Previously viewed as a dangerous, unapproachable type of trading, intraday trading is becoming an increasingly popular way to make a living by first learning accessible information online. This comprehensive guide will provide the how and why of day trading.

What is Intraday Trading?

Intraday trading, otherwise known as day trading, is the action of buying and selling shares of a stock all within the same trading day. The goal is to make a profit while only trading within one day. Due to some of the complexities that come with day trading, in the past, it was left to larger institutions and extremely skilled professionals to make these types of trades. Now, however, many are learning and finding extreme success in day trading through the extensive information available online. Just about anyone can find success if they are educated, disciplined, and can keep their emotions in check.

Normal trading of stocks occurs over more than one day. This could mean selling and buying three days later, or two years later. In day trading, you buy and sell for a profit within the same day.

Pros and Cons of Intraday Trading

First, evaluating the benefits and downsides of intraday trading can help you decide if intraday trading is right for you.

Pros

- There is a very quick return time, your strategies will pay off right away.

- Sleep easy: you do not have to worry about news arising overnight that could influence a stock price the next trading day.

- It can be a straightforward way to make a profit if planning and execution are correct.

- It can be a profitable occupation: According to Zip Recruiter, the average salary for a day trader in the US is $80,081 per year.

Cons

- Day trading has a much higher risk when compared with traditional trading in which you hold a share for more than a day.

- Requires extensive, ongoing knowledge and education.

- Some laws require a minimum balance.

- Your timing needs to be correct.

- You need to have your emotions under tight control.

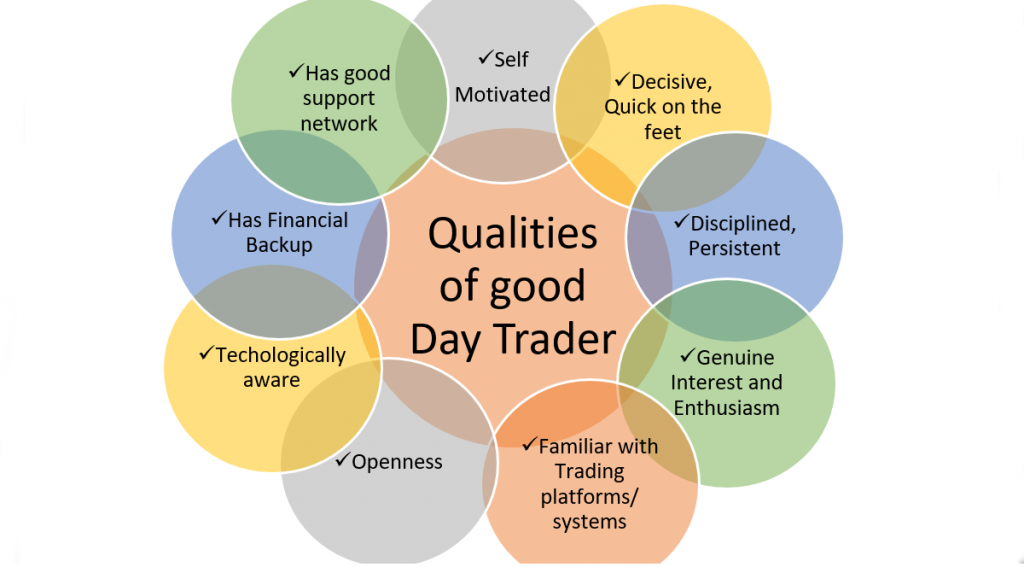

Necessities to Being an Intraday Trader

Continuous Education

To have a fruitful intraday trading career, you need to be able to have a mind that is constantly learning. The stock market can be volatile, and you need to stay on top of all the behind-the-scenes reasons for why a stock goes up or down. Day traders study many different news outlets, overall economic trends, and information about the company behind the stock they will be trading.

Adaptive, Realistic, Analytical Mindset

During a great trade, some could let greed get to their heads and hold on a bit too long, resulting in them losing any money they have made so far. Therefore, it is important to keep a realistic mindset and precisely stick to any plan you’ve made.

Enough Funds

If you are trading options and stocks using a margin account, you will need an account minimum of $25,000. This is called the pattern day trader rule (PDT Rule). You are a pattern day trader if you make four or more day trades in a five-business-day period.

In general, to make enough profit day trading, you will likely want to have a large balance. Usually, the larger amount of capital you put into a day trade, the higher your returns.

Be sure that you will want to have enough money to trade that you are comfortable losing all of it since this is a real possibility.

A Solid Plan and Ability to Cut Your Losses

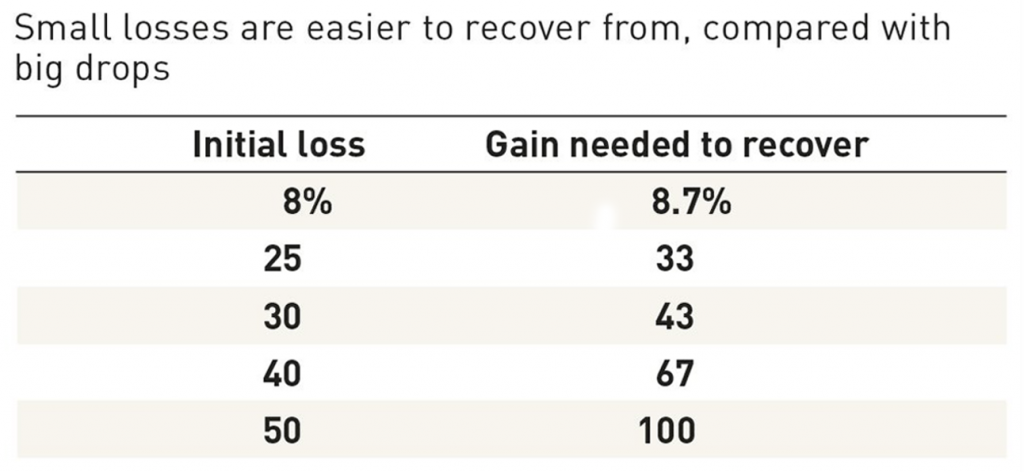

Research and a method behind the madness are crucial for coming out on top after a trade is done. Day traders will inevitably have trades in which they experience a loss. The important thing is to look at your trading history for the day and make sure that your wins make up for the losses.

As shown in the figure, it is better to stop trades at a small loss compared to letting them go and experiencing larger losses that are more difficult to recover from.

A Walk Through of The Steps of Day Trading Using a Real Scenario

First off, you will need to choose a stock. For this example, we will be using Tesla which goes by the market ticker TSLA. This could be a good choice for a day trader due to the large volume it experiences as shown in the figure. This high amount of volume (according to finbox, an average of 28 million a day) and attention can cause the price to vary greatly which is a great environment for day trading.

Next, you will look for a pattern. As shown in the figure below, the price had been staying between $300 and $360. The lowest and highest the price goes would be our resistance. We can predict that the price will stay between these bands for the near future. Based on this info, we can then know to buy when the price hits the bottom resistance band. If we buy 10 shares at $300 and sell at $360. This could net us $600 each time.

Using this simple strategy could be a great place to start when evaluating whether a stock would be a good candidate for day trading. Ideally, many different strategies and indicators would be used to provide a more confident prediction of the stock price movement.

Intraday Trading Strategies

There is no one-size-fits-all method to day trading. Successful day traders use a variety of strategies and may combine a few to produce results that they are comfortable with. That is why it is important to know about the many different strategies and find the ones that fit you best.

Scalping

This is a quick profit on a small price increase. Typically, you will need to buy many shares for this small increase to be profitable. Stock prices waver every single day due to the demand for that stock fluctuating. You will be profiting from these small increases and decreases. This will require very quick entrances and exits. This is usually repeated a few times a day and this strategy can be easily combined with news-based trading since price jumps are usually based on positive press.

Fading

The price jump shown in the figure would be an indicator that you could short the stock. Fading is the act of shorting a stock when you see it has shot up. The goal is to short at the peak so that when investors take their gains and the stock falls, you will benefit from the downfall. This type of strategy is based on the limited assumption that investors will sell at the peak, so it can be a risky strategy because it fails to consider other factors.

Range Trading

This type of strategy is just as the name describes. This is the act of choosing a range for the share price and only buying or selling when the price is within this range. For example, if a stock is at $25 and you believe that it will go to $35, you will only buy or sell when it is within this range. Your support is the lowest that the price goes and is where you would need to buy. The resistance is as high as the price will go and is where you’ll sell.

Pivot points

This method of trading utilizes indicators called pivot points to provide a basis for predictions. This is based on the previous day’s high, low, and closing price. If the price is trading above a previous day’s price, this can indicate bullish, or an up-trending stock. Or it can indicate the opposite, bearish.

News-based Trading

This is a very popular method in which you trade based on the good or bad press. For example, many investors base their trades on companies releasing their earnings reports. If the earnings report is good, the stock typically goes up, unless there are other circumstances.

Momentum

Momentum trading is self-explanatory and is related to news-based trading. You trade based on the momentum of a stock. For example, if there is a strong trend upward resulting from huge amounts of positive press or volume of trades. Buy, ride the wave, and sell when the momentum begins to die down.

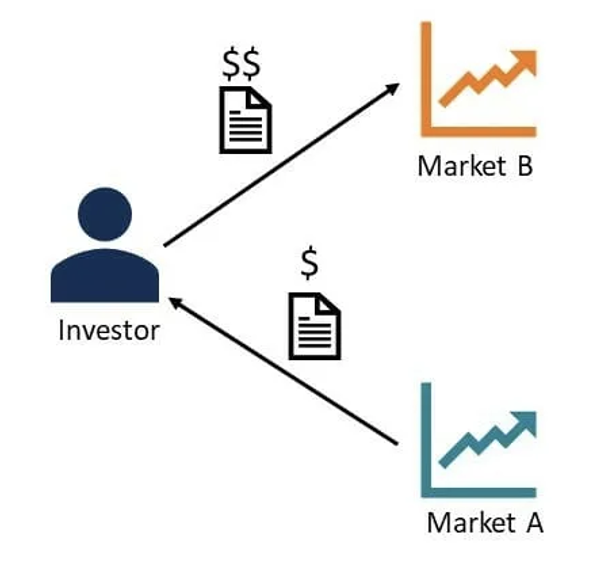

Arbitrage

Arbitrage trading can be tricky but is viewed as low risk. This type of trading profits from the inconsistencies between different markets. In one market, the price may be listed as lower than another. You will buy and sell at the same time to pocket the difference between these two prices.

How to Choose the Best Day Trading Stocks?

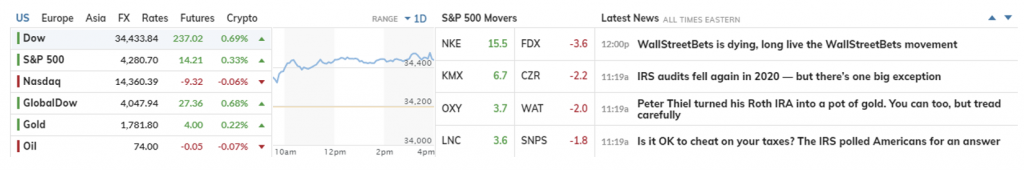

Many new-day traders simply choose to keep an eye on their favorite companies’ stocks. However, another option for locating a stock is keeping a close eye on the news. If you see that a company had a positive event occur, it is likely that their share price will be on an upward trend and the opposite can be true as well. Trading a company that has a lot of media buzz surrounding it can be a great way to cash in on the high volatility that this can cause. The figure below shows MarketWatch’s banner that provides the latest news pertaining to the stock market, and this can be a good place to start when searching for stock related news:

It is recommended that highly liquid stocks are chosen for day trading. High liquidity stocks are those that have high trading volumes. According to SmartAsset, trading volumes over 500,000 per day constitute as high. You will possibly also want to look for stocks that are volatile as large changes in the stock price can equal big payouts for you. According to The Balance, you’ll most likely want to choose a stock that moves more than 5% a day as this can mean it is volatile and bring you higher returns.

The way you choose stocks is also based on which trading strategy you are using.

For example, if you are looking to profit off the good press, you will want to find companies that are releasing an earnings report that is expected to be positive.

You may also choose a stock based on trading volume. This could be beneficial if you’re looking to use momentum as your strategy.

Generally, the more you know about the stock, the better. Proceed with a stock only after you have done enough research so that the reasons behind your choosing it are clear. Remove all emotions or biases you may have toward this stock and look at data.

Know the Risks or Intraday Trading

Intraday trading requires an analytical mind, time commitment, and risk management, to name a few. The best day traders will plan as much as possible before executing their trades, but sometimes pure luck can play a part in whether they make a profit. To be effective, you need to be comfortable with this uncertainty.

Best Day Trading Platforms

These are some of the most popular platforms in the US to help you get started.

TD Ameritrade

The most function-packed option, TD Ameritrade platform thinkorswim is great for those who want lots of tools. This can be a bit overwhelming for beginners, but intermediate or expert traders may like the customizability.

- Stock Trades: $0

- Options (Per Contract): $0.65

- Account Minimum: $0

- Desktop Application: Yes

Fidelity

Along with TD Ameritrade, Fidelity has been a leader in the trading platform industry. Fidelity has two different platforms that address what beginners and experts want in a platform. Beginners may not be comfortable with lots of tools, but experts need them.

- Stock Trades: $0

- Options (Per Contract): $0.65

- Account Minimum: $0

- Desktop Application: Yes

Webull

Although Webull has fewer features than other platforms, beginners may find this to be helpful and easier to learn.

- Stock Trades: $0

- Options (Per Contract): $0

- Account Minimum: $0

- Desktop Application: Yes

E*TRADE

E*TRADE is great for ease of use and can be beneficial for beginners. It has many educational resources that benefit both beginner and expert traders.

- Stock Trades: $0

- Options (Per Contract): $0.50-$0.65

- Account Minimum: $0

- Desktop Application: No, web-based.

Just Get Started

Day trading, or intraday trading, is a high-profit, high-risk strategy for producing gains from the stock market. To be successful, you need to know yourself and the market intricately. You also need to try different strategies for trading and see which one works for you.

A great way to start without the high risk of losing real money is through paper trading. This is a fancy way of describing a simulated trade. The market will match the real one exactly. Many different platforms have paper trading available. Whichever platform you choose will provide you with a balance, or you can set a balance, and you can practice making trades with no worries. Some may find this a useful way to learn, while others need the pressure of real money to force them to learn quickly.

Many people warn against this type of trading, but like anything, with the right amount of knowledge and leverage, you can be successful too. Even the best professionals in the day trading field were beginners once, and there is no better time to start than now.