Equity Crowdfunding lets private businesses raise capital from a pool of investors who are willing to invest as little as $ 100 with an added advantage of not having to pay back loans. It allows small-scale businesses to raise capital from investors by selling company securities such as equity and revenue share. In investment crowdfunding, everyone (anyone above 18 years) can invest in privately-owned businesses, regardless of their wealth status.

What is Equity Crowdfunding?

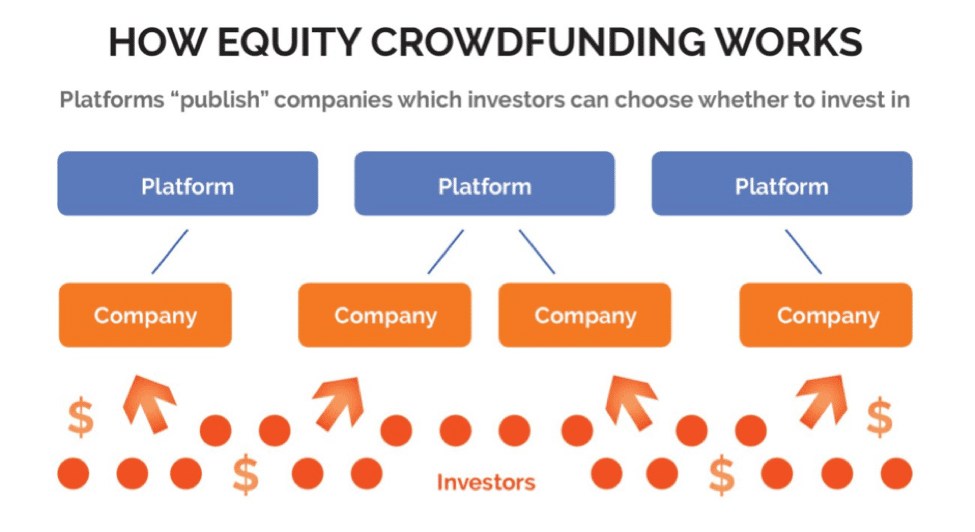

Equity Crowdfunding, also known as crowd equity is a process by which a number of investors (usually deemed as the crowd) invest in a startup company (unlisted on a stock market) in exchange for the company’s shares. Securities issued to investors in exchange for their finances include equity and debt. Upon funding, each investor becomes a partial owner of the business and owns a stake proportionate to his or her original investment. Essentially, it is a more hands-on way of sourcing for funds as investors are involved directly in the process of choosing the firms in which to invest in. By opening doors for all investors to take part in the process, equity Crowdfunding has largely simplified the investment process. Additionally, this investment is carried out on exclusive online equity investment spaces which create a liberal platform for raising capital. The image shown below indicates the typical process involved in Equity Crowdfunding.

Figure: This image shows how platforms allow investors to fund companies (source: CorporateFinanceInstitute)

How Equity Crowdfunding works

Equity crowdfunding works by connecting business people with prospective investors. Essentially, they are web-powered platforms that publish companies for investors to invest in. A business owner interested in sourcing money through this technique chooses from a range of online crowdequity platforms available at his or her disposal. These online platforms necessitate the portfolio exchange with investors, create opportunities or startups to collect investments, and offer services and support required in successful transactions.

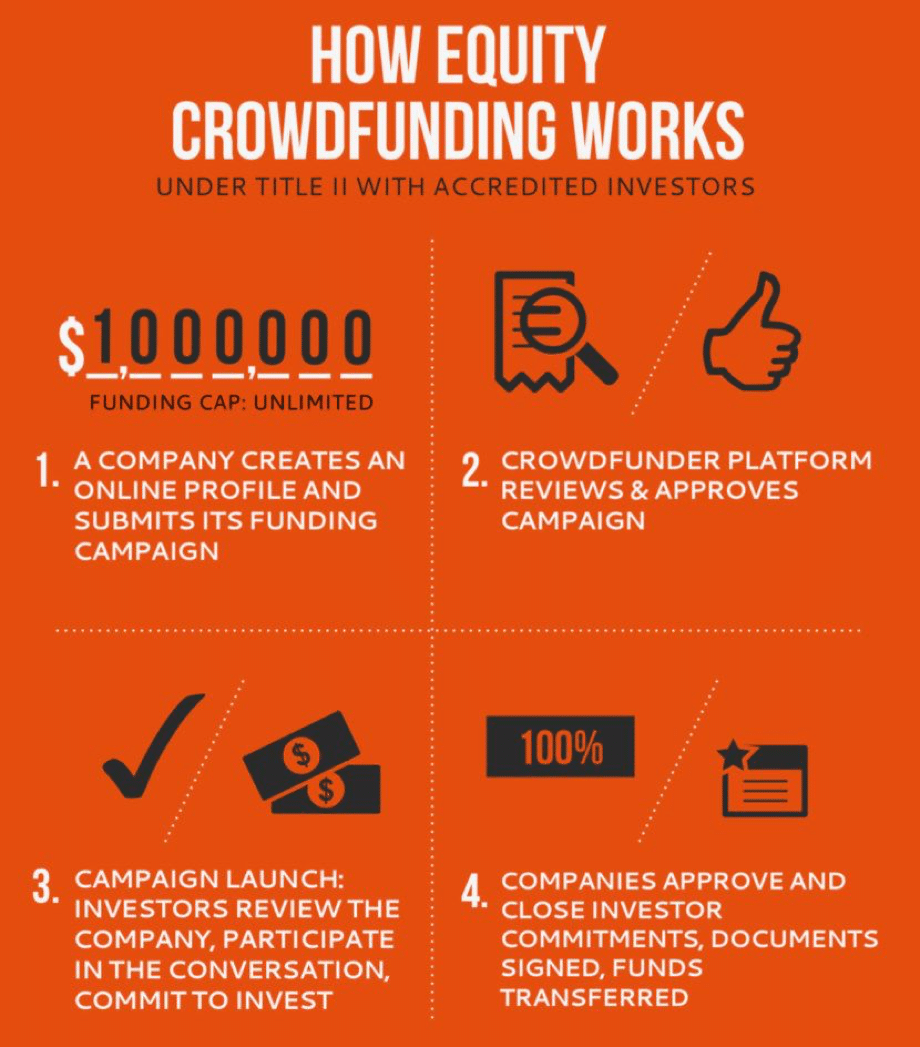

For a person to be active on the platform, he or she has to set up an online profile detailing the business plan and financial history. A business pitch is also critical in convincing the investors that the business is worth their money.

Once the portfolio is set, the business owner sets the goal of fundraising and launches the campaign. Interested investors registered on the platform are able to view the proposition. When interested in investing in a company, the investor follows the platform’s stipulated process and draws up the investment deal.

As companies start garnering crowdequity, a threshold amount is set to shield individuals willing to invest from overambitious spending. The amount that a company can raise is usually limited depending on the fundraising tier that a company chooses. Companies can issue up to $1.07 million in securities without necessarily going through the SEC process of registration. See the following link for details.

Below is an image that stipulates the step-by-step procedure for equity crowdsourcing.

Figure: How equity crowdfunding works

Case study: Equity Crowdfunding investment (The case of Eureeca)

To better understand how equity-based crowdfunding works; here is a typical presentation of a case of Equity Crowdfunding for Eureeca Company.

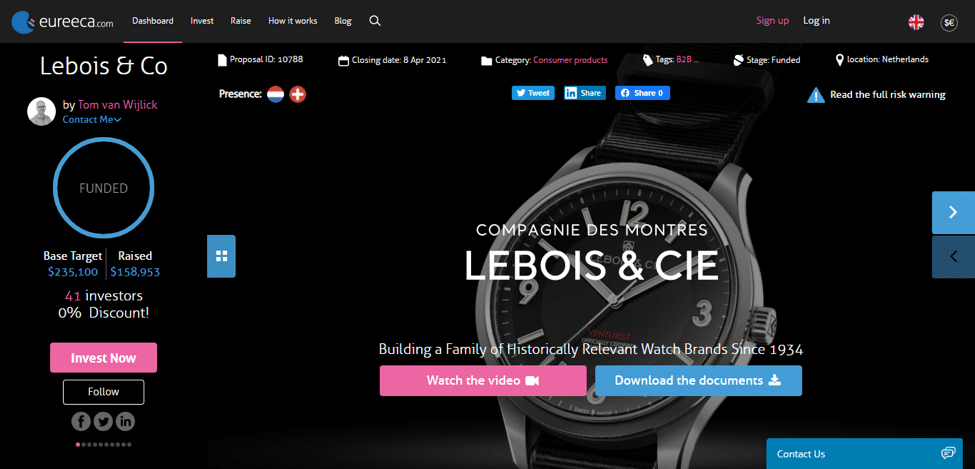

Figure: This is a sample of a business owner’s campaign pitch dashboard on Eureeca

The illustration above is a sample of a campaign pitch carried out by a business on the Eureeca crowd investing platform. On this campaign, entrepreneurs pitch ideas for a fixed amount of funds and a set number of shares. This is the profile of the business owner Lebois & Co who wishes to crowd source for finance for a watch manufacturing business. As indicated, the business has a base target (amount to be raised) of $235,100 and has already raised $122.327 which is equivalent to 52 percent. Further, 39 investors have invested so far. The closing date for the campaign has been extended to allow the businessmen to reach more interested investors and acquire the target amount.

In essence, Eureeca, an equity crowdfundng company, has offered SMEs like Lebois & Co a comprehensive framework to source for investments from investors regardless of the countries they are looking to base their business in.

Equity Crowdfunding Market size, growth, and forecast

The business of investment crowdfunding has recently emerged and its market is poised to grow exponentially. Legalized in 2016 via the Jumpstart Our Business Act, it has since shown an impressive penetration into the crowdsourcing market. See link or more: https://techcrunch.com/2016/06/07/equity-crowdfunding-is-now-legal-but-dont-expect-anything-to-change-just-yet/

Market size

The Equity crowdfunding market has matured significantly to become one of the most popular businesses financing option. In the US, it has over 1250 platforms which have raised billions dollars. As at 2014, the US market was valued at $173 million (https://www.toptal.com/finance/fundraising/us-equity-crowdfunding-market)

Market growth

By the year 2019, most countries had ventured into the equity crowdfunding business.

- In 2020, the Equity crowdfunding market in the US was valued at 214.9 million. This number was equivalent to a 105% growth from the year 2019. Between 2016 and 2020, the US Equity Crowdfunding market’s value rose to $514 million.

- In the UK, the size of the market was 360 million pounds as of December 2018. This figure reflected a 120% growth from the 30 million pound amount witnessed in 2011 as shown here.

Market Forecast

- It is estimated that by the end of 2021, Equity Crowdfunding business will surpass the $500 million mark in market value in the US. See details here.

Pros and cons for investors

Pros

Equity Crowdfunding is advantageous to investors as it offers them an opportunity to earn returns from the investments.

- It gives investors lucrative opportunities to invest with as little as $100. Equity crowdfunding creates low risk, yet potentially beneficial investment opportunities which promise satisfying returns should the business pick.

- It also allows investors to have a well-diversified portfolio for investment. Investors benefit from this criterion when they diversify their investment funds across several entities. This way of dividing money (portfolio diversification) may help mitigate the risk of loss.

- Equity-based crowdsourcing also grants businesses a simple platform to start up and control the investment seeing as the business is in charge of the investment operation. Besides, the campaigns ease the process for investors because typically, businesses go to them.

- Investors with little finances can invest like accredited investors in crowd investing as the amount threshold is comparatively low.

Cons

Some of the negative factors of crowdfunding include:

- The risks involved are high in that the companies are in their start up stages, thus their likelihood of thriving in the business is uncertain.

- The companies are mostly in their infancy stage; therefore it might take investors a considerately longer duration for to get returns on their investment.

Risks

Like any other forms of finance sourcing, equity crowdfunding runs the risk of failing in several aspects. Listed below are some of the risks that businesses and investors should be aware of.

- Fundamentally, investors stand a high chance of losing returns due to uncertainties involved in startup businesses operations. Startup companies are risky to invest in as their future is never certain.

- The risk of fraud is also expected as the crowdsourcing platform is open-ended and potential fraud schemes could deceive investors.

- Lastly, such businesses run the risk of low liquidity of securities. Investors may have to wait for a longer while before they can earn their return on investment.

Return on investment (ROI)

External investors support businesses found in equity-based crowdfunding to attract a significant return on investment. Research suggests that such investors invest in diverse businesses to increase the ROI and spread risks. Research conducted on UK-based Crunchbase Company established that the total expected yearly returns for crowdfunding investment in the UK were 8.8 %. See details on the link here.

Start to invest in Equity-Crowdfunding

Equity Crowdfunding is definitely an investment hack on the rise. Through these platforms, companies avert the hustle of borrowing money from lending institutions to run their businesses. Instead, they may offer a part of their company to investors in exchange for their money. For the startup companies not in a position to rack up finance debts, this is an incredible way of securing venture capital.

Here are some investment platforms to start investing in Equity-Crowdfunding

Receive £25 free investment credit after successfully investing £150 or more within 30 days of signing up |