Cryptocurrency credit and debit cards were introduced by the crypto industry a few years back. These cards enabled cardholders to use their crypto for making purchases. Now, users can even buy groceries, a cup of coffee, coke, etc., using cryptos. There are various crypto cards available in the market offered by cryptocurrency exchanges, providing excellent features one over the other. In this article, we will review the Coinbase card and discuss everything you need to know before purchasing a Coinbase debit card.

What is a Coinbase card?

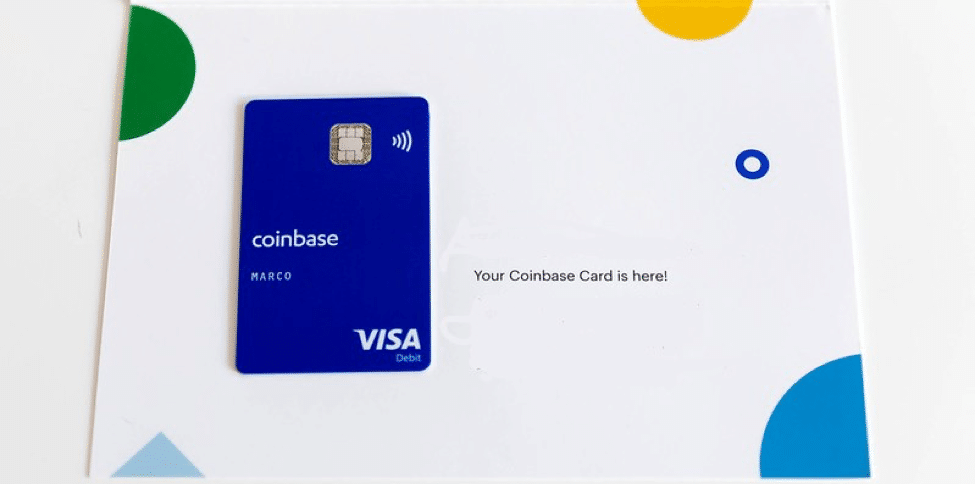

The Coinbase card is a VISA debit card, almost similar to a regular Visa card. With a standard VISA card, you cannot use your cryptos to make purchases, but a Coinbase debit card allows cardholders to use their cryptos to purchase everyday items such as groceries, etc. It is acceptable at any store that accepts VISA. Users can convert the cryptos to fiat currency on-demand in a few seconds.

The Coinbase card is issued by MetaBank, N.A., Member FDIC, under license of Visa U.S.A. Inc and powered by Marqeta. However, in Europe, the Coinbase card is issued by Paysafe Financial Services Limited.

What is Coinbase?

Coinbase Global Inc. (Coinbase) is the company behind Coinbase Cards. It is an American company working as one of the leading cryptocurrency exchange platforms in the world. It was founded in 2012 by Brian Armstrong (a former Airbnb engineer) and Fred Ehrsam (a former Goldman Sachs trader). As of September 2021, more than 56 million users are trading over $300 billion worth of cryptocurrency on the Coinbase exchange each quarter. According to CoinMarketCap, it is the exchange with the third-highest trade volume of all crypto exchanges. It has over 115,000 ecosystem partners globally in 100 different countries.

So, when you are using a Coinbase card, you can rest assured that you are working with a globally reputable platform.

How does the Coinbase card work?

Through this Coinbase card review, we want to show you all the main aspects of how the card works: rewards, fees, supported cryptos, availability per country.

Visa backs Coinbase card, you can use it at any Visa-compatible payment terminal, store, ATM, or online checkout solution.

The Coinbase card links to your Coinbase Account. It withdraws funds from your account, not from a traditional bank account. While keeping things in the Coinbase ecosystem, you need not liquidate your assets to spend for making purchases at stores. Instead, Coinbase does this for you so quickly that you do not have to wait, and it happens automatically, therefore providing ease and freedom to its users.

What are the fees on the Coinbase card?

The Coinbase card provides some services for free such as U.S cardholders do not have to pay card issuance fee and no annual fee either. However, it charges a fee on other services. The following are fees charged by the Coinbase card worth pointing out.

- 1% fee on withdrawals that exceed the daily limit which is $25,000 in transactions and $1,000 in ATM withdrawals.

- 2% fee on using card in country other than United States.

- 2.49% crypto liquidation fee on every purchase for the supported cryptocurrencies except USDC. USDC has no liquidation fee.

The fee schedule of Coinbase card for U.S. cardholders is much competitive, though, still not the cheapest.

What are the rewards on the Coinbase card?

The Coinbase card allows earning rewards. When you open an account on Coinbase, you are asked to choose a preferred reward option. The choice goes between the following cryptos:

- 4% back in XLM

- 1% back in BTC

- 4% back in The Graph (GRT)

- 1% back in Ethereum (ETH)

- 1% back in Dogecoin (DOGE)

- 1% back in DAI (DAI)

Once you have set up the preferred reward option, you can earn rewards on every purchase you make with the card, and the preference reward is applied to every purchase. You receive rewards to your account as soon as the transactions are processed, but sometimes it can take 1 to 5 days.

Cardholders can switch between rewards options as Coinbase regularly refreshes rewards.

What are the supported cryptocurrencies?

Coinbase cards can convert various cryptos into spendable funds. There are more than 35 different cryptos supported by Coinbase which you can trade and use through your Coinbase credit card. The list includes the following cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Augur (REP)

- Stellar (XLM)

What are the supported countries?

Coinbase card is available in more 30 different countries globally, which are Austria, Bulgaria, Belgium, Cyprus, Croatia, Denmark, Estonia, France, Finland, Greece, Hungry, Ireland, Iceland, Italy, Lithuania, Liechtenstein, Latvia, Luxembourg, Norway, Netherlands, Portugal, Poland, Romania, Slovenia, Slovakia, Sweden, Spain, and the U.K. In 2021, the U.S. is also added to the list.

How does Coinbase provide customer service?

Coinbase is known for its security and quality services in the crypto industry, and its debit card is no exception. You can contact the Coinbase customer service via email, phone, or through the Coinbase card mobile app. It allows you to disable or re-enable their Coinbase card account on an automated phone call while the rest of the services require contact through email.

Coinbase does not offer live chat support, but its email service is quite reliable.

What are the Pros and Cons of Coinbase cards?

Pros

The following are the pros of the Coinbase card.

- It is one of the most secure exchange platforms in the crypto industry.

- It allows automatic and quick crypto to fiat conversion.

- It offers up to 4% crypto reward to U.S. customers.

- It secures the card via PIN.

- It has a debit card mobile app available for both Android and IOS users.

Cons

The following are cons of Coinbase debit card:

- It is more expensive than other crypto cards.

- The conversion fee is high – 2.49%

- Very low rewards are offered on purchases.

- The user must have a verified Coinbase account for using a Coinbase debit card.

- It does not offer a live support service.

Conclusion

Overall, a Coinbase debit card is an excellent choice for those who want to use their cryptos for shopping seamlessly, just as fiat currency. After going through the entire Coinbase debit card review article, if you think this card is you, then you must give it a try. However, there are a few things that you must know, such as if you lose your card or it is stolen, you must contact the support team immediately. They will deactivate your card, and you can get your new card within 7 to 10 days. You must order a physical card to get virtual card details.

The Coinbase card leaves behind its competitors when it comes to services such as ease and security. It can be used in many countries across the globe. Though the fees are high, still, choosing a Coinbase debit card is the right decision.

If you want to learn about other crypto cards available in the market, then do not forget to check out our articles on other crypto cards such as our BlockFi Credit Card review and Crypto.com Card Review.