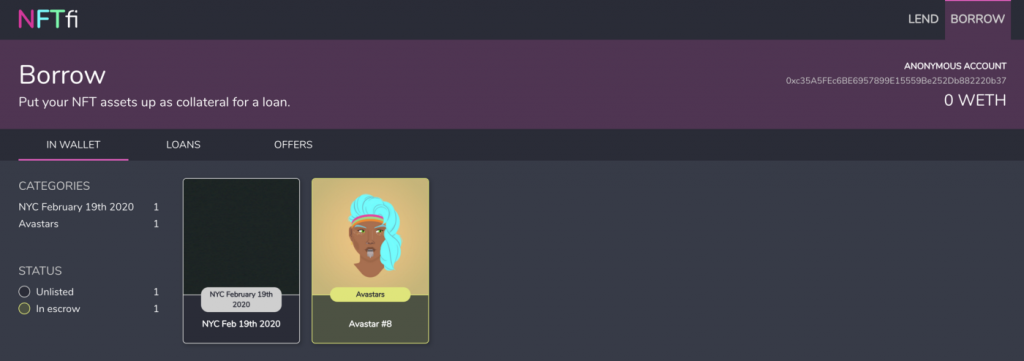

Borrowing with NFTfi

Here is the process for the borrowing part:

- Put any ERC-721 token up for collateralization

- Investors can now offer you a loan based on your collateral

- Once you accept the loan, the ETH is transferred form the lender account to yours and the NFT gets locked in the NFTfi smart contract

- Once you repay the loan amount, the NFT is transferred back to you

- Once you repay the loan the asset will be transferred back to you.

- If you don’t pay back the total repayment amount before the due date, the NFT is transferred to the lender as a repayment

Arcade

Arcade is another NFT lending platforms getting more and more trendy. This platform is headquartered in New York (United States).

As NFTfi, it is still at a startup level. The company has raised $17.8M from its investors, given them a lot of opportunity to grow (see figure below)

The platforms allows NFT lending and borrowing and has a total of loan transactions of $3.5M+, which is around 10 times smaller than the amount of NFTfi

The transactions can be done mainly with wETH, USDC, DAI and borrowers pay a flat 2% of principal on every loan originated at the time of origination.

In term of loan limitation, the platform allows returns rated of 5-60% on the lended amount. We don’t have information on the LTV value allowed.

Nexio.io

Nexio is a large crypto related platform, with $13B+ assets under management, that offers a full range of crypto services: buy, sell, exchange, borrow, credit card.

Below you can see some numbers about Nexio:

On top of the previously mentioned services, Nexio stated also offering NFT lending for borrowers

Lending with Nexio

Nexio doesn’t support NFT lending, but only NFT borrowing

Borrowing with Nexio

The NFT borrowing service is still new on the platform, pretty manual and offer a small set of available NFT to use as a collateral when borrowing. If you go on their website you will notice that:

- the onboarding is manual, with a form to fill and a person that will contact you

- the value of your NFT, to apply for a loan, should be >$500’000

- there are only 2 NFT collections available (as of Q1 2022): CryptoPunks and Bored Ape Yacht Club

If you manage to get loan money for a lender, the amount will be credited to your account in form of ETH or stable coins.

In term of loan limitation, the platform allows returns rates of 12-15% on the lended amount with the possibility for borrowers to borrow up to 20% of their asset value (LTV). The platform seems to target borrowers needed large capital (+500k) and is trying to reduce risk with smaller return and LTV value, as the money is lended by the platform itself, compared to the others where investors are taking care of it.

Drops

The Drops platform finishes last on our list since it is smaller than the others with also a very limited amount on the company and platform information.

There are no clear information on the country of the platform, but the founder and CEO is located in Lithuania (Europe) with its employees spread across several countries.

It is also at a startup level with a list of investors as shown in the figure below that allowed the platform to raise $1M+, a lot smaller than it’s competitors:

This NFT lending platform allows NFT borrowing and lending, and has a total amount of issued loans of $6M+.