Dividend investing is among the best options for those that prioritize patience and are looking for long-term financial stability, unlike other get-rich-quick schemes. Purchasing dividend stocks is a strategy that can appeal to stock market investors seeking lower-risk investments.

Dividend investing is a strategy that gives investors two sources of profit: one, monthly dividend payments, and two, stock capital gain over time. When you own dividend-paying stocks, you are set to receive a small percentage of the company’s profit as monetary repayments. These repayments are known as dividends that are paid to the company’s shareholders. This mechanism allows you to get a stream of income in addition to your portfolio’s market value growth.

Buying dividend stocks compensates you over time, but you need to be wise with your choices. For this pursuit, some companies have a dividend reinvestment plan known as “DRIP” which lets you choose to reinvest your dividends to purchase more shares instead of cashing them out. This can be smart if you have small dividends, as the company is still growing or you don’t own enough stock.

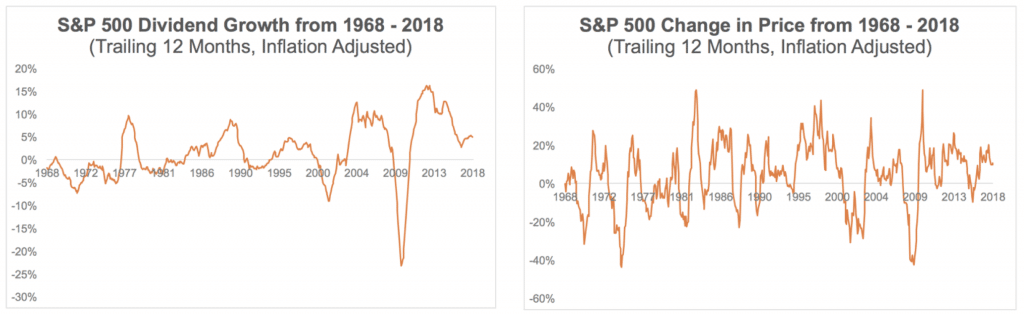

Dividend-paying stocks can be among the least volatile to own for several reasons. Dividend payments incurred by the company’s shareholders create a consistent cash flow coming from their initial investment in the stock. Besides, dividends aid the mitigation of portfolio losses when stock prices plummet.

Historically, dividend stocks have performed better than non-dividend stocks in terms of price fluctuations, as it can be seen in the two charts below. However, there are still risks to be aware of, and dividend stocks might be dangerous if you don’t know what to avoid.

How Dividend Stocks Work

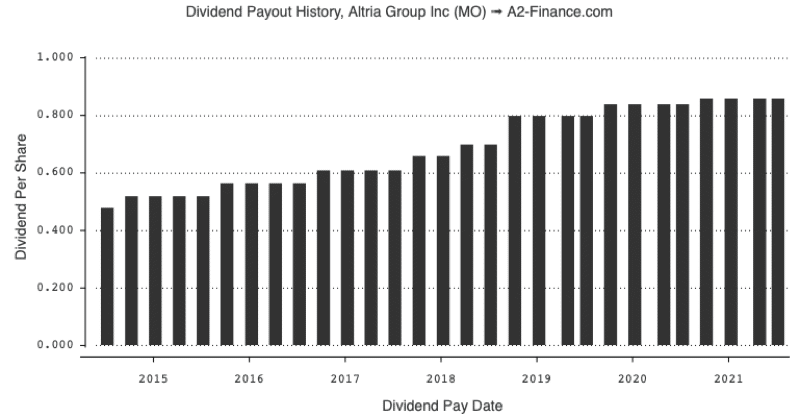

To see how dividend stocks function in reality, let’s look at what would happen if we invest in a real stock. At the moment, Altria Group Inc (MO) has shares of $47.53, issuing an annual dividend of $0.86. If you purchase 100 shares, your initial investment would be $4,753. after a year, you would get $86 in dividend payments, working out to a yield of 1.8%. If we look at how the dividend payout performed in the last 5 years, we can observe that its value has steadily increased, reaching in 2021 almost the double value $0.86 than in 2015 $0.45.

Essentially, for any share of a dividend stock that someone owns, the shareholders are paid a percentage of the company’s total earnings. To put it another way, you receive some money simply for owning the stock! You will receive dividend payments regardless of the company’s stock price fluctuating, as long as the company is disbursing them.

In general, one of the various benefits of dividend investing/owning a dividend stock is that you will have reliable quarterly payments, however, this is not always the case. Should a dividend-paying company struggle during a tough economy and suspends its payouts, you can still benefit from other dividend stocks by having a diversified portfolio.

Why do companies pay dividends?

Dividends are usually a sign of positive financial health, so a company that offers dividends will attract investors, driving up the share price. A dividend-paying company is more stable and a higher-quality business and typically pays dividends when there’s left-over money after they’ve covered their operating expenses and business reinvestment. As a result, established enterprises are more likely to pay a dividend because they require less capital reinvestment.

Dividends also get seen as a reward to its investors for trusting in the company. Shareholders also prefer dividends as they’re seen as tax-free income in several countries, such as Monaco, Bermuda, the Bahamas, Andorra and the United Arab Emirates (UAE). On the other hand, capital gains realized from selling a rising-priced stock are considered taxable income.

Why some companies don’t pay dividends?

In contrast, a new, fast-developing company frequently needs to reinvest all of its capital to fuel growth and so cannot afford to pay a dividend. To reinvest or cover expenditures, an established enterprise may forego paying a dividend. This might be a poor sign for investors, especially if the company is experiencing financial difficulties or expects future earnings to decline.

A decrease in the value of a dividend or a decision not to pay any dividends is not always indicative of negativity for a company. If a company prioritizes growth, then it is likely that it would choose to reinvest its profits instead of paying dividends. Given the company’s financials and operations, it’s feasible that management has more significant plans for investing the money. For instance, Amazon, Facebook and Google are some of the companies that opt to forego paying dividends. Their approach is underpinned by the rationale that the companies can bring an enhanced value to their shareholders by redistributing the profits back into its operational cycle.

In some cases, financial hardship might be the reason for the lack of dividends. Companies are aware that the payment of dividends is attractive for shareholders and retains them around. Nonetheless, there are times when you will run into a company that has to cut or eliminate a dividend due to financial troubles. Take the example of General Electric (GE), a well-known stock for income investors offering a very safe and stable dividend. In December of 2018, due to accumulating debt and financial mistakes, GE announced that it would drastically reduce the dividend to a penny a share. At that moment, the best option for GE was to acknowledge that continuing issuing dividends would be financially irresponsible and they chose to bail out the company.

For example, a company’s management may decide to invest in a high-return project that will generate greater long-term returns for shareholders than the tiny gains they receive via dividend payments.

Therefore, you must be selective when choosing dividend stocks for investing.

Evaluating dividend stock before purchase

You must evaluate stocks or dividend stocks before purchasing it, and to do that, you need to pay attention to the following:

- Dividend yield: The annualized dividend that’s a percentage of the stock price. The yield can be used to determine a stock’s value (by comparing its current yield to previous levels) and to spot red flags. A greater dividend yield is preferable, but a company’s capacity to maintain and, preferably, expand its dividend payout is even more important. The top 3 highest paying dividends in the S&P 500 are: Lumen Technologies (LUMN) – 7.77%; Oneok (OKE) – 7.24%; Altria Group (MO) – 7.24%

- Payout ratio: Dividends are paid out as a percentage of a company’s earnings. The payout ratio is 50% if a firm makes $1 per share in net income and pays a $0.50 per share dividend. In general, a dividend should be more sustainable if the payout ratio is low. There is no golden number that represents an ideal payout, as this aspect is highly dependent on the sector in which a given company activates. The highest dividend payout ratios are offered by: Caterpillar (197%); ExxonMobil (117%); Pfizer (100%); Coca-Cola (78%); Procter & Gamble (76%)

- Cash dividend payout ratio: A company’s earnings and real cash flows from operations might differ dramatically from one quarter to the next due to non-cash expenses. Because of this unpredictability, a company’s payout ratio might be deceiving at times. To gain a better insight into a stock’s viability, an investor should consider the cash dividend payout ratio. When a company has a high cash dividend, then it employs a big proportion of its cash flow to pay common shareholders. In the past 12 months Colgate-Palmolive Company (CL) yielded an impressive cash dividend payout ratio of 53%, a statistic that has rocketed the confidence of the investor in the stock. Another company that almost matched this performance is Procter and Gamble Company (PG), which achieved a yearly cash dividend payout ratio of 50%.

- EPS: The earnings per share (EPS) metric converts a company’s earnings to a per-share value. The best dividend stocks have demonstrated a consistent capacity to grow EPS and consequently raise the dividend over time. Earnings increase over time is frequently indicative of long-term competitive advantages.

- P/E ratio: Divide a company’s share price by its earnings per share to get the P/E ratio (price-to-earnings ratio). The P/E ratio, coupled with dividend yield, can be used to determine if a dividend stock is appropriately valued. Most of the time, investors seek stocks with a low PE ratio relative to similar companies as they are considered to be undervalued, which is a great indicator for future growth. Some of the lowest P/E ratios in the US market are: California Resources (P/E = 0.4); GEE (P/E = 0.6); Altisource Asset Management (P/E = 0/6); Hovnanian Enterprises (P/E = 1.1); Dynex Capital (P/E = 1.2). To illustrate this, let’s imagine that share X is trading at $30 and the earnings per share for the last 12-month period is $5. Hence, share X has a P/E ratio of $30 /($ 5 per year) = 6. In other words, the owner of the share is investing $6 for every extra dollar of annual earnings.

- Total return: The sum of the growth in stock price (also known as capital gains) and the dividends paid. For instance, if you pay $10 for a stock that appreciates by $1 and pays a $0.50 dividend, your $1.50 gain is equivalent to a 15% total return.

How to invest in dividend stocks?

When dividend investing, there are multiple ways to invest in dividend stocks:

- Purchasing individual dividend stocks

- Exchange-traded funds (ETFs) or index funds that hold dividend stocks

- Real estate investment trusts (REITs)

Dividend index funds or ETFs, such as Fidelity Equity Income (FEQIX) and Vanguard High Dividend Index (VHYAX), give investors access to several dividend stocks within one investment, allowing you to own a portfolio of dividend stocks. You will get dividend payments from the fund regularly, which can get reinvested or taken as an income. Dividend funds give the benefit of portfolio diversification, so you can still benefit if one stock in the fund suspends or cuts its dividend.

Dividend investing through individual stocks has its benefits and requires more attention from investors, such as adequate stock research. Individual dividend stocks allow investors to create a unique portfolio that may provide a higher yield than a dividend fund. Some of the most popular choices for individual stocks yielding dividends are FedEx Corp (FDX), PepsiCo, Inc. (PEP), Caterpillar Inc. (CAT), Clorox Company (CLX), Dow Jones & Company, Inc. (DJ), Pfizer Inc. (PFE). Dividend stocks can also save money on expenses because ETFs and index funds charge investors an annual fee called an expense ratio. A typical yearly fee for an actively managed portfolio ranges from 0.5% to 0.75%, whereas an expense fee higher than 1.5% is usually considered high these days. In the case of passive or index funds, the average ratio is typically 0.2%, but it can be as low as 0.02% or even less.

What are the Top Dividend Stocks?

Dividend aristocrats

If you’re interested in dividend investing, you can consider high-yield Dividend Aristocrats. These are an elite list of companies that get chosen annually but need to meet the following criteria:

- Be one of the S&P 500

- Meet specific liquidity requirements

- Have increased its dividends for 25+ successive years

There are currently 65 dividend aristocrats, all of which are high-quality companies with extended dividend histories. Furthermore, all of these businesses have long-term competitive advantages and are considered ‘recession-proof.’ Any company that has increased its dividends for over 25 years can weather economic downturns.

Examples of dividend aristocrats include:

- Coca-Cola

- AT&T

- ExxonMobil

- McDonald’s

- Target

Here are some well-known companies with a long history of dividend payments, together with their dividend yields at recent stock prices and the amount of each dividend paid per share:

Company | Industry | Dividend Yield | Quarterly Dividend Amount |

3M (MMM) | Industrial | 3.6% | $1.47 |

Procter & Gamble (PG) | Consumer defensive | 2.4% | $0.791 |

Lowe’s (LOW) | Consumer cyclical | 1.4% | $0.60 |

For more than 50 years, these three companies have grown their stock dividends. Dividend stocks can originate from almost any industry, and the dividend amount and percentage yield can vary from one company to the next.

Real Estate Investment Trust (REITs)

A real estate investment trust (REIT) is a business that owns, operates, or finances income-producing properties. REITs, which are comparable to mutual funds, aggregate the money of many different investors. Individual investors can now profit from real estate investments without owning, managing, or financing any properties themselves.

To qualify as a REIT, a company needs to meet the following requirements:

- Each year, pay a minimum of 90% of taxable income to shareholders in the form of dividends.

- At least 75% of total assets should be invested in real estate, cash, or US Treasury bonds.

- Rents, interest on real estate mortgages, or real estate sales must account for at least 75% of gross income.

- After the first year of operation, the company should have at least 100 shareholders.

- Have no more than five people owning more than 50% of the company’s stock.

REIT | Dividend Yield | Quarterly Dividend Amount |

Annaly Capital Management (NLY) | 9.6% | $0.29 |

PennyMac Mortgage Investment Trust (PMT) | 9.0% | $0.67 |

Blackstone Mortgage Trust (BXMT) | 7.7% | $0.54 |

Don’t Only Focus on High-Yield Dividends

Buying equities with the highest dividend yields is a common error made by inexperienced income investors. While high-yield stocks aren’t negative, they’re usually the outcome of a stock’s price dropping owing to the possibility of a dividend cut, which is a dividend yield trap.

Here are some things you can do to avoid becoming caught in a yield trap while dividend investing:

- Don’t buy stocks only for their dividend yield. If a company’s yield is much greater than its peers, it’s usually an indication of difficulty rather than an opportunity.

- Payout ratios can get used to determine the long-term viability of a dividend.

- As a guide, look at a company’s dividend history, both in terms of payout growth and yield.

- Examine the balance sheet to see what debt, cash, and other assets and liabilities are included.

- Take a look at the company and the industry as a whole. Is the company’s business threatened by competition, low demand, or other factors?

Unfortunately, a yield that appears to be too good to be true is typically just that. It’s preferable to buy a stable dividend company with a lower yield than to pursue a high yield that may turn out to be deceptive. Furthermore, concentrating on dividend growth (a company’s history and potential to increase its stock payout) is frequently more beneficial.

Conclusion about dividend investing

Assume you’re putting together a portfolio to earn money right now. In such a situation, it’s vital to understand that a company isn’t required to pay dividends in the same way that it is necessary to pay interest on bonds. As a result, if a company has to decrease costs, the dividend could be jeopardized.

It’s critical to include a safety cushion in your income portfolio and diversify across companies with various risk profiles. Investing in a dividend-focused mutual fund or exchange-traded fund (ETF) is one approach to successfully limiting risk in your portfolio. Investors are then able to diversify their portfolios and generate a passive income from dividend stocks.