When you want to choose a p2p lending platform, doing some research about the platform to facilitate your investment is one of the most crucial decisions that will not only affect the safety of your capital but also impact your earnings. If the Covid-19 outbreak has taught investors something is the importance of doing due diligence on the kind of platform you want to invest in.

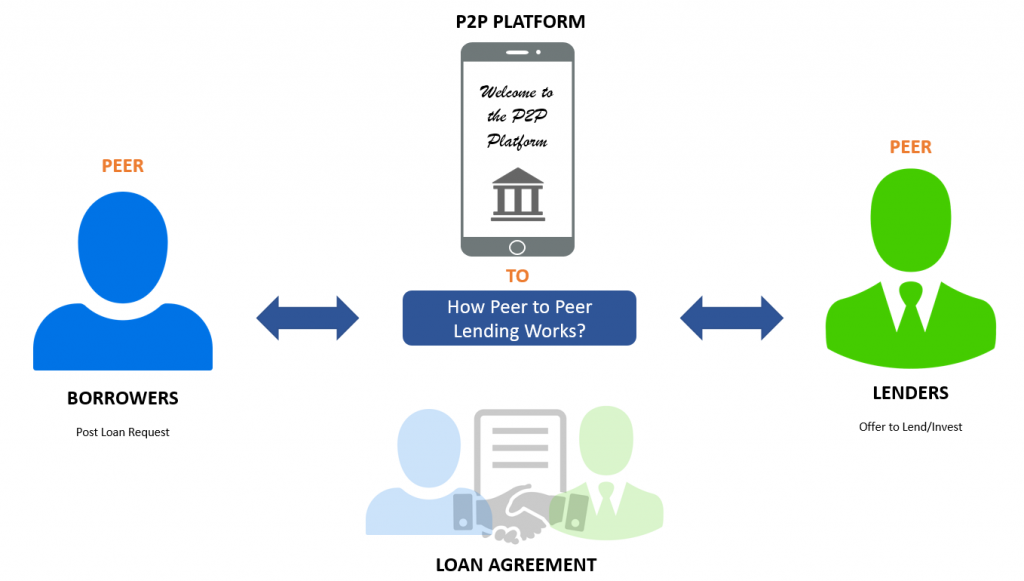

What is a p2p lending platform?

In a manner of speaking, a p2p lending platform is a middleman that links borrowers and lenders via the internet.

In recent years, the number of websites that facilitate direct lending has increased considerably with the adoption of p2p lending as an alternative method of financing. If you have decided to invest in peer-to-peer lending but still not sure which platform to use, you have come to the right place!

Here at Crowdfunding Platforms, we have been covering everything to do with peer-to-peer lending, and in this post, we are going to walk you through what you need to know when deciding the best p2p lending platform to use.

Criteria to choose a p2p lending platform

When it comes to choosing the right p2p lending platform to invest in, you want to pick the one that meets the following standards:

- Transparency

- Track record and history

- High liquidity

- Large volumes of investments with good returns

- Intuitive interface

The importance of the above criteria

So why are the above criteria incredibly important when it comes to choosing a p2p lending platform? By choosing a platform that fulfills those criteria, you can be almost guaranteed the safety of your investments as well as at least 10% interest annually from your portfolio.

Let’s see how each criterion is important when you want to choose a p2p lending platform.

Transparency

In the world of p2p lending, transparency is the currency of the day. The best platforms are always transparent and straightforward about how they make money. Their business model as well as investment numbers should be in the open for everyone to see.

One sign of a transparent p2p lending platform is how often the company updates their position and offer information about their balance sheet and any changes in their business model.

On the other hand, as an investor, it is good that you first read the terms and conditions of the platform before proceeding to invest.

The best place to find regular updates about the platform is on the blog and FAQ sections. You should also read the Privacy Policy page if you want some in-depth details about the platform and its operations.

Remember that before you start using a p2p lending platform, you will be asked to accept and agree to their terms and conditions, so make sure you read through this information. A study by Canary Claims in 2018 found that only 30% of the UK read terms and conditions when signing a financial agreement while another survey by Deloitte discovered that 91% of Americans agree to terms of service without reading it.

We understand that reading terms and conditions is not that interesting, and the legal terms don’t help either, but we strongly recommend that you read through it or at least have a quick glance.

Track record and history

Most p2p lending platforms don’t have decades of history, nevertheless, avoid putting your money on platforms that have been launched recently because such platforms usually don’t have transparency, and chances of you losing your money are high.

As you do your research on a particular p2p lending platform, make sure to look for the following data:

- Date of launch

- Amount of money earned in interest

- The number of active investors on the platform

- The number of loans funded

- Platform’s financial performance and status

- The average size of the platform’s portfolio.

But what exactly does the above mean? For instance, for how long should p2p lending be operating? How much has the platform paid to investors in form of interest? What is the accepted amount of funded loans? How many active investors does the platform have?

While this is not the written in stone rule, an ideal p2p platform should:

- Be at least three years old

- Distributed more than €1M in interest to investors

- Have funded at least €100M in loans

- Has over 10,000 actively participating investors

High liquidity

When it comes to p2p lending, there are two ways in which you can get your capital back:

- Waiting for the loan to mature or

- Selling your loan or portfolio on the secondary market

Generally, you want a p2p lending platform that can let you liquidate your portfolio easily, even if you are doing it for a long-term purpose.

An ideal platform should have a secondary market where you can sell off your loans whenever you want. However, keep in mind that most platforms charge a small fee for their secondary market services.

In addition to the secondary market, a platform should have mostly 30-day consumer loans, which means you don’t have to wait months before withdrawing your money.

You want to invest in a platform that makes it easier for you to withdraw your money once you change your mind about p2p lending investment. Also, the platform should allow you to withdraw your money free of charge.

Large volumes of investments with good returns

Just as with any kind of investment, you want loans that have the potential of high interest. So, when choosing a p2p lending platform, you need to study the risk and returns on the platform.

Understand the level of protection of your capital before proceeding to invest with the website. Ask questions and start gauging from there.

Are they taking too long to respond? And when they do, do they provide comprehensive answers to your questions?

If communication is not clear, that should be the first red flag and sign that you should probably look for another platform.

A great platform should also have large volumes of loans so you can choose and diversify your portfolio.

Bear in mind that the larger the number of loans a platform provides, the best and safe your investment will be.

Ideally, you don’t want your money to lie around in your account; you want it invested always, and with more loans, the greater the probability of this happening.

Intuitive interface

The last thing you want is to spend most of your time trying to unravel the functionality of a p2p lending platform. A good platform should be very user-friendly.

When you choose a p2p lending platform, make sure it is:

- Easy to create account

- Quick verification

- Easy and quick deposit

- Auto-invest feature

- And many more