Every crypto holder wants to earn some passive income with their cryptos. Staking and Mining have been popular in the crypto industry for the past few years because of their concept of giving rewards to people. Now, another option to earn crypto are crypto cards. Crypto cards allow you to use your cryptos for making everyday purchases and earning rewards. The BlockFi Visa Credit Card allows to make purchases with fiat currency, but users earn passive Bitcoin on their every purchase. Isn’t it interesting! The BlockFi Visa card has more to read. In this article, we will do a detailed BlockFi Credit Card review to find out whether this card is for you or not.

What is the BlockFi credit card?

The BlockFi Visa credit card has gained much popularity because it is the first crypto credit card that allows users to earn Bitcoin (BTC) back. It also offers additional ways to make more Bitcoins. The rewards are the foremost reason for most of the users to purchase this card.

With a BlockFi credit card, you use dollars to make payments like a regular credit card but earn Bitcoins as cashback.

You cannot spend cryptocurrency directly using this credit card.

If you would like to register for the BlockFi card, you can follow this link: BlockFi registration.

About BlockFi, the company behind the card

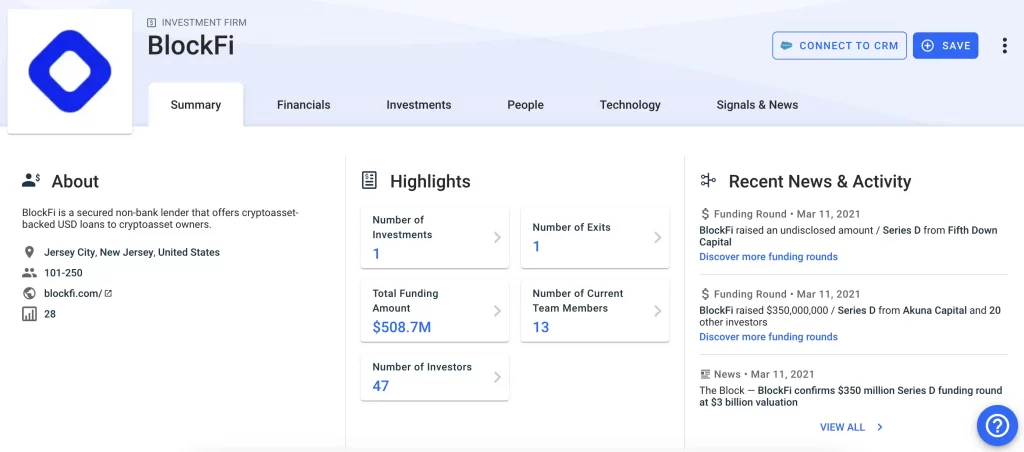

BlockFi is the company behind the BlockFi credit card. It is a New Jersey-based company that mainly focuses on cryptocurrency lending and borrowing. It was founded by Zac Prince and Lori Marquez in 2018. The company made rapid growth in 2020-2021. As of October 2021, the BlockFi company is valued at more than $3 billion. It has over 200,000 institutional clients with monthly revenues of $50 million.

Considering these stats, when you purchase a BlockFi credit card, you can assume that you are in pretty safe hands.

How does the BlockFi credit card work?

Using BlockFi, credit card users earn rewards by spending at any store that accepts Visa. Initially, the rewards are earned as points that later convert into Bitcoins automatically. As of October 2021, the conversion of points into Bitcoin happens on the second Friday of every month.

Users earn 1 cent worth of Bitcoin, depending upon the market price of Bitcoin, when the redemption transaction happens, about 1% spread. It means, if the price of Bitcoin is low, you will receive more Bitcoins for rewards each month and vice versa.

The cardholder uses his BlockFi account for receiving rewards. He can transfer earned Bitcoins to any external crypto wallet or a bank account via wire transfer. Users are not charged for one crypto withdrawal and one stable coin withdrawal every month on BlockFi. Each free withdrawal can only be applied to one currency every month.

Fees of the BlockFi card

The following are the fees associated with the BlockFi credit card.

- Initially, the BlockFi credit card was launched with a $200 annual fee, but this was removed. Now, there is not any yearly fee.

- There is no transaction fee. Foreign transactions are also free.

- Outstanding balances are liable to be charged a variable interest rate between 14.99% and 22.99%. It is quite standard for most crypto credit cards.

Rewards of the BlockFi card

The following are the rewards you can earn using a BlockFi credit card.

- Cardholders earn 1.5% back in Bitcoin, deposited in their BlockFi Interest Account, on every purchase each month.

- BlockFi offers an introductory reward rate of 3.5% (a 2% increase from 1.5% to 3.5%) back when a user spends a $3000 amount within the first three months of credit card membership.

- Users who have stable coins like USDC, etc., in their BlockFi Interest Account, can earn a 2% APY on top of the current stablecoin APY after annual card renewal. It can be up to $200 total.

- Cardholders earn 0.25% of their trading volume back in Bitcoin. It can be up to $500 maximum per month. Stable coins are not included in this.

- User can earn a 2% reward rate for every dollar he spends over $50,000 every year.

- If you refer a friend, you can earn an additional $30 in Bitcoin rewards.

Pros and cons

Pros

The following are the pros of the BlockFi credit card.

- It provides an option to earn Bitcoin without buying it. Smooth, 1.5% on every purchase a user makes.

- It provides exposure to cryptocurrency interest accounts i-e BlockFi Interest Account.

- BlockFi provides excellent rewards in starting months which beats many credit cards.

- Users can trade their earned rewards on the platform with 12 other supported cryptocurrencies, allowing users to diversify their holding.

- No annual fee or foreign transaction fees.

Cons

The following are the cons of the BlockFi credit card.

- There is no option for crypto rewards other than Bitcoin.

- This card is only available for U.S. residents for now. But soon it will be launched in other countries as well, in 2022.

If you would like to register for the BlockFi card, you can follow this link: BlockFi registration.

Frequently Asked Questions

What is the required credit score to get BlockFi credit card?

You need to have a good to excellent credit score to be approved for the BlockFi rewards card. You can check your score to find out if you are eligible for the card or not before applying for it.

Is it necessary to have a BlockFi account to get BlockFi credit card?

You must have a working BlockFi Interest Account because you will receive your rewards in this account at the end of each month.

What if my BlockFi credit card is lost or stolen?

You can report it lost or stolen and order a replacement card through a web application or by calling Customer Service. The support team will replace your card after confirming your address.

Is the BlockFi credit card worth it?

If you are looking for a crypto credit card with no annual fee and foreign transactions fee, also the one that offers excellent returns in Bitcoin, then the BlockFi credit card may prove to be the best choice for you. It is available in the U.S. for now, so you cannot use it if you live in any other country.

Overall, it is a good choice. After going through the review, you must have found out this card is for you or not.

If you want to learn about other crypto cards such as Coinbase, Crypto.com, etc., do check out our other articles as well.

We hope this BlockFi crypto credit card review was helpful, and if you would like to open an account at BlockFi to request your crypto credit card, you can follow this link.