Due to the ongoing pandemic, safe to say, 2020 had its fair share of ups and downs for investors where at certain instances share prices exploded and on the other saw an all-time low. 2021 however is all about recovery and there’s no better time for investors to study the market and maximize their earnings. The following article goes on to explain real estate investment funds (REITs), how to invest in REITs, and how it is a good choice of investment!

What are REITs

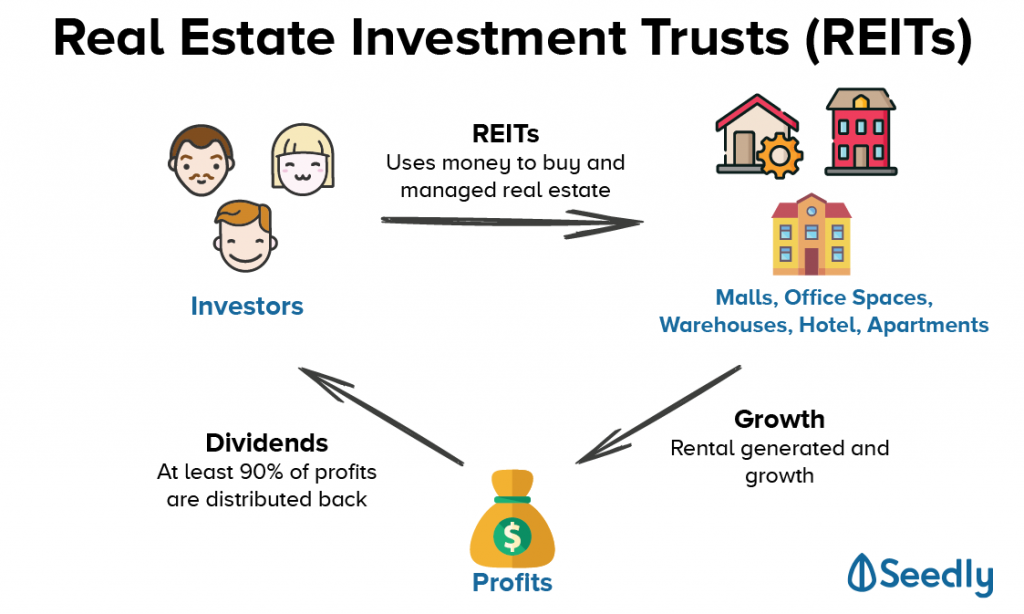

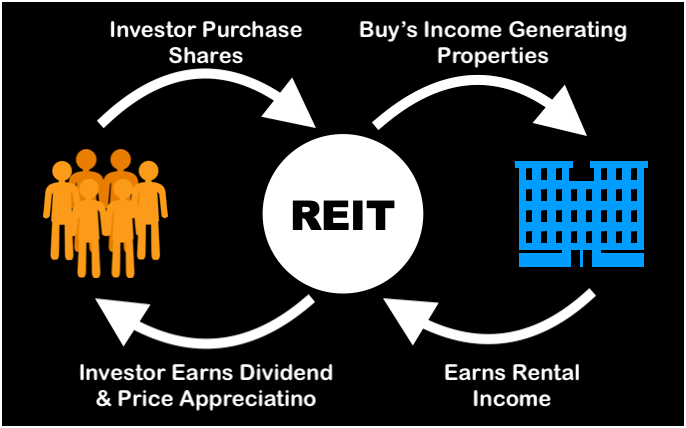

To make it simple for you, Real Estate Investment Trusts are investment schemes that own and manage income-producing real estate, usually through which investors own, operate, and finance income-generating properties. Similar to mutual funds, REITs procure capital from multiple investors and make it attainable for individual investors to procure dividends and profits from these investments. A REIT invests in physical real estate and distributes profits from rental income and capital gains to its shareholders.

Types of REIT Stocks

Equity REITs

Equity real estate investment trusts acquire, manage, build, renovate, and sell income-producing real estate. Their revenues are mainly generated through rental incomes on their real estate holdings and hence income is comparatively easy to predict and capture, usually increasing over time (asset appreciation) – which is why investors usually prefer to invest in equity REITs mainly.

Assume a REIT company X purchases a housing building with funds raised from investors and leases out the space to tenants. Company X now owns, manages and is responsible for operating this real estate property and collects rent every month and hence company X is considered an equity REIT. Equity REITs includes but is not limited to office buildings, apartments, shopping centers, or self-storage facilities. Some equity REITs are diversified and may own multiple types of properties.

Debt REITs

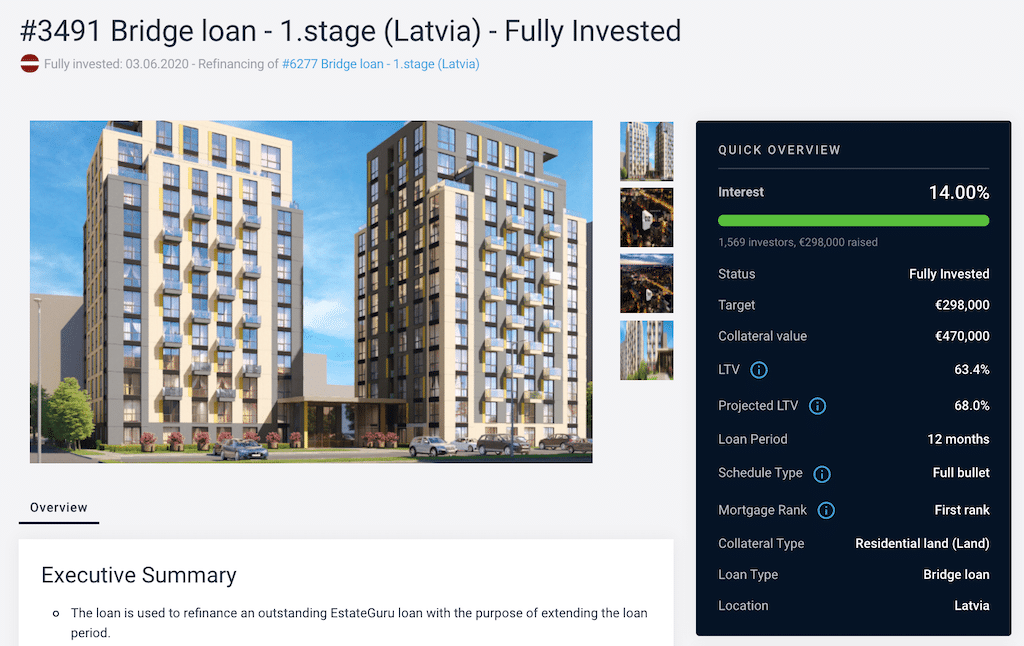

As the term explains, mREITs or debt REITs lend capital to real estate buyers as loan, debt-like instruments including first mortgages generating revenue from interest earned on through these debt instruments. Investors usually buy shares in mREIT listed on stock exchange, or through any mutual fund or exchange traded fund but mainly since mREITs provide comparatively higher dividends.

Similar to equity REITs, mREITs are to allocate at least 90% of their annual taxable income to shareholders. For instance, company Y is a REIT and gives out loans to a real estate sponsor. Contrary to company X, company Y generates revenue from the interest earned on the loans and hence, therefore, company Y is a mortgage or debt REIT.

Hybrid REITs

As the term itself indicates, hybrid REITs own properties and mortgage loans. This combination of property appreciation and dividends can produce significantly high total returns with relatively low risk.

W.P. Carey Inc. (NYSE: WPC) is an example of a hybrid, top REIT. W.P. Carey’s main business is owning properties, with a portfolio of 866 properties that generated 91% of its adjusted funds from operation. However, the company has an investment management division that invests in REITs and provides and loans capital to other builders and property owners.

What qualifies as REIT?

Before you invest in REITs, you need to see whether your investment agent qualifies as a real estate investment trust, the criteria of which is;

- the majority of the firm’s assets and income must be real estate investment related

- the company will pay 90% of the taxable income as dividends to its shareholders annually

- the company will be managed by trustees or a board of directors

- at least 100 shareholders after the first year of operation

- at least half of the shares must be held by six or more individuals during the second half of the year

- Shares shall be transferable

- the company will operate as a taxable corporation

How REITs work? How to invest?

As an investor, you buy REIT securities through ETFs or mutual funds on stock exchanges like NYSE or Nasdaq after carefully doing your due diligence like you would do on stocks since REITs operate like stocks.

As explained in the figure above, you invest some capital and buy/manage real estate, generating rent and other revenue from these services and ultimately profiting as dividends are distributed (at least 90% profit will be given back to you!)

Before we go ahead, REITs are either public or private companies, with the majority being publicly owned, separated mainly through transparency and liquidity.

Private REITs

Private REITs are comparatively illiquid and come under no compulsion of registration with the security and exchange commission (SEC), meaning you may face difficulty accessing the capital you invested and may not be fully aware of its proceedings. Moreover, private REITs usually have higher fees typically 20%-30% of profits, and don’t disclose much information to the public meaning, not every investor can buy into this type of REIT.

Private REITs are sold via broker-dealer, meaning they procure high commission usually around 2-3% of the profit, and are offered to only well-reputed investors. Since they are mostly illiquid, you may only be able to sell a portion of your holdings at certain times each year and also come with great risk hence aren’t the go-to while talking about REITs. They typically have high minimum investments that range from $1,000 to $25,000 (or more).

Public REITs

This will most likely be where you will invest in REIT, public REITs are listed relatively liquid and are listed on stock exchanges where you can easily buy and sell their shares. Public REITs usually offer transparency as opposed to private since they register with SEC disclosing information needed before investing.

If you are looking to invest in REITs, this is the way to go. Publicly traded REITs have minimum purchases as low as the price of one share, making these REITs accessible to almost anyone, particularly beginners. Moreover, publicly traded REITs can be purchased and sold whenever the stock exchange is open making it easy for you to always understand the cash value of your investment!

A good place for you to start is VICI Properties Inc. (VICI), which is considered the fastest-growing REIT and has a price of $30.48. VICI owns gaming, hospitality, and entertainment destinations.

The stock price for VICI generally increased in the year 2020-2021, peaking in April at $32.5 showcasing just how swiftly the company recovered from the pandemic and grew fastly.

Public Non-Traded REITs

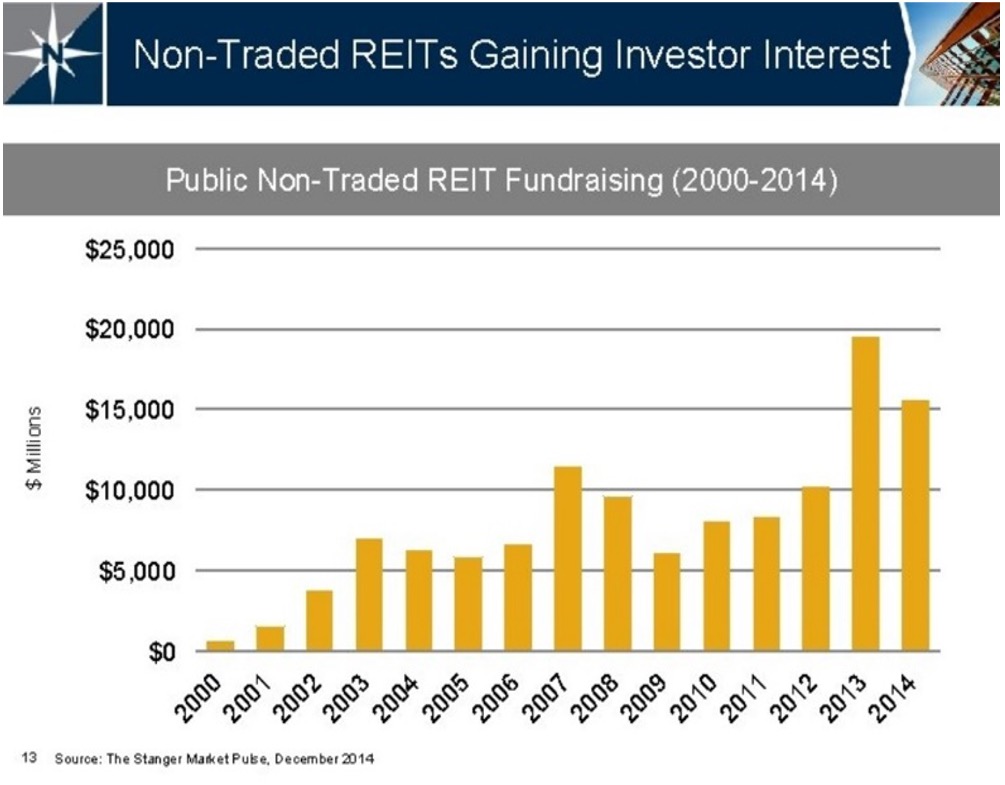

These are not traded on major stock exchanges and hence are also relatively less liquid investments but come with good transparency since they too must register with the SEC and disclose quarterly, annual financial reports making them a good place to begin REIT investment with. They usually have a minimum investment requirement of $1,000 to $2,500 hence if you’re an early investor, this comes with great returns!

By 2000, small investments started to get integrated in the society with individuals looking for return on their capital and seeking opportunities to invest, hence, public non-traded REITs fundraising only increased as show in the graph below, peaking in 2013 at $19,00.

DiversyFund, Realty Mogul and such crowdfunding real estate investing platforms offer a way to invest in public unlisted REITs.

REIT from an Investor Perspective

As an investor, REIT is the way to go since it offers you consistency and stability, both of which promise return on your investments. REITs provide you with reliable income, significant dividends, and capital appreciation.

REITs are your choice of investment as they pave the way for small investors to invest in real estate giving you revenue in shape of rental income, through a proper entity procuring higher profit along with safe investments. REITs enable broader investment portfolio and allow risk diversification; provide easy exit to real estate investors and enable daily pricing as REIT units are tradable on stock exchange.

Income

Dissimilar to bonds, REITs cater towards income as well as capital appreciation since the value of assets usually grows with time hence in the long term, REIT values tend to increase by reinvesting capital into a property. Moreover, given REITs provide with high dividends, you get a consistent revenue stream.

Diversification

Unlike stocks which are driven by business cycle, REITs follow the real estate cycle which has absolutely no correlation with each other. Hence, as the prices of stocks took an all time low as the pandemic emerged, most real estate investments went on with their business adding diversity in your portfolio as an investor.

Inflation Production

As prices of goods and services increase under inflation, real estate tends to remain stable as the value of real estate assets increases along with the rental rate for real estate investments.

Thereafter, income from your real estate investments increases which leads to an increase in dividends eventually handing you stable and consistent earning.

Liquidity

Unlike actual real estate property, as an investor, you can readily buy and sell REIT stocks through major exchanges and avail cash in no time.

A researcher summarized it as:

The effort involved in buying a REIT stock (a few clicks) is a tiny fraction of the effort involved in researching, acquiring, closing, and managing real estate investments privately.

No Corporate Tax

To be considered a REIT, your company needs to invest at least 3/4th of assets in real estate and pay a minimum of 90% of taxable income to shareholders, gaining a big tax advantage.

High Dividend Yield

Since REITs demand a minimum of 90% taxable income to be distributed to shareholders, they tend to have above-average yields. The average stock on S&P 500 yields less than 2% whereas REITs usually yield no less than 5% hence REITs become an excellent choice for those wanting to invest but are risk-averse.

Best REITs

According to the National Association of Real Estate Investment Trusts, this year (2021), REITs alongside commercial real estate are onto their road to recovery from the wounds opened by the pandemic, considering vaccine distribution and its effect.

Americold Realty Trust

Americold Realty Trust gained massive benefit as Covid-19 spreads through the globe since it is an essential link in the farm-to-table supply chain. The publicly traded real estate investment fund has acquired a total of 185 cold-storage warehouses spanning almost 1 billion cubic feet of storage space across America, Canada, South America, and Australia having a noticeable clientele including but not limited to ConAgra (NYSE:CAG), Unilever (NYSE:UL), Kraft Heinz (NASDAQ:KHC), and Kroger (NYSE:KR).

The REIT is also expanding by acquiring a privately owned agro merchants group in a deal worth $1.74 billion. Despite the economic meltdown covid caused, EPS and sales rose to 39.8% and 14.1% over a year and hence financial analysts believe the next year would reach an all time 14% and 22% respectively.

This massive high EPS indicates that Americold is profiting well, meaning significantly higher dividends for shareholders hence if you’re to invest, there are REIT stocks to invest into.

Vanguard Real Estate ETF (VNQ)

Well known for its low-cost index funds, vanguard real estate offers two varieties of its real-estate-investment-trust-focused index fund, a mutual fund and an exchange-traded fund both having an expense ratio of 0.12% — this means that for every $10,000 you have invested in the fund, you’ll pay $12 in annual expenses to Vanguard.

The mutual fund version is the Vanguard Real Estate Index Fund Admiral Shares (NASDAQMUTFUND: VGSLX) which has a $3,000 minimum investment however the Vanguard Real Estate ETF (NYSEMKT: VNQ) has no minimum investment. You can invest in it by purchasing one share, which is priced at approximately $87.

This RIET has a dividend yield of 3.21% meaning showing great financial health of the company and good performance by the company.

Global Medical REIT Inc. (NYSE: GMRE)

Global Medical REIT Inc. is a net-lease medical office REIT functioning in the health care REITs acquiring purpose-built specialized healthcare facilities to lease to healthcare systems. In the first quarter of 2021, Global Medical REIT Inc. revenue was $27.35 million, up by 26.33% year over year, and beating estimates by $1.61 million. Global Medical REIT Inc. (NYSE: GMRE) has also gained about 18.62% in the past 6 months and 22.22% year to date.

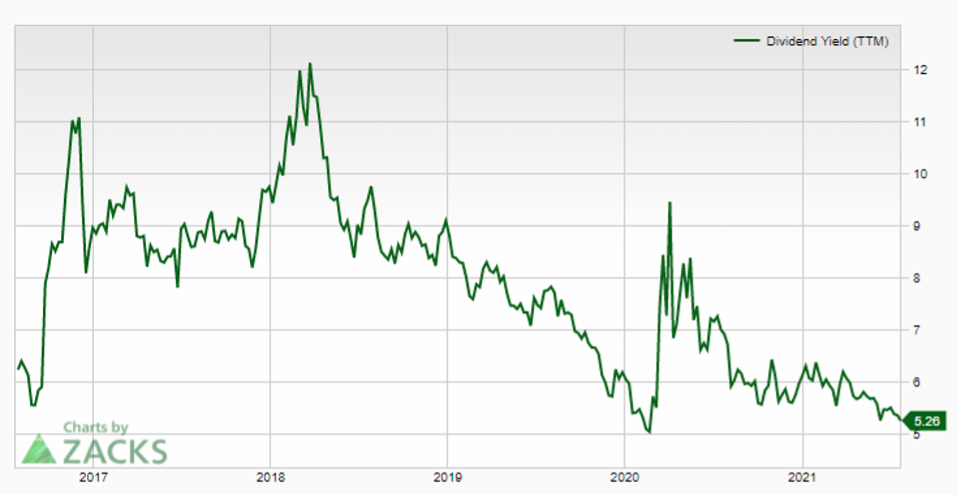

The graph below showcases the dividend yield of Global Medical REIT Inc for 2017-2021 showcasing the fluctuations GMRE faced and how it smoothly grew in event of the spread of the novel virus, Covid.

Moreover, GMRE has had a dividend yield of 5.26% compared to the REIT and Equity Trust – Other industry’s yield of 2.82 making GMRE stand out and becoming your ultimate choice for investment!

Conclusion

Hence, as an investor, there are multiple things you need to keep in mind while looking at real estate investment funds, however it is pivotal to understand there is no black and white when it comes to investing and a little risk troubles no one. You can decide for yourself if you choose private REITs or public but whatever you may decide, chances of profiting are way more than for going in loss.