If you are looking to grow your wealth, P2P lending vs. the stock market is a debate that should pique your interest. Both of these two vehicles present modern popular ways of investing, but that is where the similarity ends and the differences begin.

Many investors want to know if one is better than the other and if it is possible to invest in both of them.

First and foremost, just like with any different types of investments, it is possible to invest in both the stock market and P2P lending as this way you will be diversifying your assets.

Perhaps the bigger question is, which one of the two should you take a bigger risk on?

Let’s try to answer this question and several others that will help you make an informed decision.

P2P Lending vs. Stock: Differences and Similarities

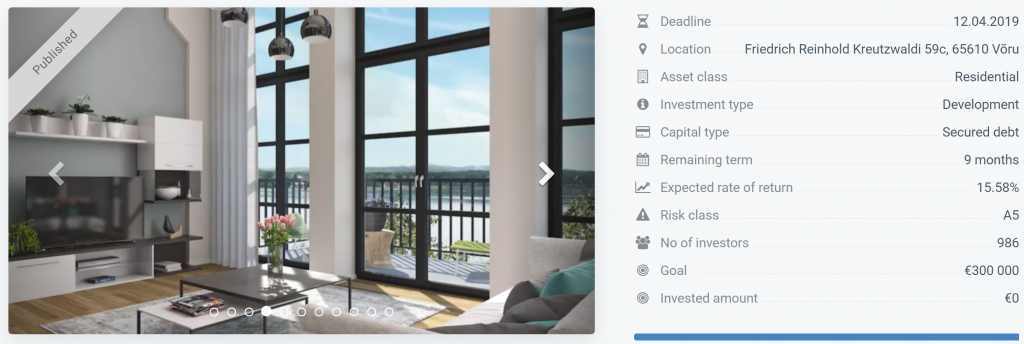

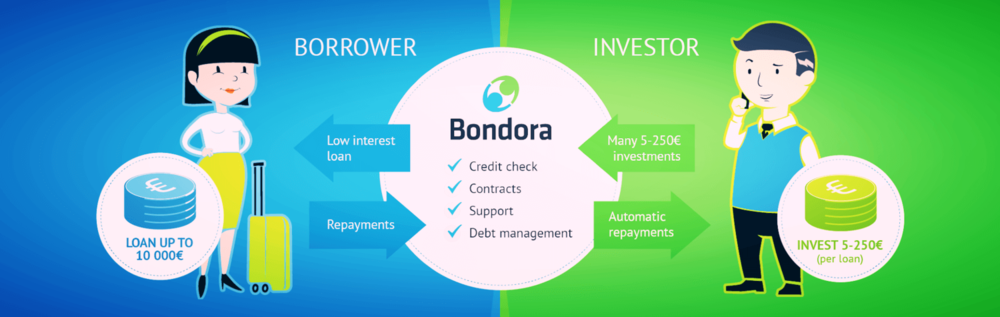

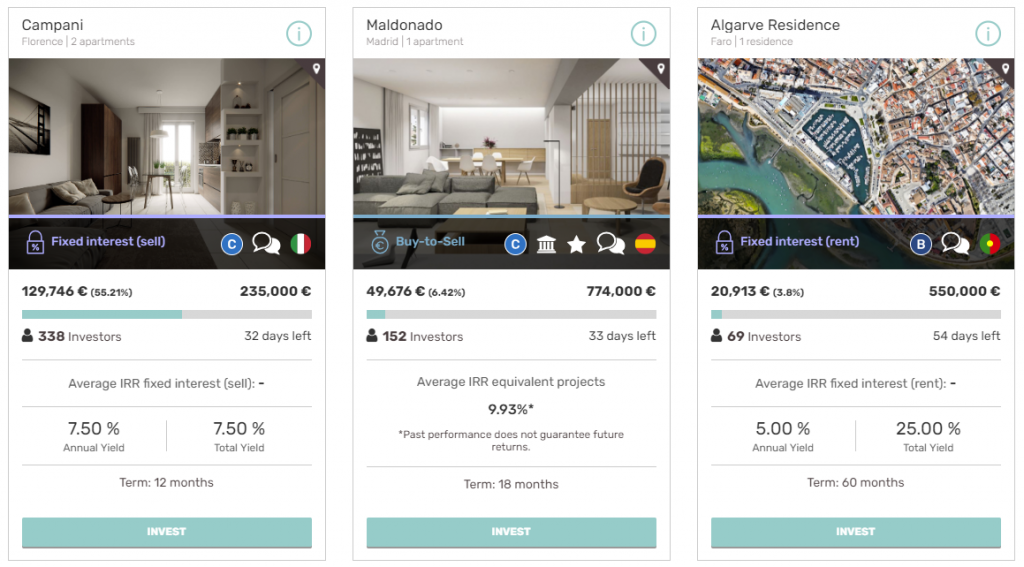

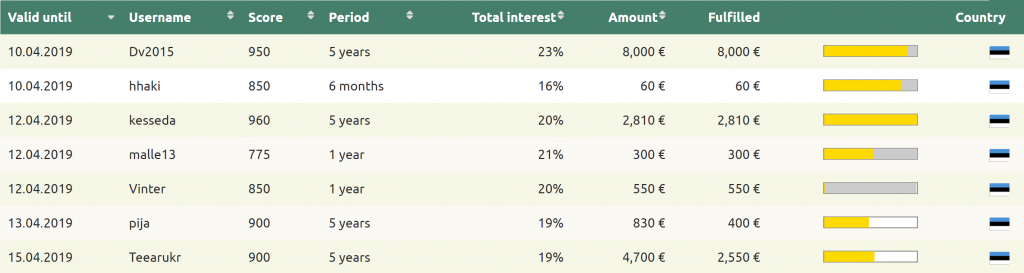

In p2p lending, you essentially offer your money to cash-strapped individuals or companies to borrow and earn profits from loan reimbursement with interest.

On the other hand, when you buy a stock you get fractional ownership of the company, which you can earn in two different methods.

- First, you earn on your investment through asset appreciation, meaning if the company is performing well, its valuation increases, allowing you to sell your shares at a higher price than you bought them.

- The second way is through dividends. This is when the company chooses to share a percentage of its profits with the shareholders.

While a similar arrangement can also be planned in p2p lending through equity-based crowdfunding, it represents an insignificant portion of the total crowdfunding market, which is a mere 0.5 percent.

Below is a summary of the main similarities and differences between P2P lending and the stock market.

P2P Lending |

Stock Market |

Investors can screen borrowers before investing |

Investors can also screen stocks before investing |

Investors tend to diversify their portfolios of loans to lower the exposure to individual loans |

Investors also tend to diversify their portfolios of stocks to reduce exposure to individual stock |

Investing in P2P means you own a collection of debts |

In stocks, you own a portion of the company |

You earn through loan repayments and related interests |

You earn through dividends payments or asset appreciation |

Investors can understand the expected return based on default rates and interest rates |

In stock, returns are unpredictable since you wouldn’t know the rate of return of a stock |

But there is more to it than just the above similarities and differences when it comes to P2P lending and stock market investing.

Advantages and Disadvantages

Let’s take a look at the advantages and disadvantages of the two.

Advantages of P2P lending (Why P2P is better than stocks)

Safety first

P2P lending investment bears a very minimum risk as well as less short-term volatility compared to the stock market, yet it offers better returns than bonds and saving accounts.

For instance, the recent economic slump brought about by the Covid-19 pandemic wiped off nearly 35 percent of the value of the stock markets in less than a month, and in what is considered the worst day in the stock market, it lost over 12 percent!

The stock market is highly volatile and extremely unpredictable, making it unsuitable for short-term investments as well as nerve-wracking for investors.

Resilience

Since P2P lending is de-correlated with popular asset classes such as stocks, it is more resilient to external factors.

This is not true with stocks since they (stocks) are highly sensitive to economic shocks and geopolitical unrest as well other turbulences of financial markets such as variation in oil price.

Because it is much more resilient, P2P can to some extent, guarantee more stability, thus saving you lots of emotional roller-coasters.

Easy for beginners

If you are a new investor, P2P lending might just be the perfect plan to start. For one, the minimum investment is very low, with some platforms requiring as little as $10/£10/€10 in every single loan.

Second, most platforms are intuitive to use and will take a few minutes to get started, which is usually opening and verifying your account, transfer funds to your account, and start investing in loans.

And since you will be actively selecting, your investments can allow you to learn about investing as well as shaping how you will react to downturns and successes in the future.

Disadvantages (Why stocks are better than P2P)

Long-term returns

The stock market is known for its long-termism and thus if you are in for a long haul, consider investing in a portfolio of shares.

The best example is the S&P 500, which tend to post positive return in long-term. From 1970 till today, the overall US stock market generated a return of 8.7% yearly. Over longer periods, stocks also tend to outperform massively in nearly all other types of asset classes.

High liquidity

You can withdraw funds from the stock market anytime and will take just a few hours. This is great for investors, unlike in P2P where you receive your money in form of installment and interest.

It takes longer for an investor to get back his money in P2P because of the amortization which has variable terms going for few days to 2-3 years. You can’t ask the borrower to pay upfront.

Though most P2P platforms have secondary markets, you will have the possibility to sell off your loan at a discount in order to attract buyers.

Proven

Stocks have a proven track record as a great investment because they have been around for centuries.

The stock market has endured all sorts of economic downturns and has emerged unscathed. P2P lending on the other hand has been around for less than two decades and has cracked at the first sign of economic turmoil with the Covid-19 disruptions.

Detailed Summary of P2P Lending vs. Stocks

Categories |

P2P Loans |

Stocks |

Returns |

8-12% |

8.7% (US) |

Capital Requirements |

Low |

Low |

Know-How |

Low-Moderate |

Moderate-High |

Cash Flow |

Monthly, end of the loan term in case of full bullet loans |

Quarterly, no cash flow for non-dividend stock options |

Security |

Depends on the type of P2P platform, can be collateral, none, or buyback. |

None |

Fees |

Often null (included in the % of return) |

Withdrawal fees, secondary market fees |

Liquidity |

Moderate-High |

High |

Taxation |

Income tax, capital gain tax |

Dividend tax, capital gains tax. |

Volatility |

Low |

Moderate-High |