Peer-to-peer lending popularity has never slowed down since the first platform Zopa was launched in 2005. This widespread form of investment allows borrowers and investors to link in an online marketplace. The sector offers a wide range of loan types, from personal loans and business loans to mortgages. Each platform offers different types of loans, which come with their own unique risk profile. For experienced investors, it is clear that the higher the rate of returns the higher the risk, so they typically examine the risk vs return before deciding to invest in a particular loan.

Unfortunately, new investors are usually attracted by high-interest rates without weighing up the detail underneath the high rates.

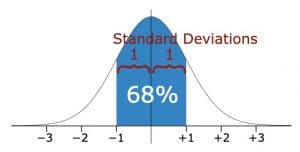

The easiest and the most common way to measure the risk is by using the volatility of the investment. The smaller the volatility, the lower the risk, but risk and volatility are two different terms.

How to determine the risk ratio in P2P lending

The peer to peer lending platform usually determines the creditworthiness of the borrower in order to assign the rate of interest. But before we see how the platforms assess borrowers, let’s see first how, as an investor, you can determine the risk ratio of the investment.

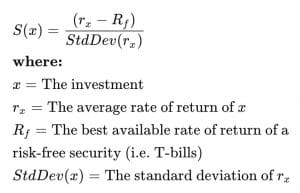

In general, the Sharpe ratio is the standard calculation for determining a risk ratio of an investment.

Figure: Sharp ratio formula

Figure: Standard deviation (container of 68% of the ROIs of the investments)

Typically, a Sharpe ratio below 1 is very bad, 1-2 is ok, 2-3 is good, and anything over 3 is very excellent. For the past decade, stock markets have been having a Sharpe ratio of below 1.

Though this makes peer to peer lending as a pretty attractive investment from a risk ratio perspective, it should be understood that there are a number of risks that a Sharpe ratio cannot detect. Most of these risks are associated with the nascent nature of the p2p industry. Some of the risks include:

- Much of the p2p lending growth has been after the 2008 global financial crisis. So understanding how the market can behave during a financial crisis is hard.

- Another risk is such as the Collateral debacle

- The Sharpe ratio is quite old, and it cannot capture new impacts such as the recent Brexit.

How p2p lending platforms evaluate the creditworthiness of borrowers

Generally, the p2p lending industry is made up of 3 elements, namely the borrower, the lender, and the platform. The platform enlists the concept of crowdfunding to make it convenient for borrowers to find lenders willing to fund unsecured loans.

The borrower is checked and verified on various grounds before being listed on the platform. Different platforms have different parameters for assessing the borrower, but the main factors are identity, credit history, and risk profile.

A borrower is required to provide PAN, bank statement, address, and income statement details to the lending platform.

After going through the details provided, the p2p platform will undertake some rigorous verification of the borrower at his or her home and workplace.

Unlike traditional banks, p2p lending platforms do not rely solely on the income statement and tax details to determine if a borrower qualifies for a loan or not.

Social media footprints

P2P lending platforms may also use social media platforms such as Twitter, Facebook as well as e-commerce sites to evaluate the creditworthiness of the borrower.

Most platforms use technologies such as social modeling and data analytics to understand the profile of a borrower.

Risk Categorization

Peer to peer platforms categorizes borrowers according to their risk ratio: very low risk, low risk, medium risk, high risk, and very high risk. Depending on the person’s income statement, financial history and repaying ability, the platform will give a borrower a certain rating.

Very high-risk borrowers typically have high debt to income ratio. This means that the borrower uses most of the income in paying debts, essentially meaning that they have a high probability of paying the loan back. However they the volatility could be higher. These types of borrowers are usually ignored by banks. On the other side, very low-risk borrowers provide the lowest rate of return for investors and are also the ones banks like.

Blacklist in p2p lending platforms

Unlike banks and other traditional lending institutions, p2p lending does not blacklist any type of borrowers. The platforms usually treat every borrower as differently without generalizing and try to provide customized loans based on their profiles and risk levels.

However, this does not mean that just anybody can get a loan on peer to peer lending. Despite the flexibility, which is not present in banks, still, a credit assessment algorithm is used.

Methods used by p2p platforms to protect the investment

Peer-to-peer lending companies use various methods to secure the assets of the investors including creditworthy assessment and scoring of all borrowers, diversification of investments, anti-fraud checks, secured loans, and many others.

The risk ratio in peer-to-peer lending platforms is also further reduced by the Financial Conduct Authority (FCA) regulations.

[insert page=’cta-footer-crowdlending’ display=’content’]