Introduction: Why Forex Trading?

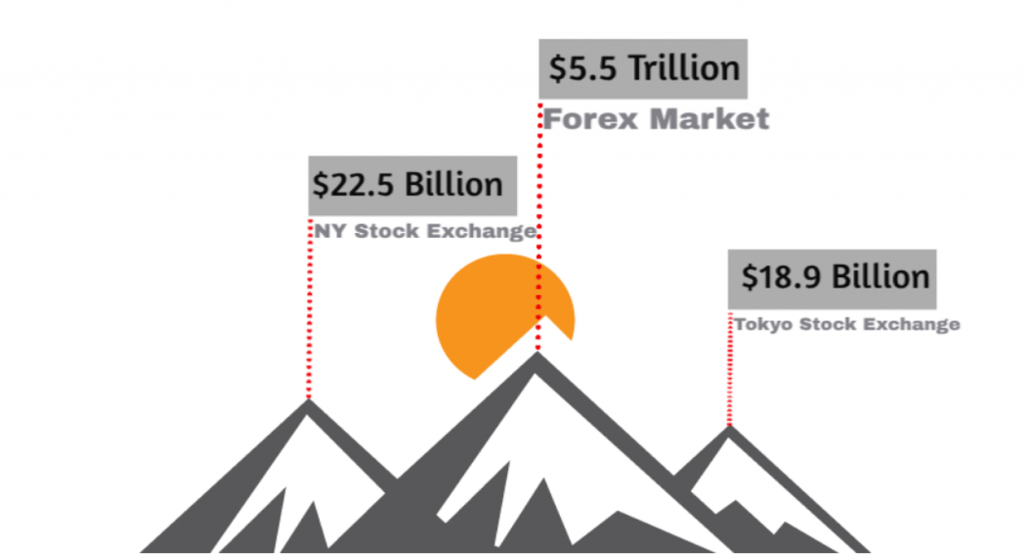

Trading in financial markets is one of the most profitable ways to make money online, for this purpose we would like to show you the best forex trading platforms. You get to make profits from the swings in prices of various financial assets. While there are many financial markets to choose from, one of the best is the forex market. Many other markets are limited by a number of restrictions and downsides.

One such restriction is that of time as several of these markets are only open at certain hours of the day. That means market participants can only take advantage of trading opportunities during the open hours. Furthermore, these other markets are not as large and as volatile as the currency or forex market.

The benefits of trading in the forex market far outweigh those of trading in any of all other markets. For one, the forex market is regarded as the largest of all the financial markets; the total daily turnover done in the market is over $6 trillion. Still, despite this already humongous size, the market keeps growing at an average rate of 7%. As a result of this size, the market is known to be highly liquid, that is, traders and investors in the market can easily enter and exit trades almost instantly.

By far, one of the most significant selling points of the forex market is that the market is almost always accessible for trading. It is always open, 24 hours all through a working week (24/5). This means that traders can always get trading opportunities at any point in time, and as such, they can adapt trading to their lifestyles. Finally, there is the feature of leverage, through which traders can take larger positions in the market, but only commit a small percentage of the amount required.

What is a Forex Trading Platform and why do you need it?

With all the above benefits and more, there is no debating the fact that the forex market is the place to be. However, to trade this market there is the need to register with a trading platform. The same applies to all other markets. For instance, to trade stocks, you need to get registered with a broker. Without the forex trading platform, you really cannot get to trade or participate in the forex market.

Some people have the notion that the term “trading platform” is synonymous with “trading broker” while others think that they are different. The correct notion is somewhere in between. The trading platform is the trading software provided for you to make trades, while the trading broker is the company or firm that offers the platform. As a result, a lot of times, people simply refer to them as one and the same. This is also what we will do in this piece.

Why You Should Choose the Best Trading Platforms

Due to the ever-growing popularity of forex trading, several forex trading platforms offering trading services to people now exist. Depending on where you are located, there are hundreds of platforms, which is a good thing as it offers you freedom of choice. Nonetheless, you have to be careful when selecting trading platforms as not all platforms are worth trading with.

In fact, there have been several cases of people falling into scams as a result of signing up with the wrong trading platforms. Therefore, there is the need for you to only go for only the best trading platforms out there.

Selecting the best trading platforms amongst the several that exist is quite a difficult task. However, we have conducted extensive research and have come up with some of the best names. In this piece, we take a look at some of the best Forex trading platforms in 2022. Before doing so, however, there is a need to be aware of the criteria that we diligently applied to arrive at this list.

How to Choose the Best Forex Trading Platform

We did not pick the best Forex trading platforms just at random. We considered many factors that make them much better than most other Forex trading platforms. These factors include:

Regulation

We can say that this is one of the most important factors that any broker must possess. Being regulated here means that the Forex broker or platform is registered with credible financial regulatory bodies. Such regulatory bodies include the UK Financial Conduct Authority (FCA), the International Financial Commission (FinaCom), the Financial Services Commission (FSC), and the European Securities and Markets Authority (ESMA), amongst others.

There are valid reasons for being regulated. Most scam brokers are usually unregulated. Furthermore, government bodies that regulate these trading platforms take steps to ensure that the trader is protected. They stipulate rules and regulations that the trading platform must adhere to, and in case of a breach, they levy sanctions against these platforms.

Products Offered

Forex trading has grown over time, and innovations are introduced regularly. A crucial attribute of the top Forex trading platforms is that they are known to spearhead these innovations. For instance, we now have copy-trading and social trading as some of the new trends emerging in the Forex trading world. Quality trading platforms will offer you many of these new products.

Still talking about products, we can note that the range of assets and markets that you can trade on a platform is one way to select top Forex trading platforms. For instance, you should be able to trade a wide range of currency pairs. Then, apart from currencies, you should have access to other assets such as stocks, commodities, indices, and cryptocurrencies.

Technology

Another important factor that separates the top FX trading platforms from the others is the use of superior technology. As a retail Forex trader, you conduct every one of your trades over the internet using technology. The platform upon which you are executing the trades should be topnotch and not be prone to problems such as lags, slippages, and downtimes.

Fees and Spreads

To enable you to trade, FX trading platforms charge certain fees and charges and these come in the form of commissions and spreads. The leading Forex trading brokers are known to charge reasonable fees because they prioritize customers having seamless trading experiences overcharging traders excessively for the services they offer.

Other Services

Apart from the standard factors, there are other features and services that the top Forex trading websites offer to traders. The key among these is customer service. For the best trading platforms, you can access customer service via multiple channels and their customer service is usually very responsive. Other services include bonuses, amongst other offers.

The Best Forex Trading Platforms in 2022

Having outlined the criteria for choosing the top Forex trading platforms, we hereby present a list of the best Forex trading brokers in 2022. This list is ranked, in which case we have the best first, followed by the others.

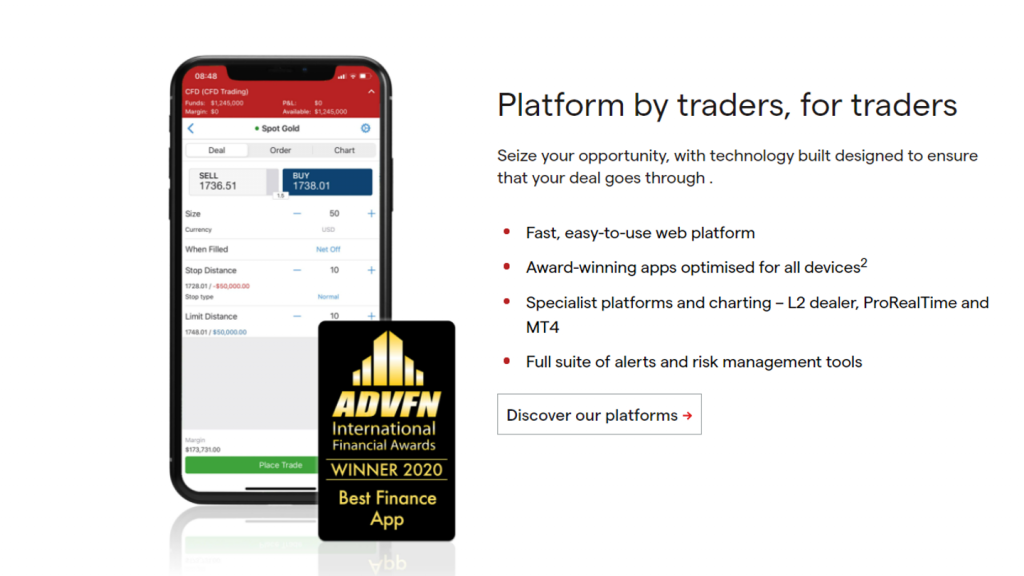

#1 IG Markets

Best overall broker

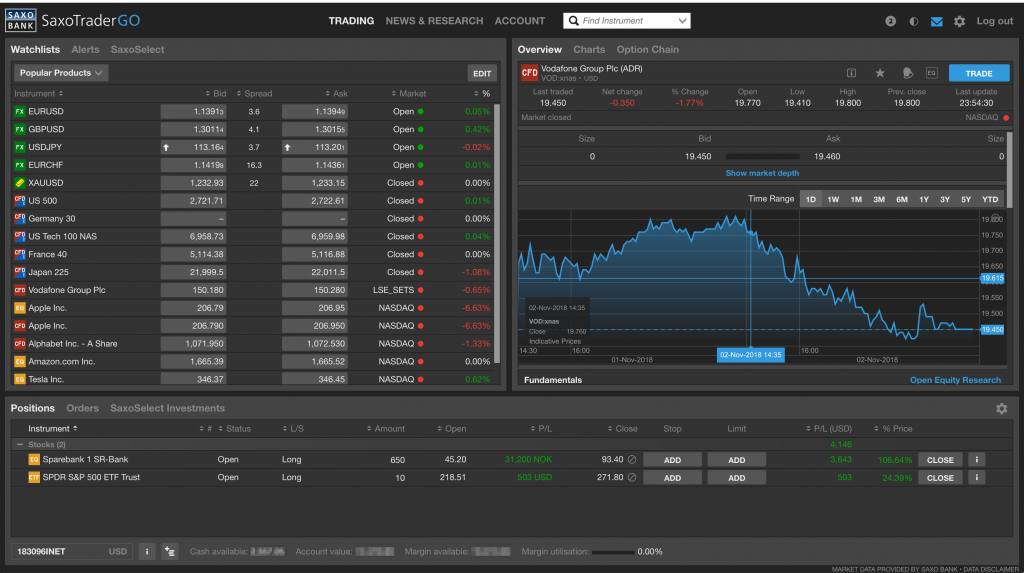

IG Markets can be safely regarded as the top Forex trading website in 2022. The firm, based in the UK, is a comprehensive derivatives trading broker. Several factors make IG Markets an undoubted leader. First, it boasts superior technology that is fast and easy to use, with minimal lags and downtimes.

It is a highly modern platform, offering one of the most diverse and widespread ranges of products and covering markets that may be regarded as non-traditional in the Forex/CFDs markets. These include futures and ETFs. A quick summary of the key features of IG Markets’ trading platform is given below:

- Available Platforms: Traders can access IG Markets trading services on MT4 and MT5, ProRealTime and WebTrader platforms. IG Markets also provides its own proprietary trading platform, L2 Dealer, which provides direct market access (DMA).

- Regulation: IG Markets is under the regulation of the FCA, UK, Commodity Futures Trading Commission (CFTC), US, and National Futures Association (NFA), US. As a result, it is available for trading in the US, UK, and most of Europe.

- Minimum Deposit: To trade with IG Markets, you need a minimum deposit of £250.

- Fees: Average spread ranges from 0.9 pips for EUR/USD and other majors and 5.4 pips for GBP/CAD. There are other fees for overnight trades and inactivity fees.

- Bonus: IG Markets does not offer any bonus for traders. There are, however, periodic offers.

- Tradable Products: Markets you can trade on IG Markets include currencies, stocks, indices, commodities, bonds, ETFs, cryptocurrencies, options, and even interest rates.

- Other Services: The customer service at IG Markets is available round-the-clock. Traders who prefer it can also get access to the Islamic account.

#2 Forex.com

Best for newbie traders

A top international Forex broker, FOREX.com offers graders access to a range of derivatives from CFDs to commodities, stocks, and more. Based in the United States, Forex.com is majority-owned by GAIN Capital Holdings, which is a publicly traded company listed on the NASDAQ. As a result, traders from the USA can trade with the company.

In fact, it will be discovered to be the top Forex broker in the US, when we consider the volume of customer funds.Forex.com provides traders with some of the lowest spreads around.

Some key features of Forex.com include:

- Available Platforms: Traders can access the broker’s services across MT4, MT5, Web Trading, and a Desktop Trading version.

- Regulation: It is registered with the CFTC, NFA (both in the USA), the FCA (UK), the Investment Industry Regulatory Organisation of Canada (IIROC), the Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS), amongst others. We can say that it is the most regulated broker on the list.

- Minimum Deposit: You need a minimum of $100 to trade with Forex.com.

- Fees: The spreads traders incur depend on the type of account they choose to trade with. Nevertheless, Forex.com spreads go as low as 0.1 for EUR/USD, which is one of the lowest in the industry. There are also swap fees for overnight trades.

- Bonus: Forex.com offers traders an array of bonuses of which the most popular is the Welcome Bonus. Traders get up to 20% of their initial deposit if they fund their trading accounts within 14 days of opening them.

- Tradable Products: With Forex.com, you can get to trade the stock market alongside.

- Other Services: The service offerings are all-encompassing. For instance, traders can access professional and institutional trading accounts.

#3 Pepperstone

Best for trading tools

Pepperstone is an Australia-based, but internationally-focused Forex broker. Some of the key selling points of this broker include tight spreads, a user-friendly trading platform, and quick trade executions. You should, however, note that Pepperstone is not available in the United States.

Some important pieces of information to note about Pepperstone include:

- Available Platforms: You can trade with Pepperstone via the MT4, MT5, as well as its own cTrader platform.

- Regulation: Pepperstone comes under the regulation of the FCA (UK), ASIC (Australia), and the Dubai Financial Services Authority (DFSA), UAE.

- Minimum Deposit: Pepperstone Features the lowest deposit requirement of all the platforms here at $0.

- Fees: Pepperstone offers ultra-tight spreads, featuring as low as 0.05 on Gold CFD and as low as 0.09 on EUR/USD.

- Bonus: Pepperstone does not offer bonuses to traders.

- Tradable Products: With Pepperstone, you get access to Forex, commodities, index CFDs, stocks as well as indices of currencies.

- Other Services: Pepperstone offers Social Trading, a feature through which traders can copy the trades of much more experienced traders. The broker has partnered with services such as Myfxbook and DupliTrade that enable traders to mirror others’ trades.

#4 CMC Markets

Best for next-generation trading

Another London, UK-based broker, CMC Markets is a leading global provider of quality derivatives trading services. The broker is listed on the London Stock Exchange (LSE) and has been at the forefront of providing quality services for over 30 years. You should, however, note that its services are not open to US-based traders.

Below summarized are what you should know about CMC Markets:

- Available Platforms: You can trade CMC Markets on the MT4 and web platforms. It also has its own in-house mobile app available for download on various app stores.

- Regulation: CMC is mainly regulated by the FCA UK. We should also note that since it is listed, it bears a greater burden of offering quality services and guaranteeing transparency in its conduct.

- Minimum Deposit: CMC Markets minimum deposit is the lowest here, as it is $0.

- Fees: The fees charged by CMC Markets include spreads, which range between 0.7 and 1.0 for major pairs. The spreads on indices are quite higher. Also, when trading stocks and ETFs, there is a commission charged.

- Bonus: CMC Markets has a referral/affiliate program where traders earn $250 for each referral.

- Tradable Products: CMC Markets offers trading across forex, indices, cryptocurrencies, commodities, stocks, stock ETFs and even treasuries. It also offers spread betting.

- Other Services: The broker offers innovative and next-generation trading tools that can enable traders to forecast market moves.

#5 eToro

Best in social trading

Based in the UK, eToro offers brokerage services in over 100 countries, including most of the US. The company is known to pioneer the copy trading feature, otherwise known as social trading.

Key features of eToro include:

- Available Platforms: The broker does not offer third-party trading platforms such as MT4 and Web Trader. eToro is best used on its popular proprietary mobile application which is available on both iOS and Android.

- Regulation: eToro is regulated by FCA (UK) and the Cyprus Securities and Exchange Commission (CySEC). With its CySEC license, it can offer services to most countries in the European Economic Area.

- Minimum Deposit: The minimum deposit required differs from country to country. For instance in the US, it is $50. However, in some other places it goes as high as $1,000.

- Fees: eToro offers commission-free trading across board, but charges fees for crypto trades and spreads for Forex positions.

- Bonus: Traders who refer others get $50 to invest in whatever markets. This is alongside the $50 in cryptocurrency offered as bonus for purchasing your first crypto coins through the platform.

- Tradable Products: Apart from CFDs and derivatives on Forex, stocks, and indices, traders can also buy and own actual stocks. Then, eToro is also fast becoming a market leader in cryptocurrency trading.

- Other Services: eToro’s flagship product is social trading through the proprietary CopyTrader software. With it, traders can follow the positions of more experienced traders.

Comparison of the best forex trading platforms

IG Markets | Forex.com | Pepperstone | CMC Markets | eToro | |

Available Platforms | MT4, MT5 for mobile. ProRealTime, WebTrader, L2 Dealer for desktop. | MT4, MT5 for mobile. Desktop web trading platform. | MT$4, MT5, cTrader for both mobile and desktop | MT4, MT5, and web trading platform both on mobile and desktop. The CMC mobile app. | eToro mobile app, available on iOS and Android. |

Areas Available | 16 countries, including US & some EU member-states. | All over the world, including the US, Canada, UK and some EU countries. | All over the world – in 65 countries. Not available in the US. | All over the world, including the UK, US and EU. | Available in the UK and EU. Limited availability in the US. |

Fees | Between 0.9 pips for EUR/USD and 5.4 pips for GBP/CAD. There are also fees for overnight trades and inactivity. | As low as 0.1 pips for EUR/USD. There are swap fees for overnight trades. | As low as 0.05 for Gold CFDs and 0.09 for EUR/USD. | Between 0.7 and 1.0 for major currency pairs. Commission charges for Stocks and ETFs trades. | Commission-free trading, but charges for crypto trades and spreads for forex positions |

Minimum Deposit | £250 | $100 | $0 | $0 | $50 in the US. Varies all over the world |

No. of registered investors | Over 178,000 clients | Over 200,000 users | Over 57,000 users. | Over 60,000 active traders. | 20 million users across products |

Tradable Products | Currencies, Stocks, Indices, Commodities, Bonds, ETFs, Cryptocurrencies, Options, Interest Rates | Forex, Metals, Indices, Stocks, Commodities | Forex, Commodities, Index CFDs, Stocks, Currency Indices | Forex, Indices, Cryptocurrencies, Commodities, Stocks, Stock ETFs, Treasuries. | CFDs, forex, stocks, indices, Cryptocurrencies |

Top Features | Best overall broker | Best for newbie traders | Best for trading tools | Best for next-generation trading | Best in social trading. |

A handful of benefits exist for choosing any of the above brokers. First, you can be assured of a seamless trading experience. You also get to avoid scams and phonies. Finally, these brokers are known to be innovative, and you can expect to enjoy new products from them from time to time.