Cryptocurrency has been the talk of the town for the past few years. After many successful cryptocurrency projects, another trend that is gaining popularity very quickly are crypto cards.

Crypto enthusiasts did not have many options to spend their crypto, and they were restricted to use wire transfers and Bitcoin ATMs. Now the crypto environment is broadening by providing more convenience to its users in the form of these cards.

But what are crypto cards? How do they work? What are the best cards available?

Take a deep breath. Here, we have prepared a complete guide for you, and we have discussed everything for your better understanding of crypto credit and debit cards.

So, let’s get started.

What are Crypto Cards?

Crypto cards are almost the same as your regular payment cards. The only difference is that you use cryptocurrency instead of fiat (such as USD, CAD, EUR) to pay for the goods and services. These cards can be either crypto credit cards or crypto debit cards.

When using these cards, you are not directly paying with Bitcoins or other cryptocurrencies, but first, your digital asset is converted into your local fiat currency and then is sent to the retailer.

Crypto cards are supported by two financial giants, i-e Visa, and MasterCard. A crypto company issues card after receiving a license from these companies. This card is then ready to use at any store that supports Visa or MasterCard payment.

How do Crypto Cards work?

Since all cryptocurrency cards are licensed under Visa or MasterCard, they have the same regulations and restrictions.

For using a crypto card:

- You have to connect your card with a wallet. Some platforms ask you to create a dedicated wallet in which you have to transfer your assets (it can be the platform’s wallet as well). In contrast, others allow you to use your personal wallet so that you remain the sole owner of your digital assets.

- Once your crypto funds are connected with the card, you can start using them for shopping.

These cards may vary in terms of withdrawal limits, maximum payments, cash backs, unique features to special members, etc.

Consider an example to learn how crypto cards actually work.

Suppose you had dinner in a restaurant and want to pay for it in cryptocurrency. You hand over your crypto card to the cashier. When the cashier swipes your card, the crypto processing company will reach your card’s crypto wallet and take the fiat amount of crypto needed to pay the bill. This company will then convert this crypto into your local currency and deliver it to the restaurant’s bank account.

This all happens in few seconds.

Check out these 2 crypto card platforms

Difference Between Crypto Credit and Debit Cards?

Crypto debit cards require you to have a wallet. The funds are drawn from your wallet when you use it for purchase. Debit cards are often prepaid; therefore, you need to load money onto your card before using it – like you would do with a Revolut card.

On the other hand, when you use a crypto credit card, you borrow money from the card issuer, which is then paid back.

Benefits of Crypto Cards

If you own cryptocurrency, a crypto credit or debit card can indeed be handy for you. The following are the benefits of crypto cards.

Use Crypto More Conveniently

People have been making money from cryptocurrency by investments and carrying it all the time but could not pay conveniently for services in the real world. The transactions would take up to 30 minutes which is generally not acceptable by any store.

But now, with the help of Visa and MasterCard, crypto cards can complete transactions in only a few seconds.

Low Annual Fees

In some banks, you have to pay a high annual membership fee for using their credit or debit card services, but the yearly fee is meager with crypto cards. Also, if you spend a specific limit of cryptos within a year, the fee is generally waived off.

Use Both Crypto and Fiat Currencies

Many crypto-backed cards allow you to access and use both fiat and cryptocurrencies. It means you can access different currencies with one card without going through the hassle of switching between cards to make payments.

Say Goodbye to Foreign Exchange Fees

With regular credit or debit cards, banks charge a fee on the foreign exchange (F.X.), sometimes up to 3%.

In contrast, crypto cards do not charge an exchange fee on foreign transactions, but you have to pay standard Visa and MasterCard fees.

Cashback Rewards

With a crypto card, you can also earn extra coins when using it for making a purchase. The rewards depend on which card provider you are using.

For example, the crypto cards mentioned below can help you get rewards from 1% to 8% of your transactions.

Some cards also give rewards such as airport lounge access, Netflix & Spotify subscription, Expedia discount, VIP concierge etc… So, shop around to see which one suits you better.

Best Crypto Cards

Many amazing crypto cards are in the market, so it might be difficult for you to choose the best one. Here we have listed the five best crypto credit and debit cards.

1 – Crypto.com Debit Card

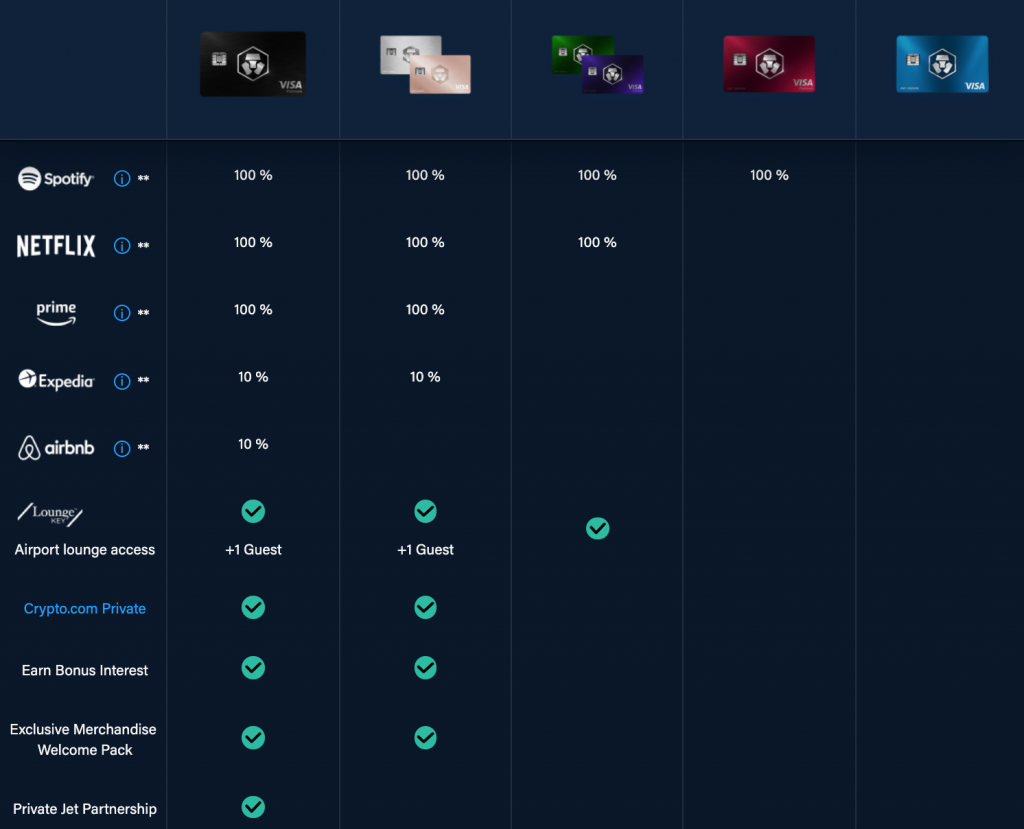

The Crypto.com Visa card is one of the first crypto cards that offers tons of rewards.

Crypto.com is offering an excellent crypto card solution via its MCO Visa card. The MCO Visa card is a debit card that enables crypto users to spend their cryptocurrency. Its distinguishing feature is not asking to exchange your digital assets into fiat to fund the card. Do you want to know more about this card on its crypto cashback, you can read this article: Crypto.com Crypto Card.

Crypto.com offers its crypto cards in almost all jurisdictions such as the U.S., U.K., Singapore, Hong Kong, Thailand, Australia, New Zealand, Philippines, etc. People from these countries can easily register for their Crypto.com debit cards. In the future, more countries will be added to the list. You can use it anywhere Visa is accepted.

Crypto.com Visa card supports more than 90 different cryptocurrencies, which makes it the best choice. The company offers even this card in seven different colors. Choose your desired crypto with your favorite color crypto.com debit card.

Crypto.com MCO visa card is very famous for cashback. It offers 100% back on your entertainment subscription including, Netflix, Amazon Prime, and Spotify. You also get 10% back on Airbnb and Expedia purchases. Crypto.com cards also offer exclusive airport lounge access.

The rewards vary depending upon which crypto.com visa card you are using. The company usually rewards its cardholders with 1% to 8% of their total transactions. These rewards are distributed via native MCO cryptocurrency. You can get cashbacks in CRO tokens. You can earn $25 in Crypto token (CRO) for each person you refer. There is no fee on ATM withdrawal. There is also no limit on the number of free currency exchange transactions you make every month.

All cards are not accessible to everyone. You need to stake a certain amount of money in the Crypto token (CRO) to access card. Overall, this crypto debit card seems to be the best card available.

|

Crypto Card (up to 8% cashback)

For Bonus: Order the Ruby card (red one) or above |

2 – BlockFi Rewards Visa Credit Card

BlockFi Rewards Visa Credit Card is also among the cards catching the attention of crypto lovers. It is one of the only reward cards that earn Bitcoin (BTC) cashback. If you are interested to know more about the card cashback returns, fees, perks, you can read this article: BlockFi Crypto Credit Cards.

The BlockFi credit card earns 1.5% rewards on all purchases held in Bitcoin in the user’s BlockFi account monthly. It can be used anywhere Visa cards are accepted.

There are no transaction fees; even the foreign transactions are free. The company offers an introductory rewards rate of 3.5% back when you spend $3000 within the first three months of credit card membership. You can receive a 2% reward rate for every dollar you spent over $50,000 each year. You can also earn $30 additional in Bitcoin rewards by referring a friend. The BlockFi Interest Account (BIA) allows you to earn up to 7% APY on crypto.

Cardholders have to pay zero annual fee. The reward structure is not so complicated that it helps users to earn.

Cardholders using BlockFi for trading cryptocurrencies can also earn 0.25% of their trading volume back in Bitcoin up to a maximum of $500 Bitcoin monthly.

This card is only available in U.S. for the moment but will be launched for rest of the world also in Q1-Q2 2022.

Though the bonus categories are few, if you prefer Bitcoin, then BlockFi can be your go-to visa card platform.

|

|

3 – Coinbase Card

Coinbase card is one of the unique crypto debit cards options available. The Coinbase Visa card is similar to a regular Visa card, except it supports nine different cryptocurrencies which are Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Bitcoin Cash (BCH), Augur (REP), Basic Attention Token (BAT), Ox (ZRX), Stellar Lumens (XLM) and Litecoin (LTC).

Coinbase cardholders can directly fund the card by transferring cryptocurrencies from the exchange’s wallet.

Coinbase Visa card is accepted anywhere Visa is accepted. Coinbase provides enhanced security features via two-step verification and a highly regulated mobile app that enables you to control your card all the time. You can access account notifications, transaction summaries, and digital receipts any time.

Coinbase credit card charges a high fee. Coinbase has an ATM withdrawal limit, $200 per month. Cardholders have to pay a 1% fee on withdrawal and a 2% fee overseas. Overseas withdrawals are expensive as each transaction charges can total up to 3%.

Cardholders can get rewards of high 4% on purchases which after 2.5% of the transaction fee becomes 1.5% actual gain.

Customers are generally satisfied by the Coinbase credit card because of its security and convenient features. It is considered to be the second-best card after the Crypto.com card.

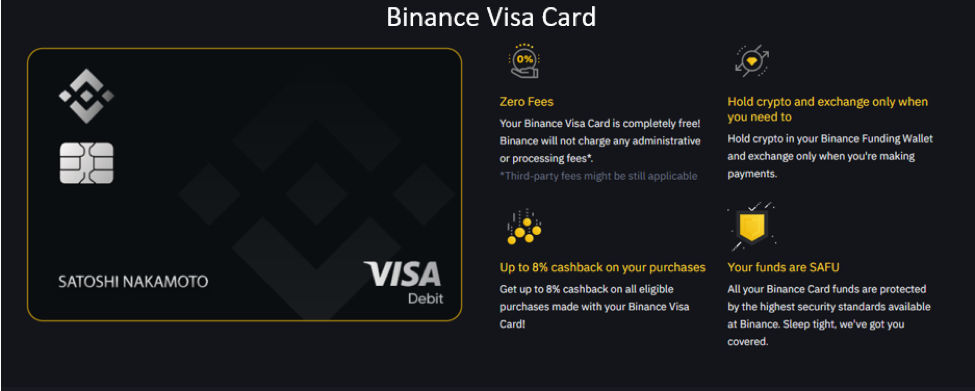

4 – Binance Visa Card

The Binance card is a Visa debit card that enables users to draw on their Binance crypto holdings. The card supports payments with cryptocurrencies such as Bitcoin (BTC), Binance Coin (BNB), Ethereum (ETH), Binance USD (BUSD), etc.

When you purchase using a Binance card, your crypto holding will be converted to fiat currency in real-time. So, make sure that you have topped up your card wallet with funds from your main Binance wallet; otherwise, payment will be declined. You can also enable auto top-up to make sure your card’s balance is daily refilled.

Binance Card is backed by Visa and can be used by more than 60 million sellers across 200 jurisdictions worldwide.

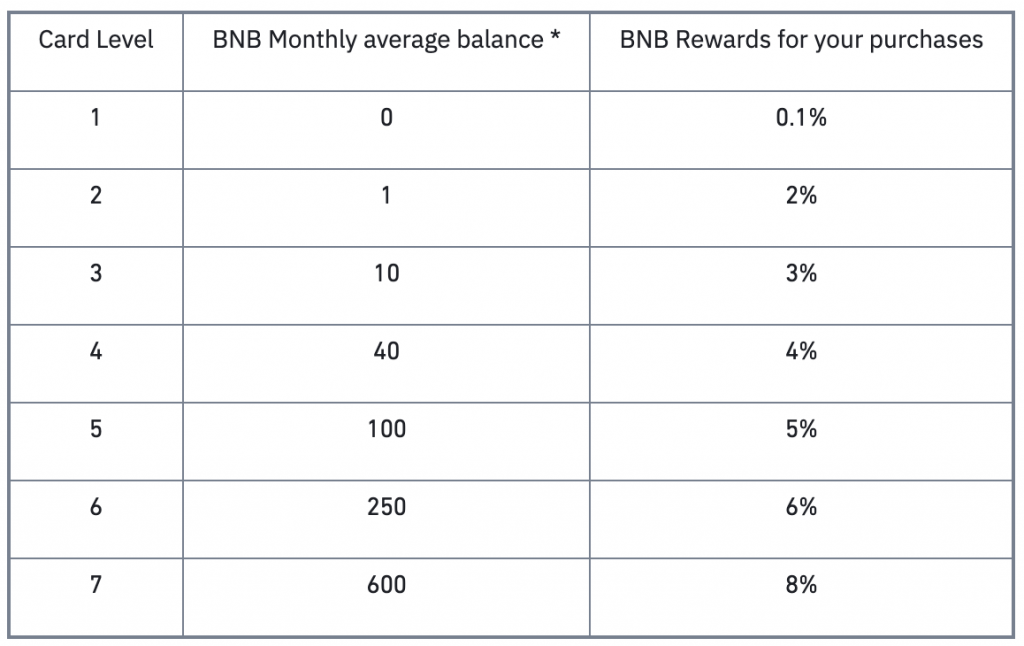

Binance Card gives cashback for every purchase. It can be up to 8% cashback in the form of BNB coins after you make a specific amount of purchases. The amount of reward depends on how much BNB you are holding on Binance currently. The cashback is given monthly.

Cardholders have to pay a $15 initial issuance fee of the card. There is no fee for monthly or annual card maintenance. There is zero transaction fee, and you also have to pay no subscription fee.

Binance offers both physical and virtual Visa cards. The virtual Binance Card has a daily limit of $1026 USD and a physical card with a limit of $10264 USD. While the daily ATM limit is $242 USD. For the reissue of the physical card, you have to pay $29.50 USD.

5 – Gemini Credit Card – Coming soon

Gemini credit card is also another fantastic crypto card that allows users to earn real-time cryptocurrency rewards. It supports more than 30 different cryptocurrencies. It is issued by WebBank and created by MasterCard. It be used anywhere Mastercard is accepted in the world.

Users have to pay zero annual fee. However, there is no sign-up bonus.

Gemini card enables its users to manage their accounts via a mobile app. You can quickly freeze and unfreeze your card while enjoying 24/7 live customer support.

Users can earn up to 3% on dining, 2% on groceries, and 1% on other purchases in any cryptocurrency. These rewards can then be traded on the Gemini platform. It enables you to earn not only Bitcoin (BTC) but various other cryptocurrencies.

With a Gemini card, you earn rewards in real-time. You can hold the crypto soon after your purchases. With other cards, your cashback is converted into cryptocurrency, which you get at the end of the month. But Gemini card allows you to receive a reward soon, and you also do not have to worry about the exchange fee.

However, the Gemini credit card is not available yet. But you can join the waitlist for early access.

Other Crypto Cards to Check

Other than the above-mentioned crypto cards, you can also check the following cards.

Wirex Crypto Card

Wirex card supports multiple cryptocurrencies with a minimal fee and rewards its users in Bitcoin. It has a “Cryptoback” reward system that gives 2% back in Wirex Token (WXT) rewards for specific in-store purchases only. You can also earn a $10 in Bitcoin (BTC) reward on referring new members. It does not charge an annual fee. However, there is a 2.5% fee charged on transactions of total rewards. You have to pay a 1% fee to fund your account with cryptocurrency.

Nexo Crypto Credit Card

Nexo credit card is accessible through the Nexo Wallet app. With Nexo, you do not have to convert your assets. You can freeze and unfreeze your card anytime via its mobile app. You can earn 2% cashback rewards on all transactions, which are distributed either through NEKO token or Bitcoin. You do not have to pay any deposit or withdrawal fee.

TenX Crypto Debit Card

TenX crypto debit card is another popular option that does not charge any fee on foreign exchange, deposits, or withdrawals. However, you have to pay a $15 card issuance fee for a physical card and $5 for a virtual crypto credit card. After a year, you will have to pay a $10 annual fee. The in-app exchange rates are reported to be high for TenX as compared to other platforms.

You can also try Swipe Visa Card, SoFi Credit card, Club Swan crypto cards, etc.

Things to consider when using a Crypto Card

The following are the things that you should consider when using a crypto credit or debit card.

- Does your desired crypto card is supported in your country?

- How much tax do you have to pay on your crypto card transaction when making purchases?

- Which cryptocurrencies your chosen crypto card supports?

- What are the fees and exchange rates?

- What is the reward structure of the card?

The Bottom Line

There are various crypto credit and debit cards available in the market, and many of them are really doing great. Many people are showing huge interest in these cards.

Each card has specific features. You can choose the one that fits best according to your requirements. But it would be best if you are always concerned about the security of your funds. So, choose a reputed card issuer platform.

We hope that our article has helped you learn a lot about crypto cards.

Stay tuned for more informative content!