A loan from a stranger that doesn’t require the user to deposit any of their funds? That sounds improbable. But it is possible, on one condition: individuals must repay the lender in the same issued transaction. Sounds strange, doesn’t it? What can you do with a loan that needs to be paid back seconds later? Turns out you can buy Smart Contracts in that same transaction. If you can make more money using your loans you can pay them back and pocket that profit in a flash. That’s what we call crypto loans, which are part of the overall crypto lending ecosystem.

Decentralized finance (DeFi) has exploded in the past three years, since 2019. It is currently one of the key use cases of blockchain technology. With this new trend, the DeFi ecosystem is creating new ways to grow crypto assets of investors. In today’s article, let’s dive into crypto loans (and, to an extent, crypto flash loans), which have been very popular over the past few months.

Understanding everyone’s rising interest in this new crypto investment method, in this article, we are going to tell you a whole lot about these loans by answer three important questions:

- What are crypto loans and crypto flash loans?

- How do crypto loans work?

- What are the best crypto loan platforms?

So, buckle up and get settled in. We have a lot to learn. Let’s get started!

What are crypto loans and crypto flash loans?

In layman’s terms, crypto loans (or crypto lending) are given as an alternative form of investment, where investors lend fiat or cryptocurrency to others who want to take out loans in those currencies, in exchange for interest payments. Naturally, there will be two main parties involved in this loan: the lender and the borrow.

On the other hand, crypto flash loans offer a mechanism that allows users to quickly and easily borrow an amount of cryptocurrency without any collateral. The condition that they need to meet to be eligible for such a loan is that they will repay the amount borrowed right at the end of the same transaction.

If the above condition isn’t met, the entire transaction will be reversed. Flash crypto loans will be used in cases where borrowers want to borrow money for arbitrage, trading, etc.

How do crypto loans work?

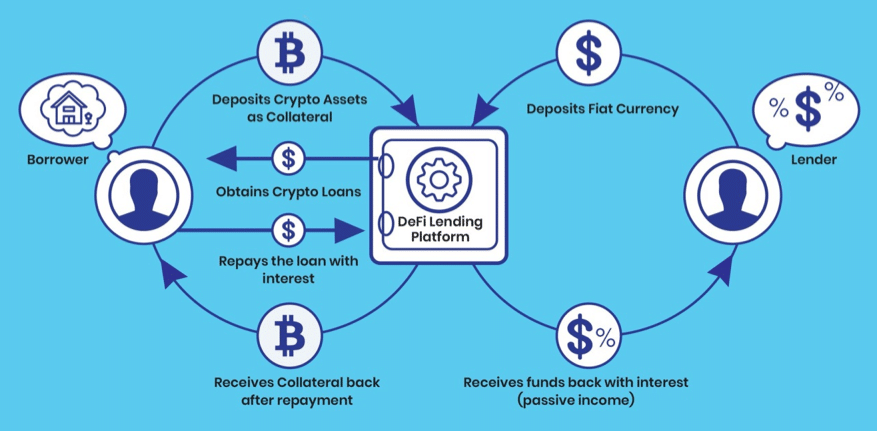

Basically, in a crypto loan, the lender will receive interest from the borrower in exchange for the loan. The borrow will, in turn, send in their crypto assets as collateral to secure an investment. In the same way, lenders can be sure that if something goes wrong, that collateral will be used to compensate them.

People who hold cryptocurrencies will want to use these coins to invest in their goals for the future. Even though it’s easier and less of a hassle just to keep their assets in their wallets, it is actually unproductive because the assets will essentially stay “cold.” It is also a harmful behavior as it will limit the market supply of the assets. Therefore, investors selling off their crypto assets is a better idea. However, instead of selling, they can actually use these coins as collateral to take out crypto loans, which they can then use for personal benefits.

Crypto loans also open an opportunity for both lenders and borrowers to perform arbitrage trading. Arbitrage trading is made possible by users between a Decentralized Exchange and Centralized Exchange performing trades. A trader can borrow USD at a rate lower than the Decentralized Exchange (DEX) then trade it on a Centralized Exchange (CEX) against a crypto coin. After that, they can list that coin for lending on a DEX to earn an arbitrage fee*.

However, it’s not just that. There are actually two types of crypto loans with slightly different mechanisms. They are collateralized crypto loans and non-collateral crypto loans (also known as crypto fast loans).

*Arbitrage fee: A fee for an arbitrage transaction, in which a trader earns profits from the differences in an asset’s listed prices on two different markets by purchasing it in one market and selling it in another.

Types of crypto loans

Collateralized crypto loans

As simple as it can get, collateralized crypto loans are loans that come with collateral. They are loans given to a borrower in exchange for their crypto assets as a guarantee that they will pay that loan back when the term of the loan expires.

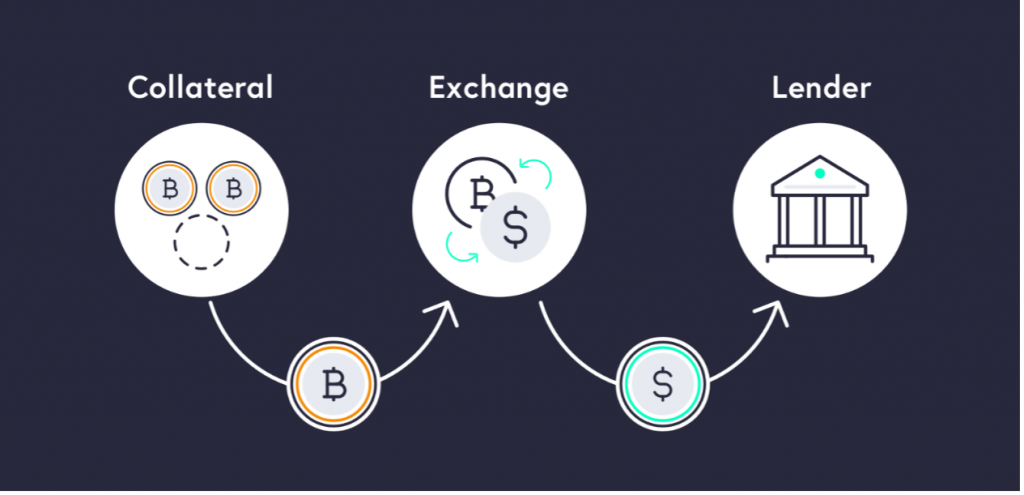

A borrower will exchange their crypto assets for fiat loans, such as Bitcoin (BTC), Ether (ETH), or Litecoin (LTC). These will be used as compensation in absence of repayment of the loan.

The lender and the borrower will agree on a specific interest rate on the loan. Similar to a traditional loan, a crypto loan amount is credited in the borrower’s bank account. The borrower can then pay Equated Monthly Installments (EMIs) to the lender. Once the amount is repaid completely, the lender releases the collateral that acted as security.

Non-collateralized crypto loans (crypto flash loans)

This type of loan is also known as crypto fast loan. They work similarly to normal crypto loans, but with a few differences:

- Smart Contracts: Flash crypto loans use smart contracts, tools enabled by a blockchain that do not allow money to change hands unless certain rules are met. In the case of flash crypto loans, the rule is that the borrower must repay the loan before the transaction is over. If they do not, the Smart Contract will reverse the transaction, as if it never happened in the first place.

- Non-collateralized Loans: Usually lenders ask borrowers for collateral to ensure that if the borrower is unable to repay the loan, the lender can still get their money back. But in non-collateralized loans, there is no need to mortgage the property. This lack of collateral doesn’t mean flash loan lenders won’t get their money back. The borrower will instead have to pay the money back immediately, which brings us to the next point.

- Instant: Usually, getting and completing a loan is a lengthy process. If a borrower is approved for a loan, they usually have to pay back that loan at regular intervals over a period of months or years. However, a flash loan is instantaneous. The Smart Contract makes sure that the loan will be repaid in the same transaction in which it was lent. This means that the borrower must call on other smart contracts to execute instant transactions with the loaned capital before the transaction ends, usually a few seconds.

A flash crypto loan can be useful in certain situations, such as for traders looking to quickly profit from arbitrage opportunities when two markets are pricing a single cryptocurrency differently.

Having learned about what a crypto flash loan is and how it works, the next step for you is finding out where you can get such a loan. Lending platforms allow lenders and borrowers to interact directly without the presence of any intermediary.

Don’t worry. We have also composed a list of the best loan platforms for the job for your reading convenience.

What are the best crypto loan platforms?

The following paragraphs give you some highlights of the best platforms. If you want more detailed you can read our full article: Best Crypto Lending platforms.

1. SpectroCoin

SpectroCoin is an estonian-based crypto platform providing a wide range of crypto-related services going from the usual crypto wallet, to a crypto exchange and a crypto card. With its services, the platform covers most of peolpe’s need. In this SpectroCoin review we will go through the platform with a focus on the crypto loans service it offers called “SpectroCoin Loans”.

In terms of number, the crypto platform SpectroCoin is operating since 2013 and has a total of 1.2M+ registered users (as of December 2021) with an increase of 200k during the year.

2. Celsius Network

Celsius is probably the most popular crypto lending app. Alex Mashinsky co-founded the platform. Users can earn interest in CEL Tokens, up to 6.2% annually on their first BTC or 100 ETH, and up to 12% on stable coins.

Celsius also offers an astonishing 17.8% on crypto. Those profits are generated through a method called re-hypothesis, with 80% of those profits being returned to the user’s advertising preferences and the remainder going to funding Celsius’s operations.

3. BlockFi

In 2017, BlockFi was founded and backed by some of the greatest names in the crypto world, including the Winklevoss twins.

At BlockFi, you can offer major cryptocurrencies and stable coins for loans and earn significant interest rates. For example, you can deposit any amount of LINK and get 5.5 APY. There is no minimum threshold on the amount you deposit

Users on the platform can earn up to 8.6% annual interest on BTC, ETH, LTC, USDC, GUSD, and PAX.

4. Hodlnaut

In March of 2019, Hodlnaut was founded by two entrepreneurs and self-proclaimed Bitcoin maximalists in Singapore. Hodlnaut is now a platform that provides a variety of financial services to individual investors. Users can earn great interest rates on cryptocurrencies through these platforms by lending to margin traders who would otherwise have difficulty accessing crypto loans.

The interest rates on BTC are 6% (effectively 6.2% annually), 6.5% on ETH (effectively 6.7% annually) and 8% (effectively 8.3% annually). years) for DAI, USDC and USDT.

5. Nexo

Nexo has more than 1.5 million customers, with coverage of up to 375 million US dollars for non-custodial assets.

In a nutshell, lenders can get an APR of 8% to 12% on any supported asset, including fiat currencies like Euros, British Pounds, and US dollars. This makes Nexo a great choice against the false interest rates many banks seem to offer.

Bottom Line

We hope that this article has helped you understand what crypto loans and flash crypto loans are, as well as how they work. However, as usual, always take care of your own wallets and do your homework before making investments to choose the best crypto lending platforms for your needs.