What is an IPO?

An Initial Public Offering, commonly known as IPO, refers to offering shares of a private company to the public. The primary reason behind this is to raise the capital required by the company or corporation for further development of the company. As an investor, it can be interesting to make sure that in your portfolio you are investing in IPOs to diversify it from the standard stocks and ETFs you have in it.

Investing in IPOs can be highly fruitful for private investors. It allows them to participate in the long-term growth of the specific corporation from the beginning, and such corporations also include share premiums for current private investors. On the other hand, if you are a public investor, this opportunity can do wonders for you if you invest in a company that is here to bring a change.

To give you a perspective of how fruitful investing in IPO stocks can be; over the past 40 years, the shares of new investors in the IPO stocks jumped a massive 17.9 percent by the end of first trading day.

If we talk about the long-term potential, the Healthcare was the best performing sector for an IPO in the United States in 2020. The average return for this sector was 89 percent, and the primary reason was the rise of Covid-19 and the high demand for medical supplies. On the other hand, the lowest returns were provided by the communication services sector. This sector reaped an average return of 25 percent.

Recent IPO Stock Prices

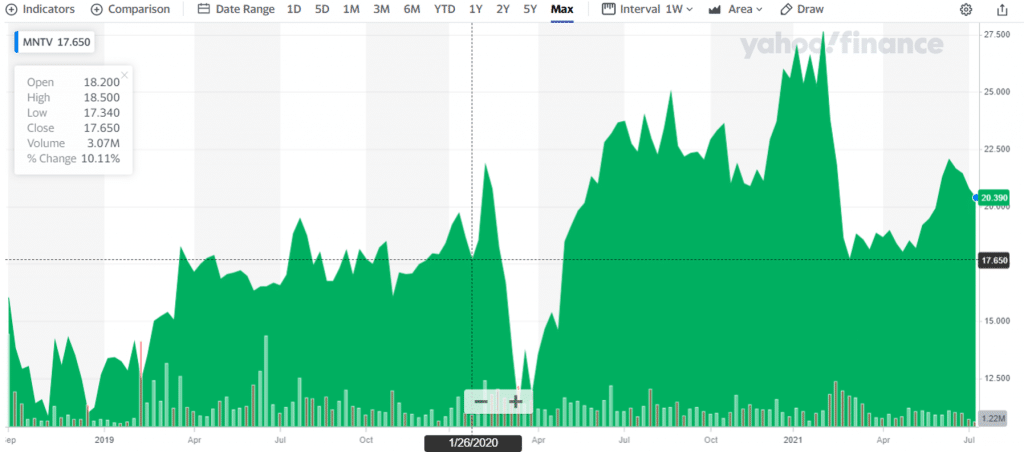

Let’s take a look at some recent IPOs between 2018 and 2020 that showed some impressive gains over the months.

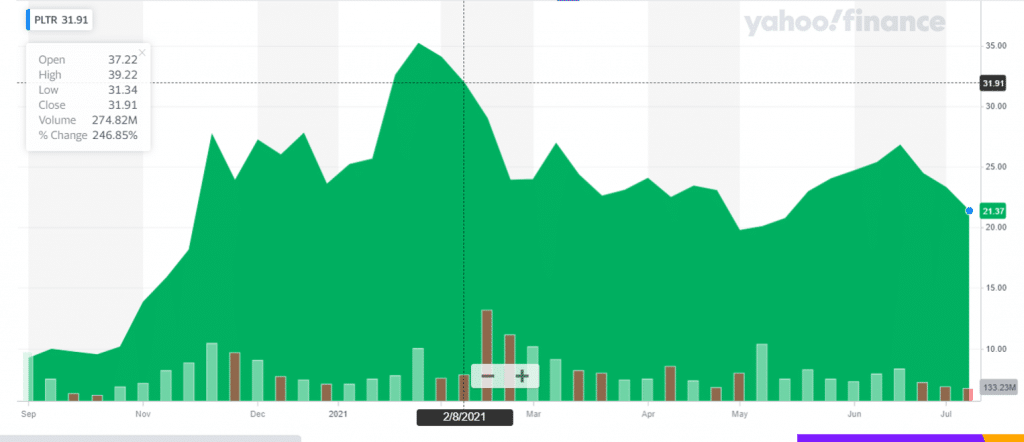

Palantir Technologies Inc

Palantir Technologies Inc, a software company that focuses on big data analytics, was offered to the public on 30th September 2020.

The share price opened at $10 and closed at $9.2. This price movement gave Palantir a market valuation of $15.2 billion. As of today, Palantir Technologies Inc is trading at $21 per share, and this is a 124% increase since it was initially offered.

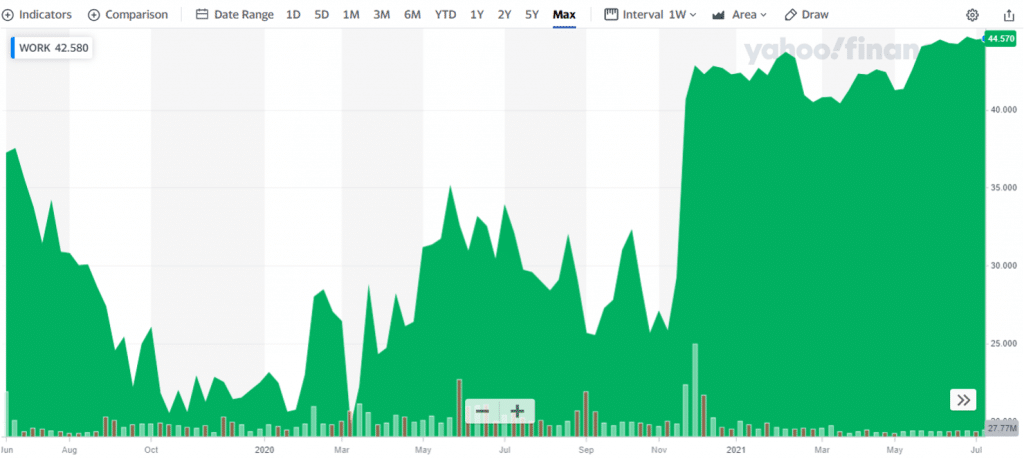

Slack Technologies Inc

Slack Technologies Inc is a California-based business technology platform that offers software to bring people, data, and applications together for a smoother organizational workflow.

The company went public in 2019 through a direct stock listing with an opening price of $38.50 that equated to a well over $23 billion market cap. This means that this stock still has some untapped potential. The stock has climbed an increase of a whopping 20% since it’s offering.

Survey Monkey

SurveyMonkey is a California-based online survey development software firm. The company has more than 20 million active users and works in more than 340,000 organizational domains.

The company went public in 2018, starting trade at $12 per share, a number that went up 43% by the end of the trading day. If you had invested in this company, your portfolio would have made a massive jump of 27%.

Finding Upcoming IPO Stocks

You must be wondering how to find new and upcoming IPOs to invest in and make some sweet gains.

So, let’s dive into that topic.

The main benefit of investing in an IPO is that you are getting a price that is undervalued, and there is a high chance of that price skyrocketing once brokerages take significant stock positions.

Therefore, to seize this opportunity and make juicy gains, you must check the list of the different platforms you can use to track upcoming IPOs given below.

Market watch

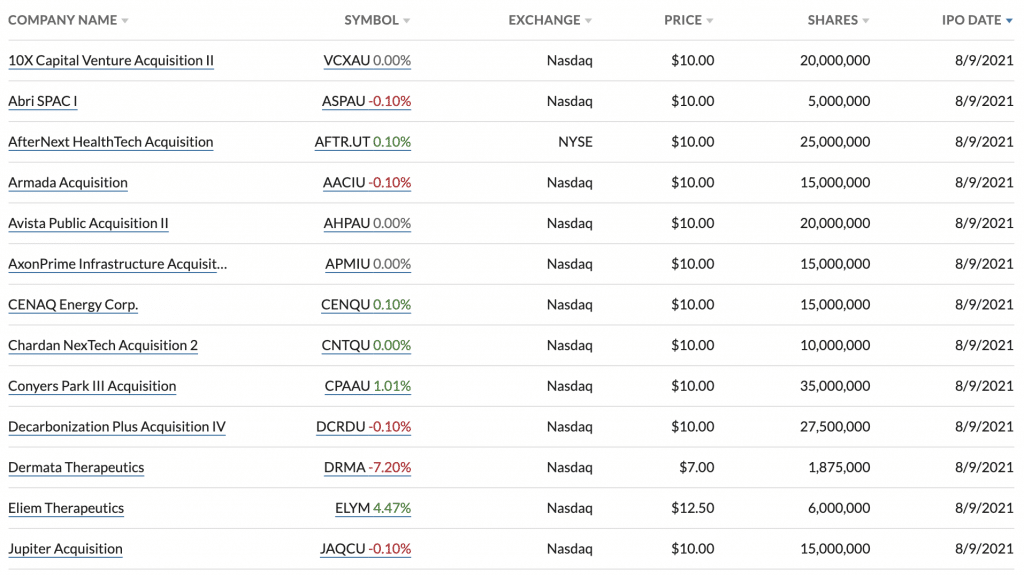

The market watch gives you a month by month calendar with all the upcoming IPOs. This calendar is really useful to track the upcoming IPOs to analyze them and get ready to invest in them.

You will find information such as:

- Company name

- Ticker

- Stock exchange

- Expected share price (which might be different when the IPO really goes live)

- Number of shares (available to be traded on the stock market)

- IPO date

Here is an image of what the calendar looks like.

Exchange Websites

The most reliable and up-to-date source to track upcoming IPOs is the exchange websites. Take New York Stock Exchange and NASDAQ, for instance; they both have dedicated a section called “Upcoming IPO”. To top this all, NYSE maintains and updates the “IPO Center” section frequently. However, the downside is that as these websites are highly regulated, the IPO section is updated only after proper verification, and this may cause a delay in the flow of information.

Google News

We all know that Google is an information hub. Performing a simple search on Google News with the title “Upcoming IPOs” can give you access to various up-to-date announcements regarding new IPOs. The bright side is that you can also view analysts’ opinions, and market commentary, which will help you make a much better investment call.

Yahoo Finance

Last up on the list, we have Yahoo Finance. Yahoo finance has dedicated a portion entirely to IPO. This section includes IPO date, symbol, price, and links to IPO profiles and news items.

Which Platform to go for?

The best and most reasonable approach is to incorporate all three platforms while doing your IPO research work. By doing this, you will be getting news and updates from different sources, and in the end, you will have well-researched material to back your investment decision.

Different Ways to Invest in an IPO Stock at the Best Price

Typically, the giant whales of the investment world, the institutional investors, are the ones who get early access when investing in IPOs, and they get to invest in them at a premium price. These institutions carry out a lot of business transactions with the brokers underwriting the deal, and this relationship puts them on the top priority of accessing shares in the IPO.

However, if you have an account with a broker bringing a specific company public, and you are their premium customer, you might have a chance to pave your way to invest in the next hot IPO.

Once the deal is sealed and the stock is trading on the exchange, small as well as big players of the investment world can buy the shares. The bright side is that investing in a stock’s actual debut can be a great strategy if you are a small-time investor.

But what if you want to get in on the action from the beginning and pocket some sweet gains from the offering price?

Then you have the following approaches!

Going for an account at a thrift bank!

You can open a deposit account at a mutually owned thrift bank and wait for such banks to carry out their IPO. Depositors at these small banks can get access to the IPO, and if you are lucky enough, you can make a solid profit on the first trading day.

However, the drawback is that thrift may wait for several years before it conducts an IPO, and it has absolutely no obligation to do so.

Mutual Funds & ETFs

Mutual Funds

Back in 2015, the only mutual fund that invested in IPOs was the Renaissance Global IPO Fund. The fund was initiated in 1997 and focused on investing in promising IPOs across the globe. However, as IPOs carried some inherent risks due to extreme volatility, these funds were relatively riskier than the overall market. Fast forward to 2018; the Renaissance Global IPO Fund closed as the interest was shifted to ETFs.

ETFs

The focus was now shifted towards ETFs that invested in IPOs. Investors who had their strategy based on investing in IPOs had the opportunity to invest through the First Trust US Equity Opportunities ETF (FPX) and the Renaissance IPO ETF (IPO). Both of these passively tracked major indexes composed of the US IPOs.

Platforms allowing to invest in IPO Stocks

Previously, retail traders didn’t have a proper platform to purchase IPO shares until those shares began trading on an exchange. This was a significant drawback for small investors as high-profile IPO shares were set aside for the big players in the game, such as institutional investors or high net worth individuals. However, things are different now, and platforms such as Robinhood are giving access to IPO shares.

Since the beginning, Robinhood has been trying hard to give retail traders a level playing field against the big players of Wall Street. Now fast forward to 2021, they are planning to provide access to IPOs to everyone. This means that every user on the Robinhood platform will have the option of purchasing a newly listed stock through Robinhood.

With this access, you will have the opportunity to buy shares of companies at their IPO price. You can now participate along with Wall Street Investors in upcoming IPOs with absolutely no-account minimums.

To give you a perspective as to why this can be a massive opportunity for you to make sweet gains is because IPO stocks averaged 36% in 2020 on the first day. These are some severe gains an average investor is missing out on. However, things can be different once an army of retail investors jumps into the IPO shares at the initial price, and the profit margins can be massive as the buying volume of these IPO shares will increase significantly.

The Perfect Time to Sell An IPO Stock

The primary reason why people look to invest in IPOs is the upside potential of making huge gains.

As with any other stock, your IPO stock is held with a brokerage account and can be sold on any given day or time.

The critical thing to consider here is the amount of money you are taxed. The profit that is made from shares held for less than one year from the date of purchasing are taxed as ordinary income in the US. This percent is higher than the long-term capital gains rate.

So, what’s the perfect time to exit?

Well, it completely depends on your investment goal and risk appetite. If you are a day or swing (trader, then you can take advantage of the initial volatility in the stock.

On the other hand, if you are a long-term investor, you can hold the stock for more than a year and save some money on the taxes you have to pay.

Things to consider before investing in IPO Stocks

Before pouring your money into IPO stocks, you must consider the following things:

Investing in IPOs requires in-depth research

The first thing to do before investing your money is analyzing and evaluating the company’s business model. You must look at the company’s management and ask yourself this one question: What will this company look like in the next ten years?

Investing in IPOs is not a guaranteed approach to making money

There is a myth floating that IPOs are bound to succeed, and this is where all the new and even skilled investors make a mistake. Usually, there is extreme volatility when you are investing in an IPO on the first day, and there is a high chance that the offering price may take a hit in the coming days.

The most promising IPOs can take a hit

Many prominent stocks such as Twitter, Spotify, Uber, and Facebook fell after their stocks debuted. Therefore, you must consider all the possibilities while investing in such IPOs

Questions to Ask Yourself Before Investing in IPO Stocks

Now, let’s say you have made up your mind that you will invest in an IPO Stock; there are a few questions below you must ask yourself to have complete confidence in your investment decision.

- Is the company doing something different than the other companies?

- Does the company have a history of steady earnings growth?

- Is the management competitive and focused on the betterment of the company?

- Who are the competitors? And can they damage the company’s financial performance?

- Are they innovative and creating something new for the customers frequently?

If a company is showing a favorable status in all of these questions, then it is bound to succeed. There may be ups and downs along the way, but the long-term growth aspect of the company should not be compromised, and you will not regret investing in the IPO stock of that company.

Final Thoughts

The bottom line is that investing in IPOs is a wise way to diversify your investment portfolio. You have to find the right IPO stock, and do not be afraid of the initial volatility.

You should keep looking for upcoming IPOs and do your own due diligence before investing a single dime in the IPO Stock.

If you follow this step, the possibility of making sweet gains is simply huge. Take LinkedIn, for example; when they were first publicly offered, the share prices rose 109 percent from $45 to $94.25 on the same day.

However, the flip side is that the odds will be against you when you are investing in an IPO stock. Historically, IPOs have not performed really well relative to the market as they are already priced to their exact value. But this should not stop you from investing in IPO stocks as the fundamentals of investing are the same. With discipline, timing, and research, you can go home with some nice gains!