Everyone wants to have passive income. Passive income is beneficial as it allows you to create some financial stability, security, and freedom, and since most sources of passive income do not involve your active participation, it can have a massive positive and effect on your wealth-building efforts.

Passive income is proceeds earned from limited partnership rental property, or any other business in which you are not actively involved, and is usually treated differently by the IRS. When it comes to passive income, you need to understand three main categories – portfolio income, active income, passive income.

Protagonists of passive income often propagate a work-from-home culture and be-your-own-boss kind of lifestyle. In recent years, passive income has been a term used to describe money earned on regular basis with little or no effort on the part of the individual earning it.

However, the IRS defines it as “income from a business in which the taxpayer does not materially participate” or “net rental income” and it can sometimes feature self-charged interest.

Examples of passive income

Passive income can help you earn money even as you are still pursuing your primary job. It is the best way to save up enough money to meet your early retirement goals. Below are the most common examples of passive income you should try out.

Crowdlending

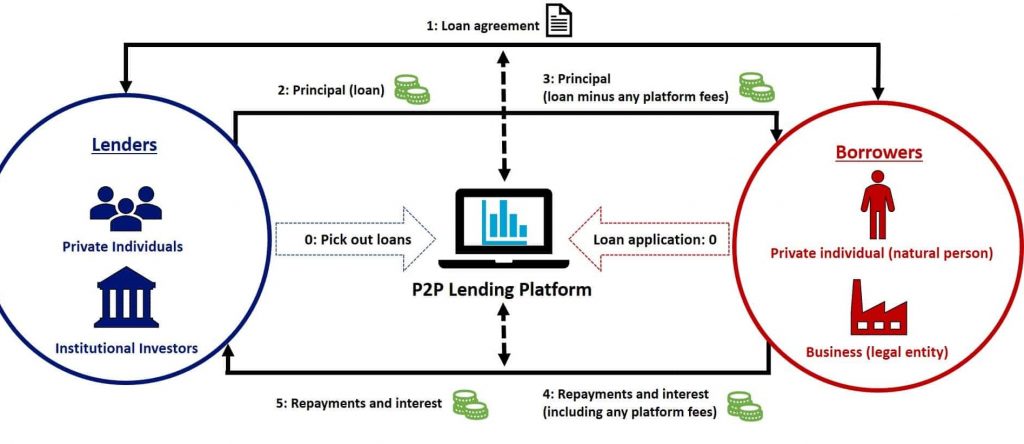

Crowdlending is any activity that takes place online through an electronic platform, matching lenders with borrowers. It is sometimes also known as p2p lending, marketplace lending, or loan-based crowdfunding.

When you invest in loans through Crowdlending platforms, you are known as the peer-to-peer lender (p2p lender), crowdfunder, marketplace lender, or loan-based crowdfunder.

You can invest in business loans, consumer loans, or property lending in Crowdlending. Everything is facilitated by a Crowdlending platform and you can invest through as many platforms as you wish and in many countries as you want.

However, the term and condition of use will depend on the jurisdiction of the location of the platform.

The platform serves as a marketplace where investors are matched with borrowers. You can either search and find loans to invest in or automatically choose investment opportunities.

The most common type of Crowdlending platform uses diffused model where platforms allocate investors’ funds to different loans in small chunks, allowing investors to diversify and for borrowers to get quick funding.

The automation feature allows investors to set up a maximum amount they want to fund a single loan as well as distribution of their investment based on loan maturities, risk bands, and any other criteria for automatic execution.

Today many Crowdlending platforms offer a secondary market feature to increase the liquidity of the investment.

Pros of Crowdlending

- Potential high returns

- Low risks

- Generates passive income

- Monthly interest earnings

- Buyback guarantee

Cons of Crowdlending

- Platform risk as many have been shut down

- The interest rate is not tax-free

- You not in control

Example of Crowdlending platforms to invest in in Europe:

Platform | APY | Min. Invest | Buyback Guarantee | Type |

11% | €10 | Yes | Consumer | |

12.5% | €1 | Yes | Consumer | |

18% | €50 | No | Business | |

11.3% | €50 | No | Real estate |

Stock market

The stock market has been around for quite some time now. A stock, or as it is sometimes known as share or company equity, is a financial instrument that represents ownership of a business as well as a proportionate claim on its earnings and assets.

If you invest in a company’s stock, you are known as a shareholder and it means that you own a small portion of the company, which is equal to the number of shares held in relation to the company’s total outstanding shares.

There are usually two main types of shares or stocks – preferred and common. The main difference between the two is that common shares often have voting rights that allow you as an investor to have a say in company meetings or annual general meetings, where important matters like the appointment of auditors or board of directors’ elections are carried on.

Preferred shares on the other hand don’t have voting rights and are named so because they have special preference over the common shares to receive dividends and assets in a time of liquidation.

Stock is one of the simplest methods of earning passive income. When a company generates profits, a percentage of the earnings is channeled back to the shareholders in form of dividends. You can choose to reinvest the money or withdraw the cash.

Pros of stock

- Easy to buy and sell stock

- Requires very small minimum investment

- Allows you to stay ahead of inflation

- You grow with the economy

Cons of stock

- Highly volatile

- Emotional rollercoaster

- Requires a lot of time to research the right stock

Stocks to invest for passive income

Stock Name | Price | Market Cap ($B) | 12-Month Trailing P/E Ratio |

Agios Pharmaceuticals Inc. (AGIO) | 56.31 | 3.5 | 2.5 |

Annaly Capital Management Inc. (NLY) | 9.19 | 12.9 | 3.0 |

AGNC Investment Corp. (AGNC) | 18.58 | 9.8 | 3.4 |

Tesla Inc. (TSLA) | 619.13 | 596.4 | 132.0 |

Gap Inc. (LB) | 34.02 | 12.8 | 5.9 |

Real estate

Passive income real estate is one of the best and reliable ways to earn additional revenue, save for your retirement, and build a roadmap to obtaining financial freedom. When you invest in real estate for passive income, it means you are not looking to actively participate in the management of the property. There are three ways in which you can invest in real estate and earn passive income.

One way is through real estate investment trust REIT. This is known to be the easiest way to invest and earn passive income in real estate. REITs are similar to mutual funds – you buy shares, contribute funds, and then earn monetary benefit in return.

REITs are usually traded publicly and you can find them on large stock exchanges. You can buy and sell the shares online quickly and even spread your investments over a portfolio of different properties.

Another way you can earn through real estate is through real estate syndications. In real estate syndication, you buy a certain real estate property and own it. As an owner, you can increase tax benefits as a passive investor.

But you are not alone; multiple investors join you by pooling their funds to buy a specific property.

An example of real estate syndication would resemble the following example:

Hold time – Five years

Passive income – 8% to 10% cash-on-cash return per year

Profit on sale – 40% to 60% ROI at the sale of real estate asset

Last but not least, you can invest in real estate through crowdfunding. Just like in syndications, a group of investors pool their capital to buy real estate in crowdfunding.

Pros of real estate

- Appreciates in value

- Has tax benefits

- Easy to leverage

- Provides steady cash flow

Cons of real estate

- Takes time before you start earning

- Has a unique set of risks

Cryptocurrency

Cryptocurrency mining is the organic way to make passive income. This process involves using your computing power to solve intricate mathematical problems and verify transactions.

You will then require a cryptographic professional to prove your work. If you are the first person to solve the problem, you will be rewarded with tokens or crypto coins. However, this process requires the use of expensive equipment and high electric costs, making it a pretty much unsustainable way of making money.

As a result, proof of stake has been devised as an alternative method to confirm transactions and mining cryptocurrency. However, the easiest way today to make passive income in cryptocurrency is through lending. It uses the same basic lending principles as traditional lending – borrowers pay interest to investors. But the loan is secured by cryptocurrency assets in value higher than borrowed funds.

Pros of cryptocurrency

- High returns potential

- Protection against fraud

- Immediate settlement

- International transactions

Cons of cryptocurrency

- Highly volatile

- Black market activity

- Unregulated

Example of cryptocurrencies to invest in:

Cryptocurrency | Price $ | Market cap (Billion) | Volume (24 hours) |

Bitcoin | 34,200.99 | $640.91 | $36.05 billion |

Ether | 2,118.15 | $246.42 | $25.69 billion |

Dogecoin | 0.265452 | $34.50 | $2.77 billion |

Litecoin | 147.78 | $10.04 | $2.57 billion |

XRP (Ripple) | 0.727391 | $72.73 | $3.37 billion |