| Invest | Up to $250 BONUS Bonus: First deposit of at least $100 to earn from $15 |

Users [03.2021] | Assets [03.2021] | Founded | Country |

|---|---|---|---|

+225k | +$15B | 2017 |  United States |

About BlockFi

First of all, thanks a lot for reading our BlockFi review! BlockFi is a US-based company (precisely based in New Jersey. The centralized crypto lending platform was founded in 2017.

BlockFi provides a Interest Account called BIA (BlockFi Interest Account) where you can store your cryptocurrencies and earn interests in exchange.

The platforms offers interests on 10 differents crypto currencies such as BTC, LINK, ETH, LTC and stablecoins such as USCD, GUSD, PAX, PAXG, USDT, BUSD.

While interest rates are not between the highest of the market (maximum of 9% on stablecoins, 5% on BTC while other crypto lending platforms such as Celsius.Network go up to 12+% on stablecoins and 6-7% on BTC), BlockFi can provide a “sense of accrued safety ans stability” versus its competitors. As of 2021 BlcokFi has secured a total of $500M+ financings in Venture Capital funds (according to Crunchbase), with the last financing round in 2021 of $350M making in the largest-money backed crypto lending company with a valuation of $3B+. Its closest competitor Celsius.Network raized nearly $100M.

BlockFi is available in most countries including the United States.

Another difference that BlockFi has compared to its competitors (e.g. Celsius.Networ or Crypto.com) is that BlockFi doesn’t offer their own crypto tokens. Crypto lending platforms that offer their own tokens as a reward usually have slighlty higher reward rates when lending.

How works BlockFi?

In this BlockFi review we think it’s crucial to talk about BlockFi’s product offering because BlockFi doesn’t offer only crypto lending services. It actually provides a wide range of services: crypto lending, crypto borrowing, crypto trading (buy, sell, exhange). Let’s dig more in details into each of the products.

How works BlockFi lending?

The most interesting product that we would like to discuss in this BlockFi review is Earn. The product Earn allows you to earn interests on the crypto you are holding. You can earn interests on several cryptos you hold with returns paid monthly in the currency that you have chosen.

The table below lists the available coins to be lended on BlockFi.

Coins | Stablecoins |

|---|---|

GUSD USDT PAX USDC PAXG LINK BUSD USDT |

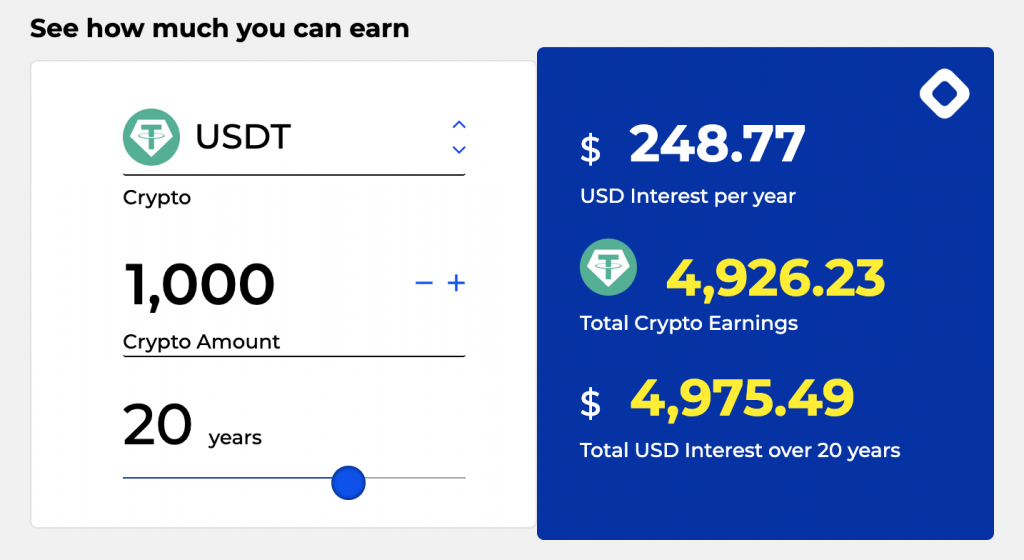

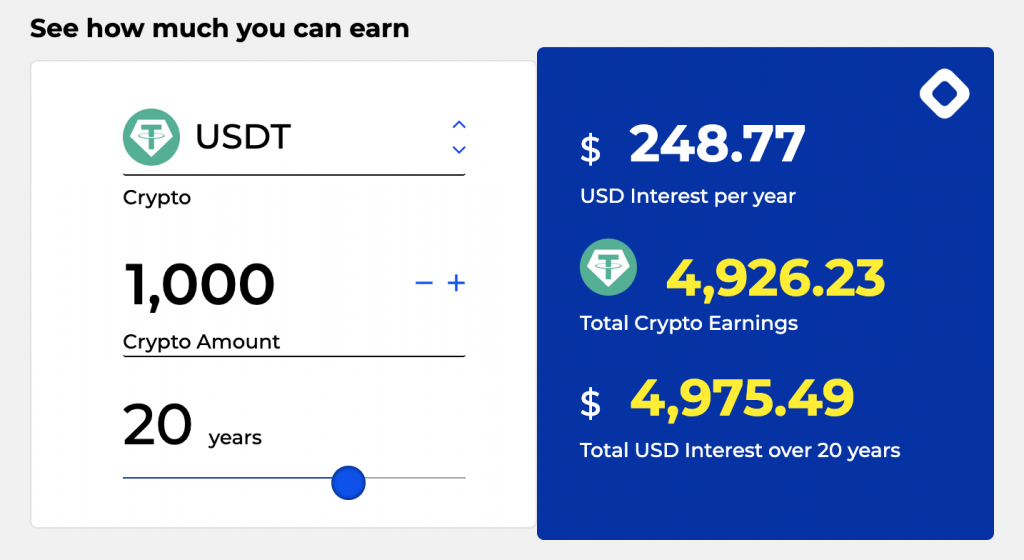

The figure below is the simulator allowing you to estimate your potential earning from crypto lending, you can try it by your won directly at BlockFi.

How works BlockFi borrowing?

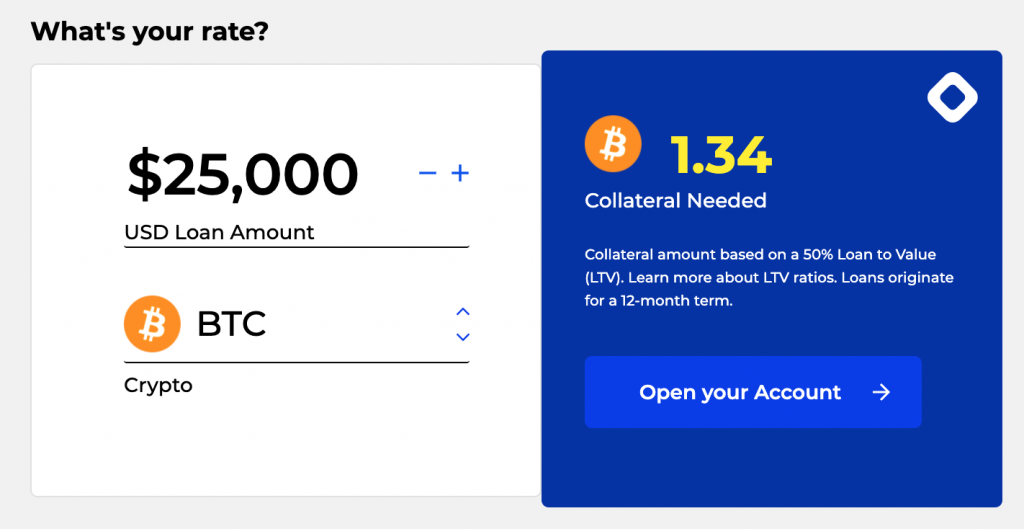

Another interesting product is Borrow. This product allows you to borrow funds (for e.g. in USD) by ensuring the loan by collateral made of your crypto (either Bitcoin, Ethereum, Litecoin or PAXG).

Let’s take a practical example, imagine that you have $10,000 in BTC, you will be able to stake this amount (which means to lock them in your BlockFi account) and to receive in exchange a loan in real currency. This is very practical if you need cash and don’t want to sell your crypto.

The borrowing interest rates start at 4.5% and the minimum amount you can borrow is $5,000 dollars while the maximum is defined by how much crypto you have available to set as collateral. The figure below allows calculating what is the collateral that you need to take a loan at BlockFi. Basically, the rule is simple, you need to stake in crypto 50% of the amount you want to borrow. This value of 50% is called Loan to Value (LTV).

How to trade on BlockFi?

The last product discussed in this BlockFi review is Trading. Whith BlockFi you can buy, sell and exchange cryptos.

BlockFi also allows you to setup recurrent tradings. Let’s say for example that you want to monthly convert $100 USDT into BTC, BlockFi will allow you to do that.

Concerning the withdrawal fees, when using BlcokFi you are entitled to one free crypto withdrawal per calendar month and one free stablecoin withdrawal per month. Each free withdrawal can only be applied to one currency each month. For each subsequent withdrawal request within that month, the following fees apply:

Currency | Withdrawal Limit | Fees |

|---|---|---|

BTC | 100 BTC per 7-day period | 0.00075 BTC |

ETH | 5,000 ETH per 7-day period | 0.02 ETH |

LINK | 65,000 LINK per 7-day period | 0.95 LINK |

LTC | 10,000 LTC per 7-day period | 0.0025 LTC |

Stablecoins | 1,000,000 per 7-day period | $10.00 USD |

PAXG | 500 PAXG per 7 day period | 0.015 PAXG |

Start to earn interests with BlockFi

To benefit from these different products you need first of all to create a BlockFi account. Good new! With BlockFi you can earn a bonus when creating the account via our partner link.

Go on BlockFi website or use the button below to register and get up to $250 bonus.

For bonus: Register via the button and get a bonus based on your first deposit

BlockFi interests rate

BlockFi is in the Top 3 crypto lending platforms with the highest crypto lending rates. In addition to this BlockFi review, you can read a full comparison of crypto lending platforms on our article: Best Crypto lending platforms.

BlockFi offers between the highest lending returns on the market:

- Up to 9.3% APR on stablecoins (average at 8.74%)

- Up to 5.5% APR on cryptos (average at 3.65%)

If you want higher returns Celsius.Network is an alternative that offer up to 17.7% on stablecoins and 6.35% on crypto. You can read our Celsius Network review for more information.

The table below lists the 10 crypto and stablecoins that can be lended on BlockFi and their interest BlockFi rates:

Currency | Amount | APY |

|---|---|---|

BTC (Tier 1) | 0 – 0.10 BTC | 4.5% |

BTC (Tier 2) | 0.10 – 0.35 BTC | 1.0% |

BTC (Tier 3) | > 0.35 BTC | 0.1% |

LINK (Tier 1) | 0 – 100 LINK | 2.5% |

LINK (Tier 2) | > 100 – 500 LINK | 0.2% |

LINK (Tier 3) | > 500 LINK | 0.1% |

ETH (Tier 1) | 0 – 1.5 ETH | 5% |

ETH (Tier 2) | > 1.5 – 5 ETH | 1.5% |

ETH (Tier 3) | > 5 ETH | 0.25% |

LTC | > 0 | 3.5% |

USDC | > 0 | 8.6% |

GUSD | > 0 | 8.6% |

PAX | > 0 | 8.6% |

PAXG | > 0 | 4% |

USDT | > 0 | 9.3% |

BUSD | > 0 | 8.6% |

Is Blockfi safe?

Is the company safe?

BlockFi has raized the largest amount of funds (compared to its crypto exchange competitors) from Venture Capital firms for a total of $500M+ bringing its valuation to $3B. For sire this is not a warranty that the company is safe, but if these professional investors invested so much money into it, it means that they assessed seriously the management behind.

But we are never sure that the platform won’t go into bankruptcy it the future (but it has a really small probability).

Is the platform safe?

- BlockFi is a centralized cryptocurrency exchange. In this case you will have to trust a third party to monitor the transaction and secure the assets on behalf of the buyer and the seller. BlockFi deals aren’t tracked on the blockchain in opposition to decentralized exchanges where funds remain stored on the blockchain. These platforms allow peer-to-peer (P2P) trading for which it uses assets, proxy tokens, or an escrow system.

- BlockFi keeps reserves with the crypto custodian Gemini.

- BlockFi is registered with the U.S. Department of Treasury Financial Crimes Enforcement Network (“FinCEN”) as a money services business (“MSB”). As a registered MSB, BlockFi is subject to the Bank Secrecy Act and its implementing regulations (collectively, the “BSA”) which set out the requirements imposed upon financial institutions to implement policies and procedures reasonably designed to detect and prevent money laundering and terrorist financing.

Review of BlockFi Pros & Cons

Pros | Cons |

+ Unlimited lending duration + $500M in VC financings + Free withdrawal (once per month) + No minimum investment amount + Cryto card available soon |

Blockfi investment details

Investment currencies | 10 supported coin | |

Return on investment (ROI) | Up to 9.3% APR on stable coins (average at 8.74%) Up to 5.5% APR on cryptos (average at 3.65%) |  |

Minimum investment | – | |

Investment period | Unlimited | |

Investment fees | 0% | |

Accepts US citizens | Yes | |

Trustpilot Score (Safety) | 3.9/5 | [05.2021] |

Investment types

Investment result forecast

Below you will find the resulting forecast when investing using BlockFi. By investing $1’000 (Tether) using BlockFi for 20 years you might end up with $4,975 (Tether). If you want to earn more interest on your crypto, you could also use some slightly smaller platforms but that have higher returns such as Celsius. You can check our review HERE.

Blockfi bonus and cashback

For bonus: Register via the button and get a bonus based on your first deposit

Deposit $100 – $1,499 | Bonus of $15 in BTC

Deposit $1’500 – $19,999 | Bonus of $20 in BTC

Deposit $20,000 – $39,999| Bonus of $40 in BTC

Deposit $40,000 – $74,999| Bonus of $75 in BTC

Deposit $75,000 – $99,999| Bonus of $150 in BTC

Deposit $100,000+ | Bonus of $250 in BTC

Blockfi competitors

View the list of all the platforms

Learn how to invest in crypto lending

Learn to invest in Crypto lending