Before crowdfunding, it was really difficult for retail investors to invest in real estate. The entry barrier was just too high in terms of the minimum investment and other associated fees. But with real estate crowdfunding, it is now very easy for anyone to invest in the property market. Until recently, the only options for entering the real estate market were through REITs or by buying a property directly. To be fair, real estate crowdfunding combines those two types of investment, but it is more efficient and cost-effective on the side of the investor.

Real estate crowdfunding proposes property deals and then does all the heavy lifting for you, like legal work and managing the property.

The European market for property crowdfunding is not as strong as the Asia Pacific and North America and is mainly driven by countries such as the UK, Germany, France, Spain, and Italy. The UK registered the highest share of the market in 2019 with 41.5% (source).

If you are looking to invest in real estate using crowdfunding, we have prepared a list of the best platforms in Europe you can use to achieve your goal.

EstateGuru |

Reinvest24 |

Housers |

Bulkestate |

Property Partner |

Category

Loans |

Category

Equity |

Category

Equity |

Category

Loans |

Category

Equity |

Yield

11.54% |

Yield

14.63% |

Yield

10.42% |

Yield

14.7% |

Yield

11.23% |

Auto Invest

Yes |

Auto Invest

No |

Auto Invest

No |

Auto Invest

Yes |

|

Secondary Market

Yes |

Secondary Market

Yes |

Secondary Market

No |

Secondary Market

No |

Secondary Market

Yes |

Min. Investment

€50 |

Min. Investment

€100 |

Min. Investment

€50 |

Mini. Investment

€50 |

Min. Investment

€5,000 |

The good thing about these platforms is that you can invest in all of them to reduce your investment risk.

EstateGuru

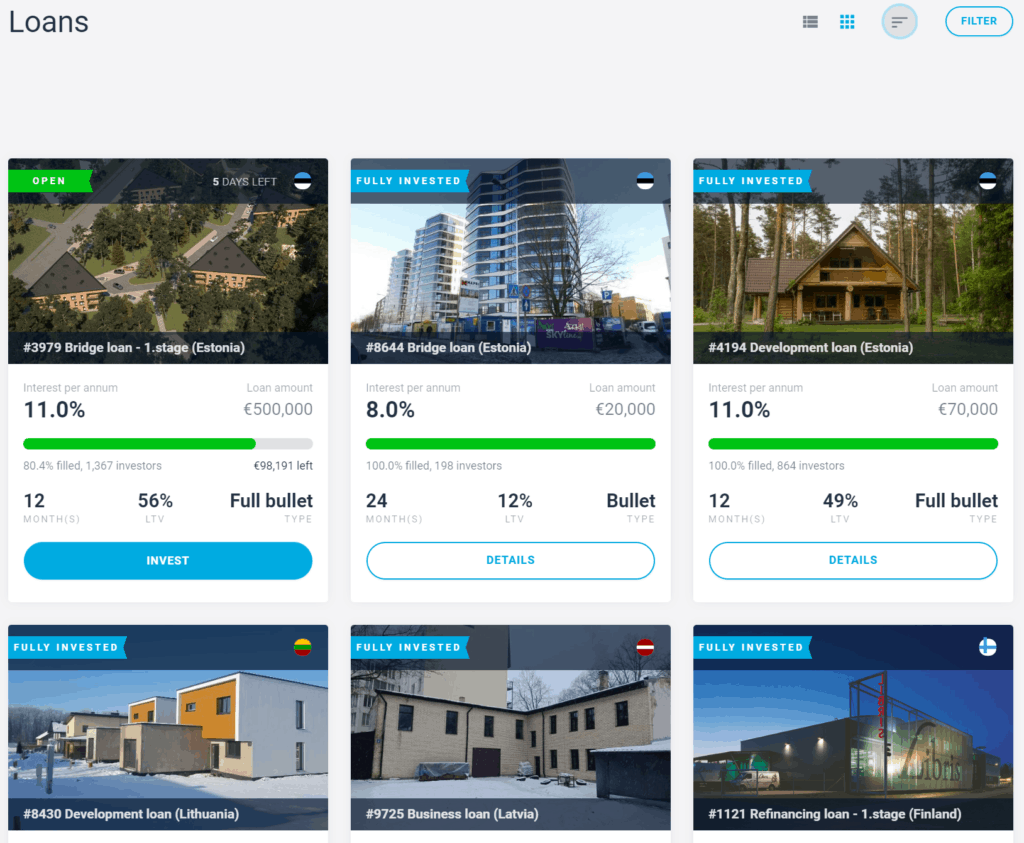

EstateGuru is the biggest real estate crowdfunding platform in Europe and offers investors from anywhere in the world a chance to invest in property loans.

Launched in 2013, this platform provides investors with a complete package of real estate investing tools along with tight security for their investments.

Living up to its reputation as the leading property crowdfunding platform in continental Europe, EstateGuru serves more than 55,000 users and to date has funded over 1,500 loans.

It is one of the most consistent real estate crowdfunding platforms and has been performing above expectations since it was founded eight years ago with so far zero capital loss as well as above-industry-level interest rates.

In addition to pure property development loans for new projects, the platform also offers the following types of loans:

- Bridge loans

- Business loans

- Reconstruction loans

Investors prefer EstateGuru to other real estate crowdfunding platforms because most of the listed loans return interest every month.

Since the platform was founded in Estonia, the country is its main market, although there are also loans from Lithuania, Latvia, Spain, Finland, and Portugal.

With these property development loans, investors are guaranteed to receive a fixed-rate interest of around 10% to 12% at the start.

What you will like about EstateGuru is that any investor can invest in the loans, thanks to the lower minimum investment threshold.

In terms of the user interface, this platform has a very nice and intuitive interface, with each listing well-detailed and documented.

Moreover, there is also an auto-invest feature that allows investors to automate their investments as well as secondary market for liquidity.

Pros

- Secondary market

- Solid returns

- Great track record

- Low default rate

- Lower investment threshold

Cons

- Limited auto-invest

- A limited number of projects

Reinvest24

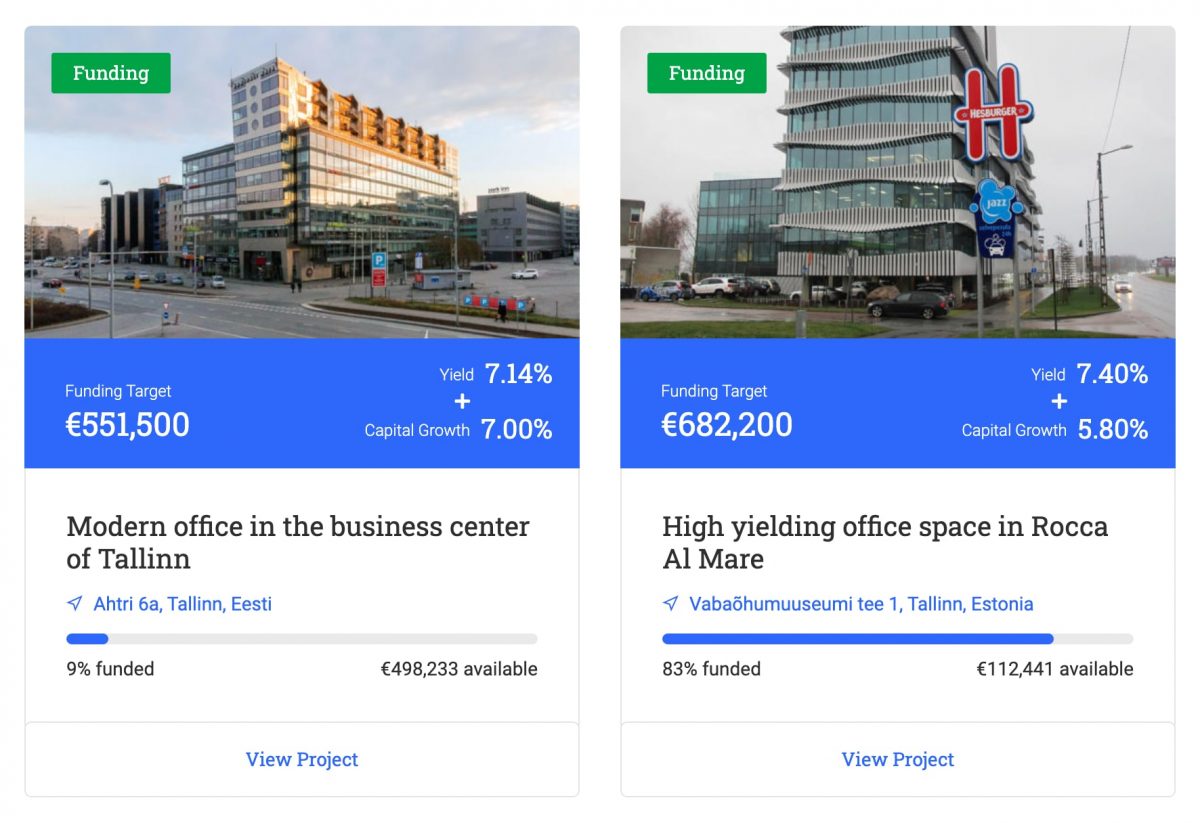

Founded in 2017, Reinvest24 is a platform that enables investors to invest in real estate without the hassle of paperwork and agents. The platform currently operates in Baltic real estate though it is slowly expanding into other territories such as Spain.

Reinvest24 covers such Baltic cities as Riga (Latvia), Vilnius (Lithuania), and Tallinn (Estonia) but it also provides investment possibilities in Spain and Moldova.

Since its inception a few years ago, the platform has funded more than 10 projects with over €12 million invested so far and €4 million interest earned.

Unlike most property crowdfunding platforms Reinvest24 provides you with an option to buy shares of a commercial or residential real estate as a group along with other investors starting from €100.

You earn profit from capital growth and rent, with no limits on the period of investment.

Generally, there are two ways your capital is working for you in Reinvest24:

- You receive income from the rental income the property generates, which is transferred directly to your account.

- You also earn from the increase in the value of the property, the money which you will receive after you sell off your shares.

An SPV (special purpose vehicle), a subsidiary company of Reinvest24, owns the property documents as well as managing tenants and maintaining the properties.

Pros

- Solid yield

- Diversity of real estate projects

- Investment secured by mortgage

- Secondary market for liquidity

Cons

- Operates in fewer markets

- No auto-invest feature

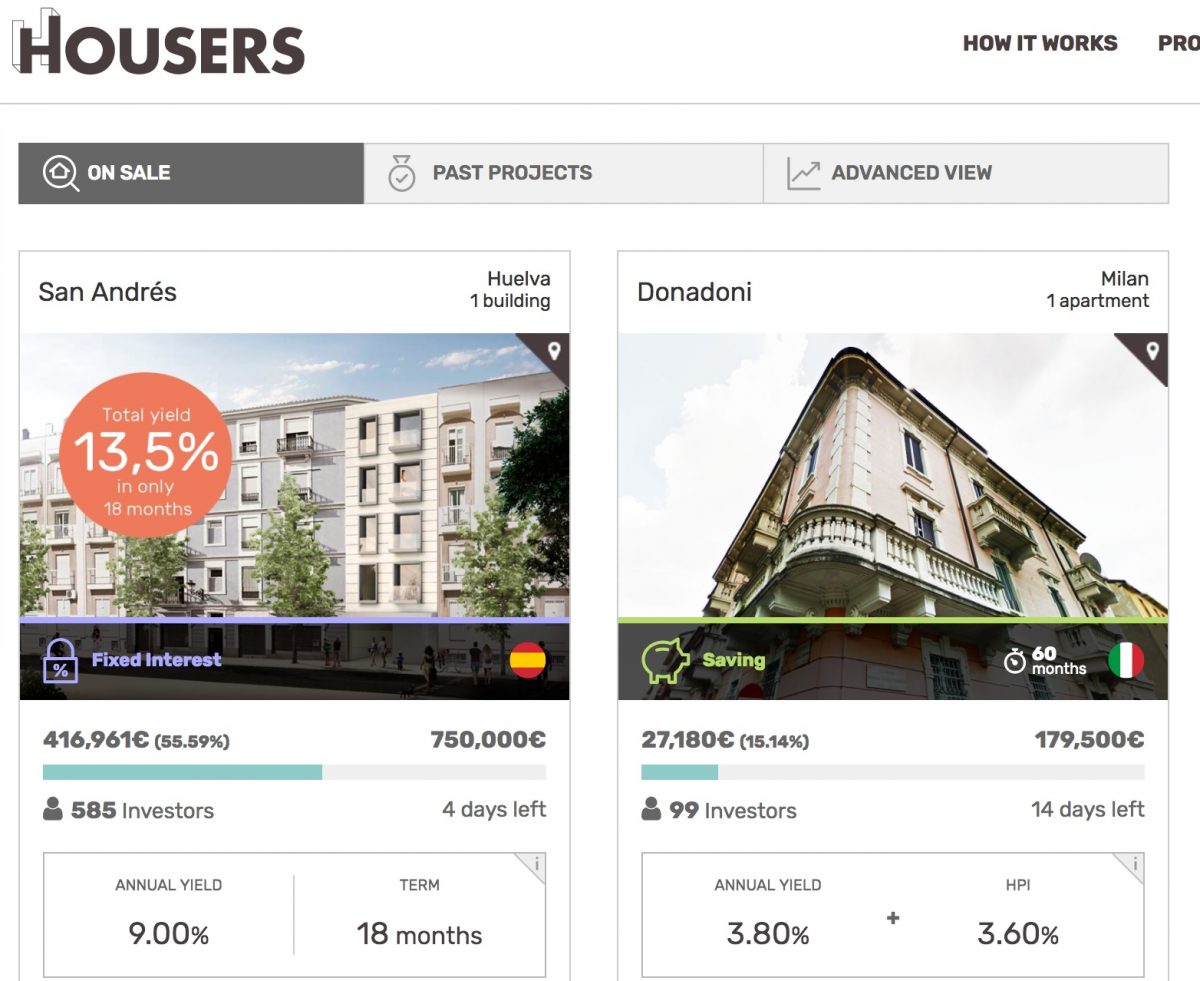

Housers

Founded in Madrid Spain, Housers is a real estate crowdfunding platform that allows you to invest in property loans that are backed by mortgage. Having been around for more than half a decade, this platform is the first of its kind in the Spanish market.

Currently, the platform operates in three markets, including Italy and Portugal in addition to Spain.

One thing investors must be cautious about Housers is its opaque fee structure. Nothing is provided on the open and it seems the platform takes a huge chunk out of investors’ profits.

Nevertheless, Housers is known for its wide range of available projects that allow you to diversify your investment to different categories of risk.

Pros

- Collateralized loans

- High-interest rates

- Direct investment structure

- New projects launched monthly

Cons

- Opaque fees structure

- No auto-investing

- Poor customer support

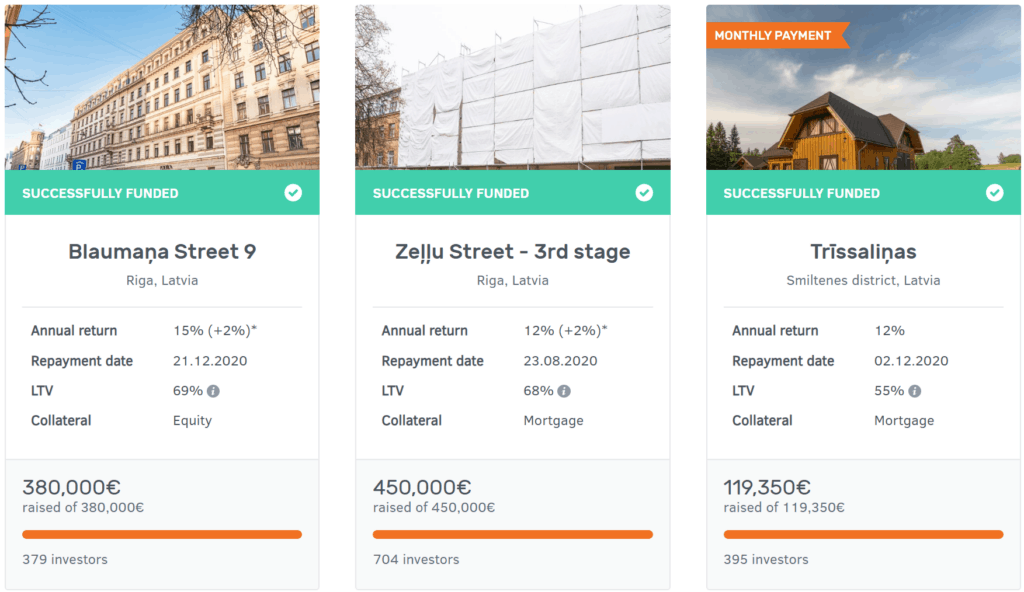

Bulkestate

With tens of thousands of retail and institution investors, the Bulkestate property crowdfunding platform is one of the leading real estate investment vehicles in Europe.

You can start investing with €50 with a loan term of around 12 months. Since it was launched in 2016, more than 33,000 investments have been made through the platform.

The platform differs from others on the market because they offer both group buying and lending services.

Its auto-invest features allow investors to automate their investments with very minimal effort or hands-on style investment.

The group buying feature enables you to buy an entire building with other investors at once for a special price.

As an investor, you can expect a rate of around 14.63% though you can achieve a higher return than this average.

It is quite easy to invest in Bulkestate, just:

- Create your account

- Top-up your account with funds

- Invest in projects of your liking

- Earn your profits

Pros

- No investment fees

- Bulk buying of properties

- Auto-invest

- Safety-oriented platform

Cons

- Limited projects

- No buyback guarantee

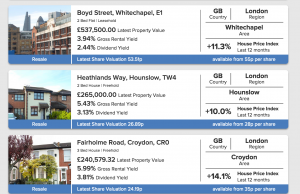

Property Partner

Founded in 2014, Property Partner is considered one of the best property crowdfunding platforms in Europe. It offers investments a chance to invest in the UK property market starting from £1,000.

That is quite a high minimum investment, but that is a clear reflection of the nature of the UK property market, which is known for being heftier compared to most of continental Europe.

As result, it provides investors with a great opportunity to invest in the UK property market without having to break the bank.

London is probably the most prestigious property market in entire Europe, and now even retail investors can take part in the market.

Just like any other property crowdfunding platform, investors earn a share of monthly rental income as well as a share of property appreciation.

Pros

- Buyback guarantee

- Secondary market

- Great customer support

- Profitable platform

- Long-track record

Cons

- High minimum investment required

- Lower returns