NFTs have been one of the hottest investments in the crypto investing industry over the past few months (as of beginning 2022). Buyers are paying millions of dollars for artworks, music, pictures, even for memes and tweets. Artists, sports players, TV actors, musicians, and even many common people are jumping into this sector, clearly indicating its return potential. If you do not know much about the NFTs industry, such an increased adoption of NFTs might confuse you. You might want to know what NFTs are, how you can invest in them, why you should invest in them, and many more. This is the time to say goodbye to all confusions because we have prepared a thorough guide on NFT investing, and you will learn how to crypto invest in NFTs.

So, let’s dive in!

What are NFTs?

NFTs or “non-fungible tokens” represent unique digital items that cannot be replaced. They enable tokenizing real-world things such as art, videos, music, photos, games, even real estate. These tokens are built and managed on the blockchain, specifically the Ethereum blockchain.

The most exciting thing about NFTs is that they can have only one official owner at a time. Unlike cryptocurrencies, they are not mutually interchangeable but can be sold and traded.

Most expensive NFTs sold so far

NFTs are growing popular as time goes on. Many NFTs items have been sold for millions of dollars. The following are some of the most expensive NFTs sold so far.

- The Merge by PAK (Digital artist) is on top of the most expensive NFTs, sold for $91.8 Million.

- Everydays: The First 5000 Days by Beeple sold for $69.3 million. It is a collection of 5000 images created over 13 years by the artist. He sold three other NFTs, HUMAN ONE, Crossroad and OceanFront, for nearly $30 Million, $6.6 million, and $6 million, respectively.

- Many CryptoPunk NFTs by Larva Labs have been sold for millions of dollars. The most expensive CryptoPunk #7523 is sold for $11.75 million.

How to invest in NFTs?

The sale price of some NFTs mentioned above might be enough for you to get an idea of how much potential there is in this sector. Now let’s see how you can start NFT investing.

There are generally two ways to invest in NFTs.

- Create and Sell

- Buy and Flip

Create and Sell

If you are an artist or designer, you can earn a living by putting your work on blockchain as NFT and selling it. There are several marketplaces where you can list your NFT for sale. The following steps are involved for selling an NFT in a marketplace, which is almost the same for every market.

- You need to create a crypto wallet and link it to the marketplace account, where you want to list and sell your work.

- You will need to pay some fees for using the platform. Most platforms charge a fee in ETH cryptocurrency.

- Create a collection of your art and generate NFT from it.

- List your NFT on the marketplace and make it available for sale either for a fixed price or for sale via auction.

The buyer will pay in ETH, and you can convert it into USD. However, the fees associated with NFTs depend on the marketplace on which you are creating your NFT. Also, some platforms charge only a one-time gas fee, and after the first NFT, the rest will be free.

Buy and Flip

If you cannot create an NFT, you can still manage some NFT investing by buying an NFT and then flipping it. NFT flipping has the potential of generating profits in a short period. Like cryptocurrency, early adoption of NFT before the prices go to the moon can be rewarding.

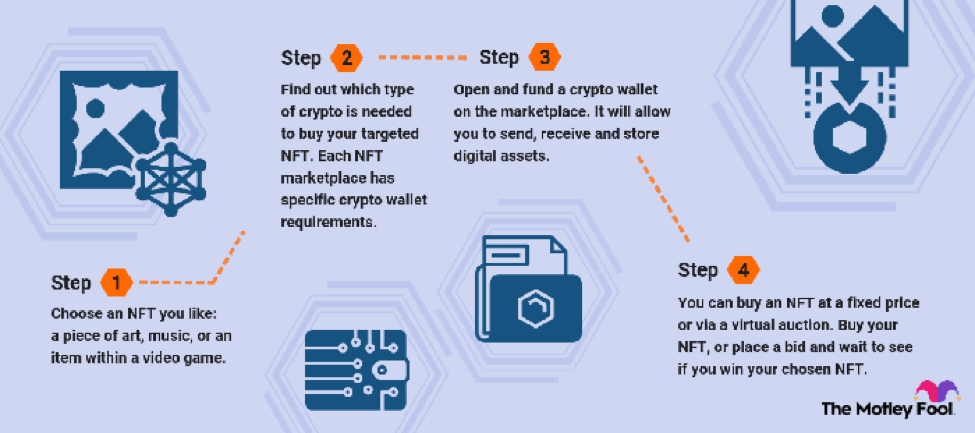

Buying an NFT is quite simple. You need to connect your digital wallet to the marketplace and fund it. Most of the NFT markets offer auction mode, where you can submit your bid and wait to see if you got that NFT or not. The bidding process is the same as the usual one. Or you can buy it at a fixed price.

The following figure shows the process of buying an NFT.

Once you own an NFT, it is your choice to keep it or flip it. If you decide to flip an NFT, you can list it in a marketplace for a fee. Your chosen marketplace should support the blockchain on which the NFT was built. The listing can be for a set price or an auction. The marketplace handles transferring assets between you and the buyer, and funds are automatically transferred to your digital wallet.

How to choose the project for creating an NFT or the NFT you should buy for flipping?

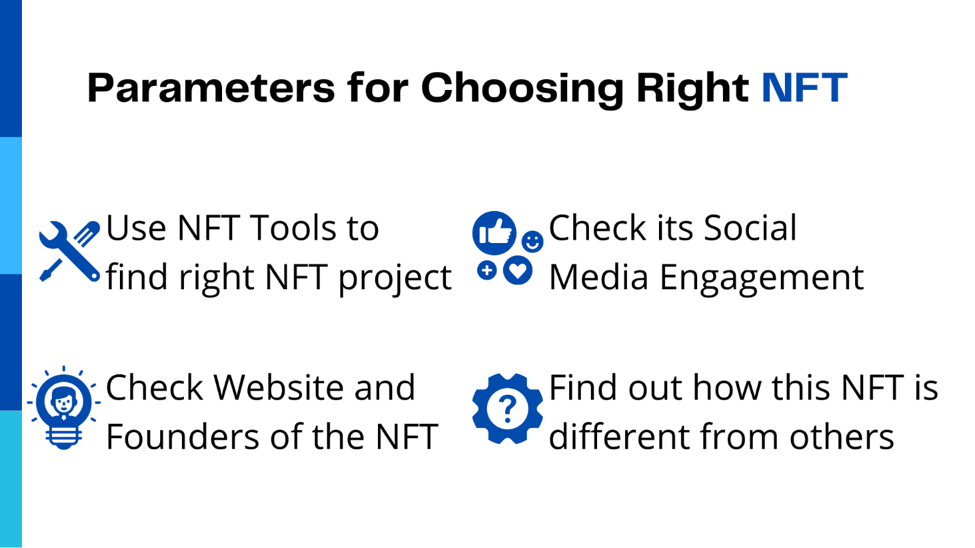

It’s a valid question because your efforts and resources will be wasted if you choose to work on a project with no market demand. The same goes for buying an NFT to flip later, considering it is competitive. The following are some factors that can help you choose the NFT for investment.

NFT tools can be your friends

You can easily find the most popular projects, but their prices might go out of budget. That’s why you need to find a project of an upcoming big artist, and of course prices will be low at the start. It sounds easy, but it is not! You will need to do proper research, and there are chances you might miss any of the upcoming blockbuster NFT.

In this case, NFT finding tools can be a great help. There are several available tools in the market, both paid and free, that give detailed information about NFTs upcoming projects, their prices, creator name, etc. The most popular tools are Rarity.tools, UpcomingNFT, Icy.Tools, NFT Stats, etc.

Social Media can also help to discover new NFTs. Check the community engagement for a project and make sure it is legit. If there are many fans of it, then the chances of selling NFT for profit are higher. But again, NFT tools can bring you exclusive insight at a glance within a few minutes.

The same factor applies if you are thinking of creating an NFT. Search the market to find the interest of buyers.

Check the details of the project

The NFT you are going to invest in should have a legit website. For example, you can judge it as it should not lack critical information, poor design, irregular structure, spelling errors, etc.

A website must provide all the necessary details about the NFT, such as its whitepaper, founding team, partners, previous owners, etc. Double-check the details. However, it is recommended not to choose the project whose founders’ identity is not displayed publicly.

Different and unique projects are more attractive

Fact about human nature, we are attracted more easily towards different and unique things. Therefore, if you choose an NFT, find out how this NFT is different from others. What does this NFT have to offer to attract buyers? You can find its specialties by reading its whitepaper or visiting its website. Once you find out its uniqueness, check how large the community is for this specialty.

Other questions to ask can be:

- Do you also like the project you are going to invest in?

- How many pieces of the NFT exist? The rarer it is, the more expensive it will be.

- What is the selling price of the NFT for now?

Once all insight into a project is clear to you, you can better judge if the project has the potential or not. And ultimately your right choices will bring you profits.

How much can you make by creating or flipping an NFT?

Up till now, you have learned different ways to crypto investing in NFTs and parameters for choosing a project. The next question should be how much you can earn by creating or flipping an NFT?

The answer is: the more buyers are interested in buying your NFT, the more expensive it will be. If you are new to creating NFT, the chances of earning huge are rare. Still, the world of the internet and social media can make anyone famous overnight. The same goes for NFT if you are lucky. About flipping, if you choose the right piece, the chances of success will be higher.

Also, choosing between creating & sell and buying & flip is entirely your choice. But the interesting thing to know is that the secondary market (reselling NFT, flipping) is considered more vibrant than the primary market in terms of USD traded. According to a report shared by Chainalysis, NFT flipping has much higher chances of generating profit than primary selling. More precisely, on the OpenSea NFT marketplace, 28.5% of NFTs purchased in the primary market resulted in a profit, while flipping NFTs on the secondary market led to 65.1% profit. It is probably because NFTs receive the most publicity only after trading on secondary marketplaces.

Best NFT marketplaces

The following are the best NFT marketplaces for buying and selling NFTs.

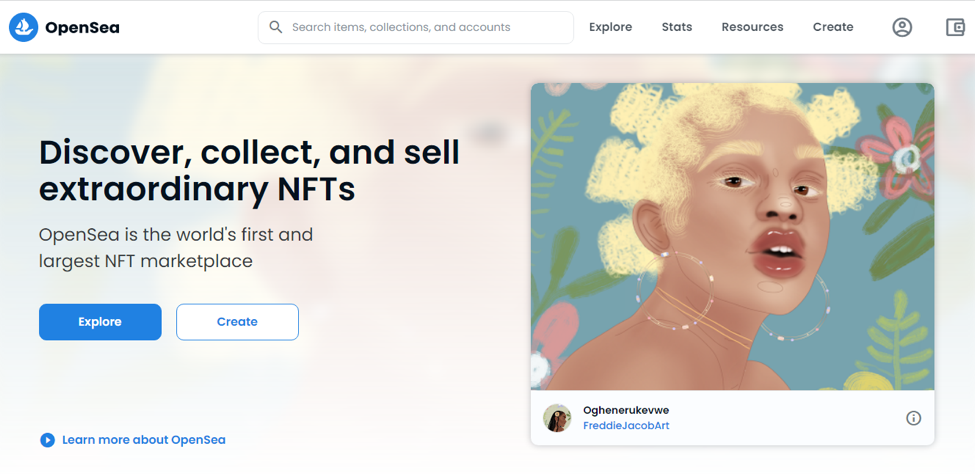

OpenSea

OpenSea is the biggest NFT marketplace with all sorts of digital NFTs available. It was created in 2017 and currently is the market with the largest number of registered designers and over 1.8 million active users. You can easily buy, sell, and auction your NFTs. As of November 2021, the market volume of OpenSea was $2.4 billion.

Axie Infinity Marketplace

Axie Infinity is an NFT-based game with mythical creatures called “Axies”. The game follows the play-to-earn model allowing players to earn tokens that can be traded as Ethereum-based cryptocurrency. Players can also buy and exchange in-game assets as NFT within the marketplace. As an NFT marketplace, Axie Infinity supports ETH and RONIN NFTs. The company started in 2018. In November 2021, the market volume of Axie Infinity was $3.06 billion.

Rarible

Rarible is another NFT marketplace similar to OpenSea. It is an Ethereum-based platform supporting the creation, purchase, and sale of all sorts of NFTs. But Rarible requires you to use its own token Rarible for buying and selling purposes on the marketplace. The company was founded in 2020, and its market volume is $250 million (Nov. 2021).

SuperRare

SuperRare is an NFT marketplace to collect and trade single-edition NFTs. Buyers pay in Ethereum for NFTs, but recently the platform has announced its token. SuperRare was founded in 2018, and its trading volume as of November 2021 was $18.77 million.

Foundation

Officially launched in February 2021, Foundation is an invite-only marketplace. Foundation invites creators, and it has a “Community Upvote system” in which artists vote for each other. The top 50 artists with the highest votes join the community as creators. Though the marketplace launched in early 2021, it has thousands of registered creators and has sold NFTs for more than $100 million.

Comparison of the best NFT marketplaces

The following is a comparison of the above-mentioned NFT marketplaces.

Marketplace | Twitter Flowers | Runs on | Buyer fees | Seller fees | Accepted File Formats | Sale Method |

OpenSea | 825.5k | Ethereum | 2% | 2.5% | GLTF, GLB, WEBM, MP4, MP4V, OGG, MP3, WAV, OGA, SVG | Fixed Price, Best Offer, Auction |

Axie Infinity | 818.7k | Ethereum | 4.25% | 4.25% | N/A | Auction, Fixed Price |

Rarible | 311.2k | Ethereum | 2.5% | 2.5% | JPEG, PNG, GIF, WEBP, MP4, WMV, MP3 | Auction, Fixed Price |

SuperRare | 228.4k | Ethereum | 3% | 3% | JPEG, PNG, GIF, MP4, WEBM | Auction, Fixed Price |

Foundation | 237.5k | Ethereum | N/A | 15% | JPG, PNG, GIF, MP4, | Auction |

Figure: Comparison of the best NFT marketplaces

Best NFT Tokens

NFT token is a one-of-a-kind digital token that is permanently associated with an NFT and is encrypted with the signature of the artist. It validates the authenticity and ownership of an NFT piece.

The following are the best NFT tokens available in the market.

Axie Infinity (AXS)

AXS is the governance token for the Axie Infinity video game. AXS holders can stake their tokens to earn more AXS. They can also vote to dictate how the funds in the Axie community treasury should be spent.

Theta Network (THETA)

Theta Network is a blockchain-powered video streaming network. It is an open-source protocol with a video stream network. Users donate their computer resources and bandwidth in exchange for the Theta fuel reward.

Enjin Coin (ENJ)

Enjin Coin is a cryptocurrency for virtual goods created by Enjin. It is an ERC20 token built on the Ethereum network. Enjin is one of the largest gaming communities, with over 18.7 million registered gamers. Users can create clans and websites and also run virtual stores. The platform also has in-game items acting as NFTs that have their value.

You can also check other NFT tokens such as Chiliz, Decentraland, etc.

Comparison of the best NFT tokens

The following table compares some of the best NFT tokens available.

NFT Token | Symbol | Current Price | Market Cap |

Axie Infinity | AXS | $95.79 | $6 billion |

Theta Network | THETA | $4.92 | $4 billion |

Enjin Coin | ENJ | $2.69 | $2 billion |

Decentraland | MANA | $3.33 | $4 billion |

Chiliz | CHZ | $0.2920 | $1 billion |

Figure: Comparison of the best NFT tokens. Data is collected from CoinGecko on December 30, 2021

Pros and Cons of NFT investing

Pros

The following are the pros of investing in NFTs.

- You can invest in NFTs to complete your art collection.

- NFT investment can symbolize status as the sole owner of the piece.

- Investing in NFTs can help you generate profits.

Cons

The following are the cons of investing in NFTs.

- The listing fees can be high for less famous artists, acting as a barrier to benefit from this system.

- Sometimes a buyer does not find any secondary buyer to resell his NFT for profits.

- The value of NFT can decrease over time with a decrease in people’s interest.

Conclusion

NFT investing is fascinating, risky, and rewarding as well. The industry has vast potential. But only if you choose the right project. Still, you can also easily earn from it if you do proper research and follow the parameters mentioned in this article. The NFT industry has been operating since 2015 but reached the moon in 2021, earning billions of dollars. As cryptocurrency is here to stay, so are NFTs. Therefore, it is evident that the future of NFTs is going to be prosperous.