Ideally, when investors experience low-interest rates in their traditional savings account, they try to find other options that would beat that inflation. On average, bank saving rates are around 0-2% in the UK, which is available on limited balances and strict qualification demands. For this reason, the hunt for attractive returns has driven investors towards other options like p2p lending, stocks, and bonds.

However, the most appealing option for investors recently has been lending their finds through Innovative Finance ISA, which matches lenders with borrowers directly with potential returns of 5 to 8%; but with a higher level of risk than traditional savings accounts.

What exactly is IFISA?

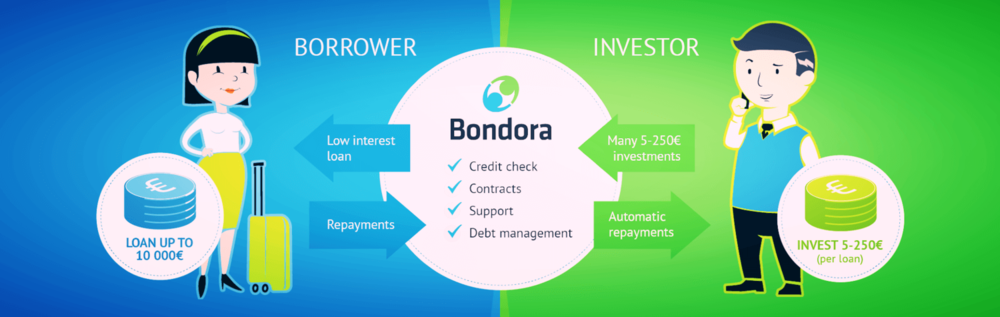

IFISA was launched back in 2016, as ISA peer-to-peer lending, lining all activities of p2p platforms so that small businesses can access finance without going to the bank. IFISA enables lenders to invest part or all of their annual ISA allowance through peer-to-peer lending and receive tax-free interest that is higher compared to cash ISAs and conventional saving products.

The higher potential rates are made possible due to the fact that p2p lending partially eliminates the “middle man” or traditional banks, thus reducing overheads and leaving more margins for investors.

Which p2p lending platforms offer IFISA?

Currently, the type of peer-to-peer platform that is eligible for IFISA is exclusively limited to debt-based p2p lending (also called Crowdlending). However, there have been talks around including equity-based p2p lending as well in the future.

The Rules of IFISA

IFISA investors lend directly to businesses and individuals through p2p lending platforms that are under the Financial Conduct Authority (FCA). As we have mentioned above, it is only debt-based loans that are permitted and not equity-based.

All taxpayers in the United Kingdom over 18 years have an annual ISA allowance. The provision allows individuals to invest the whole allowance in the IFISA or divide it between IFISA and other types of ISA. Investors are only allowed to invest in one IFISA every year but can invest in different ISA in the following years.

However, just like with other ISAs, your annual allowance cannot be rolled over to the incoming tax year, meaning you either use it or lose it.

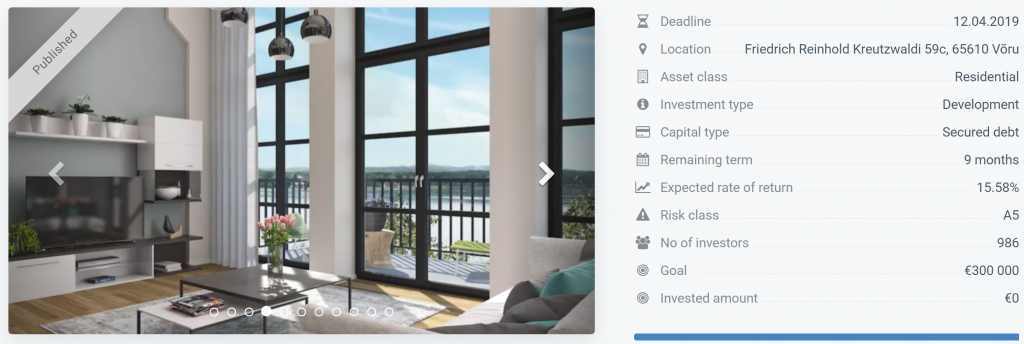

The Expected Returns

It is recommended that you invest in an IFISA only as a part of a balanced portfolio due to the levels of risk associated with them and also the fact that they are not regulated by the FSCS.

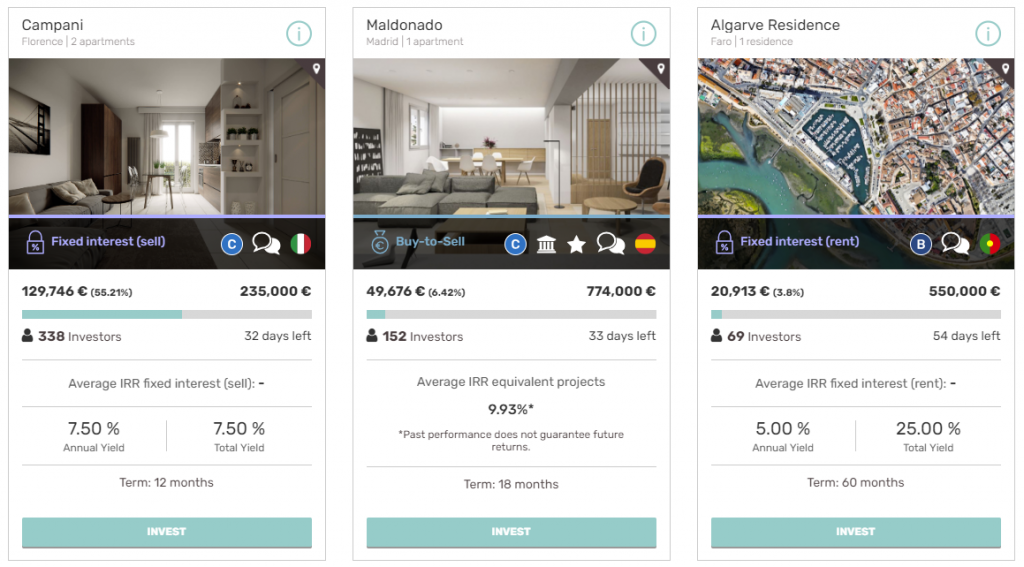

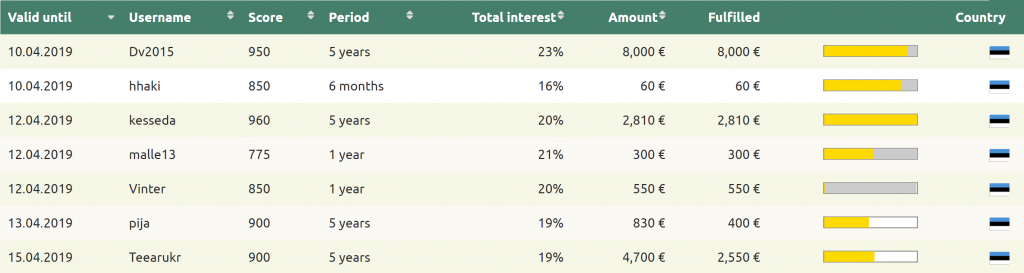

While most p2p lending advertises returns of between 5 and 8%, there are significant variations, and just as other types of loans in the platforms, the lower the rate the lower the risk.

Can you transfer your ISA?

You can transfer your ISA balances from stocks and shares ISAs or cash ISAs into an IFISA. But you must transfer the entire amount for the current tax year. However, you can transfer whatever amount you wish from ISAs from the past tax years and it will not affect your current tax year ISA allowance.

How to invest in IFISA to save p2p lending taxes

This investment normally involves a medium-term commitment for at least a year to give room for performance fluctuations as well as time to build a balanced portfolio. Diversifying your investment in a wide range of platforms and types of assets will help you effectively manage the risk and allocate your investment portfolio efficiently.

Currently, the biggest p2p platforms that offer IFISAs are Zopa, Ratesetter, Funding Circle, and Lending Crowd.

The above platforms generally have an impressive track record on protecting the assets of investors although Ratesetter was forced to pull a plug a 9 million euro gap for failed loan deal in 2017, while Zopa had to cut customer return rates after an increase in consumer bad debts.

Besides the mentioned platforms, there are new others that have been entering the market, without much history, so be careful and examine a platform before you deal with it.

Since the flexible ISA rule was introduced in 2016, cash ISA investors can withdraw and re-invest their funds in the same tax year without facing any penalties or affecting its tax-free status or its allowances.

Before investing in an IFISA, make sure you study the platform to see if they offer flexible ISAs since some do and others that don’t.

Generally, IFISAs don’t charge investors for using the platform but you may incur some charges like when transferring funds from your tax-free wrapper.

What are the IFISA risk factors?

The Innovative Finance ISA is still a growing market. Initially, there were 2’000 IFISA platforms during the 2018/17 tax year, but since then, new providers have launched products.

For a platform that wants to offer IFISAs, it must be first authorized by the FCA, which is also a mark of credibility, so make sure you check the platform’s FCA credentials.

[insert page=’cta-footer-crowdlending’ display=’content’]