Cryptocurrency has gained massive popularity in recent years. The transformation of the world from barter to bit has changed the working of almost every industry. We also came across many stories of people becoming millionaires due to their investments in bitcoin and cryptocurrency when people feared it. The stories and increasing adoption themselves are ample proofs that when you invest in cryptocurrency there is an excellent potential for high returns.

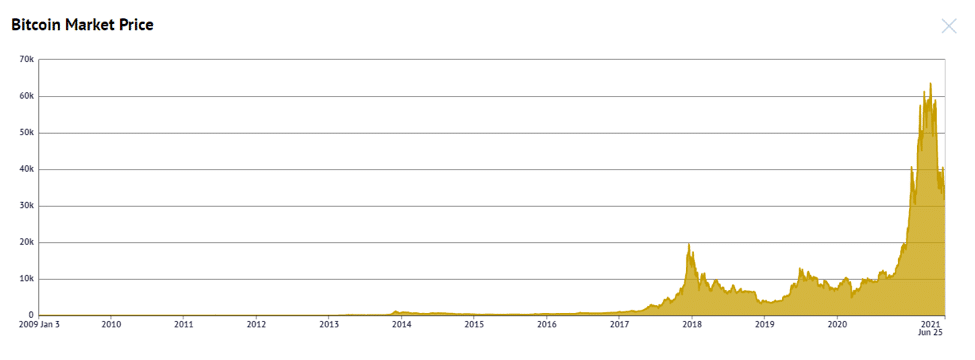

In recent months, the price of bitcoin raised to ever highest of $60,000 (as of Q1 2021).Such an increase in price has also gained the attention of those who were still not believing in cryptocurrency. Today, everyone is hopeful about the bright future of cryptocurrency and wants to learn how to invest in cryptocurrency.

There are many questions related to crypto investments such as, is it safe to go for it? How can you start investing in cryptocurrencies? What are the platforms you should visit? Many more.

For your better understanding of the entire process, we have created a guide for you. Give it a read, and we hope that you will know all you need to know about investing in cryptocurrencies by the end of the article.

So, let’s dive in! But just before, the image below gives a summary about the article.

What is Cryptocurrency?

Cryptocurrency is a digital currency that does not depend on intermediaries. It is secured by cryptography which ensures that it is not double-spent. It is a peer-to-peer system that allows transactions around the world. Unlike fiat currencies (such as USD, EUR, CAD), it does not exist in physical form but can be stored or carried into online digital wallets. Transactions are verified and maintained by highly secure and decentralized blockchain ledger technology. Decentralization, immutability, and security are central pillars of blockchain technology based on a network of thousands of computers worldwide competing for validation of each transaction. Cryptocurrency is not issued by any central authority, therefore free from government involvement.

Bitcoin is the most popular cryptocurrency launched by a group of people with pseudonym Satoshi Nakamoto in 2009. Many companies accept cryptocurrency as payment. The price of cryptocurrency depends on the market demand and keeps on changing accordingly. In the start, many criticized cryptocurrency because of many reasons, but now people understand its potential and praise it for its profitability, transparency, and inflation resistance.

In 2009, bitcoin worth $0. In 2011, it hit the level of $1 for the first time. After this, the price kept on increasing. 2018 had been a great time for bitcoin, as the price raised to $20k at once. The demand kept on increasing, simultaneously the price was surging. In 2021 the price of bitcoin hit the ever-highest value $60k.

Different Ways to Invest in Cryptocurrency

Following are different ways to invest in cryptocurrency.

Buy and Hold Cryptocurrency

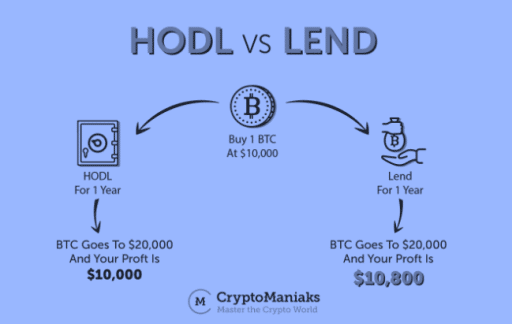

The buy and hold strategy of cryptocurrency is called “Hodling”. HODL is misspelt of “hold”. In this case, investors buy cryptocurrency and tend to hold their crypto assets for an extended period to earn profit from the value appreciation. Traders also earn significant gains by buying cryptocurrency at low prices and selling them at high prices. The high volatility nature of crypto provides excellent opportunities for obtaining gains by building short and long positions.

Due to volatility, investors may experience extreme ups and downs in the value of crypto assets. Hodling is regarded as the safer choice for investors so that they don’t become prey to short-term volatility and can avoid the risk of buying at a high price but selling at a low price.

Every cryptocurrency has a unique nature of price fluctuation, and how long you should hold the cryptocurrency depends on various factors; therefore, it is hard to say the exact time. But mostly, it is recommended to treat crypto like a marathon, and the best strategy is to hold for a long time.

Crypto lending is one of the emerging trends in the crypto industry in which investors lend cryptocurrencies to borrowers in exchange for crypto dividends. In this case, you can earn returns without selling your crypto. The borrower deposits crypto assets as collateral which ensures the security of investors’ investments. Borrowers deposit cryptocurrencies worth more than the actual value of the loan. The typical loan-to-value (LTV) is at maximum 50% to 70%.

Crypto Lending

Several crypto lending platforms offer opportunities for crypto-backed loans. Talking about returns, many top crypto lending platforms promise annual yields between 3% to 17%. The amount of return depends on the cryptocurrency you are lending. Using automated lending platforms, you can be tension free because the earning from lending dividends is entirely automated by the platform.

Crypto Mining

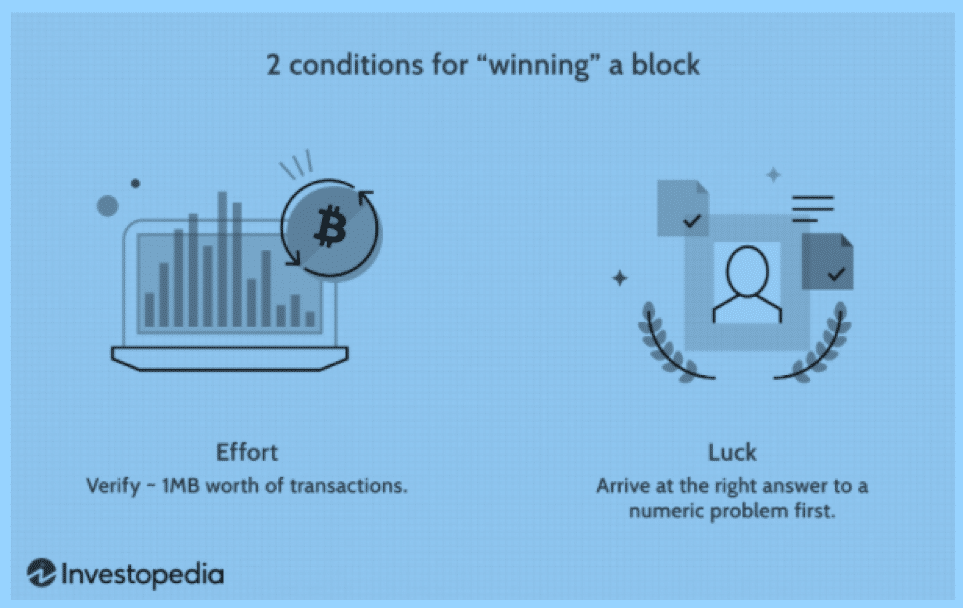

Crypto mining is the process of creating cryptocurrency by auditing and processing cryptocurrency transactions. It can also be defined as creating new bitcoins by solving complex computational problems.

Investors can start cryptocurrency mining and earn a reward for every successful mining of a bitcoin block. For each successfully solved problem, miners are rewarded with 6.25 bitcoins (as of 2021 until 2024). The process repeats approximately every 10 minutes for every mining machine on the network.

Not every miner who verifies the transaction get paid but the one meeting two specific conditions. The following figure shows two conditions for winning a block in mining process.

The process of mining is energy-consuming. The revenue generated from mining can be calculated by determining hardware costs, energy prices, and cryptocurrency prices.

In China, the cost of electricity is meagre; therefore, 60% of the world cryptocurrency mining occurs in China.

Cryptocurrency / blockchain stocks / ETFs

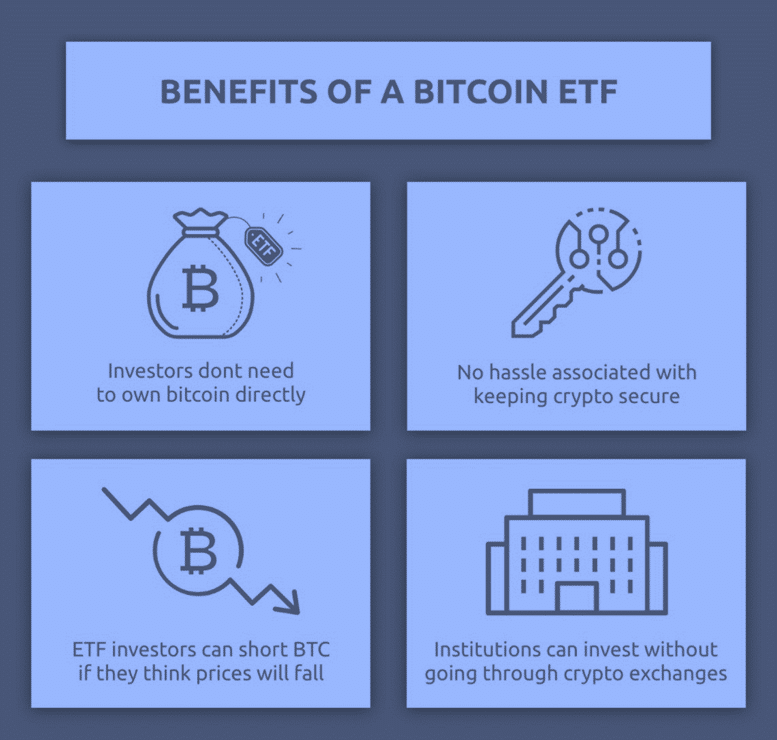

An exchange-traded fund (ETF) is an investment that tracks the performance of a particular or group of crypto assets. It allows investors to buy an ETF without trading cryptocurrency. It is a better option for those investors that do not want to manage cryptocurrency investment but want to diversify their crypto portfolio.

Investors can invest in Bitcoin without using a cryptocurrency exchange while providing leverage to its price using bitcoin ETFs. Investment in ETFs ensures convenience, diversification, and tax efficiency (such as: ETF TSX: BTTC).

Bitcoin stocks are another option for investors. You can easily trade bitcoins for cash or other assets instantly with low fees and can earn interesting gains.

The image given below shows the main benefits of Bitcoin ETFs.

How to Buy Cryptocurrency?

You can buy cryptocurrency in merely four steps which are given below.

1 – Choose a Crypto Exchange

To buy bitcoin or any cryptocurrency, you will need a cryptocurrency exchange (such as Coinbase, Binance) to exchange fiat currency (such as USD, EUR, CAD) for cryptocurrencies. There are thousands of cryptocurrency exchanges out there. You should use one with high security and low fees. Make sure that your opted platform offers a built-in wallet, or you have to find it on your own.

2 – Decide on a Payment Option

Once you have selected an exchange, you have to fund your account. You can fund it via bank transfer, PayPal, wire transfer, credit, or debit, or even a cryptocurrency wallet. It depends on which payment method the platform accepts. The transaction rate for each mode varies.

In common observance, electronic transfers from a bank account are preferred as compared to other methods.

3 – Place an Order

Your account is funded, now you can place your order to buy cryptocurrency. You will input the amount you want to invest. Once the transaction is completed, you will own a fixed percentage of cryptocurrency based on your invested amount.

4 – Select a safe storage option

You need a secure wallet to secure your crypto assets. Your exchange platform may offer an integrated wallet, but if not, you can opt for a wallet according to your requirements. You can also choose not to use the wallet provided by the exchange and can use the one you feel is more secure, either online or offline.

Best Platforms to invest in Cryptocurrency

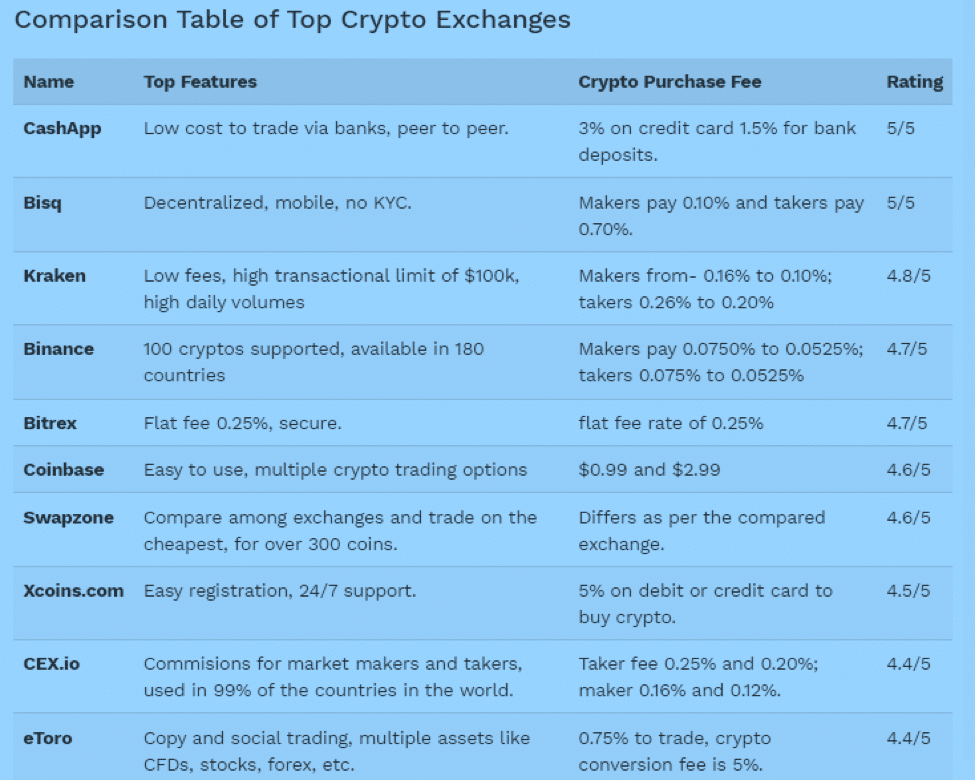

The best cryptocurrency platform should be secure, cost-effective, easy to use, quick, and accept various funding methods. Following are our top picks for buying cryptocurrency.

Coinbase

Coinbase is one of the largest cryptocurrency exchanges based in San Francisco. It has 56 million active users in more than 100 countries. Coinbase charges a reasonable fee, which is based on the funding methods. It supports a large number of cryptocurrencies; you have a great choice to choose at one platform. It offers high security through its vaults, two-factor authentication, and offline storage for most assets.

The fees can be high for debit card transactions.

eToro

eToro is the best platform for beginners. It is a straightforward, easy to use and focused platform that allows buying cryptocurrency while offering an opportunity for beginners to learn more about the cryptocurrency ecosystem. It provides free practice account without any risk to your actual money. Users also have a copy-trading system option to learn.

It charges a high spread fee for cryptocurrency purchases.

Binance

Binance is a platform that offers crypto-to-crypto trades. One of the main reasons for Binance popularity is the listing of many different cryptocurrencies. When trading crypto-to-crypto, Binance charges the lowest fees in the crypto industry. This platform takes security very seriously, offers two-factor authentication, and uses Cryptocurrency security standard CCSS to protect accounts.

It may appear to be a bit difficult platform for crypto beginners.

Coinmama

Coinmama offers instant delivery; therefore, it is the best option if you want to own cryptocurrency or bitcoin quickly. It provides fast account setup and verification. It allows numerous funding options.

The fee structure is complex, and you have to pay 5% additional fee for instant service.

Cash App

Cash App is another great option for beginners that want to invest in cryptocurrency. It is a peer-to-peer money transfer service like Venmo. It allows its users to invest in stocks, ETFs, and cryptocurrency. It is effortless to use and deal with a first-time investor.

It offers only bitcoin investment at this time. It charges a 3% fee for using credit cards.

Bisq, Robinhood, BlockFi, Uphold, Gemini, Kraken etc., are several other outstanding cryptocurrency exchanges. You can check out these as well.

Types of Cryptocurrency Wallets

A crypto wallet is used for storing and retrieving digital assets. Following are different types of cryptocurrency wallet.

Hot wallets

Hot wallets are connected to the internet somehow. These are easy to set up, quickly accessible, and convenient.

Cold Wallets

These wallets have no connection to the internet. They store keys offline. These are resistant to online hacking. These are suitable for long term hodlers.

Software wallets

Most of them come under the category of hot wallets. These include web wallets, desktop wallets and mobile wallets.

Web wallets

These wallets allow accessing blockchain through a browser interface and convenient for inexperienced users.

Desktop wallet

As the name suggests, you download this wallet and execute it locally on your computer. It gives you complete control of your keys and funds. It is considered more secure than web-based wallets.

Mobile wallets

Mobile Wallets work like the desktop wallet but designed specifically for smartphone users. These are easy to use and allow sending and receiving cryptocurrency through QR codes verification.

Hardware Wallets

Hardware wallets are physical, electronic wallets that generate public and private keys. These are not connected to the internet. These come under the umbrella of cold wallets. These offer a higher level of security against online hacks.

Paper wallet

It is a piece of paper on which crypto address and private keys are physically printed in QR codes. These codes are scanned to execute transactions. This wallet is dangerous to use due to numerous flaws.

Which Cryptocurrency to Buy First in 2021

There are several cryptocurrencies in the market with different worth. A bitcoin is of thousands of dollars, ETH worth more than hundreds of dollars, and many others like this. According to several analysts, the following few cryptocurrencies are considered the best investments in 2021.

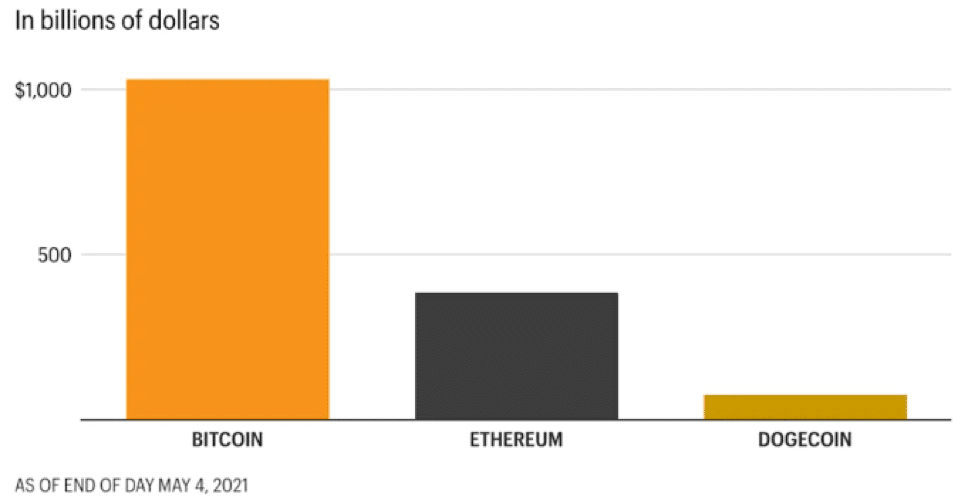

Bitcoin (BTC)

Bitcoin is the market giant. In April 2021, the price of bitcoin surged to $60,000. It has enormous potential and a bright future ahead.

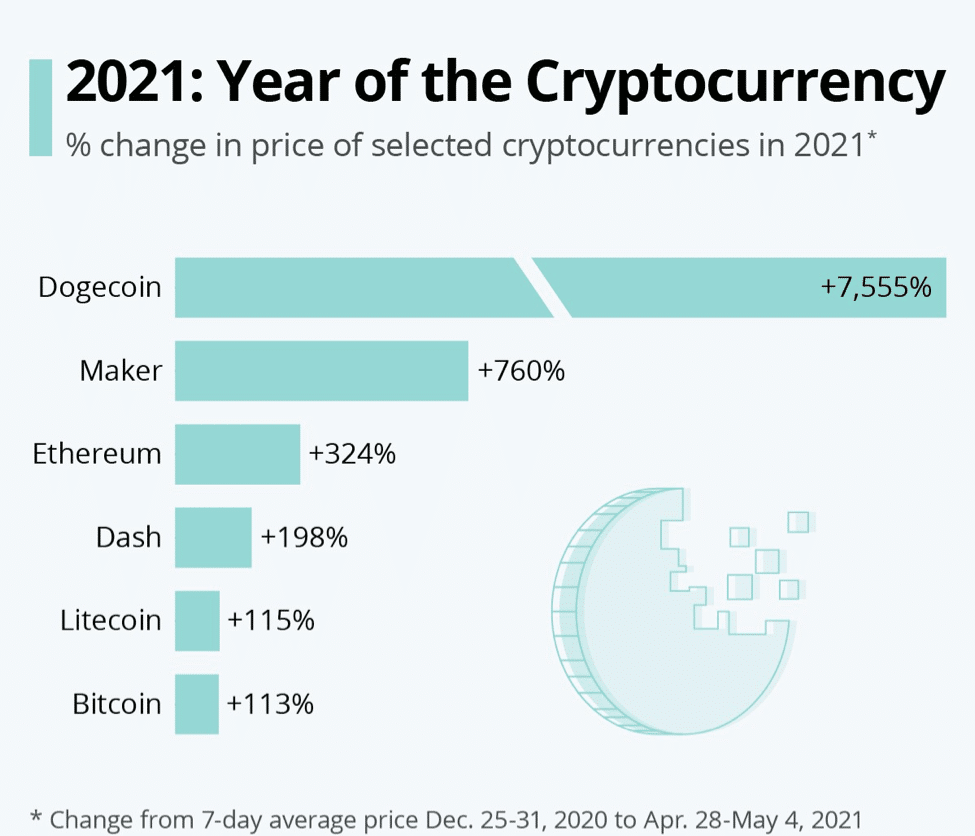

Dogecoin (DOGE)

2021 has been considered as the year of dogecoin. This cryptocurrency has surged more than 13,000% this year and regarded as the cryptocurrency with the fourth-largest market cap.

Ethereum (ETH)

Ether has become one of the most popular cryptocurrencies in the world. The recent gain of ETH is nearly 500% in 2021.

You can also check Cosmos (ATOM), Compound (COMP) and Polkadot (DOT) etc., for investment in 2021.

Things you need to know before you invest in cryptocurrency

Following are few things that you must consider before investing in cryptocurrency.

- Cryptocurrency investment is risky. So, do not invest more than you can afford to lose

- Do thorough research before investing a significant amount of money in the cryptocurrency

- Resist the FOMO (fear of missing out). Evaluate your investment on merits.

- Do not get trapped by offers that sound too good to be true. Always beware.

- Do not trust the market, as it is full of scammers. Do the research and verify it.

- Save your keys yourself. Never share them.

- Understand the tax consequences

Conclusion

Cryptocurrency is a highly volatile market where you need to be very cautious. You need to use a good platform, keep track of your investments and also taxations. In the beginning, you may find it complicated, but you should accept yourself being new in the industry and keep on educating yourself. There is not any hard and fast rule for when to buy cryptocurrency. Usually, it is recommended not to buy when prices are crashing.

Do research, create a proper understanding by educating yourself, reach out to your colleagues already in the crypto industry, learn from them, and when you think you are ready to take the plunge, do not hesitate.

Keep learning, Keep Growing!

You can check out our other articles to learn more about the crypto industry. Stay tuned for more knowledgeable content!