Over the years, Blockchain has not only proven indispensable but also very dynamic. Today it has applications in every market and industry imaginable. Who would have thought that one day Crypto would become a household name? And when we think about crypto, lending is one of those features that are common between the Crypto sphere and the traditional finance system. The following article about KuCoin Lending is going to explore everything about Crypto lending on the highly recommended platform KuCoin.

- Learn more about Crypto Lending

- Choose the Best Crypto lending platforms

Understanding Crypto lending

Every investor under the sun has one goal which is to increase his holdings. Some prefer buying low and waiting to sell high (HOLDING). However, most Crypto enthusiasts lack the patience to wait in a highly unpredictable market.

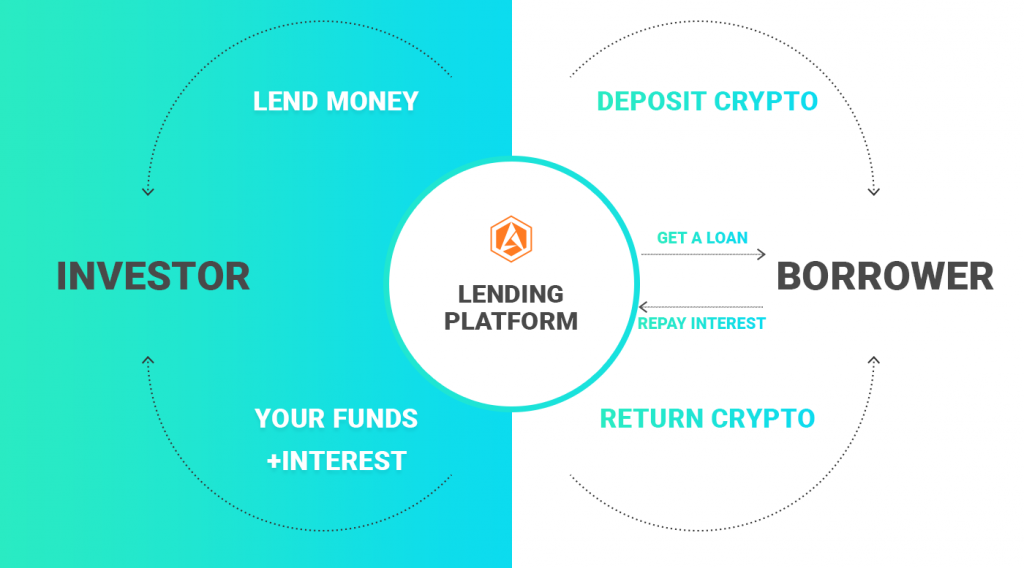

Crypto lending is an investment strategy that enables the lending of Cryptocurrency between individuals in exchange of interest rates on the lended amount. It is similar to traditional Peer-to-Peer lending.

Most popular Crypto exchanges allow crypto lending; however, the process varies among each one of them. Here are the 2 use-cases:

- as an investor you will deposit crypto on your crypto wallet and once you activated the crypto lending functionality, you will automatically earn interests on your crypto based on the amount you have in your wallet. So let’s say you have 0.1 BTC on your account and that the lending function of the account generated 6.2% of yearly return (which is a standard case), then over 1 years you’ll earn 6.2% of 0.1 BTC, paid usually on a weekly base

- the borrower on the other side, will use this platform to borrow money. The typical use-case is a person that has a bit on crypto on the side and that urgently needs some standard Fiat money (e.g. USD, ERU, GBP, …). He will go on the platform, block some money as a collateral and will receive Fiat currency. Usually the borrowed amount can be only 25% to 50% of the value of the crypto amount blocked.

Here is an image that illustrates how it works:

Crypto lending is therefore a dream come true for most investors, they can unlock the true value of their investments because Crypto lending comes with significant interests on investments generating often 6 to 10% yearly return.

Start to invest

KuCoin Crypto Lending

As already mentioned, many Crypto platforms facilitate lending. The list is only bound to expand as Crypto adoption increases. KuCoin has, however, created a name for itself as the Crypto lending platforms space and you’re about to find out why.

About KuCoin

KuCoin is a universal Cryptocurrency exchange platform that was launched back in 2017. It has since grown into one of the most popular crypto exchanges in the world. Today, it boasts over 8 million registered global users and numerous digital assets.

KuCoin has a native coin known as KCS and that can be used on the platform with many perks.

KuCoin lending

Among the impressive features provided by KuCoin is a Customer-to-Customer lending function. Users that need to borrow funds are matched with the most appropriate lenders. Once the transaction is matched, the borrower received the money which means that the lender earns the set interest. KuCoin lending comes second to none.

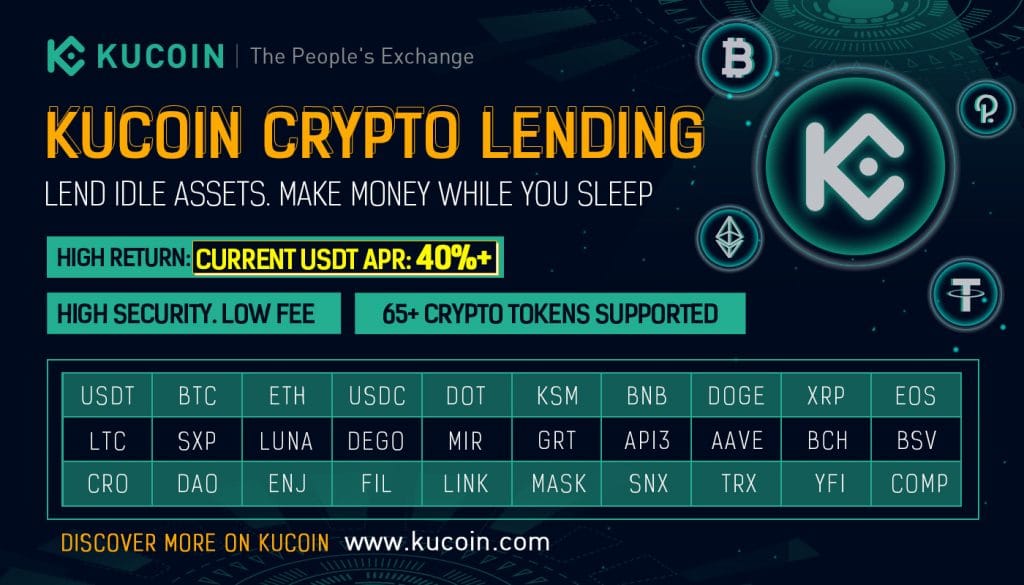

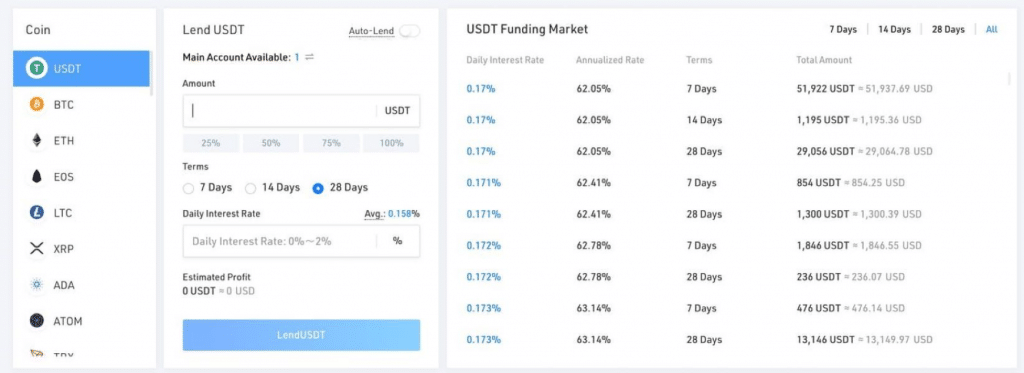

On KuCoin, 65+ cryptos are supported for lending, as you can see in the image below. And rates of return can go pretty high, with a APR of 40%+ at the moment for USDT.

How it operates?

The best type of Crypto lending platform is the kind that operates differently from the typical loans. The borrower should be required to deposit the interest (in Crypto) beforehand. This interest serves as collateral in case of loan defaulting to ensure the investors’ money is not lost. Once the collateral has been sent to the exchange, the seller then sends the ‘loan’ to the borrower. In case the transaction goes south, the collateral can be used as a form of compensation.

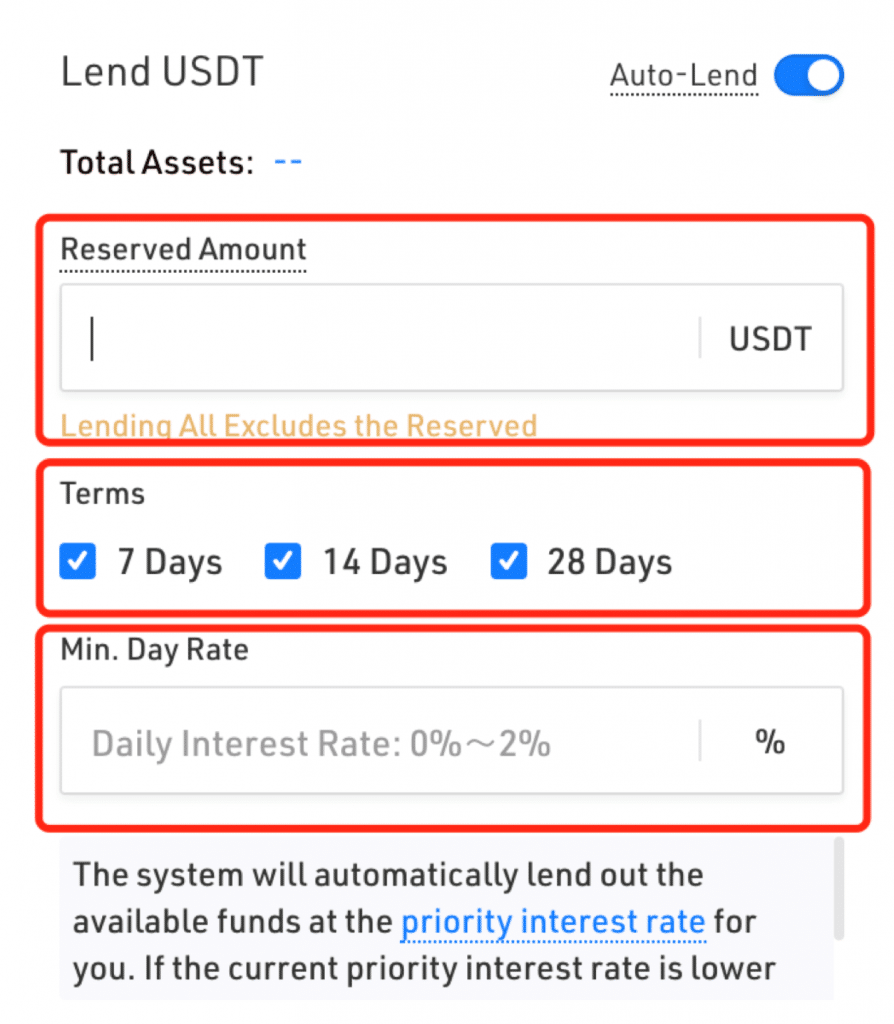

There are a few outstanding features that will optimize your lending experience; they are as follows:

- The terms – the period you intend to lend your money There are three options, either 7 days, 14 days, or 28 days; sometimes the borrower will pay ahead of time which the system will accept. Other times the borrower will delay and not pay until the debt expires, in which case the system will collect the principal as well as interests.

- Rates – Percentage of returns

- Reserved amounts – Amount of money that you wish to withhold on your exchange wallet. This money cannot be lent out unless you change the settings.

- Regularly updated information on your orders – KuCoin ensures that you can track all your transactions by periodically updating the open orders, unsettled orders, settled orders, and the order history.

- Auto–lending – a feature that allows you to make profits without having to physically place and update the orders.

How to Invest in KuCoin lending

Here is the procedure on how to lend on KuCoin step by step.

1. Add assets in your Main Account to start lending them

2. Enter the lending marketplace to open an order

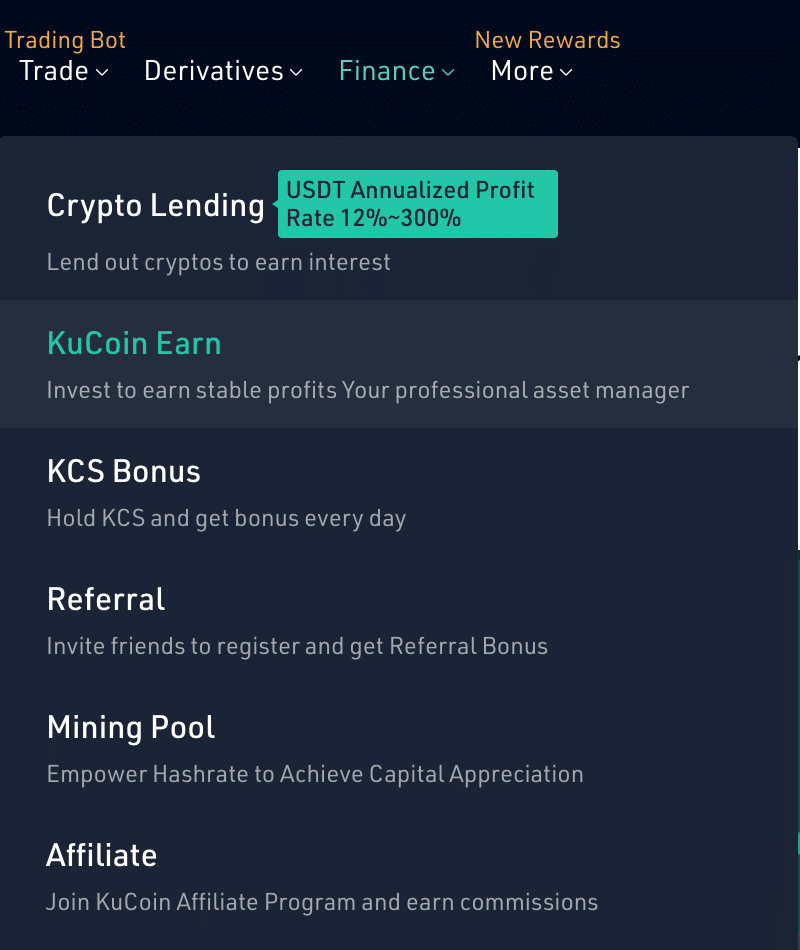

Go on the top menu of your dashboard, click on Finance > Crypto Lending. You will then be redirected to the lending marketplace.

Once the marketplace open, you will see the coind you can lend on the left sidebar. And by clicking a coin you will see the daily returns you can earn. Returns are written in daily interests so you need to multiply them by 365 to calculate the yearly return. But overall rates range from 3% to 70%, depending on the coin you are lending.

To lend you only need to fill in the Loan Amount, the Daily Interest Rate (ranging from 0 to 0.2%) and the Lend Terms (7 days, 14 days, and 28 days).

3. Your order will then be listed on the market. All the open orders are listed on the right side of the screen (as you see in the figure below).

Once your order is matched, it is moved to the Unsettled page and becomes a loan.

So as you could see, the lending process is pretty simple, but here are some advices.

- The first thing you need to consider when lending on KuCoin is how competitive the rates are. You will have to estimate the rate you believe will work.

- Always go for the most prudent investment option. USDT has proven to have the biggest rates (currently at 12% APY).

- It is recommended that you use auto-lending to free yourself of some of the load.

Start to invest

KuCoin lending Rates

As already mentioned, the rate (interest rates) can simply be understood as a percentage calculation of the returns from the amount of investment. KuCoin offers up to 300% APR (yearly interests), but usually interest range from 6-12% with some specific cryptos peaking at 50%-70%.

As we explained below, simply click on the different cryptos and look at the daily interest rates, multiply them by 365, and you will have the annualised return.

KuCoin Lending advantages and risks

Advantages

- Income-generating opportunity – KuCoin avails money to both borrowers and lenders; the lender earns through interests while the borrower earns prudent use of the borrowed money. The returns are generally higher than those of traditional savings.

- Assured transparency – Blockchain was created specifically for this; the system is immutable thus fraud and risk-proof.

- Speedy transactions – The entire transaction is virtual and automated; it only takes a couple of minutes thus making it considerably faster than traditional lending.

- Safety – Safety is right at the heart of the KuCoin Lend platform; it is also a top concern for every single investor whether they are holding their funds or lending them. The platform has a comprehensive risk control system that secures the user’s assets. This top-notch security feature is a great relief for users that like to store piles of coins.

- Lenders are assured of full repayment – Say you have lent money to a certain borrower and they don’t have enough balance to repay at the end of the agreed term. Borrowers are mostly usually hindered by extreme market conditions such as volatility. In case that happens, the insurance fund of KuCoin margin will cover the gap to ensure that the lender always gets the full repayment.

Risks

- The crypto market is not fully regulated – The Crypto sphere is mostly unregulated which may make the debt collection difficult if the borrower decides to default on the loan. KuCoin Lend has put measures in place to ensure that lenders get value for their money (collateral). Still, in the event a loan defaulting occurs, the process to recover your assets or interests can be quite complicated.

- Borderless transactions – Normally, this is huge merit because Crypto introduces you to an entirely new market. However, when it comes to Crypto lending, this leaves room for potential abuse. It can be exhausting to follow up on a debt abroad. KuCoin has put functionalities in place to avoid this but it is still a risk worth noting.

- Extreme price volatility – Crypto and price volatility go hand in hand, the prices could swing against your favor and greatly undermine the value of your investment.

- Hacks and thefts – Holding your Crypto on an exchange platform come with the risk of theft. KuCoin is very secure but it’s still on many hackers’ target lists. KuCoin has a long and successful history of keeping its customers safe and satisfied.

The Best practices for Lending KuCoin

It is not enough to just set up an account on KuCoin and then put in some money. You need to be prudent and plan every move before you execute it. One of the biggest mistakes that most Crypto investors make is thinking that the investment will take care of itself.

Investments need proper planning; you must have a good reason for each move you make. If you have ever invested without a “why”, then it wasn’t the right call.

Here are a few pointers to improve your KuCoin lending experience.

Determine the amount of risk you are willing to take beforehand.

If you prefer low-risk investments coupled with stable returns; KuCoin lending is perfect for you. It is the perfect way to make an extra profit while still keeping your coins. Only invest money that you are willing to part with based on your risk evaluation and reserve the remaining amount.

It is recommended that you deal in USDT

USDT has the best rated on the platform, its rates are up to 40% more than other coins. KuCoin margin traders often prefer long-term investments over short-term investments thus resulting in USDT always having the highest APR for lending.

Leverage traditional lend to maximize your APR

You will be required to choose between interest rate and fund utilisation rate. Interest rate, also known as APR is self-explanatory and also more popular. Fund utilisation Rate on the other hand is the speed at which you can lend out your funds.

Utilize the auto-lend feature for maximum returns

Any type of Crypto investment requires undivided attention at all times. This is not sustainable for anyone; it is better to utilize the auto-lend feature. All you are required to do is specify your lending parameters and leave the rest to the exchange. Such parameters include reserve amount, terms, and minimal daily rate. Provided there is money in your account, the system will place orders for you thus earning passive income.

Conclusion

KuCoin lending is the perfect opportunity to make passive income. It is a very simple process and the risk involved is notably low which makes it perfect for amateur traders who are not ready for advanced trading. Borrowers get the necessary money to amplify their profits while lenders earn a stable passive income. If you have digital assets that you don’t currently need, then it couldn’t possibly get better than lending might be a great win for you. Always exercise extreme caution; do thorough research before committing your money to anything. You can be sure that KuCoin will indeed cater to all your needs.

Start to invest