Users [05.2021] | Assets | Founded | Country |

|---|---|---|---|

+1.2M | ? | 2013 |  Estonia |

About SpectroCoin

Introduction

SpectroCoin is an estonian-based crypto platform providing a wide range of crypto-related services going from the usual crypto wallet, to a crypto exchange and a crypto card. With its services, the platform covers most of peolpe’s need. In this SpectroCoin review we will go through the platform with a focus on the crypto loans service it offers called “SpectroCoin Loans”.

The complete offering of this platforms is as follows (illustrated in the figure below):

- Buy, sell and exchange cryptocurrencies

- Personal VISA debit card

- Dedicated IBAN account

- Take a crypto-backed loan.

- Accept crypto payments in your business

In terms of number, the crypto platform SpectroCoin is operating since 2013 and has a total of 1.2M+ registered users (as of December 2021) with an increase of 200k during the year.

SpectroCoin is available worldwide with more than 200 countries and territories worldwide.

Great! So we summarised the basics, let’s now jump in this SpectroCoin review.

How it works

SpectroCoin allows to get a crypto-backed loan by pledging your crypto assets as collateral.

Registered users can borrow fiat money against their crypto holdings such as Bitcoin, Ether, XEM, Dash.

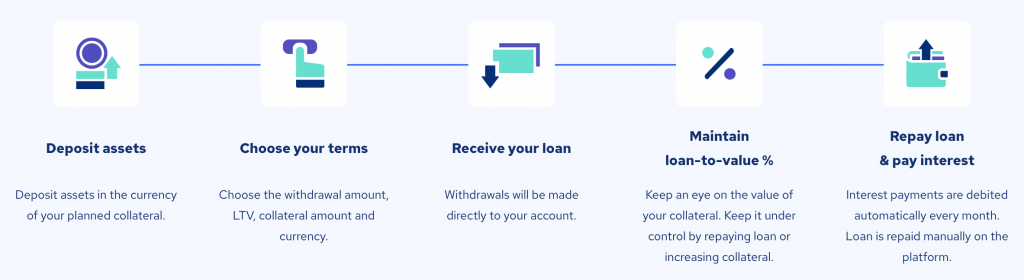

The loan process works as follows:

- Submit a loan request by selecting the amount, the crypto collateral, and the loan-to-value ratio

- Once applied, your crypto collateral is locked

- You receive an instant payout to your bank account or blockchain wallet for example in euro or USDT

- The interests are debited automatically from your account monthly or added to your loan amount if you do not have enough assets in your wallets. You may get a discount of -25% for your interest payments if you own a BNK token and pay interest using it

- After maternity date, you either repay your loan manually or it gets extended for another year “

On the

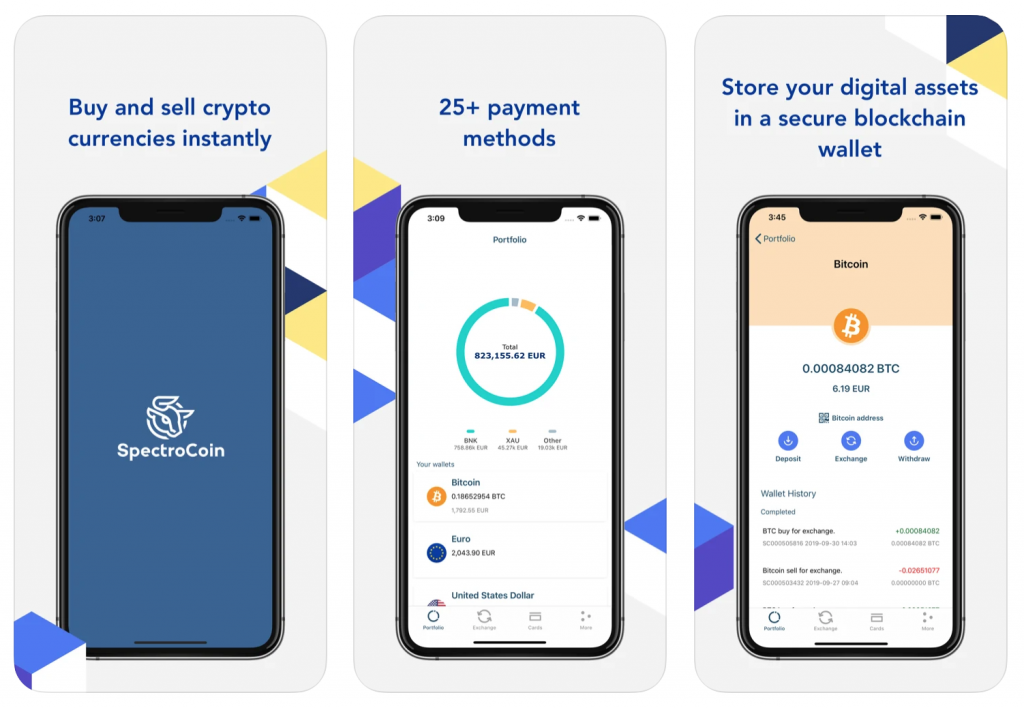

Download the mobile app and open an account:

SpectroCoin offers a mobile app for iOS and Android

If you want to start using SpectroCoin you can directly open an account on the

SpectrCoin interest rates

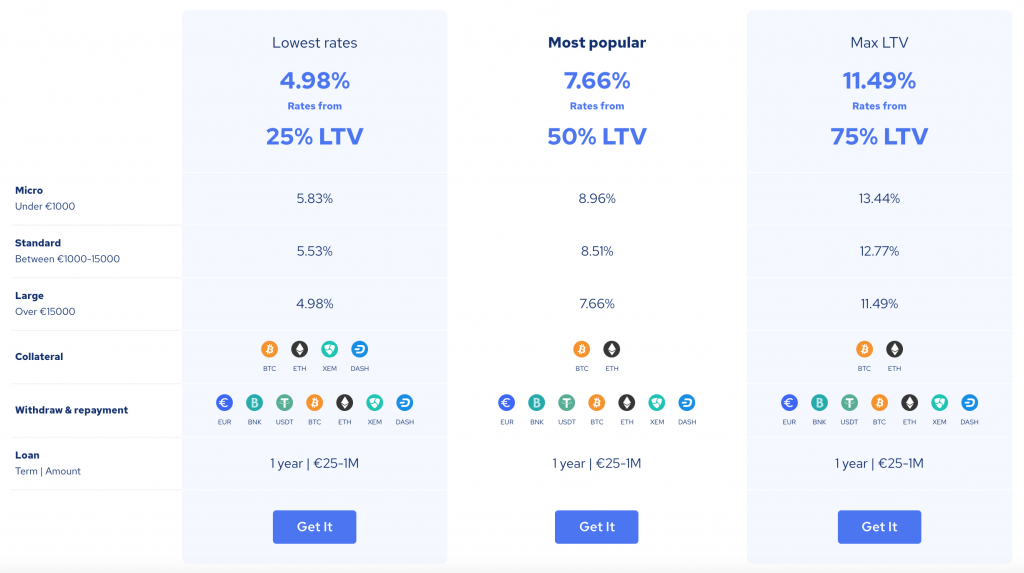

SpectroCoin offers the following rates for their crypto loans (see more details in the image below)

- From 4.98% for a 25% LTV (meaning your loan size is max 25% of your crypto assets)

- From 7.66% for a 50% LTV

- From 11.49% for a 75% LTV

If the LTV term is not clear yet to you, here is an example:

- You own $1’000 in BTC

- If you take a loan of $250 the LTV rate is 250/1000 = 25%

The image below summarises loan rates per LTV value and the possible currency collateral and withdrawal amount.

Is SpectroCoin safe?

Another important information for this SpectroCoin review is the safety of the platform.

It is impossible to be 100% sure, but we look at the team, the company and the website in terms of safety.

The team

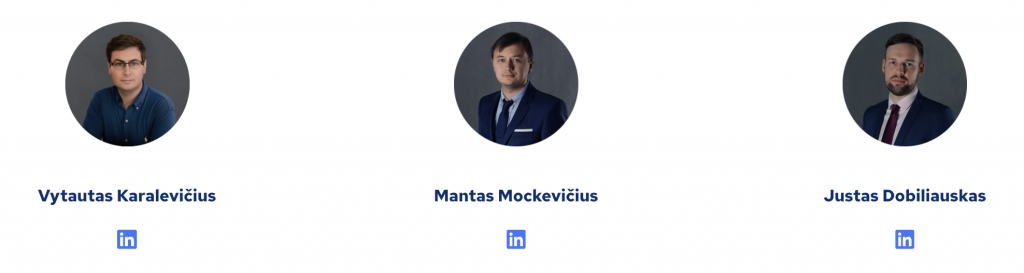

- The company has 40+ employees linked to their LinkedIn company profile, which seems to be legit real people

- Another good point is that the founders have a good track record. The 3 of them have launched SpectroCoin 9 years ago and since 4-5 years they have launched the promising startup Bankera which has collected $ 100M in fundings via an ICO (Initial Coin Offering).

The figure below shows the names and faces of the three founders.

Website

- The website offers a 2FA (two-factor authentication) to secure your account

Company

- The company has more than 8 years (as of 2021) of life

- The company own a crypto license in Estonia

- Whole ecosystems consist of three: SpectroCoin (wide variety of solutions for cryptocurrencies and its adoption for daily finance), Pervesk (EMI licenses, white-labeling for IBANs, and debit cards), and Bankera (FinTech solutions for cryptocurrencies and blockchain business).

Pros & Cons

Pros | Cons |

+ Low minimum loan of 25 EUR + Loan size up to 75% of assets + Large customer base of 1.2M+ + Founded in 2013 + Offers extra services (crypto cards, buy sell exchange) + 40+ listed crypto currencies | – No crypto lending available |

SpectroCoin loan details

Collateral currencies | BTC, ETH, XEM, DASH | |

Loan rates | From 4.98% from 25% LTV From 7.66% from 50% LTV From 11.49% from 75% LTV | |

Loan size | EUR 25 to 1M | |

Loan term | 1 year | |

Fees (only withdrawal) | BNK: 7500.00 BNK USDT: 12.00 USDT BTC: 0.0006 BTC ETH: 0.007 ETH DASH: 0.0001 DASH XEM: 0.100000 XEM EUR: 0.04% | |

Accepts US citizens | No | |

Trustpilot Score (Safety) | 4.5/5 | [12.2021] |

Investment types

Loan example

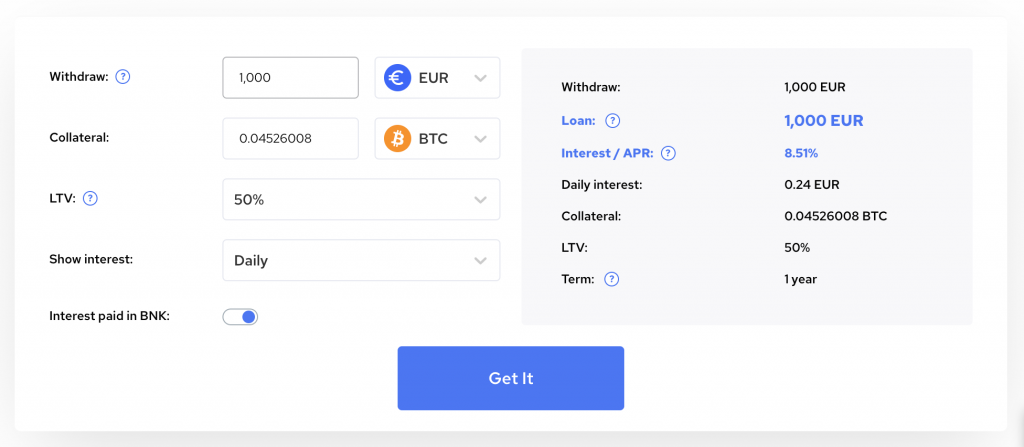

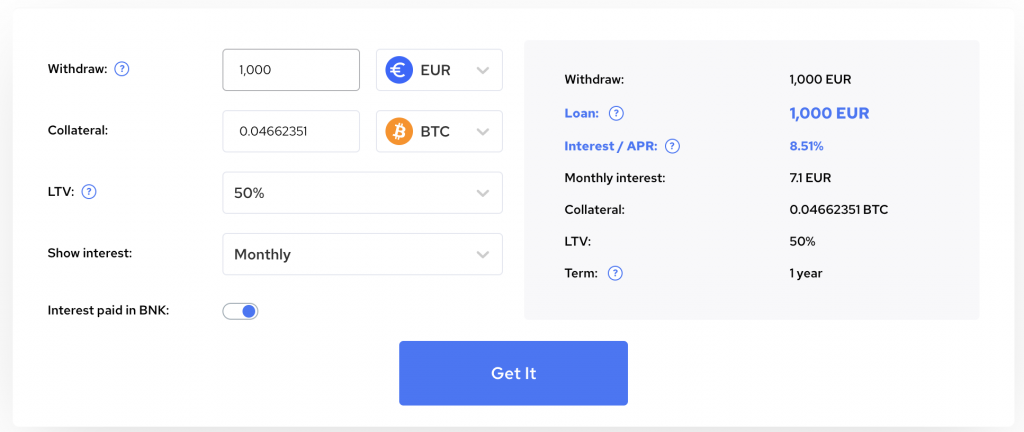

Let’s image you own 1 BTC and don’t have a lot of cash available on the side to be used.

Now let’s image that you need 1’000 for a special expense.

As shown on the figure below, you will be able to take a loan of 1’000 EUR/USDT by blocking 0.04662351 BTC as a collateral. In exchange, over one year you will have to pay 8.51% (paid monthly).

The figure below illustrates the loan numbers:

SpectroCoin bonus and cashback

We hope this SpectroCoin review was useful. Don’t hesitate also to check out the competitors below.

SpectroCoin competitors

View the list of all the platforms