What is a startup?

In order to understand what is Startup Crowdfunding, let first talked about what is a startup.

Startups are young companies, usually founded by a small team of 2-4 people and willing to develop a unique product or service. Startups are usually innovative and this product, service or business model, which should allow them to enter the market by their “disruptor” characteristic.

Most of the large corporations we know have passed through the startup stage. Think about Facebook, Amazon, Netflix, Google.

Traditional startups investing: Venture Capitals

To grow and expand a startup needs fundings. These fundings are usually provided by Venture Capital funds. These investment funds specialize to invest in startups and SMEs with their usual funds ranging from $50M to several hundreds of millions.

Venture Capital investments return higher profits than for example investing in the stock market, but the risks are also higher and more skills are needed in order to understand which startups could lead to great returns in the future.

Let’s also take a looks at the different stages of a startup where it generally raises money. These steps are called funding rounds:

- Pre-Seed: The concept and idea are developed

- Seed: MVPs and prototypes are developed

- Series A: The product is deployed on the market and adapted if needed (product-market fit)

- Series B: The startup scales to become a large company

- Public Initial Offering (IPO): The company is made available on the stock market. Anyone can invest in a public company, and the startup founders and early backers can sell their stakes to realize a big return on investment -> this is where you will usually be able to sell your share and make a lot of money when investing in a startup

Figure: Startups fundings stages (source: MintyMint)

Now most of the VCs invest in the Seed round, and some of them do also Pre-seed and a part of Serie A, and these are mostly the stages where you will be able to invest when investing in startup crowdfunding.

Innovative startup investing: Startup Crowdfunding

Startup crowdfunding is an alternative model to finance startups. Instead of the model we talked about before, startup crowdfunding removes the role of Venture Capital firms and allows instead retail investors (meaning normal people from home) to have the opportunity to invest and finance a startup.

So instead of heaving (usually) 1 to 3 Venture Capital funds investing several hundreds of thousands to several million each, there will be thousands of small investors (with investments raging) from $10 to $x thousands investing in a startup project.

Startup crowdfunding has two main categories :

- Equity crowdfunding: investors invest and receive in exchange a share of a company (called equity). These shares can then be sold usally 1) if the startup is sold to a larger company, 2) if the company is made available on the stock market by an IPO (Initial Public Offering). Some examples of startup funding websites are AngelList (US) and Seedrs (Europe).

- Rewards-based crowdfunding: investors invest and receive in exchange some sort of reward, usually the product from the startup at a cheaper price. Imagine for example investing in a startup building a next-generation connected watch, then you will get one or more of these watches in exchange for your investments (based on how much you invested). Some examples of startup funding sites are Kickstarter, GoFundMe, Fundable, Indiegogo and Crowdcube.

How Startup Crowdfunding works

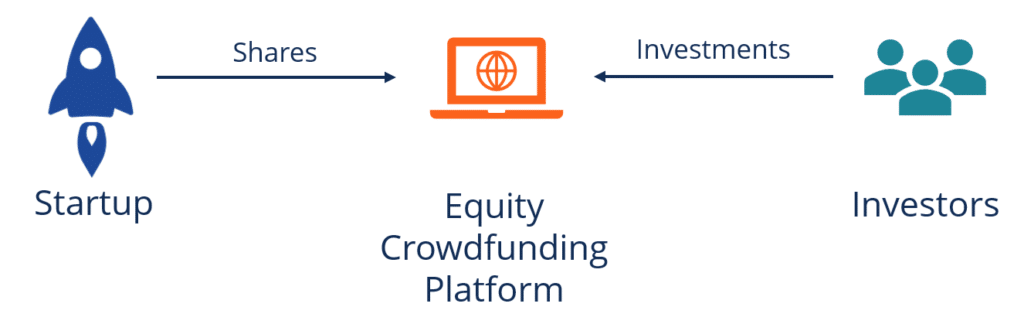

When investing in this field, there are always three parties involved (see figure below):

- The startup team: looking for fundings

- The startup crowdfunding platform: managing the funding campaign during when money will be raized while ensuring the security of the transaction and the legal papers

- Investors: investing their money in the startup via the platforms

Figure: How works Equity Crowdfunding (source: Corporatefinanceinstitute)

So let’s take a look step by steps at how it works concretely:

- As an investor, you have to find first of all a startup crowdfunding platforms (we will talk at the end of this article about the best ones).

- Once you have created an investor account, you will be able to browse through a catalog of startups requesting fundings. It’s basically like a marketplace for startups. There you will find the usual information that is included in a business plan (e.g. Unique Sales Proposition, description of the product or service, customers’ information, competitors, go-to-market strategy, the purpose of fundings, teams, ….). These pieces of information should allow you to judge (until a certain level) if you would like to invest in a project.

- Once you found the startup you want to invest in you can buy a piece of it, it will be a share percentage of it (based on the estimated total value of the startup and the money you are putting in).

- At the end of a funding campaign, once many investors did they transactions, the startup crowdfunding platform usually creates a company where all the investors will be shareholders, and this company will invest in the startup (this to avoid having too many small owners directly in the startup)

- To do this funding orchestrations investments platforms will collect a commission which is usually a percentage of the total transactions ranging from 5 to 10% (paid by the startup founders with the money collected).

Case study: Seedrs crowdfunding

Let now get more concrete and take a look at an investment example. In this case study, we will look at the equity crowdfunding investment available on the website called Seedrs.

Seedrs offers a large range of startups looking for fundings. Even renowned companies are using it. Revolut is for example planning a campaign in 2021 to collect around $4M fundings via Seeders.

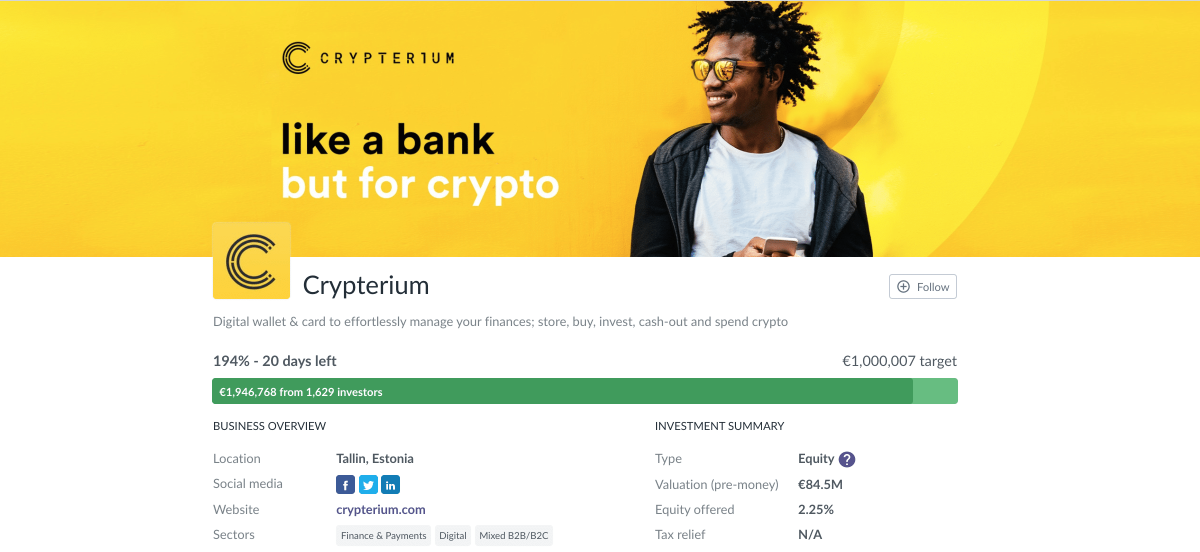

Now let’s look at our example. Below you will see the main page of our example, the Crypterium campaign.

Figure: Crypterium equity campaign (source: Seedrs)

When you look at the main information you can find:

- The name of the company: Crypterium

- The description: Digital wallet & card to effortlessly manage your finances

- The target money to be collected for this campaign: €1’000’007

- Type: Equity (which means you buy a piece of the company)

- The pre-money valuation (which is the estimated value of the company for the campaign): €84.5M

- The equity offered (which is the amount of share available to be purchased via the campaign): 2.25%

- Plus you will find more information on the customer base, the income, the expansion, the spendings, etc.

So let’s imagine that you now want to invest €1’000 in this company, let’s calculate how much percentage of the company you will own:

- €84.5M being the 100%

- €1’000 equal to 0.0012% – not so much right 😉

Now, this is already a pretty large company with a big valuation (being between Seria e A and B described above), but you can find companies valued at several hundreds of thousands where you can own a good part of the company.

And what you will be wishing for is that the company you invest in will go IPO (which means enter the stock market). And then even if you own only 0.001% of the company’s equity, the value you own will be massive.

Market size, growth, and forecast

The global crowdfunding market size (see figure below) is estimated at $13.93 B as of 2019 and is expected to reach in 2026 a value of $39.79 B with a CAGR of 16.18%. This being said the market is in clear expansion due to the high demand of funds by startups and a large number of retail investors willing to take more risk in venture investments.

Figure: Market size of crowdfunding worldwide in 2019 and 2026 (source: Statista)

Advantages & disadvantages

While being an exiting investments field, startup crowdfunding (via equity and rewards-based) carries alongs in advantages and disadvantages.

Advantages:

- high return investments (can do x5, x10 in 5-7 years)

- interesting and exciting investments in innovative businesses

- possibility to access a new segment of investments normally available only for professional investors

Disadvantages

- high risk (around 70% of startup don’t succeed in generating income and substantial returns in the long run)

- complexity and time needed to analyze, understand and evaluate investments

- exit not possible at any time (must wait that the company is sold and goes IPO)

Return on Investment (ROI)

Let’s have a look at historical data on returns in public (stocks) and private markets (source: Kingscrowd) to understand Rewards-based and Equity Crowdfunding returns.

The annualized public market return is 10.2%, while the annualized private market return is 26%.

This difference in return on investment (ROI) can make a large difference when investing. For example, if you started with $10’000 in your portfolio and invested during 20 years:

- on public market (e.g. via stocks): with a 10.2% internal rate of return, you would have $77,000.

- on the private market (e.g. via startup crowdfunding): with a 26% internal rate of return, you would have $1’813’000

Now you see then point 🙂 But you need to be willing to spend a larger amount of time analyzing your investments and diversifying between them to reduce considerably the risk of loss.

Best Startup Crowdfunding websites

Equity Crowdfunding platforms

Receive £25 free investment credit after successfully investing £150 or more within 30 days of signing up |

- Companisto (Europe)

- Crowdcube (Europe)

- FundedByMe (Europe)

- Invesdor (Europe)

- MyMicroInvest (Europe)

- AngelList (US)

- Wefunder (US)

- EquityNet (US)

- Crowdfunder (US)

- SeedInvets (US)

- MicroVentures (US)

Rewards-based Crowdfunding platforms

- Kickstarter (US): Kickstarter helps artists, musicians, filmmakers, designers, and other creators find the fundings to finance their venture. Over $2 B have been financed via Kickstarter by more than 10 million people.

- GoFundMe

- Fundable

- Crowdcube

- Patreon (US): Patreon is the world’s largest crowdfunding site for artists and creators.

- Indiegogo (US): Indiegogo funds projects that matter to founders, e.g. idea, charity or start-up business.

- Crowdfunder (UK): Crowdfunder offers Rewards, Community Shares and Equity options. Headquarters in the UK.

- Pozible (AUS): Pozible is an Australia-based yet global crowdfunding platform and community-building tool for creative projects, ideas and community projects.

- Vision Bakery (DE): Vision Bakery is operating since 2010 and aims to help strengthen awareness in society so that everyone can change things and make their visions come true.

- Thunderfund (AF): Thundafund is South Africa’s leading online Crowdfunding marketplace for creatives and innovators.