Crypto Cards are a growing and trendy way to make passive income from cryptos. It is getting more and more popular since 2021. In this article we will go through a comparison of the Best Crypto Cards.

What are Crypto Cards?

Crypto Cards mostly work in the same way than tradition debit or credit cards. You can use them to pay in shops and online as you would do with a standard credit or debit card.

These cards are linked to your cryptocurrency account, but the vendors you pay with these cards will receive fiat currencies (e.g. USD, EUR, CAD, etc…).

On your side, once you perform a transaction with your card, an amount of your crypto assets (equal to the transaction amount) will be converted into the fiat currency of the payment.

Crypto cards are supported by both Mastercard and Visa and are provided in partnership and via 3rd party suppliers (such as crypto.com, BlockFi, Coinbase, etc…).

The main differences between standard and crypto cards are:

- the cashback on those cards is usually paid into cryptos

- the currency used to make the payment can be either a Fiat currency (e.g. USD, EUR, CAD) or your digital crypto currency

Example of how it works

Imagine you want to buy an airplane ticket to go on holidays and that the price is of $1’000.

For this transaction you decide to use your crypto card where you hold $10’000 into Bitcoins.

Once you perform the payment with your card:

- $1’000 worth of Bitcoins are converted into USD and sent to the vendor

- you earn 2% (for example) of crypto cashback, which in this case is $20 worth of Bitcoins

- your new account balance is $9’020 worth of bitcoin ($9’000 balance + $20 of cashback)

If you want to learn more about the difference between credit and debit cards, you can read it here.

Why owning a Crypto Cards

The main reason to own a crypto card is the crypto cashback you can get from it.

On top of it, the companies that are providing crypto cards in the market offer additional benefits to make their cards competitive, such as:

- Multi-currency payments supported with low to no fees

- The possibility to choose in which crypto to earn your cashback

- Extra benefits such as airport lounges access, Netflix/Spotify subscription, booking.com discounts

The Best Crypto Cards

Below you can find the summary table of the Best crypto cards. In the last two right columns you can find:

- the blue button Review: that allows you to navigate to the review of the credit card and see more details

- the green button Go: that allows you to go directly on the card website to open your account

Otherwise you can also continue reading after the table to see a summarised description of each card.

1 – Crypto.com Debit Card

The Crypto.com Visa card is one of the most famous cards. The cashback ranges from 1% to 8%. This rate solely depends on how much money you will stake (block on your account) to have the card. For example, bu blocking none, you will have a return of 1%, by blocking $400 you will have a return of 2%, $4000 a return of 3%, etc…

Plus the card is really famous for its rewards such as:

- Spotify and Netflix subscription

- Airport lounges access

- Airbnb and Expedia discounts

The card is available mostly worldwide, so if you are not from the US, this card is probably a great fir for you.

If you want to know more about the card, you can read our review here: Crypto.com Crypto Card.

2 – BlockFi Rewards Visa Credit Card

BlockFi Visa Credit Card is for the moment the only crypto credit card on the market (the others are all debit cards). Thus it is really a great differentiator, as you don’t need to top-up your account to use it. The card on itself have also a really decent cashback of 1.5% paid in BTC on all your spendings.

As for the availability, the card is only for US residents as of beginning 2022, but BlockFi has already plans in 2022 to make it available for other world countries.

If you are interested to know more about the card cashback returns, fees, perks, you can read this article: BlockFi Crypto Credit Cards.

3 – Coinbase Card

Coinbase card is a great solution since it comes from the most trusted crypto trading platform on the market (also listed on the stock exchange). So if you are interested to stay on the safety since, this card is a good solution.

The Coinbase Visa card is similar to a regular Visa card, except it supports nine different cryptocurrencies which are Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Bitcoin Cash (BCH), Augur (REP), Basic Attention Token (BAT), Ox (ZRX), Stellar Lumens (XLM) and Litecoin (LTC).

The card gives a cashback of 4% but charges a fee of 2.5% of the transaction, so the final read cashback is of 1.5% like for BlockFi.

If you are interested, you can read more about Coinbase Credit Card on our review: Coinbase Card Review: 6 choices of cryptos for cashback

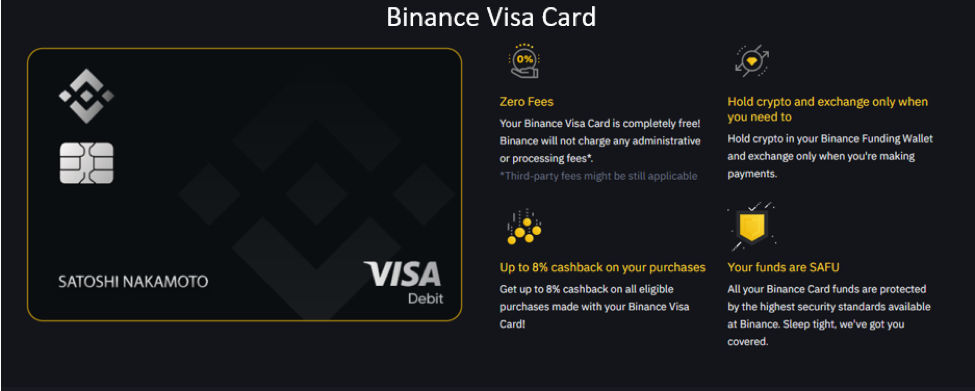

4 – Binance Visa Card

The Binance card is a great solution if you hold a good amount of BNBs, as the cashback is calculated based on the amount of BNBs you hold. It is for example of 2% if you hold 1 BNB, of 3% if you hold 10 BNBs, etc…

Upcoming crypto cards

We are waiting the next updates of two big players of the cryptocurrency field. Two crypto cards are planned to be released soon:

- the Celsius.Network crypto debit card which is a platform famous for its crypto wallet and its crypto lending automated feature

- the Gemini crypto credit cards which will be one of the only crypto credit card available (in competition with BlockFi)

| Name | Cashback | Type | Available |

|---|---|---|---|

| Celsius.Network | no info | Debit | no info |

| Gemini | 3% max | Credit | USA |

| Nexo | 2% max | Debit | World |

Celsius.Network crypto debit card

Rewards

no infos

Fees

- No annual fees

- No late payment fees

- No foreign transaction fees

- No ATM fees

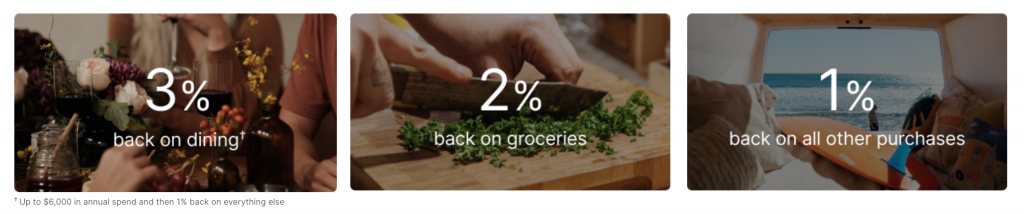

Gemini crypto credit card

Rewards

- Up to 3% cashback (3% on dining, 2% on groceries, 1% on the rest)Rewards available in bitcoin, ether, or 40+ other cryptocurrencies

- Change your crypto reward type at any time, as much as you like

- Receive rewards when the transaction occurs

- Exclusive offers with select merchants such as DoorDash, HelloFresh, Lyft, and ShopRunner

Fees

- No annual fee

- No foreign transaction fees

- No exchange fees to acquire your rewards

Nexo Crypto Debit Card

The fast-growing platform Nexo, with more than 3M+ users, made available a crypto debit card.

The card allows to earn a cashback up to 2%. The cashback is paid either in Bitcoins (BCT) or Nexo Tokens, and you will see it in your account juste after your transaction.

The usage of the card at an ATM is also optimized in terms of fees. You can get up to $10,000 in ATM withdrawals per month with no fees.

The card is also practical to use as it can be managed directly in Nexo’s mobile app and you can create, if needed, virtual cards for protection.