Real estate remains a superior investment option despite the current economic woes. But before we explore the reasons, let’s begin with a quick introduction before jumping into why real estate is a superior investment.

The word “investment” conjures images of stocks, bonds, and mutual funds in our minds — and that’s not surprising. Studies suggest that more than half of U.S. households have some stake in the stock market.

While real estate investment is not as popular, it might be a more lucrative option during this period.

According to the National Association of Realtors (NAR), sales of existing homes rose by 10.5 percent year-over-year. Indeed, it reached a seasonally adjusted rate of 6 million units in August 2020 — during a recession.

Likewise, U.S. Census Bureau data revealed that new homes sold also enjoyed a whopping 43.2 percent boost year-over-year. Similarly, it ended up at a seasonally adjusted annual rate of 1,011,000 units sold in August 2020.

The bottom line is real estate remains appealing to prospective investors, despite the lockdowns and social distancing. But why?

10 Reasons Why Real Estate is a Superior Investment

Image Credit: Gerd Altmann / Pixabay.com

Here’s why real estate is a superior investment and why you should consider real estate over other investment options.

1. Generate Cash Flow

One critical reason individuals invest in real estate is to generate a predictable cash flow. What does that mean?

Cash flow refers to the net income from a real estate investment after paying the mortgage and operating expenses. It can include any of the following:

- Rental income

- Profit generated from property-dependent business

- Appreciation

For example, rental properties generate a monthly income that can offset the investor’s expense. Over time, the earnings can return the initial investment and deliver positive returns to the investor.

In other words, cash flow tends to strengthen as you pay your mortgage and build up equity.

2. Portfolio Diversification

Investing in a single market increases your risk of losing it all when things go wrong. That’s why it’s always an excellent idea to diversify your portfolio.

The good news is an investment in real estate provides the perfect opportunity to do just that — create financial stability. Still in doubt? Consider the numbers.

Six million homes were sold despite the pandemic, recession, and surge in unemployment. At the same time, the average home price increased by up to 5 percent in 2020.

Instead of locking your money in a single investment option, consider using real estate to spread the risk.

3. Enjoy Tax Breaks and Deductions

Taxes are a massive expense for anyone, including a real estate investor. Luckily, most state tax laws, including federal regulations, provide tax relief to property owners.

For example, the Federal tax code allows deduction in the cost of owning, operating, and managing a property.

Another tax perk of real estate investment is the ability to defer capital gains by using a 1031 exchange. It means you won’t have to pay the traditional 15 to 20 percent capital gain tax because you’re swapping one investment property for another.

Thanks to these tax deductions and breaks, investment in real estate is even more lucrative.

4. Build Equity with Real Estate

Equity refers to the difference between your home’s market value and the amount you owe the lender who holds the mortgage.

Real estate investors usually have to borrow money to complete their deals. While you’ll have to pay back with interest, each payment also brings you closer to paying the principal amount.

That way, you’re not only increasing your wealth but also building your equity. That brings us to the next point.

5. Leverage Real Estate Equity

You can leverage your home’s equity build-up to purchase other properties. But what does that mean?

Leverage in real estate entails using borrowed capital to buy a property. It begins with borrowing funds from a lender to purchase an investment property. That way, you won’t have to cover the entire purchase price on your own.

However, you build up equity when you pay back the property mortgage. What’s more, you can leverage this equity to buy more properties and increase your cash flow.

Another option is to collect a home equity loan to renovate your home or pay off high-interest debt.

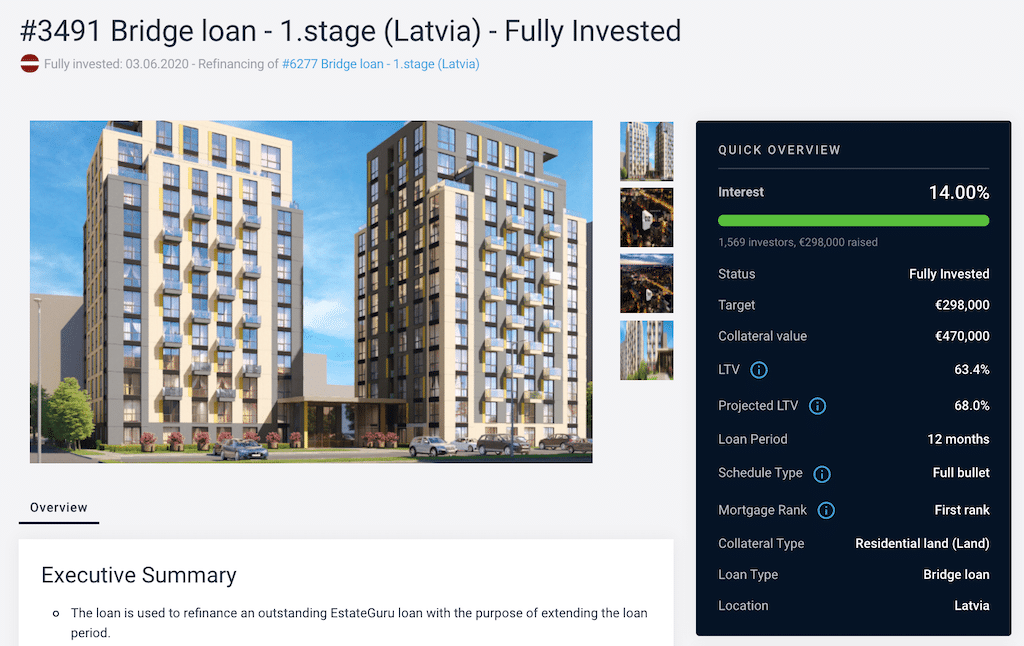

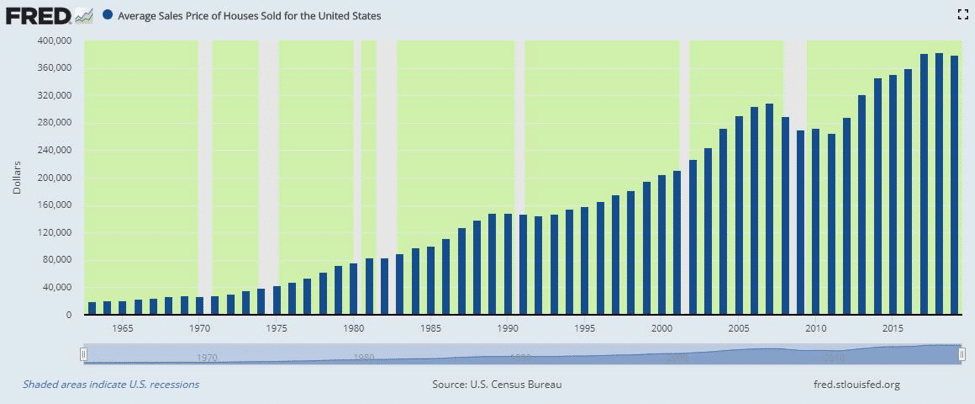

6. Real Estate Appreciates Over Time

Image credit: Federal Reserve Bank of St. Louis

Real estate investment offers a diverse source of revenue. Alongside rental income, property owners can also generate profit through other property-dependent activities.

However, the biggest source of revenue for real estate investors may be appreciation.

As you may have guessed, the value of properties tends to increase over time. As a result, real estate owners can make a decent profit when they buy and sell properties.

Likewise, rental rates also follow an upwards trend. And that can lead to a higher cash flow for the property owner.

7. Inflation Hedge

The term “inflation” refers to a sustained rise in the general price of an economy over a specific period. It often results in a reduction in the purchasing power per unit of currency. So, every dollar you own will buy fewer goods and services over time.

Higher inflation is negative for stocks because it increases borrowing and input costs. In addition, inflation also reduces expectations of earnings growth and puts pressure on stock prices.

On the other hand, real estate investment can serve as a hedge against inflation.

That’s because real estate tends to pass some of the inflationary pressure to tenants via an increased rent. It can also occur through capital appreciation.

8. A More Secure Investment

A famous American financier, Russel Sage once described real estate as the most solid asset ever developed by human ingenuity.

Sage was right. Real estate may be the only imperishable asset that appreciates over time. So, your property will always have value — whether it’s a piece of land or a home.

Admittedly, your property’s value can vary based on factors such as:

- Location and Asset class

- Updates and Upgrades

- Interest rates

- Home size and Usable Space

- Supply and Demand

However, several real estate investors aim to beat the average returns of the S&P 500. And they often do.

According to reports, the average annual return for residential and diversified real estate investment over the past 25 years is 10.5 percent. Meanwhile, the S&P 500 Index’s average annual return within the same period is roughly 9.8 percent.

9. Room for Improvement

Real estate investment offers a chance to improve your holdings, resulting in higher earnings.

As any property investor knows, real estate is a tangible asset made of wood, metal, stone, and glass. As such, you can modify and renovate it to suit the current consumer demands.

Indeed, 79 percent of sellers in the U.S. make at least one renovation to their home before sale. What’s more, the right improvement can increase your anticipated home sale price by up to 10 percent.

It doesn’t matter whether the change is structural or cosmetic. The goal is to make your property more appealing to potential buyers and improve its pricing.

10. Excellent Retirement Asset

Real estate can serve as an excellent retirement asset. In fact, experts recommend investing in properties when you are short of the funds required for retirement. Here’s why.

The real estate market is inefficient. For this reason, investors can always find awesome bargains that offer high ROI. Moreover, you’re likely to increase your income if you manage the property by yourself.

Ultimately, a rental property can produce more returns than other passive investments. However, it begins with buying the right property at a competitive price.

Wrapping Up: Start Buying and Selling Properties Today

There’s no denying that real estate investment is profitable for buy-and-hold investors.

However, it’s equally as lucrative for flippers. These are individuals who buy properties, hold them for a short period, and sell for a profit.

With that said, the outcome is the same regardless of the investment approach. You’ll enjoy a predictable cash flow, diversification, decent ROI, and tax deductions. More importantly, you’ll be able to leverage your real estate investment to build wealth.