Introduction

A stock simply means a unit of ownership in a company. Thus, when you own a stock, you own some part of a company, which you acquire by paying the price per unit of that stock. Members of the public who purchased the stock may also look to sell it to others, who may be interested in owning a piece of the business. They do this through a stock exchange. Most countries of the world have their own stock exchanges. And to purchase stocks on stock exchanges you need to use a stock broker (ideally picked from the top 10 stock brokers).

For instance, there are the New York Stock Exchange (NYSE) and National Association of Securities Dealers Automated Quotations (NASDAQ) in the United States; the London Stock Exchange (LSE) in the United Kingdom, and the Frankfurt Stock Exchange (FSE) in Germany. In Asia, top exchanges include the Japan Exchange Group and the Shanghai Stock Exchange in China.

This buying and selling brings about the creation of what is popularly known as the stock market. The stock market is one of the leading financial markets and investing in the stock market can be quite profitable. However, to be able to trade stocks, you need the services of what is known as a broker.

If you would like to read more information about the stock market, please look at our Stock Market course.

How a Stock Broker Works

Remember that stocks represent ownership of a company. Ideally, purchasing units of ownership of a company may be quite complex and complicated. This is because of the number of processes that will typically be involved. There are thousands of companies out there, and you may be interested in investing in the stocks of a number of them.

However, it is somewhat impossible to go about trying to purchase the stocks of each of them. In essence, you can’t go to Apple, IBM, Coca-Cola, The Walt Disney Company, and JP Morgan amongst many others, to purchase their stocks. That would be impracticable. The stock broker is essentially a middleman. They help you to seamlessly buy and sell stocks.

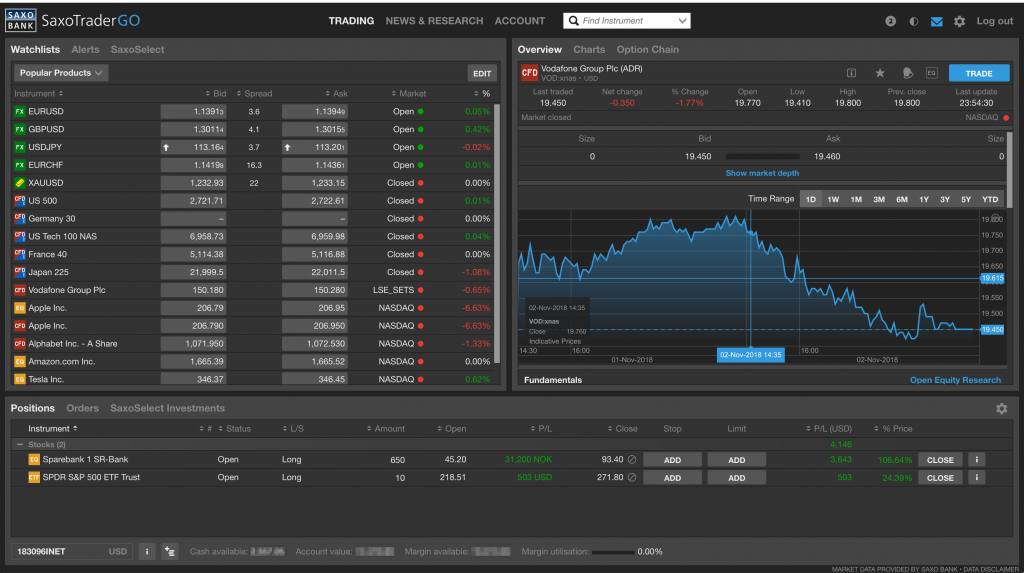

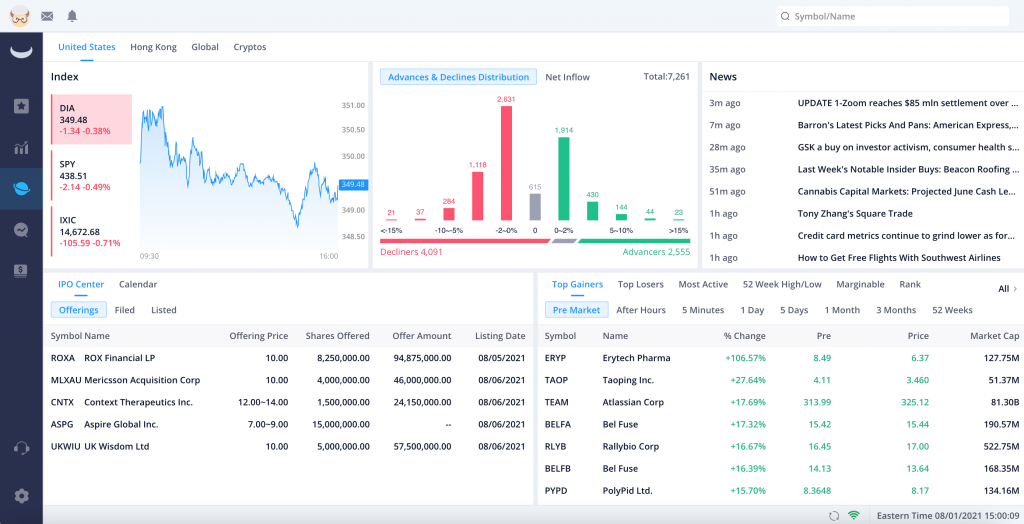

In the past, when people heard about stock brokers, they thought about Wall Street and an army of people in official suits receiving phone calls authorizing stock trades. While that used to be true, a whole lot has changed. Today, stock trading has become “cool”. Right from the corner of your room, you can get to buy and sell the stock of almost any company all over the internet. Nevertheless, to be able to trade stocks online, you will need a top stock trading platform or broker. That’sqhy, as part of this article, we look at the top 10 stock brokers for you to invest online in the stock market.

Why using the Top Online Stock Brokers in 2022

Online stock trading has become extremely popular in 2020, 2021, and will continue to be so even into 2022. In 2020 for instance, a record number of people started investing in the stock market, almost all of whom did so online due to the pandemic-induced lockdowns.

As a result of this rapid rise in popularity, there are a lot of companies looking to come into the market to provide this service. However, not many of them are credible or worth trading with. A lot of them come with juicy offers and bonuses but offer substandard services. You do not want to experience this.

Furthermore, stock trading involves committing your hard-earned capital through a broker, and getting to do so with the wrong brokers may lead to some unpalatable experience. As a result of the above, you should only go for the top stock brokers in 2022. In this piece, we take a look at the top 10 stock brokers in 2022.

Top 10 Stock Brokers in 2022

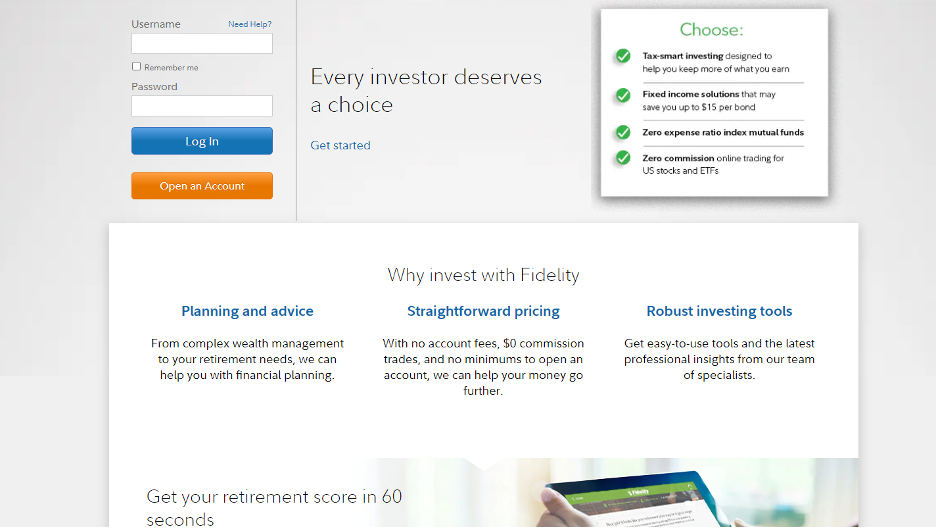

Fidelity Investments

Category: Best overall broker

Fidelity is well known as one of the largest asset management firms in the world, with trillions of dollars under management. It is also known for providing leading mutual funds.

However, its brokerage service is just as good. With superior technology, lots of research services, customizable screeners, and other features that aid trading and investing, Fidelity is the broker to beat.

Features include:

- Tradable Products: With Fidelity, you can trade everything from stocks to bonds, ETFs and options. It features more than 3,400 mutual funds. Traders can also trade fractional shares.

- Trading Platforms: Traders can access all its services via the Fidelity.com website. You can also go through the Active Trader Pro. Finally, mobile-savvy traders can download its Android or iOS mobile applications. All of these are free for all customers.

- Fees and Costs: Fidelity does not charge fees for stock trades. However for options trades, there is a $0.65 charge per contract.

- Minimum Deposit: Minimum required deposit is $0.

- Services: There is a free and comprehensive research service. The customer service is also topnotch as you can access them via multiple channels including phone, live chat, and email, as well as in-branch across 200 locations.

Furthermore, if you don’t trade for some time, your funds are deposited in a money market fund that generates some returns for you.

E-trade

Category: Best for trader education and analysis

Mainly online brokerage service, E-Trade has experienced a lot of growth in recent years due to its culture of introducing groundbreaking and innovative products and services to the investing public. This growth caught the eyes of the big players. In October 2020, it was acquired by the leading investment bank, Morgan Stanley, for $13 billion, but continues to retain the E-Trade brand.

Key features include:

- Tradable Products: Products tradable on E-Trade include stocks, fixed income, options, ETFs and futures. It offers well over 4,500 mutual funds to interested investors.

- Trading Platforms: Fidelity provides arguably the most diverse set of trading platforms to traders. Traders can trade on the web via its E-Trade Web and Power E-Trade proprietary platforms, while it provides the E-Trade and Power E-Trade mobile applications both on Android and iOS.

- Fees and Costs: While there are no stock trading fees, there is the $0.65 per options contract. Other fees include transfer-out fees and closing fees.

- Minimum Deposit: Minimum requirement is $0.

- Services: E-Trade provides traders with excellent educational resources and a diverse range of tools for analysis. It also provides portfolio-building tools.

TD Ameritrade

Category: Best for trading tools

TD Ameritrade is a broker that prioritizes the interests of the customers and goes the extra mile to offer the best services to traders. This is evident in all of its product offerings across categories. From having one of the largest offerings of tradable products to having the highest number of customer service channels, TD Ameritrade clearly leads the pack. Another innovative product is the trading simulator.

Its quality and growth was noticed by the brokerage giant, Charles Schwab which then acquired it for $26 billion. Important points to note about TD Ameritrade include:

- Tradable Products: With TD Ameritrade, you have the largest offerings of securities on the list. Apart from stocks, you can trade options, futures, and ETFs. Surprisingly, you can also trade Forex and cryptocurrencies. Even more surprising is that TD Ameritrade also provides American Depository Receipts (ADRs) of foreign stocks; also, qualified investors can participate in IPO trades. Apart from these exotic products, you still have the usual mutual funds and fixed income.

- Trading Platforms: On the web, you can trade via the TD Ameritrade Web and another proprietary service, thinkorswim. On mobile, there is the TD Ameritrade Mobile and the thinkorswim Mobile as well.

- Fees and Costs: Just like others, there are no costs for stock trading while options attract $0.65 per contract. Then there is a $75 for full transfer.

- Minimum Deposit: Minimum requirement is $0.

- Services: TD Ameritrade offers a whole lot of services, many of which are innovative and unpopular.

- There is the virtual trading simulator where traders have up to $100,000 to paper trade.

- A wide range of research sources including pro research providers such as Argus and Morningstar, all offered for free.

- Apart from 300 walk-in branches, customers can access the customer service 24/7 via phone and can chat via social media from Apple Business Chat to Facebook Messenger and Twitter DM.

TradeStation

Category: Best for institutional traders

TradeStation is a popular brokerage service that enables traders to participate in various financial markets. TradeStation is more commonly identified with experienced traders. In the past, TradeStation was known for offering services to fund managers and more professional traders; however, it is gradually becoming popular even with beginner traders, especially with its TS GO service which offers $0 trading.

Then there is TS Select which is for experienced investors.

- Tradable Products: You can trade stocks, bonds, futures, ETFs, cryptocurrencies, and mutual funds.

- Trading Platforms: There is both a web trading platform and also a mobile application.

- Fees and Costs: The commissions charged by TradeStation are complex and complicated. There are different levels of charges for stocks, options, and mutual funds trading. There are also charges such as an annual IRA account fee and outgoing account fee.

- Minimum Deposit: The minimum depends on the account type you go for. For the TS GO, it is $0, but for the TS Select, it is $2,000.

- Services: There is a range of educational resources and commendable customer service. There is also a number of premium tools made free.

ZacksTrade

Category: Best for international trading

Zacks is more of a traditional broker which has a strong online presence. Thus, it is somewhat best for traders with an institutional outlook and portfolio managers, amongst others.

This explains why it offers traders access to the service of making trading orders over the phone, and also the reason why its charges are high.

Its key features are:

- Tradable Products: You can trade stocks, fractional shares, ETFs, options, bonds and up to 4,200 mutual funds.

- Trading Platforms: For its web trading platform, it has three levels of platforms, including Zacks Trade Pro, Zacks Trader, and Client Portal. Then there is a mobile app, the Handy Trader.

- Fees and Costs: For stock trading, there is a cost of 1 cent per share. Then, for their options trading, the charge is higher at $1 for the first trade and $0.75 after that. There are also charges for withdrawals, amongst other commissions.

- Minimum Deposit: For Zacks Trade, this is on the very high side; you need at least $2,500.

- Services: On this side, Zacks Trade does not do so well, at least comparatively, especially when we consider customer service.

However, one aspect where Zacks Trade leads the pack is in providing access to international exchanges. So you can trade foreign stocks on it.

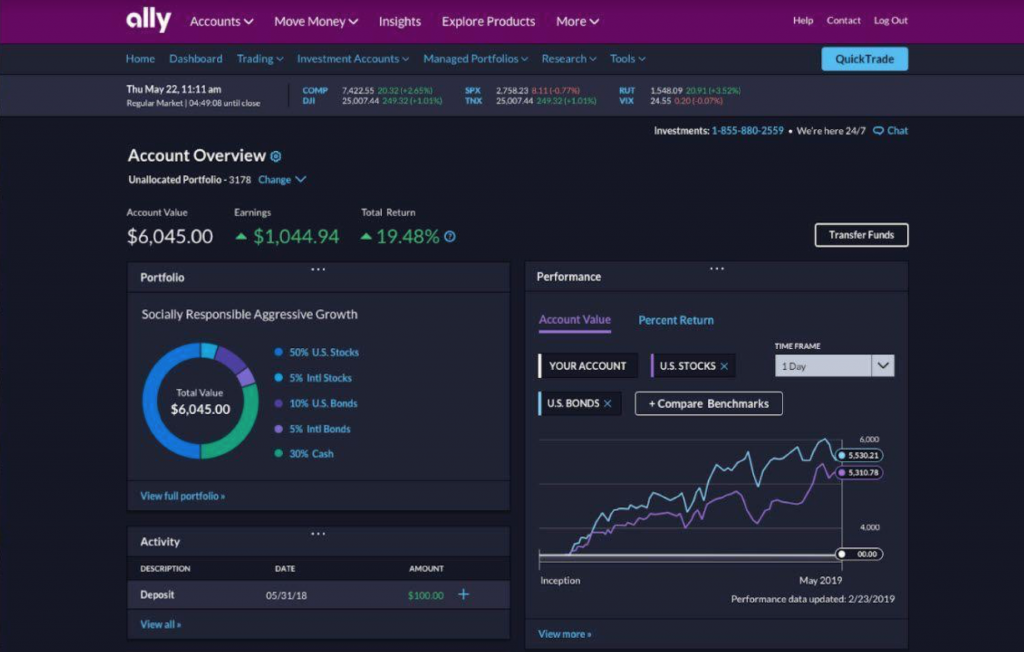

Ally Invest

Category: Best for juicy offers and bonuses

If we talk about innovation as regards brokerage services, Ally Invest appears to be at the forefront. It has invested into differentiating itself in terms of product coverage as well as the fees it charges on those profits. It also offers a lot of automation in its tools.

Finally, with Ally Invest, traders get access to really attractive promotions and bonuses amongst other perks.

Check its features below:

- Tradable Products: As per products you can trade on Ally Invest, you have stocks, mutual funds, bonds, ETFs, and options. In addition, you also have Forex (major currency pairs) and penny stocks. You don’t find these with many other brokers.

- Trading Platforms: There is a browser-based trading platform that provides high-quality analysis, research, and data tools for free. Then, you can also get all of these on the Ally Invest mobile application.

- Fees and Costs: Ally Invest’s fees measure quite well with other brokerage firms, and are even a bit cheaper when you consider its $0.50 options trade per contract charge.

- Minimum Deposit: You don’t have to deposit any funds.

- Services: From time to time, Ally Invest traders get juicy offers and bonuses to boost their trading accounts.

WebBull

Category: Best for customer care and seamless services

Founded in 2017, less than 5 years ago, WeBull is one of the latest entries into the online brokerage industry. Since establishment, it has acquired over 10 million users and a SEC approval to operate a robo-advisor. In January 2021, on the heels of the GameStop shot squeeze, it recorded its highest number of daily users – almost a million. Headquartered in New York, WeBull does not currently accept non-US residents.

Launched in 2017, WeBull followed the model of other newbie-focused brokerages and positioned its platform to attract new traders. However, WeBull is still popular with experienced traders for its advanced technical analysis and charting tools.

Key features include:

- Tradable Products: With WeBull, you have access to stocks, options, ETFs, ADRs, and cryptocurrencies. There are, however, no bonds and mutual funds.

- Trading Platforms: There is a browser-based platform alongside downloadable desktop software. WeBull also has a highly rated mobile app, available on both app stores.

- Fees and Costs: WeBull offers one of the cheapest trading services, with $0 fees across board. Even options trading is free.

- Minimum Deposit: There is no minimum deposit.

- Services: Apart from the ultra-low fees, it features a minimalist platform which attracts scores of new traders.

Interactive Brokers

Category: Best for a variety of products

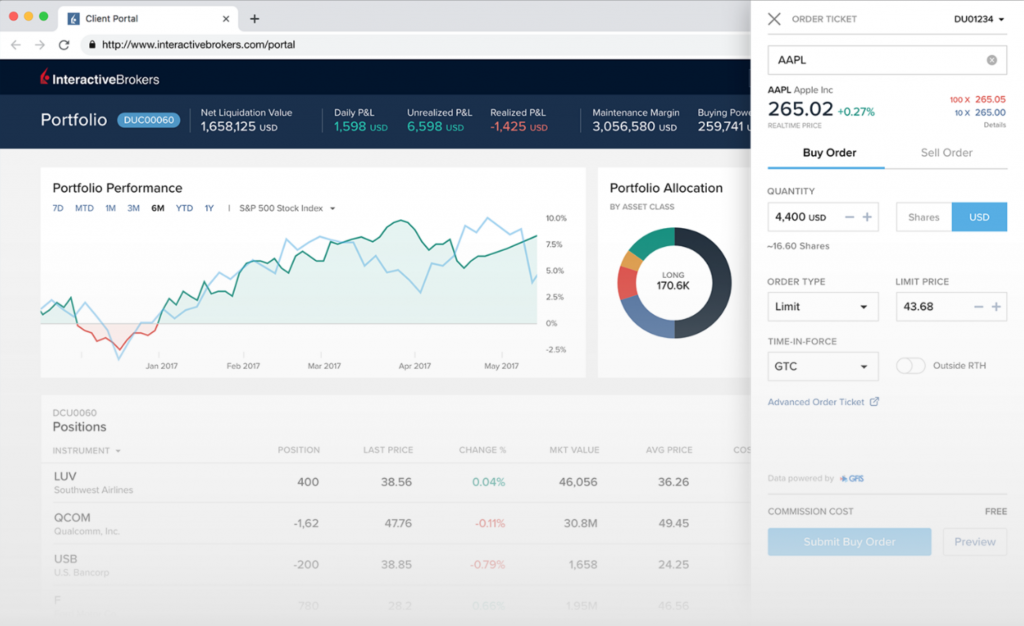

Interactive Brokers is one of those brokers that have captured both ends of the market quite well, that are both advanced and inexperienced traders. With its IBRK Lite product, newbie traders can get to invest in US-based stocks and ETFs. The IBRK Pro, however, goes further to offer investors access to more than 100 exchanges spread across over 30 countries.

The products available are not limited to stocks; you also have mutual funds, bonds, and futures.Its features include:

- Tradable Products: Another broker with a heavy portfolio of tradable products, Ally Invest simply gives you everything, including stocks, mutual funds, bonds, fractional shares, futures, options and more exotic stuff such as Forex and metals.

- Trading Platforms: Both IBRK Lite and Pro members can utilise the third-party Client Portal as well as the increasingly popular Trader Workstation. There is also the mobile app.

- Fees and Costs: Trading stocks on Interactive Brokers costs $1 per trade. And, if, as a Pro client, you have less than $100,000 in your account, you need to generate a minimum of $10 in commission every month so that an inactivity fee will not be levied on you. The charges for option trading are quite similar to what obtains in the industry.

- Minimum Deposit: The minimum deposit is $0.

- Services: IBRK goes the extra mile to show that it is the best broker that caters to both ends of the market.

Furthermore, it has helped facilitate investments internationally, as it is recognized for helping other brokers do the same.

Robinhood

Category: Best for newbie traders

Robinhood needs no introduction; it is a leading internet brokerage service. It can be said that Robinhood singularly popularised the concept of online trading, and has become a household name for it.

However, it has increasingly come under regulatory and customer backlash. Nevertheless, it still remains a top-notch online stock broker.

The features are:

- Tradable Products: These include ETFs, options, ADRs for more than 250 companies, fractional shares, and cryptocurrencies.

- Trading Platforms: While Robinhood has a web trading platform, it is best known for its mobile app.

- Fees and Costs: Fees for trading are free across the board. However, there are some account-related charges.

- Minimum Deposit: If you make use of the Robinhood basic account, as well as Gold account, there is no minimum deposit. However, those who use margin accounts need at least $2,000. This is not a figure set by Robinhood; it was mandated by the regulator.

- Services: Of the array of services offered by Robinhood, it doesn’t seem like the company does well with customer care.

It, however, provides top-notch user experience.

SoFi Active Investing

Category: Best for next-generation and tech-driven investing.

SoFi Active Investing, more commonly known simply as SoFi, is the newest of all these platforms, and although it has built quite a reputation, it still has a long way to go. Being launched out of Silicon Valley, the company is essentially a brokerage startup, and in delivering these brokerage services, employs a lot of technological tools.

Some key features of the broker include:

- Tradable Products: You get stocks, fractional shares, ETFs, and cryptocurrencies if you trade with SoFi. However, you don’t get other popular assets such as mutual funds and fixed income. Also, not all stocks are available on SoFi.

- Trading Platforms: The web trading platform is not so full-fledged, but it offers a suite of products via the mobile app.

- Fees and Costs: SoFi fees are largely comparable to what obtains with larger brokers. There are no commissions on stock and ETFs trades, but options contracts attract a charge of $0.75 per contract.

- Minimum Deposit: This is $0.

- Services: SoFi prioritises tech much more than other brokers. For example, it regularly releases the SoFi Automated Investing to help traders make quality data-driven investing decisions.

Top 10 Stock Brokers comparison

Fidelity | E-Trade | TD Ameritrade | TradeStation | ZacksTrade | Ally Invest | WeBull | Interactive Brokers | Robinhood | SoFi | |

Trading Platforms | Desktop web trading on Fidelity.com and the Active Trader Pro. Android and iOS apps. | E-Trade Web and Power E-Trade for desktop and E-Trade and Power E-Trade mobile apps | TD Ameritrade Web and thinkorswim web for desktop. TD Ameritrade Mobile and thinkorswimMobile for mobile apps. | TS Select and TS GO web trading and mobile trading platforms. | ZacksTrade Pro, ZacksTrader and Client Portal for desktop web trading. | A browser trading platform available on desktop and mobile. There is also an Ally Invest mobile app. | A downloadable desktop software and a mobile app. | Third-party platforms, Client Portal and Trader Workstation. There is a mobile app. | Best known for its mobile app. There is a web trading platform as well. | A not-so-common web trading platform and a mobile app. |

Countries Available | Available in 24 countries including the US, UK and the EU. | Only available in the US | Over 100 countries including the US, EU and UK. | Available in 33 countries, including the US, UK and EU. | Available in 194 countries, including the US and EU. | Only available in the US | Available in the US and 9 other countries, but not in the EU. | Over 200 countries including US, UK and all across the EU | All over the world, except in a few including Cuba, North Korea and Syria | Only available in the US. |

Fees | Commission-free stock trades. $0.65 charge per contract | No stock trading fees. $0.65 for each options contract. | No stock trading fees. $0.65 per contract on options. There is a $75 charge for full transfer. | There are different levels of charges for stocks, options and mutual funds. | There is 1 cent per share for stock trading. $0.75 per contract for options trades. | Stock trades attract no fees. Its charge per options contract is $0.50. | Both options and stock trades are free. | A commission of $1 per trade. | $0 for most products; but there are other account-related charges | $0 on stock trading but $0.75per contract for options trades. |

Minimum Deposit | $0 | $0 | $0 | $0 | $2,500 | $0 | $0 | $0 | Robinhood Basic – $0. Robinhood Gold – $2,000. | $0 |

No. of registered investors | Over 26 million clients | Over 5.2 million users | 11 million users. | Over 150,000 monthly active traders. | N/A | Over 400,000 customers | Over 11 million countries | Over 600,000 users | 18 million users | 7.5+ million users |

Tradable Products | Stocks, ETFs. Bonds, Options | Stocks, Fixed Income, Options, ETFs, and Futures. | Stocks, Options, Futures, ETFs, ADRs, IPOs, mutual funds and fixed income. | Stocks, Bonds, Futures, ETFs, Cryptocurrencies, Mutual funds. | Stocks, Fractional Shares, ETFs, Options, Bonds, Mutual Funds | Stocks, options, ETFs, mutual funds and major forex pairs | Stocks, options, ETFs, ADRs, and cryptocurrencies. | Stocks, mutual funds, bonds, fractional shares, futures, options and forex and metals. | ETFs, options, ADRs, fractional shares, cryptocurrencies. | Stocks, ETFs, fractional shares and cryptocurrencies. |

Top Features | Best overall broker | Best for trader education and analysis. | Best for trading tools | Best for institutional traders | Best for international trading. | Best for juicy offer and bonuses | Best for customer care and seamless services. | Best for a variety of products. | Best for newbie traders – excellent interface and stellar simplicity. | Best for next-generation and tech-driven investing. |

These top 10 brokers in 2022 can offer you the best trading experience. You can do a careful study of the above to arrive at your broker of choice.