What is Forex Trading?

Welcome to our Forex Trading course! Forex trading is the simultaneous buying and selling of currencies. While the stock and cryptocurrency markets, for example, are for the trading of companies’ stocks and digital currencies respectively, the forex market, the world’s largest and most liquid financial market, is for the trading of countries’ currencies. As of April 2019, the Bank for International Settlements (BIS) put the daily trading volume for the market at $6.6 trillion.

Forex trading, investing in forex requires a great deal of technical knowledge and emotion, and risk management. In this course, we present some of the basic terminologies you need to understand to succeed, characteristics of the market that make it so attractive, how to go about analyzing and investing in it, and the best platforms to use.

Basic Forex Trading Terminologies

Before you even think of making your first forex trade, you should understand some specific important terms. To succeed in forex trading, ignorance is not a strategy. Let’s get into our next forex trading course topic, the basic terminologies.

Currency Pair

In forex trading, as you are buying a currency so are you selling another. As a result, currencies are traded in pairs, an arrangement that helps to easily compare the value of one currency to another. The first currency is known as the base currency while the second is the quote or counter currency.

For example, the EUR in EURUSD is the base currency while the USD is the quote or counter currency. In every forex transaction, when you buy a currency pair, you buy the base currency. On the other hand, when you sell a currency pair, you buy the quote or counter currency.

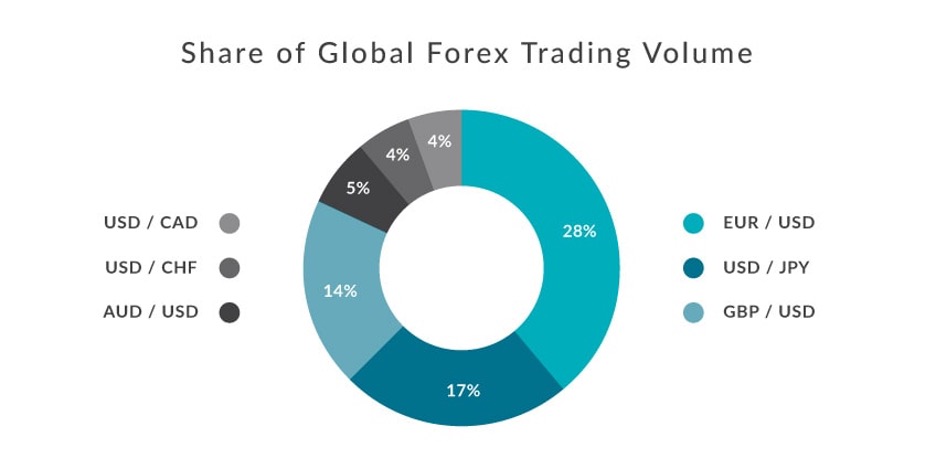

Currency pairs are grouped as majors, minors, and exotics. A major currency pair is made up of the USD and another currency. They are EURUSD, USDJPY, GBPUSD, USDCAD, AUDUSD, NZDUSD, and USDCHF, 7 altogether. These pairs are the most frequently traded and liquid, with the lowest trading costs – sometimes as low as half a pip.

The minor pairs do not comprise the USD, and include the EURGBP, EURJPY, GBPJPY, GBPCAD, CHFJPY, and EURAUD. Those pairs are not as frequently traded as the majors and are also not as liquid. Also, they attract higher trading costs – ranging from 2 to 3 or 4 pips.

Finally, the least frequently traded currency pairs are the exotic pairs which are made up of major currencies (EUR, USD, JPY, GBP, AUD, CAD, and CHF) and currencies of developing countries or emerging economies. An example is the Euro/Turkish Lira (EURTRY). These pairs take the highest costs to trade – as high as 100 pips!

Pip

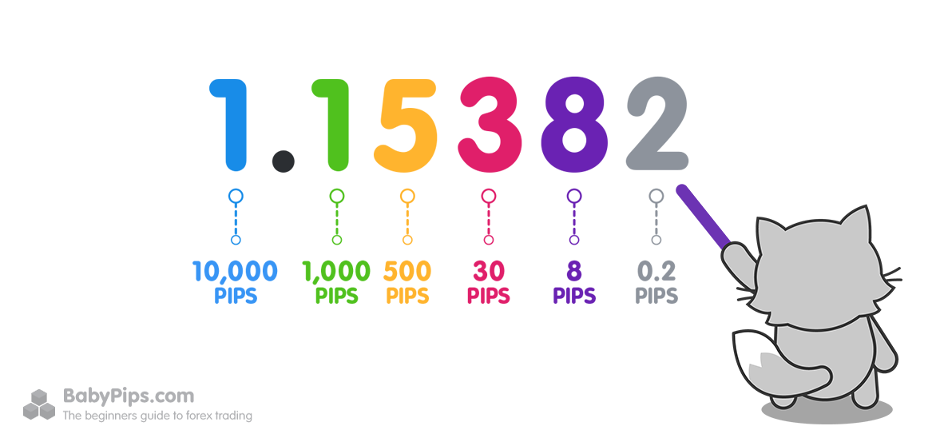

A pip is the smallest change that the exchange rate or price of a currency pair can undergo. For example, the exchange rate of EURUSD changing from 1.2555 to 1.2556 translates to a 1-pip change. Similarly, a move from 1.2234 to 1.2240 is a change of 6 pips.

Notably, the exchange rates of all currency pairs have four decimal points. Only those currency pairs containing the Japanese yen (JPY) have 2 (USDJPY = 82.51).

Lot

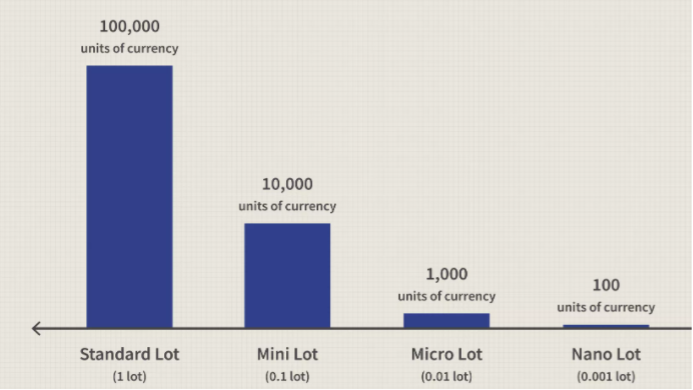

Stocks are traded in units of shares. Currencies, on the other hand, are traded in lots. A lot size is the number of units of the base currency that you buy or sell when you buy or sell a pair. In forex trading, “lot” is the unit of measurement. There are four types of lot size you can trade: standard, mini, micro, and nano. The standard lot size is made up of 100,000 units of the base currency. The mini lot is made up of 10,000 units. Finally, while the micro lot contains 1,000 units of the base currency, the nano lot has just 100 units of it.

On USD-funded trading accounts and for all currency pairs in which the USD is listed second (the quote or counter currency, that is) such as the EURUSD, GBPUSD, and AUDUSD, for a standard lot, a change of 1 pip is always equivalent to $10. For a mini lot, it is $1. For micro and nano lots respectively, it is $0.1 and $0.01. However, for those pairs in which the USD is not the quote or counter currency, the value of a pip depends on the exchange rate and the lot size.

To calculate the monetary value of a pip for those pairs, you divide 1pip (0.0001) by the prevailing exchange rate of the currency pair being traded and then multiply the result by the lot size. For example, if the USDCAD is currently trading at an exchange rate of 1.4000, the value of a pip will be (0.0001/1.4000) multiplied by 100,000 = $7.14.

Characteristics of the Forex Market

Another crucial topic of this forex trading course is about those characteristics of the forex market that make it attractive for many individuals to want to invest in? They include:

Decentralization

New York Stock Exchange (NYSE). Nasdaq. London Stock Exchange (LSE). Euronext. Every stock exchange in the world is centralized and so, has a physical address. However, that is not so for the forex market, a decentralized financial market. As a result, operating mostly over-the-counter, the forex market does not have a specific physical address; instead, it electronically connects currency traders and dealers across the world.

Because of the decentralization of the forex market, you can participate in it and deal directly with buyers and sellers, with just an internet-enabled computer, from the comfort of your room, anywhere in the world, without any regulatory hassle – unlike with stocks.

Liquidity

The forex market is the world’s largest financial market – with a daily trading volume of $6.6 trillion as of April 2019. Because of this huge size, it is highly liquid, meaning that participants in it can easily and quickly enter and close their trades without instantly causing significant changes in price. This high liquidity of the forex market helps forex traders to easily convert their currency holdings into cash – almost anytime, at will.

Opens 24/6

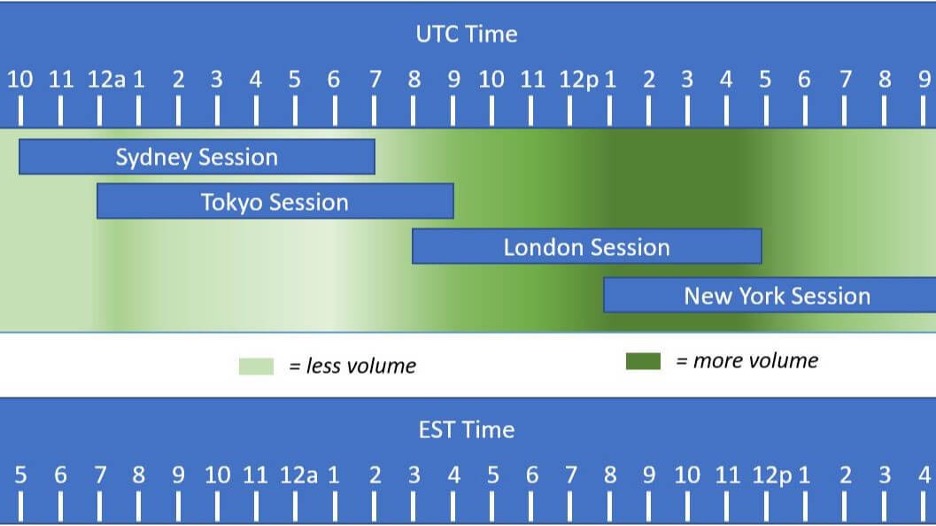

Being decentralized, the forex market opens 24 hours every day from 5 p.m. Sunday to 5 p.m. Friday Eastern Standard Time (EST) – unlike the stock market which opens for just some hours every day without weekend days. This 24/6 feature makes it possible for anyone, irrespective of their time zone, to be able to participate in it. Based on time zone, the four major forex trading sessions around the world are:

Asian (Tokyo): The Asian trading session, with Tokyo being its major market, is always the first to open. It spans 7 p.m. to 4 a.m. EST.

Australian (Sydney): The Australian trading session, the smallest of the four, starts at 5 p.m. and ends at 2 a.m. EST. In terms of trading volume, this is the smallest of the four.

European (London): The European trading session has London as its major market and is active between 3 a.m. and noon EST.

American (New York): The American trading session is concentrated in New York, the financial capital of the world. It opens at 8 a.m. and closes at 5 p.m. EST.

Apparently, the best hours to trade in the forex market will be when it is most active. Those hours tend to be when the four trading sessions overlap, as follows:

- American/European (8 a.m. to noon EST)

- Australian/Asian (7 p.m. to 2 a.m EST)

- European/Asian (3 a.m. to 4 a.m. EST)

Hence, if you want to engage in forex trading, those are the best hours for you to consider as they tend to present the best of opportunities for profit.

Little Capital Requirement

Forex trading requires low capital and overall costs. In fact, forex is the cheapest financial instrument to trade. For example, most retail brokers require as little as $25 to open an account. While it is not recommended you start trading forex with so small, this little capital requirement stands in stark contrast to stock trading for which a minimum of $25,000 is legally required to day trade.

High Leverage

If there is a feature that makes the forex market so attractive compared to other financial markets, it is leverage. Leverage is the use of borrowed capital to trade. It is a provision made by forex brokers to traders to help the latter maximize small price changes in currency pairs. As a result, leverage enables Forex traders to magnify their profits. However, it is a double-edged sword: as it can help increase profits so can it also magnify losses.

Margin trading is based on leverage. To open a forex trade and keep it open, you need to put up a margin which is like a deposit or collateral. For example, if you want to open a position of $100, 000 worth of EURUSD, your broker may require you to provide just $1, 000 in deposit. In that case, $1, 000 is your margin and 1:100 is your leverage.

How to Invest in Forex Trading

We could provide you this forex trading course without explaining in details How do you invest in forex? The process can be broken down into the following simple steps:

- Open a brokerage account: To access the forex market, you need a brokerage account. There are many brokers such as IG, CMC Markets, and Saxo Bank. You can choose from any of them, but what is important is that you choose a licensed, credible one with standard leverage and margin requirements, and fast execution speed, amongst other desirable features.

- Fund your trading account: Forex trading is the business of using money to make more money. While you can start it with even as little as $10, it is recommended you commit a far larger sum to your forex trading career to stave off undercapitalization risks and improve your profit potentials.

- Develop and use a trading strategy: Becoming a successful investor in the forex market requires a strategy, a plan. You need to have a set of conditions that must be met and a set of rules that must be followed before you can place a trade. Your trading decisions should be educated, not based on mere gut feelings. Fundamental and technical analyses are the two popular approaches to analyzing the forex market.

- Monitor your investment: How frequently you check your trading account is largely a function of your trading strategy or style. For example, if you are a short-term trader (a scalper or a day trader), you will have to be actively monitoring your account, every time. However, if you are a long-term trader (swing trader or position trader), you can afford to commit lesser time. Nevertheless, no matter the trading style you use, as a forex trader, monitoring your investment from time to time is a must.

- Manage your emotions and risks: In addition to being adept at analyzing the forex market, you also need to learn to manage your emotions and risks. This is important as fear, greed, and indecision are some of the negative emotions that can ruin your trading career – even before it kicks off.

Analysing the Forex Market

As earlier stated, before you start trading or investing in the forex market, you need to develop a strategy. The two approaches around which you can do that are here discussed:

Fundamental Analysis

When you apply fundamental analysis to a currency pair, you want to determine its intrinsic value, its fair price, its actual worth as opposed to its price. After doing that, you would then look at the price or exchange rate and see if you would be buying the pair at a discount or a premium. As a fundamental forex analyst and trader, you would analyze and make your trading decisions from news on the following economic and geopolitical factors:

Fundamental Analysis factors:

- Interest rate

- Inflation

- Unemployment rate

- Gross Domestic Product (GDP)

- Balance of Trade

- Public Debt, etc.

Countries with strong fundamentals tend to have strong currencies while the currencies of those with weak ones also tend to be weak. For example, when a country has a low unemployment rate, it means most of its citizens are actively engaged, its GDP is growing, and demand for its currency is high, leading to a boost in its value.

Technical Analysis

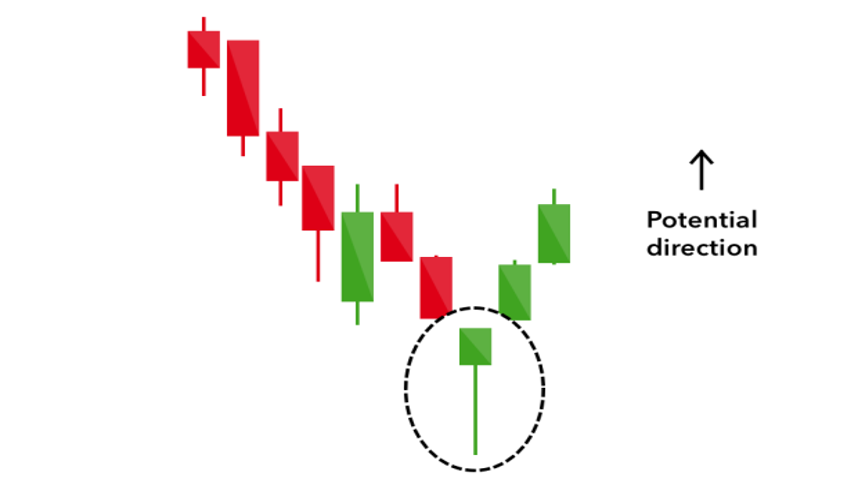

Technical analysis seeks to know how the price is doing at any time based on the three assumptions: Price reflects all the information there is to show about the market, the market moves in trends thereby making it predictable, and history repeats itself. “It is all in the charts,” technical analysis posits.

This approach to analyzing the forex market, therefore, uses a range of techniques such as charts and indicators to spot patterns and trends. Charts used in forex trading are of three types: line, bar, and candlestick (the most widely used of the three). Indicators are of four types: trend, momentum, volatility, and volume.

So, while a forex fundamental analyst weighs economic and geopolitical factors to determine strong currencies, a forex technical analyst, on the other hand, uses candlestick charts and indicators to do the same.

What are the Best Platforms for Forex Trading?

There are many brokers. You can choose any of them. However, you have to consider factors such as regulatory status, quality of analysis and trading platform and tools, range of offered investment products, availability of education resources, and commissions and fees. Based on these, the following five brokers are highly recommended to use:

- IG

- Saxo Bank

- TD Ameritrade

- CMC Markets

- eToro

We discuss them in detail in our next post.